Dairy Protein Market Analysis:

- Major Market Drivers: Increased consciousness about health and food intake, with emphasis on proteins as the building block for muscles and metabolic processes, is propelling consumption of dairy proteins. The evaluation of fitness activities and diets serving high-protein products also contributes to market growth by incorporating government-driven health awareness programs.

- Key Market Trends: Proliferation of invention in food technology is on the increase in the diversification of products based on dairy proteins. Concentration techniques also have enhanced through using advanced processing techniques of concentrate, isolate, and hydrolyzed form. These innovations, when combined with convenient packaging, have made it easy for different sectors to incorporate more use of dairy proteins by enhancing their product formulation.

- Geographical Trends: Europe has the largest share in the dairy protein market on account of its traditions in the dairy products consumption and increased expenditure on health. North America and Asia-Pacific region has also reported high growth with the emerging markets in countries such as China, India, and Japan. High quality standards and the consumer trust ensures that Europe reaps the benefits in the production of dairy products.

- Competitive Landscape: The major market players operating in the global dairy protein are Ace International LLP, Arla Foods amba, Fonterra Co-operative Group Limited, Glanbia PLC, and Groupe Lactalis. Such companies spend in new product development, geographical diversification, and sustainability strategies to improve their market competitiveness.

- Challenges and Opportunities: While the market faces challenges like maintaining quality standards and managing supply chains, opportunities lie in product innovation and expanding into new markets. Organizations are embracing sustainable livestock farming and increasing production yields will be well-placed to reap from increasing global concern on dietary protein from quality produce.

Dairy Protein Market Trends:

Rising consumer awareness about health and nutrition

The rising awareness about health and nutrition among consumers is one of the major factors creating a positive outlook for the market growth. Moreover, the growing emphasis on dietary choices as a cornerstone of overall well-being is also supporting the market growth. In addition to this, the heightened awareness of the importance of protein in muscle repair, development, and various metabolic processes is stimulating the market growth. Along with this, the increasing product consumption as an essential amino acid source is propelling the market growth.Besides this, the widespread contribution of educational campaigns, nutritional studies, and social media platforms to cultivate public knowledge about the importance of balanced diets that include high-quality proteins is bolstering the dairy protein industry. Furthermore, the increasing promotion by governments and healthcare organizations about healthier eating habits, which recommend the inclusion of protein-rich foods like dairy, is offering remunerative growth opportunities for the market growth.

Growing expansion of the fitness and wellness industry

Growing market of fitness and wellness, resulting in the increase in the number of gym subscriptions, daily practices of healthy eating, doing yoga, or other sport activities demanding adequate nutrition for the best result and muscle recovery is supporting the market growth. Alongside this, the growing need for protein supplements and value-added products is also bolstering the market growth.Also, the increasing use of dairy protein due to its rich biological value and quick digestion rates which serves as the favorite food products in the health-conscious fitness freaks and athletes is contributing to the market growth. In addition to this, the usage of dairy as an ingredient in protein shake, bars, and specialized fitness meals, as a supplement for muscle recovery and as energy source for stamina is fuelling the growth of this market.

Rapid innovation in food technology

The rising research and development activities towards the diversification of dairy protein-based products in terms of food technology are beneficial to the market growth. Besides this, the entry of new processing methods which allows the manufacture and sale of dairy proteins in various forms including concentrates, isolates, and hydrolysates for specific purposes is also a favorable sign for the market expansion. Besides, the application of dairy protein across numerous product categories, including RTD beverages, snack bars, and other dairy products, is bolstering the market growth.In addition to the enhanced convenience of consumption, the shifting trends towards the use of new and improved packaging materials that prolong the shelf life and allow for portability are expected to contribute to the market growth. Similarly, the rising trends of companies investing in the research and development (R&D) strategies aimed at formulating better tasting products with improved nutritional value profiles are opening up great growth opportunities for the market.

Dairy Protein Market Segmentation:

The research provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, form, and application.Breakup by Type:

- Casein and Derivatives

- Whey Protein

- Milk Protein Concentrat.

Whey protein dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes casein and derivatives, whey protein, and milk protein concentrate. According to the report, whey protein represented the largest segment.Whey protein, which dominates the market, is produced during the process of cheese making and its application has been adopted widely and across various industries ranging from food and beverages and especially sports nutrition and medical nutrition. It has flexibility in terms of application in so many formulations without affecting its taste or texture profile. Moreover, whey protein contains all essential amino acids in the right ratio, which makes it one of the most effective muscle building nutrients. Besides, whey protein is more soluble as compared to other proteins such as casein, thereby making it ideal for uptake after workouts.

In addition, the growing focus of consumers on high-quality, easily digestible, and highly nutritious food due to the increasing awareness of the population is also contributing to the growth of the market. Moreover, the strong focus on R&D by producers to develop different forms of whey protein, including isolates and hydrolysates with singular health benefits, and applications are also driving the growth of this market.

Breakup by Form:

- Solid

- Liqui.

Solid dominates the market

The report has provided a detailed breakup and analysis of the market based on the form. This includes solid and liquid. According to the report, solid represented the largest segment.Solid dairy protein dominates the largest market segment as it requires less stringent storage conditions, making it more convenient for retailers and consumers. Additionally, the solid form generally has a longer shelf life, reducing waste and thereby making it a cost-effective option for many applications. Besides this, it is commonly found in items, such as cheese, yogurt, and snack bars, which are staple products in many households.

