Global Document Imaging Market - Key Trends & Drivers Summarized

How Is Document Imaging Transforming Business Operations?

Document imaging technology, which converts physical documents into digital formats, has become integral in modern business operations, enabling organizations to streamline their workflows and improve data accessibility. As companies continue to pursue digital transformation initiatives, document imaging allows them to reduce reliance on paper-based processes, leading to significant cost savings and efficiency gains. This technology is essential in industries that manage large volumes of documents, such as banking, healthcare, legal, and government sectors, where quick access to accurate records is crucial. By digitizing documents, businesses can also enhance compliance and security, as digital records are easier to manage, store, and protect with encryption methods. The shift towards cloud storage and the need for efficient data management solutions have further accelerated the adoption of document imaging, making it a critical component in the transition to digital workplaces.What Technological Developments Are Enhancing Document Imaging Solutions?

Technological advancements have significantly elevated the capabilities of document imaging systems, making them more powerful and versatile. High-resolution scanners and advanced optical character recognition (OCR) technology allow for precise and accurate digitization of various document types, including forms, handwritten notes, and legal contracts. The integration of artificial intelligence (AI) enables document imaging software to automatically categorize and tag documents, facilitating quicker retrieval and better organization. Cloud-based imaging solutions are becoming increasingly popular, providing businesses with scalable, secure, and remote access to their digitized records. Additionally, mobile document imaging applications allow employees to capture and upload documents directly from their smartphones, enhancing convenience and flexibility for remote and on-the-go workforces. These innovations not only improve the efficiency of document imaging processes but also ensure that companies can keep pace with the evolving demands of a digital-first business environment.In Which Sectors Is Document Imaging Most Widely Applied?

Document imaging is extensively utilized across various industries, with each sector leveraging its capabilities to enhance efficiency and compliance. In the banking and finance sector, document imaging is used to digitize customer records, process loan applications, and manage financial documentation, ensuring quick access to critical data while maintaining regulatory compliance. Healthcare providers use document imaging to manage patient records, digitize medical forms, and improve overall information management within hospitals and clinics. In the legal sector, law firms rely on imaging solutions to digitize case files and contracts, reducing the space required for storage and facilitating easy access to records. Government agencies also employ document imaging technology to digitize forms, licenses, and permits, which streamlines public services and improves administrative efficiency. The broad application of document imaging technology demonstrates its value in enhancing document management and ensuring operational excellence in diverse industries.What Factors Are Driving the Growth of the Document Imaging Market?

The growth in the document imaging market is driven by several factors, including the increasing focus on digital transformation, the rising demand for secure and compliant data management solutions, and technological advancements in scanning and imaging software. The need to streamline workflows and reduce the costs associated with paper-based processes has pushed businesses to adopt document imaging technology as a way to digitize and automate document management. The emphasis on data security and regulatory compliance in industries like healthcare, finance, and government has also propelled the adoption of imaging solutions, as these sectors require secure and accessible digital records. The development of AI and cloud-based imaging platforms provides businesses with efficient, scalable, and remote solutions, further encouraging market growth. Additionally, the trend toward mobile and remote work necessitates the use of advanced document imaging systems that support easy capture and retrieval of documents from any location, driving further expansion in this market.Report Scope

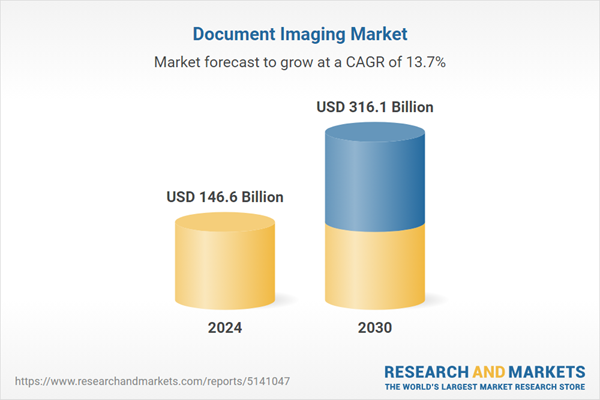

The report analyzes the Document Imaging market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Hardware, Software); Deployment (On-Premise, Cloud); End-Use (Government Organizations, Law Firms, Physician Practices, Educational Institutions, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Document Imaging Hardware segment, which is expected to reach US$178.6 Billion by 2030 with a CAGR of a 13.4%. The Document Imaging Software segment is also set to grow at 14% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $40.1 Billion in 2024, and China, forecasted to grow at an impressive 12.8% CAGR to reach $47.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Document Imaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Document Imaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Document Imaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aramex International LLC, Canon, Inc., Capital Business Systems Pvt. Ltd., Eastman Kodak Company, Epson America Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 134 companies featured in this Document Imaging market report include:

- Aramex International LLC

- Canon, Inc.

- Capital Business Systems Pvt. Ltd.

- Eastman Kodak Company

- Epson America Inc.

- Fujitsu Ltd.

- HP, Inc.

- Newgen Software Technologies Limited

- Qorus Software (Pty) Ltd.

- Xerox Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aramex International LLC

- Canon, Inc.

- Capital Business Systems Pvt. Ltd.

- Eastman Kodak Company

- Epson America Inc.

- Fujitsu Ltd.

- HP, Inc.

- Newgen Software Technologies Limited

- Qorus Software (Pty) Ltd.

- Xerox Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 242 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 146.6 Billion |

| Forecasted Market Value ( USD | $ 316.1 Billion |

| Compound Annual Growth Rate | 13.7% |

| Regions Covered | Global |