Global Electrical Explosion Proof Equipment Market - Key Trends and Drivers Summarized

How Is Electrical Explosion Proof Equipment Vital for Industry Safety?

Electrical explosion proof equipment is essential for maintaining safety in industries where hazardous, flammable, or explosive materials are handled. This equipment is designed to contain any explosion originating within its housing and prevent igniting a larger blast or fire in the surrounding atmosphere. Commonly used in oil refineries, chemical plants, paint shops, grain elevators, and other environments with explosive gases, dusts, or fibers, these devices ensure that all electrical connections perform safely without risking the health and safety of the workplace. They include elements like junction boxes, lighting fixtures, control panels, and cable glands, all manufactured to strict standards that prevent any sparks or heat they generate from escaping and igniting external flammable atmospheres. The rigorous testing and certification processes that explosion proof equipment undergoes underscore its importance in industrial operations, reflecting a commitment to safety and compliance with national and international safety codes.What Innovations Are Enhancing the Functionality of Explosion Proof Electrical Equipment?

Innovation in explosion proof electrical equipment focuses on improving reliability, safety, and operational efficiency, even under extreme conditions. Recent advancements include the use of new materials and technologies that enhance the structural integrity and heat resistance of these devices. For instance, manufacturers are incorporating corrosion-resistant materials like stainless steel or aluminum with special coatings to withstand harsh chemical environments and extreme temperatures. Technological enhancements also include wireless communication capabilities within explosion proof enclosures, allowing for remote monitoring and control without the need for physical wiring that could compromise the integrity of the explosion proof seal. Additionally, developments in sealing technology have improved the ability of these devices to prevent the ingress of dust and moisture, which can be critical in maintaining safety in explosive environments. These innovations not only extend the life of the equipment but also contribute to safer and more efficient industrial operations.How Do Electrical Explosion Proof Equipment Impact Environmental Sustainability?

Electrical explosion proof equipment indirectly contributes to environmental sustainability by enhancing the safety and efficiency of industrial processes that use or produce hazardous substances. By preventing explosions and minimizing the release of toxic gases and other pollutants, this equipment helps protect both the immediate work environment and the broader ecosystem. Furthermore, the robust design and extended lifespan of explosion proof devices reduce the need for frequent replacements, lowering the resource waste and environmental impact associated with the manufacturing, transportation, and disposal of industrial equipment. Some manufacturers are also focusing on reducing the environmental footprint of their production processes by using recycled materials and adopting more energy-efficient manufacturing techniques. These efforts contribute to making industrial operations not only safer but also more environmentally responsible.What Trends Are Driving Growth in the Electrical Explosion Proof Equipment Market?

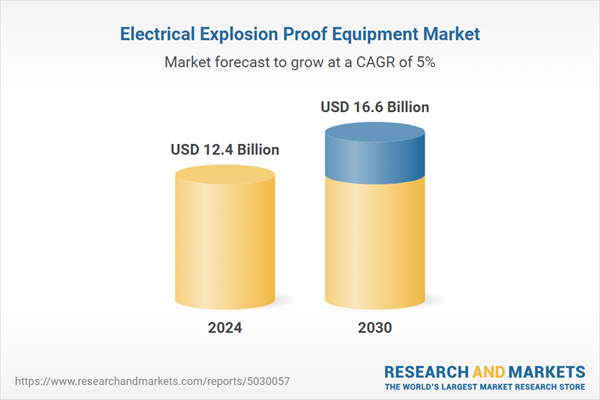

The growth of the electrical explosion proof equipment market is driven by several factors, including stringent regulatory standards, growth in industries that handle flammable substances, and technological advancements. Increased global focus on safety and environmental standards has led to stricter regulations, which mandate the use of explosion proof equipment in a wider range of industries and applications. As sectors such as oil and gas, chemicals, and pharmaceuticals expand, particularly in emerging markets, the demand for safe and compliant electrical equipment is also rising. Moreover, the ongoing developments in technology that improve the performance and functionality of explosion proof devices are making them more attractive to industries looking to enhance safety and efficiency. Additionally, the rising awareness of the potential costs associated with industrial accidents, in terms of both human lives and economic losses, is prompting more businesses to invest in reliable safety solutions like explosion proof equipment, further fueling market growth.Report Scope

The report analyzes the Electrical Explosion Proof Equipment market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Oil & Gas, Mining, Chemicals, Manufacturing Processing, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Oil & Gas Application segment, which is expected to reach US$6.1 Billion by 2030 with a CAGR of 6.2%. The Mining Application segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.2 Billion in 2024, and China, forecasted to grow at an impressive 7.7% CAGR to reach $3.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electrical Explosion Proof Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electrical Explosion Proof Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electrical Explosion Proof Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Atex System, BARTEC Feam, Eaton Corporation PLC, Emerson Electric Company, Helon Explosion-Proof Electric Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Electrical Explosion Proof Equipment market report include:

- Atex System

- BARTEC Feam

- Eaton Corporation PLC

- Emerson Electric Company

- Helon Explosion-Proof Electric Co., Ltd.

- Miretti Srl

- Pepperl+Fuchs GmbH

- R. Stahl AG

- VIMEX AS

- WEG SA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Atex System

- BARTEC Feam

- Eaton Corporation PLC

- Emerson Electric Company

- Helon Explosion-Proof Electric Co., Ltd.

- Miretti Srl

- Pepperl+Fuchs GmbH

- R. Stahl AG

- VIMEX AS

- WEG SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 294 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.4 Billion |

| Forecasted Market Value ( USD | $ 16.6 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |