Commercial vehicles obtain licenses for transporting goods and materials. They may be registered under individual ownership or leased through financial institutions. Their safety is progressively enhanced through technologies such as onboard monitoring, vehicle condition tracking, and driver assistance systems like field-of-view cameras and journey planning aids. This advancement has led to increased safety and efficiency in commercial vehicle operations. The integration of features like route optimization and real-time tracking has amplified its role in the logistics and transportation sectors worldwide. These vehicles contribute significantly to smoother supply chains and improve overall industry productivity by mitigating risks, enhancing driver visibility, and optimizing routes. As the backbone of the logistics and transportation industries, these vehicles play an indispensable role in facilitating the movement of goods and materials, supporting economic growth, and meeting the demands of a globalized marketplace.

The global market is majorly driven by increasing trade and cross-border transportation. In line with this, the expansion of e-commerce and last-mile delivery services is significantly contributing to the market. Furthermore, the rising demand for efficient goods movement in urban areas is positively influencing the market. Apart from this, the growing infrastructure development and road network expansion are catalyzing the market. Moreover, rapid industrialization and manufacturing activities offer numerous market opportunities. Besides, the escalating replacement demand due to aging commercial vehicle fleets and the increasing need for temperature-controlled transport in the food and pharmaceutical industries are stimulating the market. Additionally, the rising adoption of electric and hybrid commercial vehicles and the growing demand for specialized vehicles like refrigerated trucks and tankers are providing a boost to the market.

Commercial Vehicles Market Trends/Drivers:

Increasing incorporation of telematics and fleet management solutions

The escalating integration of telematics and fleet management solutions is catalyzing the market. These technologies empower fleet operators with real-time insights into vehicle performance, location tracking, driver behavior, and maintenance needs. Such data-driven intelligence optimizes operational efficiency, reduces downtime, and enhances fleet productivity. Telematics and fleet management solutions also play a pivotal role in bolstering safety measures by monitoring driver behavior, enabling proactive maintenance, and facilitating route optimization. As industries increasingly prioritize safety and regulatory compliance, the adoption of these solutions becomes imperative. Furthermore, the synergy between telematics and the demand for sustainable transportation is boosting the market. By optimizing routes, minimizing fuel consumption, and reducing carbon footprints, telematics contributes to greener and more cost-effective operations. The integration of telematics and fleet management solutions is transforming the commercial vehicle landscape, offering operational excellence, safety enhancement, and eco-friendly solutions. Consequently, it catalyzes market growth by addressing evolving industry needs and optimizing vehicle performance.Expansion of online grocery and perishable goods delivery

The expansion of online grocery and perishable goods delivery is fueling market growth. As consumers increasingly embrace online shopping for groceries and perishable items, the demand for efficient and reliable delivery services has increased. Commercial vehicles play a critical role in meeting this demand by ensuring timely and safe transportation of these sensitive goods. The perishable goods segment requires specialized vehicles equipped with temperature control systems to maintain the freshness and quality of products during transit. Commercial vehicles designed for cold chain logistics, equipped with refrigeration units, enable transporting items like fresh produce, dairy, and pharmaceuticals. This expanding trend creates a significant need for versatile and well-equipped commercial vehicles that can navigate urban environments, manage various load sizes, and adhere to stringent delivery schedules. Consequently, the market for commercial vehicles is witnessing growth due to their vital role in facilitating the efficient and seamless delivery of online groceries and perishable items to consumers' doorsteps.The growing trend of outsourcing transportation and logistics services

The growing trend of outsourcing transportation and logistics services is bolstering the market. As businesses seek to streamline operations, cut costs, and focus on their core competencies, they increasingly outsource transportation and logistics functions to specialized providers. This shift toward outsourcing creates a considerable rise in the demand for reliable and versatile commercial vehicles to meet the diverse needs of logistics service providers. These vehicles must accommodate various cargo types, adhere to stringent delivery schedules, and ensure efficient distribution networks. Outsourcing also emphasizes the importance of fleet management and optimization, pushing companies to invest in modern and technology-driven commercial vehicles. This dynamic contributes to the market's growth as fleet operators look to equip their fleets with vehicles fitted with telematics, tracking systems, and advanced route optimization tools.Commercial vehicles Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global commercial vehicles market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on vehicle type, propulsion type, and end use.Breakup by Vehicle Type:

- Light Commercial Vehicle

- Medium and Heavy-duty Commercial Vehicle

Light Commercial Vehicle dominates the market

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes light commercial vehicle, and medium and heavy-duty commercial vehicle. According to the report, light commercial vehicle represented the largest segment.The light commercial vehicle segment, encompassing vans, minitrucks, and pickups, is witnessing heightened demand due to the growth of e-commerce, urban deliveries, and last-mile logistics. As consumer preferences shift towards online shopping, there is an increase in demand for efficient and elegant vehicles that can navigate urban environments and accommodate smaller loads. The versatility and maneuverability of light commercial vehicles make them vital for urban logistics and local transportation, driving their market growth.

Furthermore, the medium and heavy-duty commercial vehicle segment caters to industries like construction, mining, agriculture, and long-haul transportation needs. Infrastructure development, industrial growth, and increased trade activities are propelling demand for these larger vehicles capable of handling heavier loads and longer distances. As economies expand and industries evolve, the need for medium and heavy-duty vehicles remains strong, further contributing to the growth of this segment.

Breakup by Propulsion Type:

- IC Engine

- Electric Vehicle

IC Engine dominates the market

The report has provided a detailed breakup and analysis of the market based on the propulsion type. This includes IC engine and electric vehicle. According to the report, the IC engine represented the largest segment.The IC engine segment, which includes vehicles powered by conventional gasoline or diesel engines, continues to meet the diverse needs of industries requiring long-haul transportation, heavy loads, and extensive travel ranges. However, advancements in engine efficiency and emissions regulations are shaping the evolution of this segment toward more sustainable and eco-friendly solutions.

Furthermore, the electric vehicle segment rapidly emerges as a driving force, aligned with the global push for greener transportation alternatives. With advancements in battery technology and charging infrastructure, electric commercial vehicles are gaining prominence, particularly for urban delivery services, short-haul logistics, and environmentally conscious fleet operators. Government incentives, emission reduction goals, and the lower operating costs of electric vehicles contribute to the segment's growth.

Breakup by End Use:

- Industrial

- Mining and Construction

- Logistics

- Passenger Transportation

- Others

Logistics dominates the market

The report has provided a detailed breakup and analysis of the market based on end use. This includes industrial, mining and construction, logistics, passenger transportation, and other. According to the report, logistics represented the largest segment.The logistics segment caters to the increasing need for efficient and timely movement of goods. With the rise of e-commerce and global trade, commercial vehicles in this category, including delivery vans and long-haul trucks, ensure seamless supply chains and effective distribution networks.

The industrial segment, on the other hand, encompasses a range of applications, from manufacturing to material handling. Commercial vehicles within this category, such as forklifts and industrial trucks, play a crucial role in internal logistics and factory operations, contributing to overall industrial efficiency.

Furthermore, the mining and construction segment involves heavy-duty vehicles that navigate challenging terrains and handle substantial loads. These vehicles are pivotal in extracting resources, construction activities, and infrastructure development, which are fundamental drivers of economic growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest market for commercial vehicles.The Asia Pacific region is a vibrant hub of industrial growth, rapid urbanization, and trade activities. This region's rapid expansion of e-commerce, manufacturing, and infrastructure projects has led to significant demand for diverse commercial vehicles, from delivery vans to heavy-duty trucks. This has contributed to the augmenting demand for commercial vehicles in the region.

The North American region, on the contrary, encompasses the United States and Canada and is characterized by its mature automotive industry, robust infrastructure, and diverse applications for commercial vehicles. The region's focus on efficiency, advanced technologies, and stringent emissions regulations drives the demand for innovative and sustainable commercial vehicle solutions.

Competitive Landscape:

Top companies are strengthening the market through their strategic initiatives and innovative approaches. These industry leaders consistently invest in research and development to design and manufacture vehicles that align with evolving customer needs, regulatory requirements, and technological advancements. They focus on incorporating cutting-edge technologies such as electric and hybrid powertrains, autonomous driving capabilities, and advanced telematics to enhance vehicle performance, safety, and efficiency. By leading the charge in adopting sustainability practices and developing eco-friendly commercial vehicles, these companies are catering to the increasing demand for environmentally conscious transportation solutions. Moreover, top companies are forging collaborations with technology partners, suppliers, and competitors to drive innovation and accelerate the development of next-generation vehicles. Their commitment to quality, safety, and customer satisfaction ensures continuous improvement and market-driven innovation that strengthens the market's growth trajectory. Through innovation, sustainable practices, and strategic partnerships, these companies shape and propel the market toward a dynamic and transformative future.The report has provided a comprehensive analysis of the competitive landscape in the commercial vehicles market. Detailed profiles of all major companies have also been provided.

- AB Volvo

- Ashok Leyland (Hinduja Group)

- Ford Motor Company

- General Motors Company

- Hyundai Motor Company

- ISUZU Motors Limited

- Mahindra & Mahindra Limited

- Mercedes-Benz Group AG

- Mitsubishi Motors Corporation

- Robert Bosch GmbH

- Tata Motors Limited

- Toyota Motor Corporation

- Volkswagen AG

Key Questions Answered in This Report

1. How big is the commercial vehicles market?2. What is the future outlook of commercial vehicles market?

3. What are the key factors driving the commercial vehicles market?

4. Which region accounts for the largest commercial vehicles market share?

5. Which are the leading companies in the global commercial vehicles market?

Table of Contents

Companies Mentioned

- AB Volvo

- Ashok Leyland (Hinduja Group)

- Ford Motor Company

- General Motors Company

- Hyundai Motor Company

- ISUZU Motors Limited

- Mahindra & Mahindra Limited

- Mercedes-Benz Group AG

- Mitsubishi Motors Corporation

- Robert Bosch GmbH

- Tata Motors Limited

- Toyota Motor Corporation

- Volkswagen AG.

Table Information

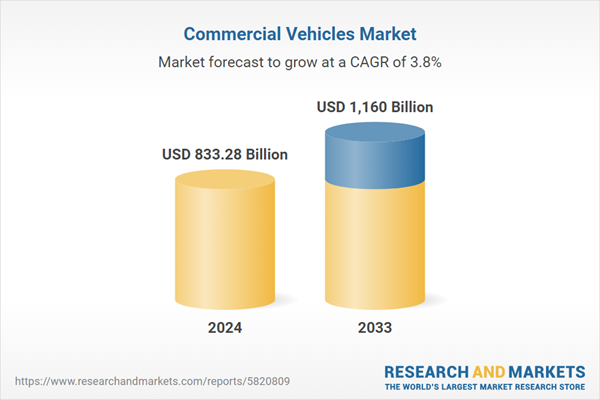

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 833.28 Billion |

| Forecasted Market Value ( USD | $ 1160 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |