In the 1,4-Butanediol (BDO) market, bio-based BDO represents an environmentally friendly alternative to conventional petrochemical-derived BDO. Bio-based BDO is produced from renewable resources, such as agricultural feedstocks, through biological processes. This type of BDO leverages advancements in biotechnology and sustainable practices to reduce reliance on fossil fuels and lower carbon emissions. The production process typically involves fermenting plant-based sugars or other organic materials using microorganisms, resulting in a product that is chemically identical to traditional BDO but with a smaller environmental footprint. Thus, the Bio-based in Germany market registered a volume of 38.75 in 2023.

The Germany market dominated the Europe Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $637.3 million by 2031. The UK market is exhibiting a CAGR of 6.8% during 2024-2031. Additionally, the France market would experience a CAGR of 8.6% during 2024-2031.

The applications of this span a wide spectrum of industries, reflecting its versatility and adaptability to diverse manufacturing processes. BDO is a key intermediate in producing polybutylene terephthalate (PBT) and polyurethanes, two essential polymers used in various industrial and consumer applications. BDO also produces spandex fibers in the textile industry, imparting elasticity and durability to fabrics and enhancing comfort and clothing performance.

In addition, the growing pharmaceutical sector is poised to drive significant demand for this and its derivatives, owing to their crucial role in drug development, formulation, and manufacturing processes.

The growth of the European cosmetics sector presents significant opportunities for this market. As consumer demand for innovative, effective, and sustainable cosmetic products continues to rise, the demand for BDO and its derivatives as key ingredients and formulation aids will likely increase. According to the Cosmetic, Toiletry, and Perfume Association Limited (CTPA), the European countries with the highest demand for personal care products and cosmetics are France, Italy, the UK, and Spain. Italy, like many other European countries, is witnessing a growing demand for electric and hybrid vehicles driven by environmental concerns and government incentives. BDO and its derivatives play a vital role in producing components for electric vehicle batteries, including electrolytes, separators, and encapsulation materials. As the adoption of EVs and HEVs continues to rise, so will the demand for BDO-based materials in the automotive sector. Hence, owing to Europe's expanding cosmetics and automotive sectors, there will be enhanced demand for 1,4-butanediol in the region.

List of Key Companies Profiled

- Lonza Group Ltd.

- BASF SE

- Mitsubishi Chemical Holdings Corporation

- Nan Ya Plastics Corp. (NPC)

- Sipchem Company

- Ashland Inc.

- INEOS Group Holdings S.A.

- Evonik Industries AG (RAG-Stiftung)

- LyondellBasell Industries Holdings B.V.

- Sinopec Group (China Petrochemical Corporation)

Market Report Segmentation

By Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Synthetic

- Bio-based

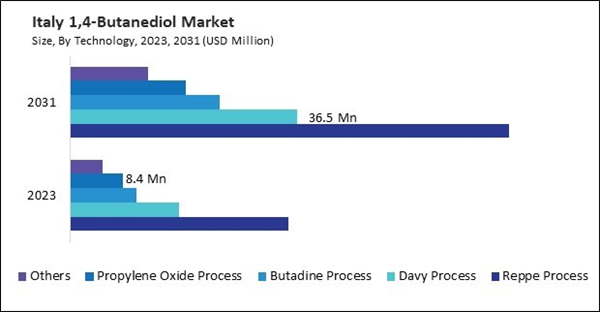

By Technology

- Reppe Process

- Davy Process

- Butadine Process

- Propylene Oxide Process

- Others

By Application (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Tetrahydrofuran

- Polybutylene Terephthalate

- Gamma Butyrolactone

- Polyurethane

- Others

By Country (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

- Lonza Group Ltd.

- BASF SE

- Mitsubishi Chemical Holdings Corporation

- Nan Ya Plastics Corp. (NPC)

- Sipchem Company

- Ashland Inc.

- INEOS Group Holdings S.A.

- Evonik Industries AG (RAG-Stiftung)

- LyondellBasell Industries Holdings B.V.

- Sinopec Group (China Petrochemical Corporation)