Global Engineered Foams Market - Key Trends and Drivers Summarized

How Are Engineered Foams Revolutionizing Material Science and Industry Applications?

Engineered foams are revolutionizing material science and industry applications by offering highly versatile, customizable, and lightweight solutions that meet a wide range of performance requirements across sectors such as automotive, aerospace, construction, electronics, and healthcare. These foams are specially designed to provide specific properties, such as insulation, shock absorption, buoyancy, and structural support, making them integral to modern manufacturing and design. Unlike conventional foams, engineered foams are tailored to meet precise standards, whether through the selection of base materials, cellular structure, or the incorporation of additives that enhance performance. This ability to fine-tune properties like density, flexibility, and thermal conductivity makes engineered foams critical in applications where traditional materials fall short, offering solutions that reduce weight, improve energy efficiency, and enhance durability. As industries increasingly seek to optimize performance, reduce costs, and meet stringent environmental standards, engineered foams are playing a central role in driving innovation and efficiency across a broad spectrum of applications.What Innovations Are Enhancing the Functionality of Engineered Foams?

Innovations in engineered foams are enhancing their functionality through advancements in material composition, manufacturing techniques, and sustainability. One of the most significant developments is the use of advanced polymers and composites, which allow for the creation of foams with superior strength-to-weight ratios, thermal insulation properties, and chemical resistance. For instance, high-performance polymers like polyurethane, polyethylene, and polypropylene are being used to produce foams that can withstand extreme temperatures, resist moisture and chemicals, and maintain structural integrity under load. These materials are often combined with fillers, reinforcements, or nanomaterials to further enhance properties such as rigidity, flexibility, or electrical conductivity, depending on the application.Another key innovation is the development of precision manufacturing techniques, such as additive manufacturing (3D printing) and advanced molding processes. These methods allow for greater control over the cellular structure and density of foams, enabling the production of complex geometries and customized solutions tailored to specific requirements. For example, additive manufacturing allows for the creation of foams with gradient densities, where different parts of the foam can have varying levels of firmness or flexibility, which is particularly useful in applications such as impact protection or ergonomic design. Advanced molding techniques, such as injection molding or continuous extrusion, are also enabling the production of large, consistent foam structures with minimal waste, making the manufacturing process more efficient and cost-effective.

Sustainability is another area where innovations are making a significant impact on engineered foams. With increasing environmental concerns, there is a growing focus on developing foams that are more eco-friendly, either through the use of bio-based materials, recyclability, or the reduction of volatile organic compounds (VOCs) during production. For instance, plant-based foams derived from renewable resources such as soy, corn, or castor oil are becoming more common, offering similar performance to traditional petroleum-based foams but with a reduced carbon footprint. Additionally, advancements in recycling technologies are making it easier to recover and reuse foam materials, contributing to a more circular economy.

These innovations are making engineered foams more versatile, efficient, and sustainable, expanding their applications and driving their adoption across various industries.

How Do Engineered Foams Impact Industry Applications and Product Performance?

Engineered foams have a profound impact on industry applications and product performance by providing essential properties that enhance durability, efficiency, and functionality in a wide range of products. In the automotive industry, for example, engineered foams are used for cushioning, sound insulation, and lightweighting, helping to improve vehicle fuel efficiency and passenger comfort while reducing noise, vibration, and harshness (NVH). The ability to create foams with specific density and elasticity allows manufacturers to design seats, dashboards, and other interior components that are both comfortable and safe, absorbing energy in the event of a collision.In the aerospace sector, engineered foams are critical for thermal insulation, structural reinforcement, and weight reduction, all of which are crucial for improving aircraft performance and fuel efficiency. These foams can be found in aircraft interiors, such as seats and panels, as well as in structural components where they provide lightweight support without compromising strength. The use of advanced, fire-retardant foams is also essential for meeting stringent safety regulations in the aerospace industry.

In construction, engineered foams are used for insulation, waterproofing, and soundproofing, helping to create energy-efficient buildings with improved thermal and acoustic performance. Rigid foam boards, spray foams, and flexible foam sheets are commonly used to insulate walls, roofs, and foundations, reducing heat loss and lowering energy costs. The moisture resistance and durability of engineered foams also make them ideal for use in harsh environments, such as in below-grade applications or in buildings exposed to high humidity.

In the healthcare industry, engineered foams play a crucial role in the design of medical devices, prosthetics, and patient support systems. For instance, memory foam is widely used in mattresses, cushions, and orthotic devices to provide pressure relief and enhance patient comfort. The biocompatibility and antimicrobial properties of certain foams are also leveraged in wound care products, where they help to protect against infection and promote healing.

By improving the performance and functionality of products in these and other industries, engineered foams contribute to higher quality, longer-lasting, and more efficient solutions, ultimately enhancing the value and sustainability of the end products.

What Trends Are Driving Growth in the Engineered Foams Market?

Several trends are driving growth in the engineered foams market, including the increasing demand for lightweight materials, the rise of sustainable and eco-friendly products, and advancements in foam technology and manufacturing processes. The demand for lightweight materials is particularly strong in industries such as automotive, aerospace, and packaging, where reducing weight translates directly into improved energy efficiency and lower transportation costs. Engineered foams, with their high strength-to-weight ratio, are increasingly being adopted as substitutes for heavier materials like metals and solid plastics, driving growth in this market.The push for sustainability and eco-friendly products is another significant driver of market growth. As consumers and industries become more environmentally conscious, there is a growing demand for materials that have a lower environmental impact, both in terms of production and disposal. Engineered foams made from bio-based materials or recycled content are gaining popularity as they offer the performance benefits of traditional foams while reducing reliance on fossil fuels and minimizing waste. Additionally, regulations aimed at reducing carbon emissions and promoting recycling are encouraging manufacturers to develop and adopt more sustainable foam products.

Advancements in foam technology, such as the development of high-performance polymers and nanomaterials, are also contributing to market growth. These innovations enable the production of foams with enhanced properties, such as improved thermal insulation, higher impact resistance, or greater chemical stability, expanding the range of applications for engineered foams. The growing adoption of advanced manufacturing techniques, such as 3D printing and precision molding, is further supporting market growth by allowing for the production of customized foam solutions that meet specific performance requirements.

The increasing use of engineered foams in the healthcare sector, driven by the demand for high-performance materials in medical devices and patient care products, is also contributing to market expansion. The need for materials that provide comfort, support, and safety in healthcare applications is driving the development of new foam products that meet the rigorous standards of this industry.

These trends underscore the growing importance of engineered foams in a wide range of industries, as they provide versatile, high-performance solutions that address the evolving needs of modern manufacturing and design. As the market continues to evolve, innovations in material science and manufacturing will likely drive further growth and diversification in the applications of engineered foams.

Report Scope

The report analyzes the Engineered Foams market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material Type (Polyurethane, Polystyrene, Polyvinyl Chloride, Polyolefin, Other Material Types); End-Use (Manufacturing & Construction, Aerospace & Defense, Medical & Healthcare, Transportation, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Polyurethane Material segment, which is expected to reach US$73.7 Billion by 2030 with a CAGR of 7.5%. The Polystyrene Material segment is also set to grow at 6.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $31.5 Billion in 2024, and China, forecasted to grow at an impressive 10.3% CAGR to reach $43.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Engineered Foams Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Engineered Foams Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Engineered Foams Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Armacell, Armacell GmbH, Century Foam, Foamcraft, Inc., Fothergill Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 11 companies featured in this Engineered Foams market report include:

- Armacell

- Armacell GmbH

- Century Foam

- Foamcraft, Inc.

- Fothergill Group

- Huntsman Corporation

- Polyrocks Chemical Co., Ltd.

- Rogers Corporation

- Tecno Spuma SL

- Trelleborg AB

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Armacell

- Armacell GmbH

- Century Foam

- Foamcraft, Inc.

- Fothergill Group

- Huntsman Corporation

- Polyrocks Chemical Co., Ltd.

- Rogers Corporation

- Tecno Spuma SL

- Trelleborg AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

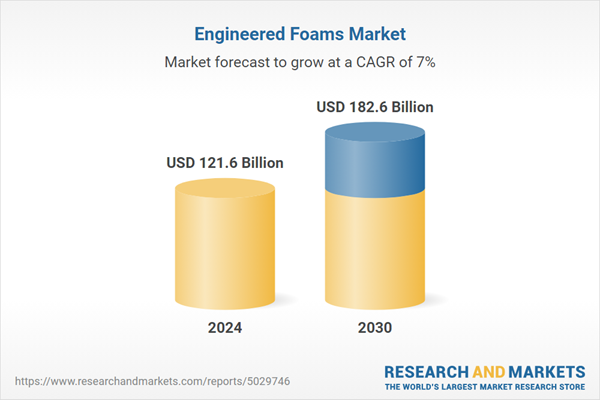

| Estimated Market Value ( USD | $ 121.6 Billion |

| Forecasted Market Value ( USD | $ 182.6 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |