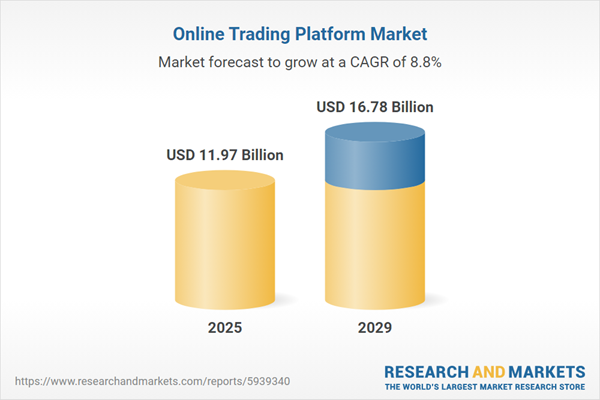

The online trading platform market size is expected to see strong growth in the next few years. It will grow to $16.78 billion in 2029 at a compound annual growth rate (CAGR) of 8.8%. The growth in the forecast period can be attributed to the increasing availability of mobile devices, supportive government initiatives, and increasing Internet penetration. Major trends in the forecast period include the online trading platform market include adoption of artificial intelligence technology, the integration of chatbots, the launch of the crypto trading platform, and the launch of the learning-based online trading platform.

The forecast of 8.8% growth over the next five years reflects a modest reduction of 0.4% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. This is likely to directly affect the US through degraded execution speeds, as low-latency trading infrastructure and order matching engines, primarily sourced from Japan and Singapore, become more expensive to maintain due to increased hardware tariffs and component shortages. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The global surge in digitalization has been a driving force behind the growth of the online trading platform market. These platforms facilitate digitally enabled transactions for the exchange of goods and services. The COVID-19 pandemic has further intensified the focus on digitalization within the online trading sector as businesses strive to streamline their models. A report from the UK Board of Trade highlights the substantial contribution of the digital sector, amounting to £151 billion ($197 billion) to the British economy and employing nearly 5% of the national workforce. This digital sector also represents a significant share of the global GDP, amounting to $11 trillion ($14 trillion) or 15.5%. Consequently, the global growth in digitalization is anticipated to drive increased demand for online trading platforms.

The anticipated growth of the online trading platform market is expected to be fueled by the increasing penetration of the internet. The rising prevalence of internet access empowers consumers to utilize online platforms for obtaining knowledge and information related to online trading. Given the high dependence of online trading on internet connectivity, the growing penetration of the internet is poised to bolster the market. According to DataReportal, a Singapore-based online reference library, around 5.16 billion people worldwide, equivalent to 64.4% of the global population, used the internet at the beginning of 2023. In India, as reported by Livemint, there are a total of 692 million active internet users, with estimates projecting 900 million users by 2025. Thus, the increasing internet penetration is expected to drive the growth of the online trading platform market.

The online trading platform market is witnessing the emergence of crypto trading platforms, gaining popularity among users. Crypto-trading platforms serve as exchange platforms allowing the interchange of digital currencies or the exchange of digital currency with fiat currency. For instance, Crypto1Capital, a Singapore-based online trading broker, launched an online trading system named Crypto1Capital in May 2022. This platform focuses on serving global investors and traders, covering six types of trading markets with a variety of tradable assets, including currency and crypto forex trading, stocks, futures, commodities, and indices.

Companies in the market are strategically launching learning-based online trading platforms to educate investors about online trading. In October 2022, Moomoo Technologies, Inc., a US-based financial services company, introduced the moomoo metaverse, 'mooverse,' as an online trading platform. This metaverse expands the platform's educational offerings, enabling investors to make informed decisions for wealth creation. Notably, the platform caters to both beginner and intermediate-level investors through features such as 'Lite' mode, paper trading, and a collection of free learning materials.

In September 2022., CoinSmart Finance Inc., a Canada-based crypto asset trading platform, acquired Coinsquare Inc. This acquisition positions Coinsquare as one of Canada's largest crypto asset trading platforms, offering a diverse and compliant range of services, including institutional and retail trading, crypto payment processing, and digital asset custody. CoinSmart Finance Inc. stands out as a Canadian platform specializing in trading digital assets.

Major companies operating in the online trading platform market include The Charles Schwab Corp, Morgan Stanley, Interactive Brokers, Fidelity Investments Inc, Bank of America Corporation, Marketaxess Holdings Inc., Plus500 Ltd., Monex Group, Ally Financial Inc., Huobi Group, Zerodha, Groww, Upstox, Icici Direct, Angel One, Alice Blue, 5paisa, Plum, Tradewaltz, Dinglian Digital, Pingan, Tencent Holdings Ltd, Octagon Strategy Limited, Ig, Finecobank S.P.A, Freetrade, Saxo, Trading212, Etoro, Capital.Com, Hargreaves Lansdown, Deutsche Bank, Alfa Capital, Ic Markets, Kit Finance, Pepperstone, Ava Trade, Blackrock, Vanaguard, State Street Global Advisors, Berkshire Hathaway Inc, J.P. Morgan, Goldman Sachs, Massmutual, Companhia De Seguros Alliance Do Brazil, Avatrade, Xtb, Bitoasis, Gath3r, Midchains, Hayvn, Pu Prime, Admiral Markets, Thndr, Ci Capital, Arabeya Online, Hantec Markets, Forex4you, Mahfazty.

North America was the largest region in the online trading platform market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the online trading platform market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the online trading platform market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sharp rise in U.S. tariffs and the ensuing trade tensions in spring 2025 are having a considerable impact on the financial sector, particularly in the areas of investment strategies and risk management. The increased tariffs have intensified market volatility, leading institutional investors to adopt more cautious approaches and driving greater demand for hedging solutions. Banks and asset managers are encountering higher costs in cross-border transactions as disrupted global supply chains and declining corporate earnings weigh on equity market performance. At the same time, insurance providers are facing elevated claims risks linked to supply chain interruptions and trade-related business losses. Furthermore, reduced consumer spending and weaker export demand are limiting credit growth and dampening investment appetite. In response to these challenges, the sector must focus on diversification, accelerate digital transformation, and strengthen scenario planning to manage the heightened economic uncertainty and safeguard profitability.

An online trading platform is a software or website that enables investors and traders to execute trades through financial intermediaries, monitor accounts, and access a range of features with minimal fees. These platforms are instrumental in facilitating online trading and investing activities.

The primary product types associated with online trading platforms include commissions, transaction fees, and other related service fees. Commissions, also known as stock trading fees or brokerage fees, are charges incurred when customers buy or sell stocks. These fees are applied by both institutional investors and retail investors and may encompass various components, solutions, and services.

The online trading platform market research report is one of a series of new reports that provides online trading platform market statistics, including online trading platform industry global market size, regional shares, competitors with an online trading platform market share, detailed online trading platform market segments, market trends and opportunities, and any further data you may need to thrive in the online trading platform industry. This online trading platform market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The online trading platform market includes revenues earned by entities by commercial platforms and proprietary platforms. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Online Trading Platform Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on online trading platform market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for online trading platform? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The online trading platform market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product Type: Commissions, Transaction Fees, Other Related Service Fees2) by Component: Solution, Services

3) by Application: Institutional Investors, Retail Investors

Subsegments:

1) by Commissions: Stock Commissions; Options Commissions; Futures Commissions2) by Transaction Fees: Brokerage Fees; Exchange Fees; Account Maintenance Fees

3) by Other Related Service Fees: Margin Fees; Withdrawal Fees; Inactivity Fees

Companies Mentioned: The Charles Schwab Corp; Morgan Stanley; Interactive Brokers; Fidelity Investments Inc; Bank of America Corporation; Marketaxess Holdings Inc.; Plus500 Ltd.; Monex Group; Ally Financial Inc.; Huobi Group; Zerodha; Groww; Upstox; Icici Direct; Angel One; Alice Blue; 5paisa; Plum; Tradewaltz; Dinglian Digital; Pingan; Tencent Holdings Ltd; Octagon Strategy Limited; Ig; Finecobank S.P.a; Freetrade; Saxo; Trading212; Etoro; Capital.Com; Hargreaves Lansdown; Deutsche Bank; Alfa Capital; Ic Markets; Kit Finance; Pepperstone; Ava Trade; Blackrock; Vanaguard; State Street Global Advisors; Berkshire Hathaway Inc; J.P. Morgan; Goldman Sachs; Massmutual; Companhia De Seguros Alliance Do Brazil; Avatrade; Xtb; Bitoasis; Gath3r; Midchains; Hayvn; Pu Prime; Admiral Markets; Thndr; Ci Capital; Arabeya Online; Hantec Markets; Forex4you; Mahfazty.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Online Trading Platform market report include:- The Charles Schwab Corp

- Morgan Stanley

- Interactive Brokers

- Fidelity Investments Inc

- Bank of America Corporation

- Marketaxess Holdings Inc.

- Plus500 Ltd.

- Monex Group

- Ally Financial Inc.

- Huobi Group

- Zerodha

- Groww

- Upstox

- Icici Direct

- Angel One

- Alice Blue

- 5paisa

- Plum

- Tradewaltz

- Dinglian Digital

- Pingan

- Tencent Holdings Ltd

- Octagon Strategy Limited

- Ig

- Finecobank S.P.A

- Freetrade

- Saxo

- Trading212

- Etoro

- Capital.Com

- Hargreaves Lansdown

- Deutsche Bank

- Alfa Capital

- Ic Markets

- Kit Finance

- Pepperstone

- Ava Trade

- Blackrock

- Vanaguard

- State Street Global Advisors

- Berkshire Hathaway Inc

- J.P. Morgan

- Goldman Sachs

- Massmutual

- Companhia De Seguros Alliance Do Brazil

- Avatrade

- Xtb

- Bitoasis

- Gath3r

- Midchains

- Hayvn

- Pu Prime

- Admiral Markets

- Thndr

- Ci Capital

- Arabeya Online

- Hantec Markets

- Forex4you

- Mahfazty.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 11.97 Billion |

| Forecasted Market Value ( USD | $ 16.78 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 60 |