Depilatories are cosmetic products that are used to remove unwanted hair on the surface of the skin and are typically in the form of creams, lotions, gels, and powder. There is a huge difference between the epilator and the depilator regarding hair removal. While epilation removes hair from its roots completely, depilation removes hair only at the surface of the skin. Depilatories are often considered more convenient and less expensive than opting for salon or spa treatments for hair removal. The chemical properties in depilatory products aid in the hair removal process by breaking down bonds in keratin present in hair that gives it strength. When the hair gets weakened, it either disintegrates or is distressed enough that it can be scraped or wiped away.

Rising disposable incomes and living standards coupled with increasing urbanization are significantly driving the market growth of depilatory products globally. People are getting more and more conscious with respect to personal grooming while enhancing their aesthetic appeal themselves. As such, convenient depilatory products are gaining popularity among consumers who are looking for easy and quick options, which, in turn, is fuelling the global market growth of depilatory products.

The growing working women population with a busy lifestyle is further accelerating the demand for convenient grooming products, thereby driving the global depilatory products market growth. The emerging popularity of hair removal products, both chemical and non-chemical, among men is a great opportunity for market players to diversify their product portfolio for this gender and gain a larger market share, which will continue to bolster the overall market growth of depilatory products across the globe during the forecast period.

The recent COVID-19 pandemic outbreak has tremendously boosted the demand for depilatory products. Mandatory government lockdowns and the shutdown of salons and spa facilities have driven the demand for depilatory products among women, which are convenient, cost-effective, and easy to use at home. Market players are continuously enhancing their product portfolios as per the requirements of their customers. Rising awareness about depilatory products infused with organic and natural ingredients is also encouraging market players to launch new products, thus positively impacting the market growth of depilatory products.

The global depilatory products market has been segmented on the basis of type, application, sales channel, and geography. By type, the global depilatory products market has been segmented as chemical and non-chemical. On the basis of application, the segmentation has been done as men and women. The Global Depilatory Products market has also been segmented by sales channels as online and offline.

The emerging male grooming market is boosting the demand for depilatory products

By application, the women's segment accounted for the major market share in 2019 and will continue to dominate this segment till the end of the forecast period. The need for quick and convenient hair removal solutions among the growing working population base is continuously augmenting the demand for various depilatory products. A high focus on personal hygiene and grooming among women has also driven the demand for depilatory products across this segment. However, the male grooming industry has recently started to gain popularity, which is boosting the demand for depilatory products across this segment as well, thus propelling the overall market growth.During the forecast period, the online sales channel segment will grow at a faster CAGR. According to the sales channel, the online segment will experience a higher CAGR between 2020 and 2025 owing to the rising proliferation of smartphones and increasing penetration of high-speed internet connectivity across the globe. Factors such as easy payment options and the growing preference of customers to shop online are also encouraging manufacturers to offer their products on various online platforms, thus spurring the growth of this segment. Moreover, the current pandemic situation caused by COVID-19 has further accelerated the growth of this segment due to the temporary shutdown of supermarkets and hypermarkets in various affected countries.

The Asia Pacific will witness the fastest regional market growth

Geographically, the global Depilatory Products market has been segmented as North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. Asia Pacific regional market for depilatory products is poised to grow at the highest CAGR during the forecast period owing to factors such as changing living standards with rising purchasing power, rising adoption of Western consumer practices, and growing concerns regarding personal hygiene and grooming among men and women. The booming e-commerce industry in countries like China and India also contributes substantially to the depilatory product market across this region.With high smartphone penetration and better internet connectivity, people are choosing to do more online shopping as it is convenient and cost-effective and also provides various international depilatory products customers can choose from at discounted rates. On account of the early adoption of new trends and technologies, coupled with the presence of major market players in the region, North America holds a significant share in the global depilatory products market. Due to a high focus on personal grooming and hygiene among both men and women.

Recent Developments:

May 2020: Daycell announced the launch of its new hair removal cream that is made exclusively for sensitive skin. The soft and gentle features of the cream help in removing hair without irritation or rashes. The product contains aloe vera leaf juice, green tea extract and grapefruit extract, which help in keeping the skin moist and soft.January 2020: Procter & Gamble (P&G) acquired the US-based body care and shaving brand, Billie, in order to further reach millennial and gen-Z women with innovative products.

November 2019: British consumer goods major Reckitt Benckiser (RB) launched a hair removal cream for men under its popular brand Veet in India's emerging male grooming industry.

March 2019: Church & Dwight Co., Inc. signed a definitive agreement with Ideavillage Products Corporation to acquire the FINISHING TOUCH™ and FLAWLESS™ brands of hair removal products for approximately $475 million.

Competitive Insights

Prominent key market players in the Global Depilatory Products market include CHURCH & DWIGHT CO., INC, L’Oréal Paris, Cire France, Reckitt Benckiser, Linco Care Ltd, SIMPLE USE Beauty, Procter & Gamble, Jolen Beauty, Nad's, and Sally Hansen. These companies hold a noteworthy share of the market on account of their good brand image and product offerings. Major players in the global depilatory products market have been covered along with their relative competitive position and strategies. The report also mentions recent deals and investments by different market players over the last two years.Impact of the Covid-19 pandemic

The COVID-19 pandemic had an adverse effect on the global economy, owing to the massive losses suffered by major industries across the world. The pandemic also had a negative effect on the depilatory product market. Due to the strict lockdown rules, people's spending on personal care and cosmetic products initially decreased. Moreover, the disruptions in supply and manufacturing lines also had a negative effect. However, the market soon saw a growth in demand due to the increase in health and hygiene concerns among people. The increasing product innovations and the release of skin-friendly products, along with the growing e-commerce sector have helped in lifting the market demand. Furthermore, as most countries have started to withdraw their COVID-19 regulations, the market is anticipated to rise.Segmentation

By Type

- Chemical

- Cream and Lotions

- Wax

- Cold Wax Strips

- Non-Chemical

- Razors

- Tweezers

By Application

- Men

- Women

By Sales Channel

- Online

- Offline

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

Table of Contents

Companies Mentioned

- CHURCH & DWIGHT CO., INC.

- L’Oréal Paris

- Cire France LLC

- Reckitt Benckiser

- Linco Care Ltd

- SIMPLE USE Beauty

- Procter & Gamble

- Jolen Beauty

- Sue Ismiel and Daughters (Nads)

- Sally Hansen

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 131 |

| Published | September 2022 |

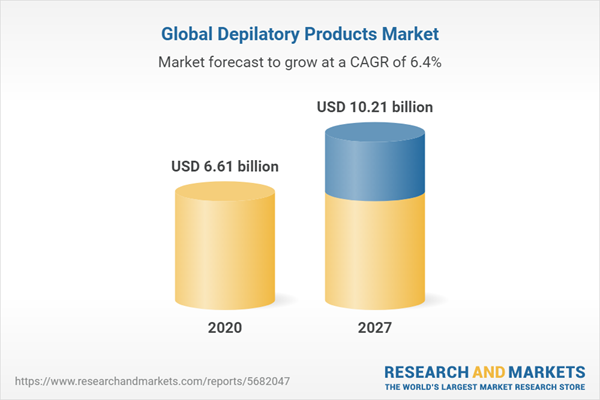

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 6.61 billion |

| Forecasted Market Value ( USD | $ 10.21 billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |