Embedded FPGA Market Analysis:

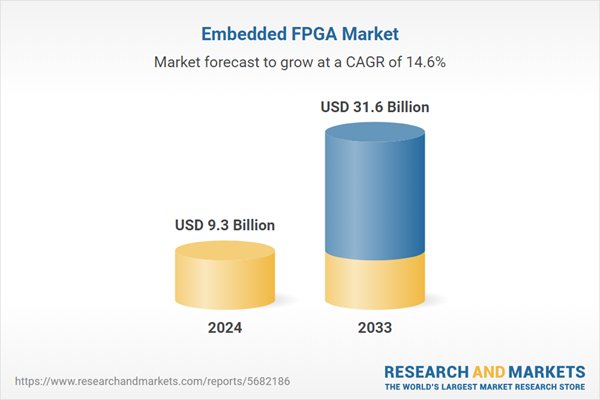

- Market Growth and Size: The eFPGA market is witnessing robust growth, with a size that is projected to expand significantly in the coming years. Factors such as rising demand for customizable computing solutions and the proliferation of applications in AI and IoT are driving this growth.

- Major Market Drivers: The primary drivers of the market include the increasing need for adaptable and reprogrammable hardware in applications, such as telecommunications, data processing, and consumer electronics. Technological advancements, especially in integration capabilities with System on Chip (SoC) designs, also contribute to market growth.

- Technological Advancements: Ongoing technological advancements are reshaping the market, enabling greater integration with SoCs, enhancing energy efficiency, and expanding the range of applications. These advancements are crucial for industries such as data centers, IoT, and wireless communication.

- Industry Applications: eFPGAs find extensive applications in diverse industries, including telecom, data processing, consumer electronics, industrial automation, military, aerospace, automotive, and more. Their adaptability and performance make them indispensable in these sectors.

- Key Market Trends: Key trends in the market include the growing emphasis on energy efficiency and low power consumption, the integration of FPGAs with advanced technologies, including RF and analog components, and the rising focus on security features, especially in data-sensitive sectors.

- Geographical Trends: Asia Pacific leads the market, driven by its dynamic technology landscape, while North America, Europe, Latin America, and the Middle East and Africa are also significant contributors with distinct regional applications and strengths.

- Competitive Landscape: Key players in the market are actively collaborating with semiconductor manufacturers and SoC vendors, investing in R&D to improve technology performance, and participating in industry events to establish themselves as thought leaders and experts.

- Challenges and Opportunities: Challenges in the market include competition from alternative technologies, power consumption concerns, and the need to address industry-specific requirements. However, opportunities lie in the expanding applications of FPGAs in emerging technologies, such as 5G, IoT, and AI, as well as in addressing the demand for customizable computing solutions in a rapidly evolving digital landscape.

Embedded FPGA Market Trends:

Rising demand for customizable computing solutions

In an era where technology is rapidly evolving, industries such as telecommunications, automotive, and consumer electronics seek adaptable and efficient computing platforms. FPGAs, with their reprogrammable nature, offer a versatile solution, allowing hardware to be tailored to specific applications even after deployment. This adaptability is critical in applications where updates are frequent or where a one-size-fits-all approach is inadequate.The ability to update functionalities without the need for complete hardware redesigns not only reduces development time and cost but also extends the product lifecycle, making FPGAs an attractive option for businesses aiming to stay competitive in fast-paced markets. Furthermore, FPGAs are gaining traction in areas, such as artificial intelligence and machine learning, where the need for high-speed, customizable computing resources is paramount.

Technological advancements and integration capabilities

Modern FPGAs are increasingly integrated with system on chip (SoC) designs, providing the flexibility of programmable logic along with the high performance and efficiency of SoCs. This integration is particularly advantageous in applications requiring high data processing capabilities, such as data centers, cloud computing, and IoT devices. The advancements in fabrication technologies have also enabled the production of more compact, power-efficient, and cost-effective FPGAs.This evolution is crucial for small form-factor devices and for applications where power consumption is a critical factor. Moreover, the integration of embedded FPGAs with advanced technologies, including RF (Radio Frequency) and analog components has opened new avenues in wireless communication and signal processing, further expanding the market reach.

Growing focus on energy efficiency and low power consumption

Embedded FPGAs are inherently more power-efficient compared to traditional FPGAs due to their optimized architecture and the ability to power down unused sections of the chip. This feature is especially important in battery-powered devices and in sectors where energy consumption directly impacts operational costs, such as data centers and mobile computing.As industries and governments increasingly emphasize sustainable practices and energy conservation, the demand for energy-efficient solutions is expected to rise. The ability of FPGAs to provide high computational power with lower energy consumption aligns with the global trend towards green technology and sustainable computing, making them a preferred choice for environmentally conscious organizations and contributing to the growth of the FPGA market.

Embedded FPGA Industry Segmentation:

The research provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on technology and application.Breakup by Technology:

- EEPROM

- Antifuse

- SRAM

- Flash

- Other.

SRAM accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the technology. This includes EEPROM, antifuse, SRAM, flash, and others. According to the report, SRAM represented the largest segment.SRAM-based FPGAs represent the largest segment in the market, primarily due to their versatility and reprogrammability. Static random-access memory (SRAM) technology allows for easy and rapid configuration, making these FPGAs ideal for applications where frequent updates or changes in functionality are required. They are particularly popular in consumer electronics, telecommunications, and data processing applications. The high speed and low latency of SRAM-based FPGAs also make them suitable for high-performance computing tasks.

On the other hand, electrically erasable programmable read-only memory (EEPROM) based embedded FPGAs are known for their non-volatile memory, meaning they retain their configuration even when power is switched off. This makes them suitable for applications where long-term data retention is crucial, such as in automotive electronics and industrial automation. EEPROM-based FPGAs offer a balance between programmability and persistence, allowing them to be reprogrammed with new configurations while maintaining stability over time.

Furthermore, antifuse technology in FPGAs is characterized by its permanent configuration, which is set during the manufacturing process. This one-time programmability makes antifuse-based FPGAs highly secure and tamper-resistant, ideal for applications requiring a high level of security, such as in military and aerospace sectors. Their robustness and reliability in maintaining configuration without power make them suitable for critical applications where long-term stability is essential.

Additionally, flash-based FPGAs combine the benefits of non-volatile memory with the advantage of reprogrammability. They retain their configuration even without power, similar to EEPROM, but offer faster write times and a greater number of write-erase cycles. This makes them well-suited for consumer applications and devices that require frequent updates, such as smart appliances and wearable technology.

Breakup by Application:

- Data Processing

- Consumer Electronics

- Industrial

- Military and Aerospace

- Automotive

- Telecom

- Other.

Telecom holds the largest share in the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes data processing, consumer electronics, industrial, military and aerospace, automotive, telecom, and others. According to the report, telecom accounted for the largest market share.As the largest segment in the FPGA market, telecom benefits significantly from the adaptability and high-speed processing capabilities of FPGAs. In this sector, FPGAs are crucial for managing the vast data flow and complex signal processing tasks inherent in modern communication systems. They are used in base stations, network infrastructure, and in the development of 5G technologies, where the need for high-bandwidth and low-latency data processing is paramount. Embedded FPGAs enable telecom equipment to be rapidly updated and adapted to evolving standards and protocols, offering a scalable and efficient solution in a rapidly advancing industry.

On the contrary, in data processing, FPGAs play a pivotal role in handling large volumes of data efficiently. They are used in servers, data centers, and cloud computing infrastructures where high-speed data processing, flexibility, and power efficiency are essential. FPGAs offer the ability to customize hardware for specific data processing tasks, such as big data analytics and real-time processing, enhancing performance and efficiency in data-intensive environments.

Additionally, the consumer electronics segment utilizes FPGAs for their versatility and ability to enhance product features. In devices, such as smartphones, smart TVs, and gaming consoles, FPGAs contribute to improved processing power, energy efficiency, and the flexibility to support multiple standards and functionalities. Their reprogrammable nature allows for extended product lifecycles with firmware updates, adapting to new formats and user requirements.

Moreover, in the industrial segment, eFPGAs are key to facilitating automation and advanced control systems. They are widely used in manufacturing, robotics, and process control, where they enable customizable, high-speed, and precise control mechanisms. FPGAs robustness and ability to operate in harsh environmental conditions make them ideal for industrial applications, contributing to increased efficiency and productivity.

Furthermore, the military and aerospace segment values FPGAs for their high reliability, security features, and performance in extreme conditions. They are integral in applications, including satellite communications, avionics, and weapon systems, where their ability to function in challenging environments and to be reconfigured for different missions or updates is critical. The security aspects of eFPGAs are especially important in this segment, providing tamper-resistant and secure hardware solutions.

Apart from this, in the automotive sector, eFPGAs are increasingly used for their adaptability and performance in vehicle electronics. They are integral in advanced driver-assistance systems (ADAS), infotainment systems, and in the development of autonomous vehicles. FPGAs allow for flexible and updatable hardware solutions in cars, accommodating rapid advancements in automotive technology and enhancing vehicle functionality and safety features. Their robustness and ability to function in a range of environmental conditions align well with automotive industry requirements.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

Asia Pacific leads the market, accounting for the largest embedded FPGA market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.Asia Pacific stands as the largest segment in the market, driven by its dynamic technology landscape and thriving industries. Countries, such as China, Japan, South Korea, and India are witnessing significant growth in sectors such as telecommunications, consumer electronics, and automotive manufacturing. The demand for FPGAs in these regions is fueled by the need for customizable and high-performance computing solutions. Additionally, the expansion of 5G networks and the rapid adoption of IoT technologies contribute to the dominance of Asia Pacific in the FPGA market.

North America is another prominent segment in the market, characterized by its strong presence in industries, including data processing, aerospace, and defense. The United States, in particular, is a significant contributor to the market due to its advanced technology sector and defense investments. FPGAs find extensive use in military applications, data centers, and research institutions in North America.

Furthermore, Europe maintains a substantial share in the market, driven by its focus on industrial automation, automotive innovation, and telecommunications infrastructure. Countries, including Germany, France, and the United Kingdom are at the forefront of utilizing FPGAs in manufacturing, automotive electronics, and 5G network development. The European automotive industry, in particular, values FPGAs for their role in advanced driver-assistance systems (ADAS) and vehicle connectivity.

On the other hand, Latin America is emerging as a noteworthy segment in the market, with growing applications in consumer electronics and telecommunications. Countries, including Brazil and Mexico are witnessing increased investments in these sectors, leading to a rising demand. As consumer electronics become more sophisticated, the flexibility and processing power offered by FPGAs make them essential components in devices ranging from smartphones to smart TVs.

Additionally, the Middle East and Africa segment of the market are experiencing steady growth, driven by developments in telecommunications and industrial automation. The region's investment in 5G infrastructure and the deployment of FPGAs in network equipment contribute to its significance in the market. Moreover, industries such as oil and gas, which require robust and adaptable computing solutions for remote monitoring and control, are increasingly adopting FPGAs. As technology continues to advance in the Middle East and Africa, FPGAs play a pivotal role in enabling efficient data processing and communication.

Leading Key Players in the Embedded FPGA Industry:

The key players in the market are actively engaged in strategic initiatives aimed at expanding their market presence and enhancing their technology offerings. These initiatives include collaborations and partnerships with semiconductor manufacturers and system-on-chip (SoC) vendors to integrate FPGAs into a wider range of applications, such as 5G infrastructure and edge computing devices. Additionally, they are investing in research and development to improve the performance, power efficiency, and security features of FPGA technology, ensuring it remains competitive and relevant in rapidly evolving industries, including telecommunications and automotive.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Achronix Semiconductor Corporation

- Adicsys

- Advanced Micro Devices Inc

- Efinix Inc

- Flex Logix Technologies Inc.

- Intel Corporation

- Lattice Semiconductor Corporation

- Menta S.A.S

- Microchip Technology Inc

- Quick Logic Corporatio.

Key Questions Answered in This Report:

- How has the global embedded FPGA market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global embedded FPGA market?

- What is the impact of each driver, restraint, and opportunity on the global embedded FPGA market?

- What are the key regional markets?

- Which countries represent the most attractive embedded FPGA market?

- What is the breakup of the market based on technology?

- Which is the most attractive technology in the embedded FPGA market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the embedded FPGA market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global embedded FPGA market?

Table of Contents

Companies Mentioned

- Achronix Semiconductor Corporation

- Adicsys

- Advanced Micro Devices Inc

- Efinix Inc

- Flex Logix Technologies Inc.

- Intel Corporation

- Lattice Semiconductor Corporation

- Menta S.A.S

- Microchip Technology Inc.

- Quick Logic Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 9.3 Billion |

| Forecasted Market Value ( USD | $ 31.6 Billion |

| Compound Annual Growth Rate | 14.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |