Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases is significantly contributing to the growth of the elderly care service market. Across the globe, populations are experiencing a demographic shift characterized by a larger proportion of elderly individuals. This aging population is accompanied by a surge in chronic health conditions, such as diabetes, cardiovascular diseases, respiratory ailments, and neurological disorders. As these chronic diseases become more prevalent, they pose unique challenges that require specialized care and attention, thereby driving the demand for elderly care services. According to the National Institute of Health, Of the population 50 years and older, the number with at least one chronic disease is estimated to increase by 99.5% from 71.522 million in 2020 to 142.66 million by 2050.Chronic diseases often necessitate long-term management, frequent medical interventions, and personalized treatment plans. Many of these conditions lead to reduced functional abilities, compromised immune systems, and an elevated risk of complications. Consequently, elderly individuals living with chronic diseases require continuous monitoring, medication management, rehabilitative therapies, and assistance with daily activities. Elderly care services are uniquely positioned to cater to the needs of individuals grappling with chronic diseases. These services offer a range of support mechanisms that address not only medical requirements but also emotional and social well-being. Caregivers and healthcare professionals in elderly care facilities are equipped to administer specialized treatments, manage medication regimens, and implement preventive measures that alleviate the progression of chronic diseases.

Moreover, the increase in chronic diseases has prompted a shift towards holistic and integrated care approaches. Elderly care services emphasize multidisciplinary teams that collaborate to create comprehensive care plans tailored to each individual's specific health profile. This includes dietary management, exercise routines, mental health support, and regular health assessments. The rise of chronic diseases also underscores the importance of early detection and timely intervention. Elderly care services often collaborate closely with medical professionals, offering a continuum of care that encompasses regular health screenings and prompt responses to changes in health status. by effectively managing chronic diseases, elderly care services enhance seniors' quality of life, minimize hospital readmissions, and reduce healthcare costs in the long run.

Therefore, the increasing prevalence of chronic diseases is a key driver behind the growing demand for elderly care services. These services play a pivotal role in addressing the complex needs of elderly individuals dealing with chronic health conditions, offering personalized care that encompasses medical, emotional, and social support. As the population continues to age and chronic diseases become more widespread, elderly care services are poised to play an essential role in improving the overall well-being of seniors and managing the challenges associated with chronic illnesses.

Technological Advancements

Technological advancements are playing a pivotal role in driving the growth of the elderly care service market, revolutionizing the way care is delivered and experienced by seniors. As the aging population expands globally, the integration of technology into elderly care services is addressing various challenges and transforming the industry landscape.One of the most impactful ways technologies is enhancing elderly care is through remote monitoring and telehealth solutions. Wearable devices, smart sensors, and mobile apps enable real-time tracking of vital signs, activity levels, and medication adherence. This proactive approach allows caregivers and healthcare professionals to monitor seniors' health remotely, detect potential issues early, and intervene promptly, reducing the risk of complications and hospitalizations. However, telehealth platforms facilitate virtual consultations and follow-ups, making healthcare services more accessible to elderly individuals, particularly those with mobility constraints. Through video conferencing, seniors can receive medical advice, discuss treatment plans, and address health concerns without the need for travel.

Artificial intelligence (AI) and machine learning are revolutionizing elderly care by personalizing services to individual needs. These technologies analyze vast amounts of data to predict health patterns, allowing caregivers to provide targeted interventions and preventive measures. AI-driven solutions also enhance fall detection and prevention, which is a critical concern for seniors' safety. Social isolation and cognitive decline are common challenges for elderly individuals, but technology is addressing these issues as well. Virtual reality (VR) and digital platforms enable seniors to engage in interactive activities, connect with loved ones through video calls, and even participate in cognitive training exercises to maintain mental acuity. Robotics is another area with transformative potential. Robotic companions and assistive devices can provide physical assistance, reminders for medication, and companionship, mitigating loneliness and improving overall well-being. The integration of electronic health records (EHR) and data-sharing platforms enhances care coordination among various healthcare providers involved in a senior's care journey. This ensures seamless communication, reduces duplication of tests, and enables informed decision-making.

Furthermore, technological advancements are reshaping the elderly care service market by addressing various challenges associated with an aging population. Remote monitoring, telehealth, AI, VR, and robotics are collectively enhancing care quality, accessibility, and personalization. These innovations empower seniors to age in place while receiving comprehensive, tailored care, and offer caregivers and healthcare professionals the tools to deliver more effective and proactive support. As technology continues to evolve, its impact on elderly care is poised to create a more connected, efficient, and compassionate care ecosystem.

Increased Awareness and Demand for Quality Care

The increased awareness and demand for quality care are key drivers propelling the growth of the elderly care service market. As societies age and the importance of specialized care gains prominence, families are becoming more informed about the unique needs of their elderly loved ones. This awareness is leading to a shift in expectations, with a focus on securing services that provide not only medical assistance but also holistic support.In response to this growing demand, elderly care service providers are enhancing their offerings to ensure high standards of care delivery. Facilities are prioritizing safety measures, personalized care plans, and skilled medical professionals to meet the evolving requirements of seniors. Families are seeking peace of mind, knowing that their loved ones are in environments that provide quality medical attention, emotional well-being, and social engagement. Furthermore, the demand for quality care extends beyond medical aspects, encompassing factors such as dignity, respect, and companionship. Facilities that create a sense of community, organize enriching activities, and foster positive interactions among residents are increasingly sought after.

As the elderly care service market continues to expand, it is driven not only by the demographic shift but also by the rising awareness of the transformative impact of quality care on seniors' lives. The desire for comprehensive, respectful, and attentive care is influencing families' decisions, leading to a surge in demand for facilities that excel in providing holistic support for the well-being of elderly individuals.

Key Market Challenges

Lack of Standardization

The lack of standardization in the elderly care service market poses a notable challenge in Europe, affecting the consistency and quality of care provided to the aging population. With a diverse range of countries, cultures, and regulatory frameworks across the continent, the absence of uniform standards complicates the establishment of consistent benchmarks for care delivery.The variation in standards across European countries hampers the ability to ensure a consistent level of care quality and safety for elderly individuals. Different care facilities may adhere to disparate protocols and regulations, leading to potential disparities in the quality of services offered. This can create uncertainty for both seniors and their families when seeking appropriate care options.

The lack of standardization also impacts cross-border care, where seniors may seek services in countries other than their own. Inconsistent regulations and practices can lead to challenges in ensuring the same level of care quality, potentially compromising patient safety and well-being.

Furthermore, the absence of standardized criteria for evaluating care facilities can make it difficult for families to make informed decisions. Without clear guidelines, families may struggle to assess the quality and appropriateness of care options, leading to doubts and hesitations in selecting the right facility for their loved ones.

Addressing the lack of standardization in Europe's elderly care service market requires collaborative efforts among countries and stakeholders. Harmonizing regulatory practices, developing standardized care guidelines, and sharing best practices can contribute to ensuring a consistent level of care quality, improving transparency, and building confidence among both care providers and families seeking services.

In conclusion, the lack of standardization in the elderly care service market across Europe poses challenges that impact care quality, transparency, and decision-making. Implementing standardized guidelines and practices can play a pivotal role in creating a more consistent and reliable care environment for Europe's aging population.

High Cost of Services

The high cost of services in Europe presents a significant challenge for the elderly care service market. The diverse economic landscape across European countries results in varying pricing structures for elderly care, often rendering quality care inaccessible to a substantial portion of the aging population. The cost of skilled caregivers, medical equipment, and facility maintenance contribute to the overall expense of care services. This challenge is exacerbated by the increasing demand for specialized care as the elderly population grows. Families and individuals seeking elderly care services may face financial constraints that limit their ability to access the necessary support and assistance. As a result, addressing the affordability of elderly care services becomes crucial for ensuring that seniors receive the care they require without placing an overwhelming burden on families or individuals.Key Market Trends

Increasing Privatization

Increasing privatization is a prominent trend in the elderly care service market in Europe. As governments grapple with budget constraints and the rising demand for elderly care, private sector involvement has gained momentum. Privatization entails a shift from state-funded or nonprofit models to privately owned and operated elderly care facilities. This trend is driven by factors such as the need for more efficient service delivery, innovation, and specialized care options. Privatization offers opportunities for investment, modernization, and improved infrastructure in elderly care services. However, it also raises concerns about equitable access, quality control, and potential conflicts of interest. Striking a balance between market-driven efficiency and ensuring that seniors receive comprehensive and compassionate care remains a key challenge. As privatization continues to shape the elderly care landscape, stakeholders must navigate regulatory frameworks, quality assurance measures, and ethical considerations to create a sustainable and effective care ecosystem.Cloud Computing

Cloud computing is emerging as a significant trend in the elderly care service market in Europe. With the growing demand for efficient, integrated, and data-driven care solutions, cloud computing offers a transformative approach. Cloud-based platforms allow elderly care facilities to securely store and access patient data, medical records, and care plans remotely. This facilitates real-time communication among healthcare professionals, caregivers, and families, enhancing care coordination and decision-making. Additionally, cloud-based solutions support telehealth services, enabling virtual consultations, remote monitoring, and personalized treatment plans for seniors. The scalability and flexibility of cloud computing also enable elderly care providers to adapt to evolving needs, optimize resource allocation, and reduce operational complexities. However, data privacy and security concerns must be addressed rigorously to ensure compliance with regulatory standards, particularly with sensitive healthcare information. As cloud computing continues to shape the elderly care service landscape, its adoption is poised to drive innovation, streamline care delivery, and improve the overall well-being of seniors across Europe.Segmental Insights

Service Type Insights

Based on the Service Type, the home-based care service segment is anticipated to witness substantial market growth with a CAGR 8.26% throughout the forecast period. The preference for aging in place, personalized attention, and advancements in remote monitoring technologies contribute to the growing popularity of home-based care. While institutional and community-based care services continue to play crucial roles, the desire for independence, familiar surroundings, and tailored care plans drives the trend towards home-based solutions. This shift aligns with the evolving needs and preferences of seniors and their families, marking home-based care as the dominant service type in the forecasted elderly care market.Service Provider Insights

Based on the service provider segment, the private service provider is the fastest growing segment with a CAGR 9.10 % in the forecast period. The increasing demand for personalized and high-quality care, coupled with the expansion of privately-owned facilities, drives the prominence of private services. While public services continue to play a vital role, the flexibility, innovation, and specialized offerings provided by private providers attract both seniors and their families. This trend signifies a shift towards more tailored and individualized care options, positioning private elderly care services as the dominant segment in the projected European market.Country Insights

Germany holds a dominant position in the European elderly care service market due to a convergence of factors. Its well-developed healthcare infrastructure, strong economy, and substantial aging population contribute to a high demand for elderly care services. Germany's comprehensive healthcare system and emphasis on quality care create a conducive environment for the growth of this sector. Government policies and financial support further bolster the market, making it accessible to a wide range of individuals.Moreover, Germany's commitment to research and innovation in healthcare translates to advanced care practices and technologies in elderly care services. The country's well-regulated industry ensures quality standards are met, inspiring confidence in service seekers. Cultural values that prioritize the well-being of seniors and the availability of diverse care options, including institutional and home-based care, cater to varying needs. These combined factors establish Germany as a leader in the European elderly care service market, setting the benchmark for quality, accessibility, and innovation in the sector.

Key Market Players

- Orpea SA

- Korian Group (Clariane SE)

- Colisee France SAS

- Attendo Group AB

- HC-One TopCo Limited

- KOS Group

- Emvia Living Group

- Victor’s Group

- DomusVi SAS

- Alloheim Senioren-Residenzen GmbH

Report Scope

In this report, the Europe Elderly Care Service Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Europe Elderly Care Services Market, by Service Type

- Institutional Care

- Community-Based Care

- Home-Based Care

Europe Elderly Care Service Market, by Service Provider

- Public

- Private

Europe Elderly Care Service Market, by Country

- Germany

- Italy

- United Kingdom

- France

- Spain

- Greece

- Portugal

- Bulgaria

- Finland

- Croatia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Europe Elderly Care Services Market.Available Customizations

The following customization option is available for the report based on your specific needs: Detailed analysis and profiling of additional market players (up to five).Table of Contents

Companies Mentioned

- Orpea SA

- Korian Group (Clariane SE)

- Colisee France SAS

- Attendo Group AB

- HC-One TopCo Limited

- KOS Group

- Emvia Living Group

- Victor’s Group

- DomusVi SAS

- Alloheim Senioren-Residenzen GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 127 |

| Published | October 2023 |

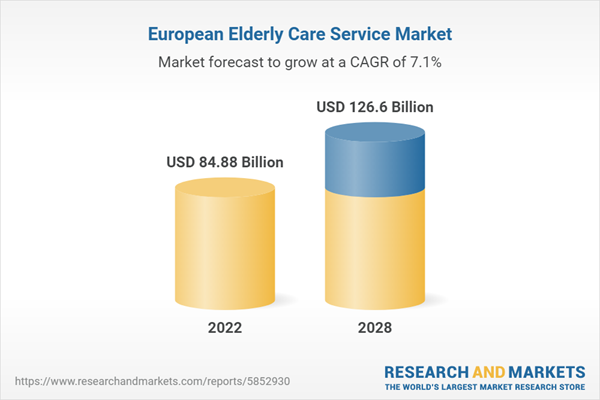

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 84.88 Billion |

| Forecasted Market Value ( USD | $ 126.6 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 10 |