Adoption of Abrasives in Automation and Robotic Applications Drives Europe Abrasive Market

According to the report published by the International Federation of Robotics in 2022, the total annual robot installations worldwide reached 517,385 units in 2021, a rise of 31% compared to 2020. The automotive industry registered ~119,000 units of annual robot installations worldwide, accounting for 23% of total robot installations in 2021, significantly driven by the component supplier segment. Industrial robots are gaining the highest demand from end-use industries such as automotive and electronics original equipment manufacturers. The increase in the use of robots in end-use industries is attributed to the reduction in the average selling price of robots.According to Castrol Ltd's research, more than 4 million industrial robots are expected to be operational worldwide by 2025. The rising use of abrasives in automation and robotic applications is attributed to the transition to industrial manufacturing. The advancement in automation technology and increased use of robots in various sectors such as automotive, electronics, and aerospace have driven precision engineering. Abrasives are significant components for facilitating tasks such as grinding, polishing, and deburring with unparalleled accuracy and consistency.

The adoption of abrasive-equipped robots streamlines production processes, minimizes downtime, and leads to cost savings. Market players, such as 3M Co, VSM Abrasives, and Norton Abrasives, offer abrasives with distinct characteristics for robotic applications. As automation continues to evolve, the utilization of abrasives with robotics is expected to revolutionize industrial manufacturing, offering high precision, productivity, and performance.

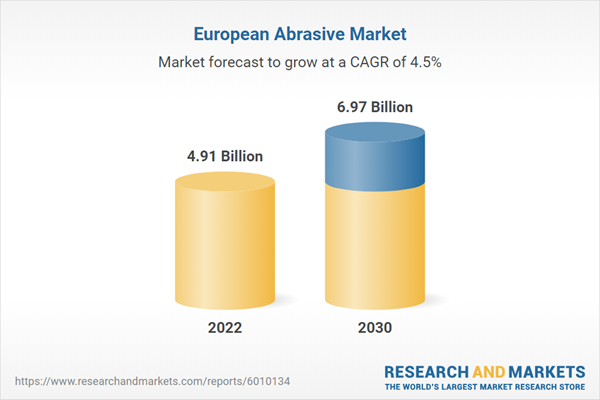

Europe Abrasive Market Overview

The automobile industry is among the most rapidly growing and most important industries in Europe. The automotive industry contributes notably to the GDPs of several European countries, including Germany, the UK, and Italy. According to the European Commission, Europe is the largest manufacturer of motor vehicles worldwide. The automobile industry directly and indirectly employs ?13.8 million people, resulting in 6.1% of overall employment in the European Union (EU). According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), the EU produced 16.2 million vehicles in 2022.The region has several prominent automotive players, including Volkswagen AG, Stellantis NV, Mercedes-Benz Group AG, Bayerische Motoren Werke AG, and Renault SA. The increasing production of vehicles in Europe has amplified the need for abrasives in various stages of the manufacturing process. From shaping and finishing metal components to refining the surfaces of automotive parts, abrasives play a vital role in ensuring the precision and quality of vehicle manufacturing.

Moreover, the automotive industry's continuous pursuit of lightweight materials, including advanced alloys and composites, has intensified the requirement for specialized abrasives. These materials demand precision machining and finishing, making abrasives essential for achieving the desired specifications in the production of lightweight and fuel-efficient vehicles.

Another significant driver is the construction industry. With ongoing infrastructure development and renovation projects in Europe, there is a heightened need for abrasives in various construction applications. According to the FIEC - European Construction Industry Federation, the volume of construction works increased by 15.1% in December 2022 as compared with December 2021. The increase highlighted capital repair works (+34.7%), current maintenance and repair works (+29.6%), and new construction works (+7.0%).

In addition to surface preparation, the construction industry relies on abrasives for cutting and shaping materials such as metal, stone, and masonry. From cutting steel beams to shaping intricate details in architectural elements, abrasive tools are indispensable for achieving precision and meeting the design specifications in construction projects. This is particularly evident in the fabrication of metal components used in structural frameworks and architectural details.

Furthermore, in 2022, the European aerospace & defense industry sustained its post-pandemic economic resurgence. In the aviation industry, abrasives are essential for shaping, finishing, and refining various materials such as metals and composites. These materials are used extensively in the construction of aircraft structures, and abrasives play a critical role in achieving the tight tolerance and smooth surfaces necessary for aerodynamic efficiency and structural integrity.

Europe Abrasive Market Segmentation

- The Europe abrasive market is categorized into material, type, application, sales channel, and country.

- By material, the Europe abrasive market is bifurcated into natural and synthetic. The synthetic segment held a larger share of Europe abrasive market in 2022.

- In terms of type, the Europe abrasive market is bifurcated into bonded abrasives and coated abrasives. The bonded abrasives segment held a larger share of Europe abrasive market in 2022. Furthermore, the bonded abrasives segment is subcategorized into discs, wheels, and others. Additionally, the coated abrasives segment is subcategorized into flap discs, fiber discs, hook a loop discs, belts, rolls, and others.

- By application, the Europe abrasive market is segmented into automotive, aerospace, marine, metal fabrication, woodworking, electrical & electronics, and others. The automotive segment held the largest share of Europe abrasive market in 2022.

- Based on sales channel of hearing loss, the Europe abrasive market is bifurcated into direct and indirect. The indirect segment held a larger share of Europe abrasive market in 2022.

- By country, the Europe abrasive market is segmented into Germany, France, Italy, Spain, the UK, Russia, Poland, Czech Republic, Hungary, Estonia, Latvia, Romania, and the Rest of Europe. The Rest of Europe dominated the Europe abrasive market share in 2022.

- Deerfos Co., Ltd; CUMI AWUKO Abrasives GmbH; Robert Bosch GmbH; Tyrolit Schleifmittelwerke Swarovski AG & Co KG; Sun Abrasives Co Ltd; Compagnie de Saint-Gobain S.A.; sia Abrasives Industries AG; RHODIUS Abrasives GmbH; 3M Co; and Ekamant AB are the among leading companies operating in the Europe abrasive market.

Market Highlights

- By material, the Europe abrasive market is bifurcated into natural and synthetic. The synthetic segment held 59.3% share of Europe abrasive market in 2022, amassing US$ 2.91 billion. It is projected to garner US$ 4.29 billion by 2030 to expand at 5.0% CAGR from 2022 to 2030

- In terms of type, the Europe abrasive market is bifurcated into bonded abrasives and coated abrasives. The bonded abrasives segment held 55.2% share of Europe abrasive market in 2022, amassing US$ 2.71 billion. It is anticipated to garner US$ 4.01 billion by 2030 to expand at 5.0% CAGR during 2022-2030. Furthermore, the bonded abrasives segment is subcategorized into discs, wheels, and others. Additionally, the coated abrasives segment is subcategorized into flap discs, fiber discs, hook a loop discs, belts, rolls, and others.

- The automotive segment held 24.5% share of Europe abrasive market in 2022, amassing US$ 1.20 billion. It is projected to garner US$ 1.77 billion by 2030 to expand at 5.0% CAGR from 2022 to 2030.

- The indirect segment held 57.9% share of Europe abrasive market in 2022, amassing US$ 2.84 billion. It is predicted to garner US$ 4.15 billion by 2030 to expand at 4.9% CAGR between 2022 and 2030.

- This analysis states that the Rest of Europe captured 27.9% share of Europe abrasive market in 2022. It was assessed at US$ 1.36 billion in 2022 and is likely to hit US$ 1.87 billion by 2030, registering a CAGR of 4.0% during 2022-2030.

- In January-2024, Tyrolit acquired a majority stake in Abrasive Tools Specialists, an importer, wholesaler, and converter of abrasive tools, to strengthen its presence in the Australian market, diversify its product offerings, and cater to diverse customer needs.

- In September-2023, Tyrolit Schleifmittelwerke Swarovski AG & Co KG acquired a complete stake in Acme Holding Company, a specialized abrasive producer and supplier, to enhance its portfolio for the foundry, steel, and rail sectors.

- In July-2020, Tyrolit Schleifmittelwerke Swarovski AG & Co KG completed the acquisition of Bibielle SpA, a producer of three-dimensional abrasive products, to meet all polishing, grinding, finishing, and surface conditioning needs.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Europe abrasive market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Europe abrasive market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Europe market trends and outlook coupled with the factors driving the Europe abrasive market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the Europe Abrasive market include:- Deerfos Co., Ltd

- CUMI AWUKO Abrasives GmbH

- Robert Bosch GmbH

- Tyrolit Schleifmittelwerke Swarovski AG & Co KG

- Sun Abrasives Co Ltd

- Compagnie de Saint-Gobain S.A.

- sia Abrasives Industries AG

- RHODIUS Abrasives GmbH

- 3M Co

- Ekamant AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 158 |

| Published | August 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 4.91 Billion |

| Forecasted Market Value ( USD | $ 6.97 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 11 |