Furthermore, it is a crucial ingredient in baked goods, confectionery, and certain processed foods, lending them textural and nutritional benefits. Moreover, solid dairy protein aligns well with consumer preferences for convenience and portability as they are available in products like protein bars and cheese sticks, thus meeting the needs of busy consumers looking for quick but nutritious food choices.

Breakup by Application:

- Food and Beverages

- Nutrition

- Personal Care and Cosmetics

- Feed

- Other.

Food and beverages hold the largest share in the market

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes food and beverages, nutrition, personal care and cosmetics, feed, and others. According to the report, food and beverages accounted for the largest market share.Food and beverages hold the largest share in the market. Various organizations in the food and beverages industry use dairy proteins in their products through the incorporation of cheese, yogurt, and other raw materials in the manufacturing of their products including bars and baked goods. Also, dairy proteins such as casein and whey protein contain a rich source of amino acids which play an important role in muscle recovery and growth and other metabolic processes which makes the product a good fit to suit the health-conscious market segment.

In addition to this, the synergization of consumer desire with lifestyle factors where consumers are taking healthier lifestyles and are tuned to the amount of nutrition they intake is working in the favor of the market. Besides, consumers are always looking for quality protein that can be easily incorporated in their diet without much cooking, this good and bad foods and beverages F&B products with dairy proteins leads to growth of the market.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

Europe exhibits a clear dominance, accounting for the largest dairy protein market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounted for the largest market share.Europe dominates the market for dairy protein as dairy products like cheese, yogurt, and butter have a deep-rooted cultural significance in the region, creating a stable platform for innovative dairy protein products, ranging from enriched beverages to high-protein snacks. Moreover, the economic prosperity of European countries allowing for a high level of consumer spending on health and wellness as affluent consumers are more likely to invest in premium, protein-rich products, is creating a positive outlook for the market growth. Along with this, the implementation of stringent quality and safety standards for food products in the region, instilling consumer confidence and ensuring that only high-quality dairy protein products make it to the market, is providing an impetus to the market growth.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the dairy protein industry include Ace International LLP, AMCO Proteins, Arla Foods amba, Fonterra Co-operative Group Limited, Glanbia PLC, Grassland Dairy Products Inc., Groupe Lactalis, Idaho Milk Products, Kerry Group plc, Royal FrieslandCampina N.V., Saputo Inc., Schreiber Foods Inc., United Dairymen of Arizona, and Westland Milk Products (Yili Group).

- Leading companies in the dairy protein market are investing in research and development (R&D) initiatives to develop new forms and formulations of dairy protein, including specialized types like whey protein hydrolysates or casein micelles that offer specific health benefits. Besides this, companies are vigorously expanding into emerging markets by partnering with local distributors or joint ventures with local firms to gain a foothold in the new markets. Along with this, some companies are adopting more sustainable farming practices, improving animal welfare standards, and optimizing production processes to reduce their carbon footprint. Furthermore, some companies are investing in advanced quality assurance methods that help in complying with regulatory requirements and instill consumer confidence in their products. In addition to this, companies are focusing on strengthening their online presence through digital marketing campaigns by educating consumers about the health benefits of dairy protein and how to incorporate it into their diets.

Key Questions Answered in This Report

- What was the size of the global dairy protein market in 2024?

- What is the expected growth rate of the global dairy protein market during 2025-2033?

- What has been the impact of COVID-19 on the global dairy protein market?

- What are the key factors driving the global dairy protein market?

- What is the breakup of the global dairy protein market based on the type?

- What is the breakup of the global dairy protein market based on the form?

- What is the breakup of the global dairy protein market based on the application?

- What are the key regions in the global dairy protein market?

- Who are the key players/companies in the global dairy protein market?

Table of Contents

Companies Mentioned

- Ace International LLP

- AMCO Proteins

- Arla Foods amba

- Fonterra Co-operative Group Limited

- Glanbia PLC

- Grassland Dairy Products Inc.

- Groupe Lactalis

- Idaho Milk Products

- Kerry Group plc

- Royal FrieslandCampina N.V.

- Saputo Inc.

- Schreiber Foods Inc.

- United Dairymen of Arizona

- Westland Milk Products (Yili Group)

Table Information

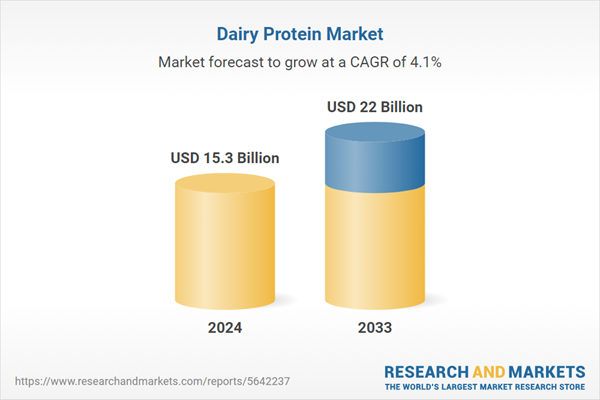

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 15.3 Billion |

| Forecasted Market Value ( USD | $ 22 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |