Rapid industrialization and e-commerce growth in nations like China, India, and Southeast Asia are driving the region's growth and raising demand for warehouse space. Governments in the Asia Pacific are also implementing stringent energy efficiency standards and incentivizing sustainable infrastructure development, further encouraging the adoption of energy-efficient lighting systems in warehouses. This combination of economic growth, increased warehouse construction, and supportive regulations has established Asia Pacific as a leader in the market. Thus, the Asia Pacific segment witnessed 38% revenue share in the energy efficient warehouse lighting system market in 2023.

As energy prices continue to climb, managing operational costs has become a top priority for businesses that rely on large-scale facilities with extensive lighting needs. Traditional lighting systems, especially in vast spaces like warehouses, can contribute substantially to electricity bills, representing a significant ongoing expense. Additionally, the rapid expansion of e-commerce fundamentally reshapes the warehousing industry, leading to an unprecedented demand for fulfillment centers worldwide.

According to the United Nations Conference on Trade and Development (UNCTAD), global e-commerce sales reached $26.7 trillion in 2020, with continued growth projected as online shopping becomes more ingrained in consumer behavior. Thus, the growth of e-commerce will also drive the growth of warehouses, which, in turn, will propel the expansion of the energy efficient warehouse lighting system market.

However, the initial investment required for energy-efficient lighting systems, including LEDs and smart lighting controls, tends to be significantly higher than conventional lighting options. These costs encompass the price of high-quality LED fixtures, advanced lighting controls, and potential installation, integration, and training expenses. This challenge is compounded by the fact that many businesses focus on short-term gains and quick returns on investment. Hence, the high cost may impede the market's growth.

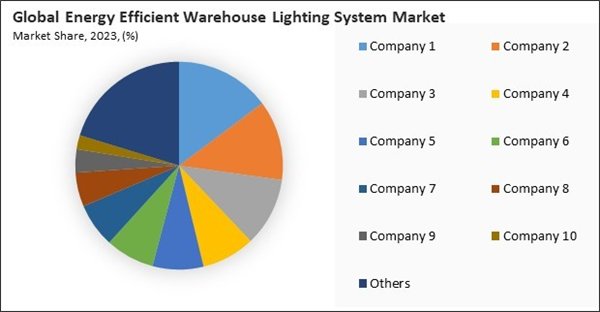

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Driving and Restraining Factors

Drivers

- Rapidly increasing energy prices

- Expansion of e-commerce and warehousing

- Implementation of environmental regulations and policies

Restraints

- High initial costs of energy-efficient lighting systems

- Technical challenges and complexity

Opportunities

- Growing adoption of smart lighting systems

- Global supply chain transformation

Challenges

- Inconsistent return on investment (ROI)

- Market saturation of conventional lighting systems

Application Outlook

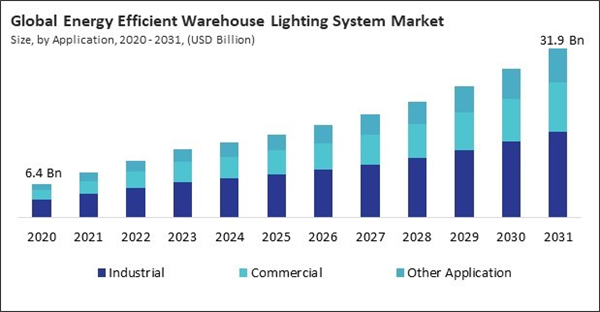

Based on application, the market is classified into industrial, commercial, and others. The commercial segment procured 29% revenue share in the market in 2023. Commercial warehouses, including retail storage facilities and distribution centers, increasingly recognize the benefits of energy-efficient lighting.Type Outlook

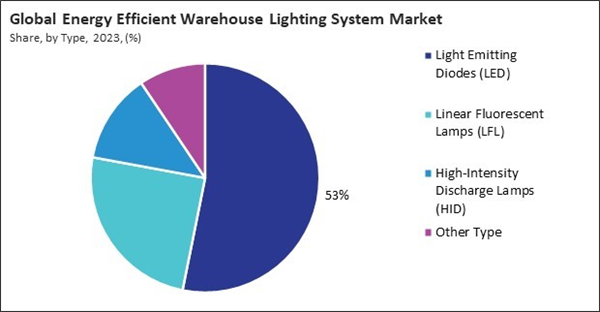

On the basis of type, the market is divided into light emitting diodes (LED), linear fluorescent lamps (LFL), high-intensity discharge lamps (HID), and others. The light emitting diodes (LED) segment acquired 53% revenue share in the market in 2023. The LED segment leads the market due to its high energy efficiency, longevity, and rapidly decreasing costs.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment garnered 30% revenue share in the market in 2023. The region’s emphasis on sustainability and corporate responsibility, along with high energy costs, has driven many warehouse operators to invest in energy-efficient lighting solutions.List of Key Companies Profiled

- ams-OSRAM AG

- Nichia Corporation

- Acuity Brands, Inc.

- Signify N.V.

- Koninklijke Philips N.V.

- Schneider Electric SE

- Legrand S.A. (Legrand Group)

- Honeywell International, Inc.

- Cree Lighting (Ideal Industries, Inc.)

- Eaton Corporation plc

Market Report Segmentation

By Application

- Industrial

- Commercial

- Other Application

By Type

- Light Emitting Diodes (LED)

- Linear Fluorescent Lamps (LFL)

- High-Intensity Discharge Lamps (HID)

- Other Type

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- ams-OSRAM AG

- Nichia Corporation

- Acuity Brands, Inc.

- Signify N.V.

- Koninklijke Philips N.V.

- Schneider Electric SE

- Legrand S.A. (Legrand Group)

- Honeywell International, Inc.

- Cree Lighting (Ideal Industries, Inc.)

- Eaton Corporation plc