Global Commercial Vehicle Remote Diagnostics Market - Key Trends and Drivers Summarized

Why Is Remote Diagnostics Crucial for Modern Commercial Vehicles?

Remote diagnostics has become an essential tool for managing commercial vehicle fleets in today's fast-paced, technology-driven environment. But what makes it so critical? As commercial vehicles operate in increasingly complex and demanding conditions, the ability to monitor vehicle health in real-time has transformed how fleet operators manage maintenance, reduce downtime, and improve overall efficiency. Remote diagnostics systems use telematics technology to provide real-time data on vehicle performance, detecting issues such as engine malfunctions, transmission faults, or brake system wear long before they result in a breakdown. This proactive approach allows fleet managers to schedule maintenance at optimal times, preventing costly repairs and minimizing unplanned downtime. Additionally, these systems allow for detailed data collection on key vehicle functions, such as fuel efficiency, driver behavior, and emissions levels, enabling operators to make informed decisions about vehicle operation and maintenance, which is vital in a sector where maximizing uptime and reducing costs are of paramount importance.How Are Technological Advancements Shaping Commercial Vehicle Remote Diagnostics?

As the commercial vehicle industry evolves, advancements in technology are continuously reshaping remote diagnostics systems. Initially, diagnostic tools were limited to basic fault detection, but today's systems offer far more sophisticated capabilities, integrating artificial intelligence (AI), machine learning, and cloud computing to enhance their accuracy and predictive power. Modern remote diagnostics not only alert operators when something goes wrong, but they also predict when components are likely to fail, based on historical data and real-time analysis of vehicle conditions. This predictive maintenance model reduces the likelihood of catastrophic failures and enables just-in-time repairs, which is essential for maintaining fleet efficiency. Connectivity is another area where significant strides have been made. With the advent of 5G networks and the Internet of Things (IoT), remote diagnostics systems can transmit vast amounts of data instantly, offering real-time insights into vehicle health. These advancements are also enabling over-the-air (OTA) updates, allowing vehicle software and diagnostics systems to be updated without the need to bring the vehicle into a workshop, thereby improving vehicle availability and minimizing disruption to operations.What Are The Benefits Of Remote Diagnostics For Fleet Operators And OEMs?

For fleet operators, remote diagnostics offers a range of operational benefits that directly impact both cost savings and vehicle uptime. The ability to continuously monitor vehicle systems in real time means that potential problems can be detected and addressed before they escalate into major issues. For example, if a vehicle's sensor detects a minor issue in the engine or the brake system, the remote diagnostics platform can alert the fleet manager and recommend the necessary maintenance or part replacement. This not only helps avoid expensive repairs but also prevents sudden breakdowns that could leave vehicles stranded and impact delivery schedules. Additionally, remote diagnostics systems help optimize fleet maintenance schedules, ensuring that vehicles are serviced only when necessary, thus avoiding the waste of resources on unnecessary maintenance. For original equipment manufacturers (OEMs), the integration of remote diagnostics opens up new opportunities for customer support and after-sales service. OEMs can monitor the performance of their vehicles remotely and provide insights or guidance to customers based on real-time data. This allows them to offer a more personalized and responsive service, increasing customer satisfaction and loyalty.What's Driving the Growth of the Commercial Vehicle Remote Diagnostics Market?

The growth in the commercial vehicle remote diagnostics market is driven by several factors, all closely linked to technological innovation, operational efficiency, and evolving consumer expectations. One of the primary drivers is the increasing adoption of connected vehicle technologies and the expansion of IoT infrastructure, which enable seamless data transfer between vehicles and central management systems. As more commercial vehicles become equipped with telematics systems, the demand for remote diagnostics solutions continues to rise. Moreover, fleet operators are under growing pressure to reduce vehicle downtime and improve operational efficiency, both of which are directly supported by the capabilities of remote diagnostics systems. The ability to predict potential failures and schedule maintenance proactively helps minimize unplanned downtime, a key factor in reducing operational costs for large fleets. Another significant factor driving market growth is the tightening of government regulations around vehicle emissions and safety. With stricter environmental standards being imposed globally, remote diagnostics systems are increasingly being used to monitor and manage emissions levels, ensuring compliance with regulations. This is particularly relevant in the context of commercial vehicles, where failure to meet emissions standards can result in heavy fines and restrictions. Furthermore, consumer expectations around the speed and reliability of delivery services are shaping fleet operations, pushing companies to adopt advanced diagnostic tools to ensure vehicles are always in optimal condition. Lastly, the rising integration of electric and hybrid vehicles into commercial fleets is creating new demand for remote diagnostics systems tailored to these types of vehicles, as their maintenance and performance requirements differ significantly from traditional internal combustion engine vehicles. This trend is expected to further fuel growth in the remote diagnostics market as fleets transition to greener technologies.Report Scope

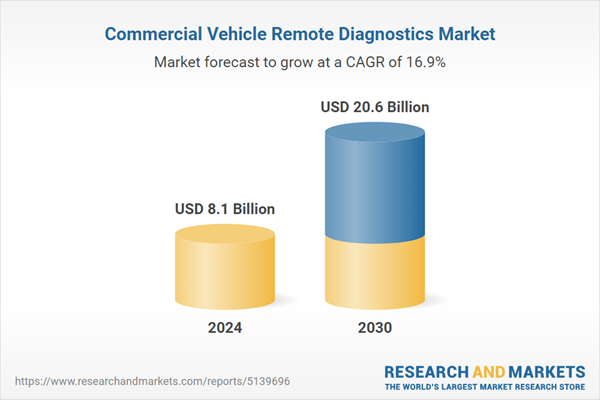

The report analyzes the Commercial Vehicle Remote Diagnostics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Light Commercial Vehicles, Medium & Heavy Commercial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Light Commercial Vehicles End-Use segment, which is expected to reach US$14.2 Billion by 2030 with a CAGR of 17.7%. The Medium & Heavy Commercial Vehicles End-Use segment is also set to grow at 15.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.3 Billion in 2024, and China, forecasted to grow at an impressive 15.9% CAGR to reach $3.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Vehicle Remote Diagnostics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Vehicle Remote Diagnostics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Vehicle Remote Diagnostics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Airmax Group Ltd., Bosch Mobility Solutions, Electronic Team, Inc, Embitel Technologies (I) Pvt., Ltd., Tech Mahindra Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Commercial Vehicle Remote Diagnostics market report include:

- Airmax Group Ltd.

- Bosch Mobility Solutions

- Electronic Team, Inc

- Embitel Technologies (I) Pvt., Ltd.

- Tech Mahindra Ltd.

- Texa

- Trimble, Inc.

- Vector Informatik GmbH

- Vidiwave Ltd.

- ZF Friedrichshafen AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airmax Group Ltd.

- Bosch Mobility Solutions

- Electronic Team, Inc

- Embitel Technologies (I) Pvt., Ltd.

- Tech Mahindra Ltd.

- Texa

- Trimble, Inc.

- Vector Informatik GmbH

- Vidiwave Ltd.

- ZF Friedrichshafen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 246 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.1 Billion |

| Forecasted Market Value ( USD | $ 20.6 Billion |

| Compound Annual Growth Rate | 16.9% |

| Regions Covered | Global |