Speak directly to the analyst to clarify any post sales queries you may have.

Navigating the Dental Disposables Industry with Strategic Insights into Emerging Trends and Operational Dynamics to Guide Clinical and Supply Chain Decisions

Over the past decade, the dental disposables sector has emerged as a critical pillar supporting modern clinical practice. As patient expectations rise and the imperative for strict infection control intensifies, dental professionals rely on a steady supply of high-quality single-use instruments and protective gear. This dynamic environment calls for a clear understanding of how innovations in materials and manufacturing processes are reshaping the landscape.In response to growing demand, the segment encompassing examination and diagnostic disposables has witnessed a surge in the adoption of advanced saliva evacuation tools and ergonomic mouth openers. At the same time, infection control measures have elevated the status of personal protective equipment, driving refinements in glove and face mask design. Procedural disposables, ranging from etching tips to orthodontic aligners, are likewise benefiting from novel polymers and biodegradable alternatives.

Meanwhile, regulatory authorities continue to tighten safety and environmental standards, compelling manufacturers and distributors to refine compliance frameworks. The convergence of digital dentistry, telehealth, and on-site 3D printing further amplifies the need for agility across supply chains. Consequently, stakeholders must navigate a complex interplay of quality assurance protocols, sustainability imperatives, and cost management pressures.

This executive summary presents a concise yet thorough synthesis of current trends, trade policy impacts, segmentation insights, regional dynamics, and competitive strategies. It aims to equip decision-makers with the strategic perspective required to optimize procurement, guide product development, and align operational priorities in a rapidly evolving market.

Embracing Innovation and Sustainability Drives Transformative Shifts in Dental Disposables Toward Digital Workflows and Enhanced Patient Safety

Digital transformation is redefining the dental disposables arena, as practices integrate advanced imaging workflows with single-use devices designed for seamless compatibility with CAD/CAM systems. This shift accelerates treatment times and elevates patient comfort, highlighting the intersection of precision manufacturing and clinical efficiency. Moreover, these innovations foster closer collaboration between device designers and dental professionals, yielding disposables that address nuanced ergonomic and procedural requirements.Sustainability has also emerged as a driving force, prompting manufacturers to explore biomaterials and biodegradable polymers. As environmental stewardship becomes a priority for providers and patients alike, circular economy principles are informing product lifecycle assessments and waste-reduction initiatives. Concurrently, suppliers are investing in closed-loop packaging solutions and recyclable tray covers, aiming to minimize ecological footprints without compromising hygiene standards.

Infection control protocols continue to evolve, with heightened focus on barrier films, disposable headrest covers, and sterilization pouches. These transformations underscore a broader commitment to patient safety and regulatory compliance, particularly in markets with stringent health authority mandates. Supply chain resilience remains equally important, as distributors diversify sourcing locations and implement digital tracking systems to mitigate disruptions.

Ultimately, these transformative shifts are fostering a more agile, patient-centric, and eco-responsible dental disposables landscape. Stakeholders who embrace technological integration, material innovation, and collaborative design approaches will be best positioned to capitalize on emerging opportunities and navigate the complexities of tomorrow’s clinical environment.

Assessing the Cumulative Impact of United States Tariffs in 2025 on Dental Disposables Supply Chains and Cost Structures

The introduction of new United States tariffs in 2025 is poised to reverberate across global supply chains for dental disposables, influencing everything from raw material sourcing to final pricing structures. Historically, trade measures have targeted a range of medical instruments and polymer imports, and the current schedule of duties will likely extend to key components such as nitrile gloves, plastic mixing tips, and paper-based bibs. Consequently, manufacturers and distributors must recalibrate procurement strategies to mitigate cost escalation.As tariffs raise the landed cost of imported goods, many suppliers are evaluating nearshoring alternatives and regional manufacturing partnerships to maintain competitive price points. This recalibration often necessitates investment in local production capacity and compliance certifications, adding capital expenditure considerations to operational planning. In parallel, contract negotiations with key clients increasingly include clauses that allow for dynamic pricing adjustments in response to shifting duty rates.

Regulatory compliance burdens will intensify as companies strive to ensure that alternative sourcing meets U.S. Food and Drug Administration requirements and established quality standards. In addition, logistics networks will need to adapt to potential bottlenecks at ports of entry, prompting some stakeholders to explore direct-to-clinic distribution models and enhanced inventory buffers.

Ultimately, the cumulative impact of these duties underscores the critical importance of supply chain visibility, collaborative supplier relationships, and flexible pricing models. Industry leaders who proactively assess tariff exposure and diversify sourcing footprints will be better equipped to preserve margin integrity and shield end-users from undue cost pressures.

Uncovering Critical Segmentation Insights Highlights Differentiated Demand Across Product Types Materials Applications Distribution Channels and End Users

Segment analysis reveals a multifaceted market structure that demands targeted strategies at every level. Within the realm of examination and diagnostic disposables, items such as air and water syringe tips, micro-applicators, and saliva evacuation products illustrate the premium placed on precision and ease of use. Infection control and PPE offerings, including barrier films, gowns, and sterilization pouches, highlight the imperative of uncompromising safety standards. Procedural disposables span dental needles, polishing brushes, impression trays, endodontic instruments, and orthodontic aligners, each category reflecting unique design and regulatory nuances.Material segmentation further underscores emerging preferences, as cotton rolls and gauze coexist with advanced biomaterials and biodegradable polymers. While traditional paper and metal components retain a stable presence, demand for nitrile gloves and plastic mixing tips continues to outpace alternatives due to durability and tactile performance. Vinyl remains in use for headrest covers, but heightened environmental scrutiny is driving investment in recyclable and renewable substrates.

Application-based insights demonstrate that general dentistry and oral surgery contribute consistent demand for a broad spectrum of disposables, while cosmetic procedures and orthodontic treatments lean heavily on specialized tips, trays, and polishing accessories. Pediatric dentistry prioritizes gentle materials and ergonomic designs, and periodontics and prosthodontics require disposables that support complex restorative workflows.

Regarding distribution channels, offline procurement through wholesalers and specialty distributors remains predominant, yet online platforms-including dedicated eCommerce portals and direct-to-clinician manufacturer sites-are capturing incremental share by offering streamlined ordering and digital tracking. End-user segmentation spans dental clinics of all sizes, laboratories, academic institutions, home care markets, and hospitals, each segment exhibiting distinct purchasing cycles and volume requirements. Appreciating these layered segmentation insights is essential for aligning product portfolios and go-to-market strategies.

Analyzing Regional Market Dynamics across the Americas Europe Middle East Africa and Asia Pacific Unveils Distinct Growth Opportunities

Regional dynamics shape the competitive environment for dental disposables through a combination of regulatory frameworks, reimbursement policies, and local practice standards. In the Americas, robust healthcare infrastructure and high procedural throughput drive consistent adoption of single-use items, with clinics and hospitals seeking reliable suppliers capable of meeting rigorous certification requirements. Latin American markets, while cost sensitive, show growing interest in premium disposables as public health initiatives emphasize infection control.Europe, the Middle East, and Africa present a diverse landscape where stringent European Union medical device regulations coexist alongside emerging market expansions in the Gulf Cooperation Council and Sub-Saharan Africa. Western European providers often favor advanced biomaterials and sustainable packaging, whereas EMEA regions experiencing economic development display increasing demand for basic PPE and diagnostic kits. In all cases, local distributors and specialized importers play a crucial role in navigating varied regulatory regimes.

Asia-Pacific stands out for its dynamic growth trajectory, underpinned by rising dental service penetration in China and India and technological adoption in Japan, South Korea, and Australia. Supply chain localization efforts, combined with government incentives for domestic manufacturing, are strengthening regional production hubs. At the same time, rising consumer awareness of oral health fuels expansion of home care disposables and clinic-based procedural kits, creating opportunities for both multinational and local brands.

Understanding these regional distinctions enables stakeholders to tailor market entry approaches, optimize distribution networks, and align product development with the specific expectations of practitioners and patients across each key geography.

Examining Key Company Strategies Illuminates Innovation Partnerships and Market Positioning within the Global Dental Disposables Sector

Leading stakeholders in the dental disposables space are differentiating through a combination of research and development investments, strategic alliances, and targeted acquisitions. Major medical device conglomerates have expanded their portfolios via partnerships with innovative materials firms, enabling the launch of next-generation barrier films and eco-friendly tray covers. At the same time, specialized dental suppliers are strengthening their eCommerce capabilities to improve order accuracy and delivery speed for clinics and laboratories.Several companies have prioritized digital integration, embedding connectivity features into single-use devices that support inventory management and usage tracking. Others have established collaborative innovation centers with academic institutions, focusing on biodegradable polymers and antimicrobial coatings. These initiatives not only address regulatory demands but also resonate with growing consumer interest in sustainability and infection prevention.

In parallel, prominent distributors have leveraged data analytics platforms to forecast clinic-level consumption patterns, enabling just-in-time replenishment and reducing waste. Meanwhile, M&A activity continues to reshape the competitive landscape, as larger players seek to acquire niche disposables specialists to broaden their geographic reach and product breadth.

Collectively, these company-level strategies underscore the importance of agility, customer centricity, and technological differentiation. Organizations that excel in integrating supply chain transparency tools, forging cross-sector collaborations, and rapidly commercializing innovations will retain a competitive edge in a market driven by both clinical imperatives and environmental considerations.

Strategic Recommendations for Industry Leaders to Optimize Operations Drive Sustainable Innovation and Navigate Regulatory Headwinds in Dental Disposables

To thrive in this evolving market, industry leaders should prioritize strategic investments in sustainable materials research and digital workflow integration. By accelerating development of biodegradable polymers and recyclable packaging, organizations can align with clinician and patient expectations while mitigating regulatory risks. Concurrently, embedding connectivity features into single-use devices will enhance inventory management, support data-driven replenishment, and reduce operational bottlenecks.Moreover, forging closer partnerships with clinical networks and academic centers can unlock insights that inform product refinement and streamline validation processes. These collaborative efforts will expedite time to market and foster brand loyalty among end-users. At the same time, strengthening supplier diversification and nearshoring initiatives will buffer cost volatility arising from trade policy shifts and logistical disruptions.

In addition, expanding digital sales channels through manufacturer-operated websites and eCommerce platforms will cater to the growing preference for online ordering. Complementing these channels with value-added services such as usage analytics and training modules will enhance customer retention and open new revenue streams. Finally, developing adaptive pricing frameworks that incorporate duty fluctuations and raw material cost indices will provide transparency and build trust with procurement stakeholders.

By implementing these recommendations, market participants can drive sustainable innovation, optimize supply chain resilience, and position themselves for long-term growth in a highly competitive environment.

Detailing the Rigorous Methodology Combining Primary Expert Interviews Secondary Data Triangulation and Quality Validation for Dental Disposables Analysis

This analysis draws on a rigorous research methodology combining primary interviews with dental practitioners, supply chain executives, and regulatory experts alongside comprehensive secondary data reviews. Interviews were conducted across key geographies to capture diverse perspectives on clinical requirements, procurement challenges, and emerging material preferences. These firsthand insights were instrumental in validating assumptions and refining thematic priorities.Secondary research encompassed an extensive review of industry publications, patent filings, regulatory policy updates, and technical standards documents. Data triangulation techniques were employed to cross-verify findings, ensuring consistency between qualitative expert feedback and quantitative indicators. This approach enabled the identification of underlying drivers and nuanced market dynamics that may not be apparent from publicly available sources alone.

Quality control measures included internal peer reviews, data integrity checks, and systematic gap analyses designed to uncover potential biases or inconsistencies. Throughout the process, confidentiality protocols were strictly upheld, and all expert contributors provided informed consent. The resulting framework offers a balanced, transparent, and actionable foundation for strategic decision-making in the dental disposables sector.

Concluding Insights Emphasize the Critical Role of Innovation Sustainability and Strategic Collaboration in Shaping the Future of Dental Disposables

In conclusion, the dental disposables market is at a pivotal moment defined by rapid innovation, shifting trade policies, and heightened sustainability imperatives. Digital dentistry advancements are reshaping clinical workflows, while emerging biomaterials and biodegradable polymers address growing environmental concerns. At the same time, new tariffs in 2025 underscore the need for robust supply chain strategies and flexible pricing frameworks.Segmentation insights reveal differentiated demand patterns across product types, materials, applications, distribution channels, and end-user categories. Regional dynamics from the Americas to EMEA and Asia-Pacific further accentuate the importance of tailored market approaches. Leading companies are responding with strategic partnerships, M&A activity, and digital integration to secure competitive advantages.

Going forward, stakeholders who embrace collaborative innovation, invest in sustainable product development, and leverage advanced analytics for supply chain optimization will be best positioned to capture emerging opportunities. By adopting the recommended strategic actions, decision-makers can enhance operational resilience, drive long-term growth, and deliver superior value to dental practitioners and patients alike.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Dental Disposables Market

Companies Mentioned

The key companies profiled in this Dental Disposables market report include:- 3M Company

- A.R. Medicom, Inc.

- Akzenta International SA

- Dentsply Sirona Inc.

- Dispodent

- Dispotech Srl

- GC America Inc.

- Getinge AB

- Hager & Werken GmbH & Co. KG

- Henry Schein, Inc.

- Kerr Corporation

- Keystone Industries GmbH

- Maxill Inc.

- Owens & Minor, Inc.

- Schülke & Mayr GmbH

- Sri Trang USA, Inc.

- Steris Corporation

- VOCO GmbH

- Young Innovations, Inc.

Table Information

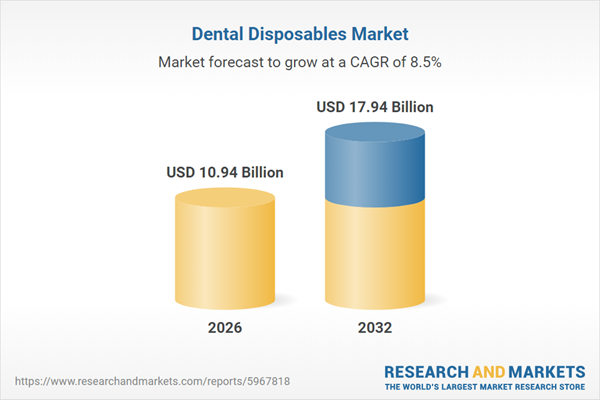

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 10.94 Billion |

| Forecasted Market Value ( USD | $ 17.94 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |