Global Cleaner and Degreaser Aftermarket Market - Key Trends and Drivers Summarized

Why Is the Cleaner and Degreaser Aftermarket Growing in Importance?

The cleaner and degreaser aftermarket has seen a significant rise in importance, driven by the growing need for regular maintenance and cleaning in industries such as automotive, manufacturing, and heavy machinery. Cleaners and degreasers are essential for removing contaminants like oil, grease, dirt, and other residues that can impact the performance, efficiency, and longevity of equipment. In automotive applications, regular cleaning and degreasing are critical for maintaining engine components, brakes, and mechanical parts, which can accumulate grime and reduce functionality over time. Beyond automotive, industrial sectors rely heavily on these products to keep equipment and machinery operating efficiently, preventing buildup that can lead to mechanical failures or safety risks. Additionally, as regulations surrounding equipment maintenance and cleanliness become more stringent, industries are increasingly turning to high-performance cleaners and degreasers to ensure compliance and extend the lifecycle of their machinery. The increasing awareness of preventive maintenance practices and the cost savings associated with avoiding equipment downtime have further propelled the growth of the cleaner and degreaser aftermarket.How Are Technological Innovations Enhancing Cleaner and Degreaser Solutions?

The development of more effective, environmentally friendly cleaning solutions has revolutionized the cleaner and degreaser aftermarket, addressing concerns about safety, efficiency, and environmental impact. Technological innovations in formulation chemistry have led to the creation of water-based, biodegradable, and low-VOC (volatile organic compound) cleaners and degreasers that provide the same cleaning power as traditional, solvent-based options without the harmful side effects. This is particularly important in industries where environmental regulations are becoming stricter, forcing companies to seek alternatives to hazardous chemicals. Moreover, advancements in surfactant and emulsifier technology have improved the ability of these products to break down stubborn grease and grime, allowing for more efficient and thorough cleaning processes. The rise of non-toxic, solvent-free cleaners has also expanded the use of these products in sensitive environments, such as food processing plants and healthcare facilities, where safety and hygiene are paramount. These technological advancements not only enhance the cleaning capabilities of products in the aftermarket but also address growing consumer demand for sustainable and safer alternatives, driving further innovation in the industry.Which Industries Are Leading the Demand for Cleaners and Degreasers?

The automotive, industrial manufacturing, and transportation sectors are at the forefront of the demand for cleaners and degreasers. In the automotive industry, both DIY consumers and professional mechanics rely on aftermarket cleaners and degreasers to maintain vehicle components such as engines, brakes, and fuel systems. With the rise of electric vehicles (EVs), specialized cleaners and degreasers designed for electric motor components and battery systems are becoming increasingly important. Similarly, the industrial manufacturing sector heavily depends on these products to clean machinery, assembly lines, and production equipment, ensuring smooth operation and reducing the risk of breakdowns due to the buildup of grease, oil, and debris. The transportation industry, including aviation and maritime, also relies on high-performance cleaners and degreasers to maintain large fleets of vehicles, where regular maintenance is critical to safety and efficiency. Additionally, the DIY culture and growing popularity of e-commerce platforms have made cleaners and degreasers more accessible to a broader audience, expanding the market to include individual consumers looking to perform routine maintenance on their own vehicles and equipment. This widespread demand across industries reflects the essential role cleaners and degreasers play in both professional and consumer markets, ensuring equipment reliability and safety.What Factors Are Fueling Growth in the Cleaner and Degreaser Aftermarket?

The growth in the cleaner and degreaser aftermarket is driven by several factors, including the increasing emphasis on preventive maintenance, regulatory pressures, and the shift toward eco-friendly cleaning solutions. Preventive maintenance practices have become a priority across industries, particularly in automotive and manufacturing, where regular use of cleaners and degreasers can significantly extend the life of equipment and reduce costly repairs. This focus on equipment longevity and operational efficiency has increased the demand for high-quality cleaning solutions in both professional and DIY settings. Additionally, stricter environmental regulations on chemicals and emissions are pushing industries to adopt water-based, biodegradable, and low-VOC cleaners and degreasers, which are safer for workers and less harmful to the environment. The automotive industry, in particular, is seeing a shift toward greener solutions, especially with the rise of electric vehicles, where specialized cleaners are required for delicate components. E-commerce growth and the popularity of DIY car maintenance have also contributed to the expansion of the aftermarket, as consumers can now easily access a wide range of cleaning and degreasing products. Furthermore, advances in formulation technologies have made it possible for manufacturers to offer powerful, non-toxic cleaning solutions that meet the growing demand for safety, sustainability, and performance. These factors combined have created a strong market for cleaners and degreasers, with continued growth expected as industries prioritize maintenance and regulatory compliance.Report Scope

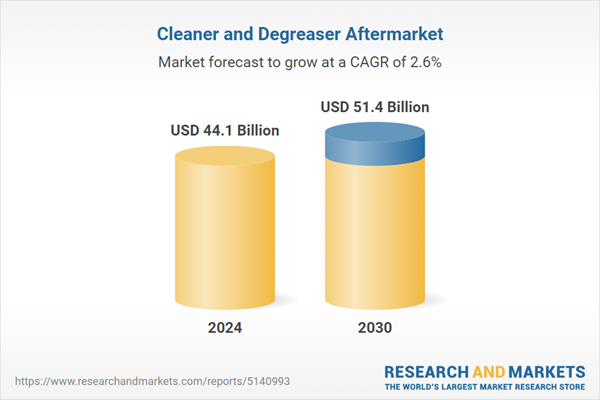

The report analyzes the Cleaner and Degreaser Aftermarket market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Solvent-Based, Water-Based); Supply Mode (Aerosol Can, Spray Bottle, Jug, Drum, Pail); End-Use (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solvent-Based Cleaner and Degreaser segment, which is expected to reach US$24.8 Billion by 2030 with a CAGR of 1.8%. The Water-based Cleaner and Degreaser segment is also set to grow at 3.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.9 Billion in 2024, and China, forecasted to grow at an impressive 3.6% CAGR to reach $9.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cleaner and Degreaser Aftermarket Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cleaner and Degreaser Aftermarket Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cleaner and Degreaser Aftermarket Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Abro Industries Inc., BASF SE, Dow, Inc., DuPont de Nemours, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Cleaner and Degreaser Aftermarket market report include:

- 3M Company

- Abro Industries Inc.

- BASF SE

- Dow, Inc.

- DuPont de Nemours, Inc.

- Fuchs Petrolub SE

- Penray

- WD-40 Company

- Wurth USA Inc.

- Zep

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Abro Industries Inc.

- BASF SE

- Dow, Inc.

- DuPont de Nemours, Inc.

- Fuchs Petrolub SE

- Penray

- WD-40 Company

- Wurth USA Inc.

- Zep

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 44.1 Billion |

| Forecasted Market Value ( USD | $ 51.4 Billion |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | Global |