Global Diesel Exhaust Fluid Aftermarket Market - Key Trends and Drivers Summarized

What Is Diesel Exhaust Fluid and How Does It Impact Emissions?

Diesel Exhaust Fluid (DEF) is a non-toxic solution used in diesel engines equipped with Selective Catalytic Reduction (SCR) systems to reduce nitrogen oxide (NOx) emissions. Comprising 32.5% urea and 67.5% deionized water, DEF is injected into the exhaust stream where it vaporizes and decomposes into ammonia and carbon dioxide. This process converts NOx into harmless nitrogen and water vapor in the SCR system, significantly reducing the emissions harmful to the environment. As environmental regulations continue to tighten globally, the use of DEF has become increasingly mandatory for new diesel engines in commercial vehicles, agricultural equipment, and heavy machinery to meet stringent emissions standards.What Drives the Demand for DEF in the Aftermarket?

The demand for diesel exhaust fluid in the aftermarket is driven by the ongoing need for maintenance in vehicles that require DEF for regulatory compliance. As the fleet of vehicles equipped with SCR technology grows, so does the requirement for regular DEF top-ups. Each diesel vehicle varies in DEF usage, generally depending on engine size, load, and driving conditions, but typically requires regular refills. This continuous demand creates a robust market for DEF, particularly in regions with strict emissions laws such as North America and Europe. Moreover, the rise in the number of older diesel vehicles being retrofitted with SCR systems to comply with emissions regulations further amplifies the market for DEF in the aftermarket.How Is the DEF Aftermarket Evolving with Technological Advancements?

Technological advancements are significantly shaping the diesel exhaust fluid aftermarket. Innovations in packaging, storage, and dispensing solutions are enhancing the way DEF is sold and utilized. Advanced storage solutions are designed to prevent contamination and degradation of DEF, which is susceptible to impurities that can reduce its effectiveness and damage the SCR system. Smart dispensing systems equipped with sensors are also being developed to monitor DEF levels and usage accurately, ensuring optimal performance of the emission control systems. Additionally, as the global logistics and transportation sectors grow, the demand for efficient and eco-friendly solutions like DEF rises, prompting suppliers to innovate in distribution and inventory management to cater to widespread and timely availability.What Drives the Growing Market for Diesel Exhaust Fluid Aftermarket?

The growth in the diesel exhaust fluid aftermarket is driven by several factors, including stringent global emissions regulations, the increasing adoption of SCR technology in diesel engines, and the overall growth in the production of diesel vehicles. As governments worldwide tighten NOx emissions standards to combat air pollution, the demand for DEF rises correspondingly. The expansion of the commercial vehicle sector, especially in emerging markets, further boosts the consumption of DEF. Consumer behavior also influences this market's growth; as awareness of environmental impacts increases, so does the commitment of businesses and individuals to comply with emissions standards. Technological improvements in SCR systems and DEF dispensing methods continue to evolve, making the use of DEF more accessible and efficient, thus promoting its widespread adoption. This combination of regulatory demand, technological advancement, and market expansion ensures a dynamic and growing aftermarket for diesel exhaust fluid.Report Scope

The report analyzes the Diesel Exhaust Fluid Aftermarket market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Supply Mode (Bulk, Intermediate Bulk Containers (IBC), Cans, Pumps); Vehicle Type (Light Commercial Vehicles, Passenger Cars, Heavy Commercial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Light Commercial Vehicles segment, which is expected to reach US$40 Billion by 2030 with a CAGR of 7.9%. The Passenger Cars segment is also set to grow at 6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $15.6 Billion in 2024, and China, forecasted to grow at an impressive 6.1% CAGR to reach $12.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Diesel Exhaust Fluid Aftermarket Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Diesel Exhaust Fluid Aftermarket Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Diesel Exhaust Fluid Aftermarket Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Air Liquide SA, BASF SE, CF Industries Holdings, Inc., China Petrochemical Corporation (Sinopec Group), Cummins, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Diesel Exhaust Fluid Aftermarket market report include:

- Air Liquide SA

- BASF SE

- CF Industries Holdings, Inc.

- China Petrochemical Corporation (Sinopec Group)

- Cummins, Inc.

- Graco, Inc.

- Nissan Chemical Industries Ltd.

- PotashCorp. (Canada)

- Royal Dutch Shell PLC

- Total SA

- Yara International ASA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Liquide SA

- BASF SE

- CF Industries Holdings, Inc.

- China Petrochemical Corporation (Sinopec Group)

- Cummins, Inc.

- Graco, Inc.

- Nissan Chemical Industries Ltd.

- PotashCorp. (Canada)

- Royal Dutch Shell PLC

- Total SA

- Yara International ASA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

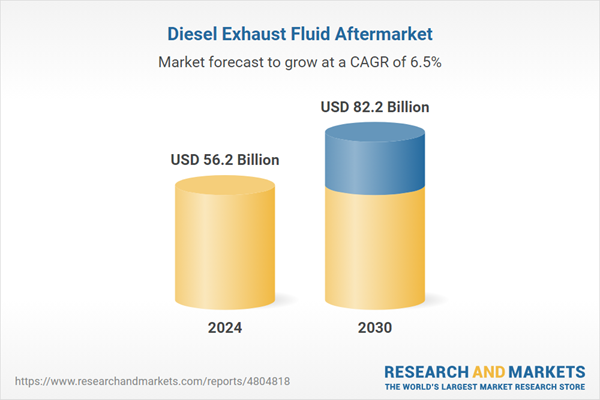

| Estimated Market Value ( USD | $ 56.2 Billion |

| Forecasted Market Value ( USD | $ 82.2 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |