Diagnostic Testing: Introduction

Diagnosis testing, a fundamental pillar of modern healthcare, involves a diverse range of tests and examinations aimed at identifying the presence of specific diseases, conditions, or health issues in individuals. Through laboratory tests, imaging techniques, genetic analysis, biopsies, and other diagnostic procedures, healthcare professionals can make accurate and timely diagnoses. Early detection facilitated by these tests enables prompt intervention and treatment, leading to improved patient outcomes.Diagnostic testing not only confirms or rules out suspected diagnoses but also plays a crucial role in disease monitoring and the implementation of personalized medicine approaches. Additionally, it is instrumental in public health surveillance, allowing for the monitoring of infectious diseases and timely containment of outbreaks.

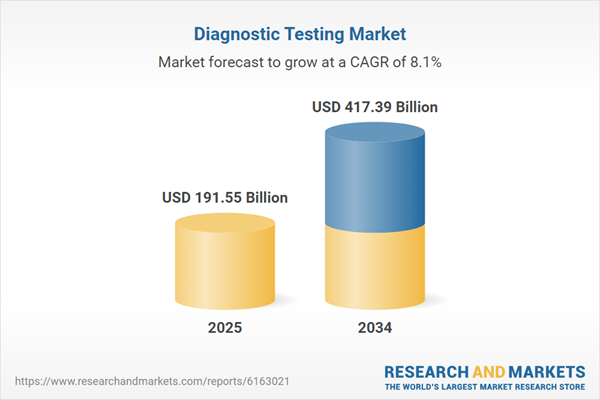

Global Diagnostic Testing Market Analysis

Diagnostic testing provides convenience, faster results, and ease of use for patients and healthcare providers, leading to increased demand for point-of-care testing (POCT). With the help of POCT devices, rapid diagnosis and treatment decisions could be made quickly in clinics, or even in remote settings, which leads to the reduction in time of fetching test results. These benefits increase the demand for better diagnostic testing procedures that are convenient for both healthcare professionals and the patients, driving the market growth.Additionally, due to its great sensitivity and specificity in detecting and analyzing genetic material, infections, and biomarkers, molecular diagnostics is also experiencing substantial growth, which is directly adding up to the global diagnostic testing market share. The integration of diagnostic testing with digital health technologies, such as telemedicine, mobile health apps, and wearable devices, has also gained enough popularity among patients and healthcare professionals. With the help of these technologies, remote monitoring, data collection, and real-time communication between patients and healthcare providers is made easy which further enhances the overall patient experience and improves the disease management approaches.

To keep up with the needs of modern healthcare, the market is constantly evolving. The market is changing, and diagnostic skills are being upgraded for better patient care as a result of technological innovations, personalized healthcare, digital health integration, and ongoing responses to global health concerns.

Global Diagnostic Testing Market Segmentations

Diagnostic Testing Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Test

- Lipid Panel

- Liver Panel

- Renal Panel

- Complete Blood Count

- Electrolyte Testing

- Infectious Disease Testing

- Other Tests

Market Breakup by Type

- Product

- Instruments

- Reagents

- Other Products

Market Breakup by End User

- Hospital Laboratory

- Diagnostic Laboratory

- Point-of-care Testing

- Other End Users

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Diagnostic Testing Market Overview

The market is a rapidly evolving and is an important part of the healthcare industry across the globe. It includes a wide range of procedures and equipment for examining illnesses, disorders, infections, and genetic disorders in people. The rising geriatric population, improvements in diagnostic technology, the rising demand for early disease diagnosis, and increasing focus on personalized medicines and healthcare, integration of smart technologies such as artificial intelligence and machine learning with diagnostic devices are some of the major factors that have been propelling the global diagnostic testing market growth. There are some major kinds of diagnostic testing included in the market which are molecular diagnostics, immunoassays, point-of-care testing, clinical chemistry, and medical imaging.Diagnostic testing continues to play an important role in enhancing patient outcomes, enhancing treatment plans, and promoting effective disease management as the focus on preventative healthcare and quick treatments is increasing.

Moreover, the ongoing efforts to fight global health crises have further showed the significance of diagnostic testing in identifying and containing infectious diseases. With ongoing research and technological innovations, the market is expected to witness substantial growth in the coming years, contributing significantly to advancing healthcare and promoting better public health outcomes.

Diagnostic Testing Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Abbott Laboratories

- Becton, Dickinson and Company

- BioMerieux

- Bio-Rad Laboratories Inc.

- Danaher Corporation

- Siemens AG

- Hologic Inc.

- Qiagen NV

- F. Hoffmann-La Roche AG

- Thermo Fisher Scientific

- Quest Diagnostics Inc.

- Sysmex Corporation

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Becton, Dickinson and Company

- BioMerieux

- Bio-Rad Laboratories Inc.

- Danaher Corporation

- Siemens AG

- Hologic Inc.

- Qiagen NV

- F. Hoffmann-La Roche AG

- Thermo Fisher Scientific

- Quest Diagnostics Inc.

- Sysmex Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 191.55 Billion |

| Forecasted Market Value ( USD | $ 417.39 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |