Solvent-borne coatings are characterized by their use of organic solvents to dissolve and deliver resins and other components. These coatings offer excellent application properties, including smooth finishes, good flow, and rapid drying times. They are commonly used in situations requiring high durability and resistance to harsh environmental conditions. Consequently, the German market would consume 343.44 kilo tonnes of solvent-borne chemical in 2023.

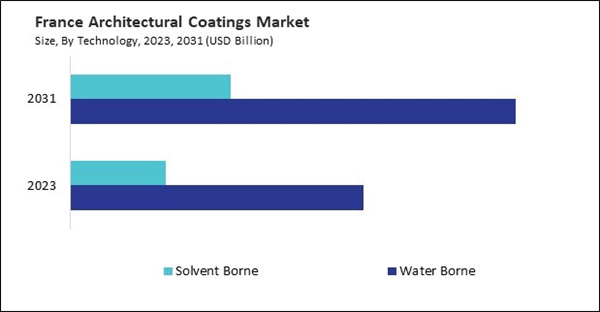

The Germany market dominated the Europe Architectural Coatings Market by Country in 2023, and is expected to continue to be a dominant market till 2031; thereby, achieving a market value of USD5.92 billion by 2031. The UK market is exhibiting a CAGR of 4.4% during 2024-2031. Additionally, the France market would experience a CAGR of 5.8% during 2024-2031.

Interior paints offer a wide range of colors, finishes, and textures, allowing homeowners, designers, and architects to improve the visual appeal of indoor spaces. The ability to customize interior spaces according to personal preferences and design trends drives the demand for interior paints. Interior paints are formulated for easy application and maintenance, allowing for hassle-free painting projects.

Quick-drying, washable, and stain-resistant interior paints simplify the cleaning and upkeep of indoor spaces, reducing the need for frequent repainting. Interior paints can be used to create various effects, including matte, satin, semi-gloss, and high-gloss finishes, as well as textured and decorative effects. This versatility allows for customization and creativity in interior design, catering to diverse aesthetic preferences and design trends.

Coatings protect wind turbine towers, solar panel frames, hydroelectric dams, and other renewable energy infrastructure from the UK's corrosion, UV degradation, and environmental exposure. In 2022, the U.K. Government planned to invest over 160 million dollars to improve infrastructure and aid local communities. This expenditure mainly focuses on developing and repairing four major road schemes: the road linking St Austell to the A30, Tyne Bridge, A34, and A35 Redbridge Causeway.

The expenditure of £35.3 million for essential maintenance on the Tyne Bridge and adjacent Central Motorway, like enhancements to traffic management and cycle route facilities, will generate £130.5 million in economic benefits by enhancing local connectivity. The A35 Redbridge Causeway is a crucial link between the New Forest, Southampton, and its port. Its essential maintenance will cost £13.4 million, and enhanced connectivity will result in roughly £340 million in direct economic benefits. Thus, all these factors will uplift the regional market’s expansion in the coming years.

List of Key Companies Profiled

- PPG Industries, Inc.

- Wacker Chemie AG

- Nippon Paint Holdings Co., Ltd.

- The Sherwin-Williams Company

- BASF SE

- The Dow Chemical Company

- 3M Company

- Kansai Paint Co., Ltd.

- Akzo Nobel N.V.

- Arkema S.A.

Market Report Segmentation

By Technology (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Water Borne

- Solvent Borne

By End-Use (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Residential

- Non-Residential

By Resin Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Acrylic

- Alkyd

- Epoxy

- Polyurethane

- Polyester

- Other Resin Types

By Function (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Ceramics

- Inks

- Lacquers

- Paints

- Powder Coatings

- Primers

- Sealers

- Stains

- Varnishes

By Country (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

Some of the key companies in the Europe Architectural Coatings Market include:- PPG Industries, Inc.

- Wacker Chemie AG

- Nippon Paint Holdings Co., Ltd.

- The Sherwin-Williams Company

- BASF SE

- The Dow Chemical Company

- 3M Company

- Kansai Paint Co., Ltd.

- Akzo Nobel N.V.

- Arkema S.A.