Global Data Center IT Asset Disposition Market - Key Trends & Drivers Summarized

Why Is IT Asset Disposition Critical for Modern Data Centers?

The demand for Data Center IT Asset Disposition (ITAD) services is rising as organizations increasingly prioritize data security, regulatory compliance, and sustainability. As data centers upgrade their IT infrastructure to keep pace with technological advancements, they generate significant volumes of obsolete or end-of-life equipment. Proper disposal and recycling of these assets are essential for maintaining data security and adhering to regulations like GDPR and HIPAA. ITAD services ensure that sensitive information is securely wiped from decommissioned devices, while also providing options for refurbishing, recycling, or reselling assets to maximize their value. Furthermore, as companies aim to minimize their environmental footprint, sustainable ITAD practices that emphasize recycling and responsible disposal methods are becoming integral to corporate sustainability strategies, boosting the growth of this market.What Technological Developments Are Influencing ITAD Solutions?

The Data Center ITAD market is experiencing technological transformations that are reshaping how data centers manage and dispose of their IT assets. Advances in data destruction technologies, including on-site shredding and degaussing, offer more secure and efficient methods for erasing data. Additionally, automation and AI-driven solutions are being utilized to optimize the tracking and management of IT assets throughout their lifecycle, from acquisition to disposition. Cloud-based ITAD platforms provide centralized management capabilities, enabling companies to monitor asset status, track compliance, and ensure data protection across multiple sites. Blockchain technology is also being introduced to create tamper-proof records of asset disposition, enhancing transparency and compliance. These technological developments are making ITAD solutions more efficient, secure, and environmentally friendly, thereby driving market growth.How Is the Emphasis on Compliance and Sustainability Driving ITAD Adoption?

As data centers expand and evolve, the emphasis on regulatory compliance and sustainability has become a key driver for the ITAD market. Strict data privacy regulations, such as GDPR in Europe and CCPA in California, require businesses to implement secure disposal practices for IT assets containing sensitive information. Non-compliance with these regulations can result in significant fines and reputational damage, making secure ITAD solutions essential for data centers. Moreover, the focus on sustainability is pushing companies to adopt eco-friendly ITAD practices, as environmental regulations encourage the reduction of e-waste and the recycling of electronic components. The rising trend of corporate social responsibility (CSR) initiatives also influences data centers to choose ITAD partners who follow green disposal methods, helping organizations reduce their environmental impact while managing costs effectively. These trends underscore the critical role of ITAD in modern data center operations.What Factors Are Contributing to the Growth of the ITAD Market?

The growth in the Data Center IT Asset Disposition market is driven by several factors, including stringent data protection regulations, the need for environmentally responsible disposal practices, and the increasing turnover of IT assets in data centers. The heightened focus on data security and compliance requirements is encouraging companies to invest in secure ITAD solutions that can mitigate risks associated with data breaches during asset disposal. The shift towards sustainable practices is further propelling the market, as companies look to reduce their e-waste footprint and maximize the recycling of valuable components. Additionally, the rapid evolution of technology and the move towards cloud computing are causing data centers to frequently upgrade their equipment, increasing the volume of assets requiring disposition services. The demand for cost-efficient and compliant ITAD services is therefore expanding, supported by growing awareness of the environmental and security implications of improper disposal.Report Scope

The report analyzes the Data Center IT Asset Disposition market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Asset Type (Servers, CPU, SSD, Desktops, Laptops, Other Asset Types); Service (Data Sanitation / Destruction, Remarketing / Resale, Recycling).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Servers Asset segment, which is expected to reach US$7.2 Billion by 2030 with a CAGR of a 6.3%. The CPU Asset segment is also set to grow at 4% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Data Center IT Asset Disposition Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Data Center IT Asset Disposition Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

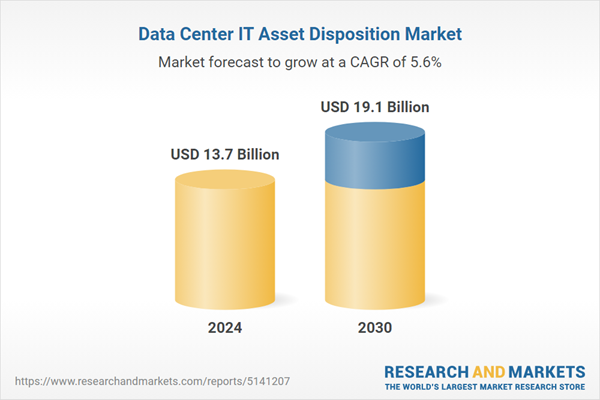

- How is the Global Data Center IT Asset Disposition Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Apto Solutions, Inc., Arrow Electronics, Inc., Atlantix Global Systems, CloudBlue, DataServ, LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this Data Center IT Asset Disposition market report include:

- Apto Solutions, Inc.

- Arrow Electronics, Inc.

- Atlantix Global Systems

- CloudBlue

- DataServ, LLC

- Dell Technologies

- GEEP Barrie

- Hewlett Packard Enterprise Development LP (HPE)

- IBM Corporation

- Iron Mountain Inc.

- Itrenew Inc.

- LifeSpan International, Inc.

- Sims Recycling Solutions, Inc.

- Tes-Amm (Singapore) Pte., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Apto Solutions, Inc.

- Arrow Electronics, Inc.

- Atlantix Global Systems

- CloudBlue

- DataServ, LLC

- Dell Technologies

- GEEP Barrie

- Hewlett Packard Enterprise Development LP (HPE)

- IBM Corporation

- Iron Mountain Inc.

- Itrenew Inc.

- LifeSpan International, Inc.

- Sims Recycling Solutions, Inc.

- Tes-Amm (Singapore) Pte., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 13.7 Billion |

| Forecasted Market Value ( USD | $ 19.1 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |