Global Electrical Conductors Market - Key Trends and Drivers Summarized

Why Are Electrical Conductors So Integral to Modern Infrastructure?

Electrical conductors form the backbone of our modern energy and communication infrastructure, facilitating the seamless transfer of electricity across a range of devices and systems. But what exactly makes a material a good conductor? Conductors, such as copper, aluminum, and silver, have a high capacity for the free movement of electrons due to their unique atomic structure, which significantly reduces resistance to the flow of electric current. This property makes them ideal for numerous applications including power transmission, wiring, and electronic components. Copper, in particular, is the most widely used due to its excellent conductivity, flexibility, and resistance to heat. Silver, though the best conductor of electricity, is less commonly used due to its high cost, making it more suitable for specialized applications such as in circuit boards and high-frequency transmission lines. Emerging research into superconductors - materials that offer zero electrical resistance under certain conditions - also holds promise for revolutionizing energy efficiency in industries. Understanding the nuances of these materials is essential for appreciating their role in the global economy and how they sustain the complex interconnectivity of our daily lives.What Are the Key Applications and Trends in Conductor Materials?

Electrical conductors are indispensable across a variety of sectors, ranging from residential and industrial power distribution to the rapidly growing fields of telecommunications and renewable energy systems. In the automotive industry, the increasing adoption of electric vehicles (EVs) is creating a surge in demand for specialized conductors that can handle high voltage and temperature variations. This trend has catalyzed research into new alloys and composite materials that offer better performance and lower weight compared to traditional copper. Similarly, the expansion of data centers worldwide is driving the need for advanced conductor materials in servers and power units, with aluminum gaining popularity due to its cost efficiency and reduced weight. Moreover, the push for smart grid technology has led to innovations in conductor design, including the use of graphene and carbon nanotubes, which offer superior conductivity and strength. These developments are reshaping the landscape of electrical conductors, highlighting a shift from conventional materials to more sophisticated solutions that can meet the diverse demands of modern electrical systems.How Do Technological Innovations Influence the Efficiency of Conductors?

Technological advancements are continuously enhancing the efficiency and functionality of electrical conductors, making them more suited to the evolving needs of various industries. Innovations such as nanotechnology have paved the way for the development of conductors with minimized resistive losses and increased power density, which are critical for applications in compact electronic devices and high-performance computing. For instance, recent breakthroughs in the production of nanowire-based conductors promise to significantly lower energy consumption in microprocessors. The use of conductive polymers is another area of interest, particularly for flexible electronics, where traditional metallic conductors fall short in terms of flexibility and durability. These new materials are not only improving performance but also expanding the potential applications of conductors in emerging fields such as wearable technology and the Internet of Things (IoT). Additionally, the integration of artificial intelligence in manufacturing processes is enabling the optimization of conductor designs, reducing costs and enhancing scalability. The convergence of these technological trends is creating a paradigm shift in how conductors are manufactured, implemented, and utilized in both established and novel applications.What's Driving the Growth of the Electrical Conductors Market?

The growth in the electrical conductors market is driven by several factors, primarily influenced by shifts in technology adoption, consumer demand, and industrial requirements. The rapid global transition towards renewable energy sources such as solar and wind power is a major growth driver, as these systems require extensive conductor networks for efficient power transmission. In the automotive sector, the accelerating shift towards electric vehicles is propelling the demand for high-performance conductors that can meet the unique requirements of battery systems and power management. Additionally, the increasing digitization of industries and the rise of smart infrastructure are boosting the need for robust conductor materials capable of supporting higher data transfer rates and greater electrical loads. Consumer behavior is also influencing the market, particularly the growing demand for smaller, more energy-efficient devices, which is leading manufacturers to invest in lighter and more efficient conductor solutions. Furthermore, the expansion of telecommunication networks, driven by the rollout of 5G technology, is significantly increasing the use of high-frequency conductors in antennas and base stations. These factors, combined with a surge in infrastructure development in emerging economies, are collectively shaping the growth trajectory of the global electrical conductors market.Report Scope

The report analyzes the Electrical Conductors market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Power Transmission Application, Power Distribution Application, Power Generation Application, Other Applications).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electrical Conductors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electrical Conductors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

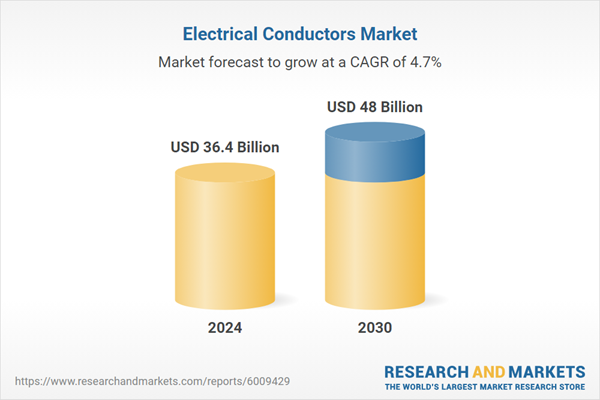

- How is the Global Electrical Conductors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Apar Industries Ltd., CABELTE SA, Calmont Wire and Cable, Inc., CMI Ltd., CTC Cable and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 52 companies featured in this Electrical Conductors market report include:

- Apar Industries Ltd.

- CABELTE SA

- Calmont Wire and Cable, Inc.

- CMI Ltd.

- CTC Cable

- Diamond Power Infrastructure Ltd.

- Furukawa Electric Co., Ltd.

- Hi tech Conductors Pvt Ltd.

- J-Power Systems Corporation

- KEI Industries Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Apar Industries Ltd.

- CABELTE SA

- Calmont Wire and Cable, Inc.

- CMI Ltd.

- CTC Cable

- Diamond Power Infrastructure Ltd.

- Furukawa Electric Co., Ltd.

- Hi tech Conductors Pvt Ltd.

- J-Power Systems Corporation

- KEI Industries Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 36.4 Billion |

| Forecasted Market Value ( USD | $ 48 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |