Increasing Need for Communications in Automobiles are Driving the Europe Automotive Transceivers Market

The growing regulatory support for zero-emission vehicles in different countries through subsidies and tax rebates encourages the manufacturing and adoption of electric vehicles. EV sales also grew strongly in Europe by 65% to reach 2.3 million units in 2021. Supportive government initiatives to strengthen EV charging infrastructure further propels EV sales. In May 2022, PMI Electro, an Electric bus maker, announced the plan to set up its largest commercial EV manufacturing plant, having an annual production capacity of 2,500 vehicles.Such huge growth of electric vehicles worldwide, there is an increasing demand for data exchange due to which there is a growing need to implement a range of automotive networks that efficiently send and receive large quantities of data through protocols such as CAN (Controller Area Network) and LIN (Local Interconnect Network) bus systems. Nowadays, electric cars are equipped with advanced features and transceivers for better communication and safety. Thus, such growing production and sales of electric vehicles are expected to hold potential demand for incorporating the Europe automotive transceivers market , which drives the Europe automotive transceivers market growth during the forecast timeframe.

Market Overview

The Europe automotive transceivers market growth is attributed to increasing sales of vehicles, coupled with growing initiatives for incorporating ADAS and advanced communication electronics devices, such as transceivers. As per the data published by the International Organization of Motor Vehicle Manufacturers, the sale of new vehicles registered in Europe increased from 16.71 million units in 2020 to 16.87 million units in 2021, registering a growth rate of 1%, which is expected to grow in the coming years. As a result, the rising sale of vehicles is expected to grow rapidly, which is likely to boost the demand for Europe automotive transceivers market during the forecast period.In 2022, the European Commission mandated the advanced safety systems in vehicles to protect passengers, pedestrians, and cyclists. The initiative was undertaken with the aim of reducing the number of fatalities and injuries on roads, as 90% of such incidents occur due to human error. For example, cars, vans, trucks, and buses must be equipped with advanced safety systems such as warning of driver drowsiness, intelligent speed assistance, reversing safety with a camera or sensors, and data recorders in case of an accident. Thus, such favorable government policies for protection against fatal accidents are increasing the adoption of ADAS and V2X communication, which is creating more demand for in-vehicle communication modules that support the Europe automotive transceivers market growth over the forecast period.

The presence of a large number of leading players for providing automotive transceivers is also augmenting the Europe automotive transceivers market growth. The key players are significantly focused on the advancement of transceiver features to deliver more efficiency and reliability in communicating the signals for providing ease in driving the vehicle. For instance, in March 2020, Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, introduced multiple Cellular Vehicle-to-Everything (C-V2X) products for leading automotive and infrastructure suppliers. The product features Qualcomm® 9150 C-V2X Platform that has achieved the certification in accordance with the European Radio Equipment Directive (“RED”) Certification in Europe. Also, in March 2021, Continental Engineering Services, a pioneering developer of technologies and services for sustainable and connected mobility, announced its plan to expand into three new branches in England, Germany (Sindelfingen), and Italy. The expansion initiative aims to develop and integrate advanced driver assistance systems (ADAS), which would create a demand for automotive transceivers in European countries. In addition, as per the study conducted by the Autopromotec Observatory based on Boston Consulting Group in May 2021, 54% of the car fleet running on Europe's roads is likely to be equipped with ADAS by 2030. Thus, the wide scope in the deployment of ADAS in European vehicles is anticipated to increase the demand for automotive transceivers, which is expected to fuel the Europe automotive transceivers market growth over the coming years.

Europe Automotive Transceivers Market Segmentation

The Europe automotive transceivers market is segmented into protocol, application, vehicle type, and country.- Based on protocol, the Europe automotive transceivers market is segmented into CAN, LIN, FLEXRAY, and others. The CAN segment held the largest market share in 2022.

- Based on application, the Europe automotive transceivers market is segmented into safety, body control module, chassis, powertrain, steering wheel, engine, and door/seat. The safety segment held the larger market share in 2022.

- Based on vehicle type, the Europe automotive transceivers market is bifurcated into passenger vehicles, and commercial vehicles. The passenger vehicles segment held the larger market share in 2022.

- Based on country, the Europe automotive transceivers market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The Germany dominated the market share in 2022.

Table of Contents

1. Introduction1.1 Study Scope

1.2 Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Europe Automotive Transceivers Market Landscape

4.1 Market Overview

4.2 Europe - PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. Europe Automotive Transceivers Market - Key Industry Dynamics

5.1 Market Drivers

5.1.1 Increasing Need for Communications in Automobiles

5.1.2 Equipment of Advanced Communication and Safety Features in Electric Vehicles

5.2 Market Restraints

5.2.1 Increasing Complexities in Electronic Systems

5.3 Market Opportunities

5.3.1 Growing Adoption of Self-Driving or Autonomous Vehicles

5.4 Trends

5.4.1 Drive-By-Wire, Steer-By-Wire, and Brake-By-Wire

5.5 Impact Analysis of Drivers and Restraints

6. Europe Automotive Transceivers Market - Market Analysis

6.1 Europe Automotive Transceivers Market Overview

6.2 Europe Automotive Transceivers Market Forecast and Analysis

7. Europe Automotive Transceivers Market Analysis - By Protocol

7.1 Overview

7.2 Europe Automotive Transceivers Market, By Protocol (2021 & 2028)

7.3 CAN

7.3.1 Overview

7.3.2 CAN: Europe Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

7.4 LIN

7.4.1 Overview

7.4.2 LIN: Europe Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

7.5 FLEXRAY

7.5.1 Overview

7.5.2 FLEXRAY: Europe Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

7.6 OTHERS

7.6.1 Overview

7.6.2 Others: Europe Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

8. Europe Automotive Transceivers Market Revenue and Forecast to 2028 - By Application

8.1 Overview

8.2 Europe Automotive Transceivers Market, By Application (2021 & 2028)

8.3 Safety

8.3.1 Overview

8.3.2 Safety: Europe Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

8.4 Body Control Module

8.4.1 Overview

8.4.2 Body Control Module: Europe Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

8.5 Chassis

8.5.1 Overview

8.5.2 Chassis: Europe Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

8.6 Powertrain

8.6.1 Overview

8.6.2 Powertrain: Europe Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

8.7 Steering Wheel

8.7.1 Overview

8.7.2 Steering Wheel: Europe Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

8.8 Engine

8.8.1 Overview

8.8.2 Engine: Europe Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

8.9 Door/Seat

8.9.1 Overview

8.9.2 Door/Seat: Europe Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

9. Europe Automotive Transceivers Market Revenue and Forecast to 2028 - Vehicle Type

9.1 Overview

9.2 Europe Automotive Transceivers Market, By Vehicle Type (2021 & 2028)

9.3 Passenger Vehicles

9.3.1 Overview

9.3.2 Passenger Vehicles: Europe Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

9.4 Commercial Vehicles

9.4.1 Overview

9.4.2 Commercial Vehicles: Europe Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

10. Europe Automotive Transceivers Market - Country Analysis

10.1 Overview

10.1.1 Europe Automotive Transceivers Market, by Key Country- Revenue (2021) (US$ Million)

10.1.2 Europe Automotive Transceivers Market, by Key Country

10.1.2.1 France: Automotive Transceivers Market - Revenue, and Forecast to 2028 (US$ Million)

10.1.2.1.1 France: Automotive Transceivers Market, By Protocol

10.1.2.1.2 France: Automotive Transceivers Market, By Application

10.1.2.1.3 France: Automotive Transceivers Market, By Vehicle Type

10.1.2.2 Germany: Automotive Transceivers Market - Revenue, and Forecast to 2028 (US$ Million)

10.1.2.2.1 Germany: Automotive Transceivers Market, By Protocol

10.1.2.2.2 Germany: Automotive Transceivers Market, By Application

10.1.2.2.3 Germany: Automotive Transceivers Market, By Vehicle Type

10.1.2.3 UK: Automotive Transceivers Market - Revenue, and Forecast to 2028 (US$ Million)

10.1.2.3.1 UK: Automotive Transceivers Market, By Protocol

10.1.2.3.2 UK: Automotive Transceivers Market, By Application

10.1.2.3.3 UK: Automotive Transceivers Market, By Vehicle Type

10.1.2.4 Italy: Automotive Transceivers Market - Revenue, and Forecast to 2028 (US$ Million)

10.1.2.4.1 Italy: Automotive Transceivers Market, By Protocol

10.1.2.4.2 Italy: Automotive Transceivers Market, By Application

10.1.2.4.3 Italy: Automotive Transceivers Market, By Vehicle Type

10.1.2.5 Russia: Automotive Transceivers Market - Revenue, and Forecast to 2028 (US$ Million)

10.1.2.5.1 Russia: Automotive Transceivers Market, By Protocol

10.1.2.5.2 Russia: Automotive Transceivers Market, By Application

10.1.2.5.3 Russia: Automotive Transceivers Market, By Vehicle Type

10.1.2.6 Rest of Europe Automotive Transceivers Market - Revenue, and Forecast to 2028 (US$ Million)

10.1.2.6.1 Rest of Europe Automotive Transceivers Market, By Protocol

10.1.2.6.2 Rest of Europe Automotive Transceivers Market, By Application

10.1.2.6.3 Rest of Europe Automotive Transceivers Market, By Vehicle Type

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 New Product Development

11.4 Merger and Acquisition

12. Company Profiles

12.1 Broadcom Inc

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Renesas Electronics Corp

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Maxim Integrated Products Inc

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Microchip Technology Inc

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 NXP Semiconductors NV

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Robert Bosch

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Texas Instruments Inc

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Toshiba Corp

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 STMicroelectronics NV

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

13. Appendix

13.1 About the Publisher

13.2 Word Index

Table 1. Europe Automotive Transceivers Market - Revenue and Forecast to 2028 (US$ Million)

Table 2. Europe Automotive Transceivers Market, By Protocol - Revenue and Forecast to 2028 (US$ Million)

Table 3. Europe Automotive Transceivers Market, By Application - Revenue and Forecast to 2028 (US$ Million)

Table 4. Europe Automotive Transceivers Market, By Vehicle Type - Revenue and Forecast to 2028 (US$ Million)

Table 5. France: Automotive Transceivers Market, By Protocol -Revenue and Forecast to 2028 (US$ Million)

Table 6. France: Automotive Transceivers Market, By Application -Revenue and Forecast to 2028 (US$ Million)

Table 7. France: Automotive Transceivers Market, By Vehicle Type -Revenue and Forecast to 2028 (US$ Million)

Table 8. Germany: Automotive Transceivers Market, By Protocol -Revenue and Forecast to 2028 (US$ Million)

Table 9. Germany: Automotive Transceivers Market, By Application -Revenue and Forecast to 2028 (US$ Million)

Table 10. Germany: Automotive Transceivers Market, By Vehicle Type -Revenue and Forecast to 2028 (US$ Million)

Table 11. UK: Automotive Transceivers Market, By Protocol -Revenue and Forecast to 2028 (US$ Million)

Table 12. UK: Automotive Transceivers Market, By Application -Revenue and Forecast to 2028 (US$ Million)

Table 13. UK: Automotive Transceivers Market, By Vehicle Type -Revenue and Forecast to 2028 (US$ Million)

Table 14. Italy: Automotive Transceivers Market, By Protocol -Revenue and Forecast to 2028 (US$ Million)

Table 15. Italy: Automotive Transceivers Market, By Application -Revenue and Forecast to 2028 (US$ Million)

Table 16. Italy: Automotive Transceivers Market, By Vehicle Type -Revenue and Forecast to 2028 (US$ Million)

Table 17. Russia: Automotive Transceivers Market, By Protocol -Revenue and Forecast to 2028 (US$ Million)

Table 18. Russia: Automotive Transceivers Market, By Application -Revenue and Forecast to 2028 (US$ Million)

Table 19. Russia: Automotive Transceivers Market, By Vehicle Type -Revenue and Forecast to 2028 (US$ Million)

Table 20. Rest of Europe Automotive Transceivers Market, By Protocol -Revenue and Forecast to 2028 (US$ Million)

Table 21. Rest of Europe Automotive Transceivers Market, By Application -Revenue and Forecast to 2028 (US$ Million)

Table 22. Rest of Europe Automotive Transceivers Market, By Vehicle Type -Revenue and Forecast to 2028 (US$ Million)

Table 23. List of Abbreviation

Figure 1. Europe Automotive Transceivers Market Segmentation

Figure 2. Europe Automotive Transceivers Market Segmentation - By Country

Figure 3. Europe Automotive Transceivers Market Overview

Figure 4. CAN Segment held the Largest Share of Europe Automotive Transceivers Market

Figure 5. France to Show Great Traction During Forecast Period

Figure 6. Europe - PEST Analysis

Figure 7. Ecosystem Analysis: Europe Automotive Transceivers Market

Figure 8. Expert Opinion

Figure 9. Europe Automotive Transceivers Market: Impact Analysis of Drivers and Restraints

Figure 10. Europe Automotive Transceivers Market Forecast and Analysis (US$ Million)

Figure 11. Europe Automotive Transceivers Market Revenue Share, By Protocol (2021 & 2028)

Figure 12. CAN: Europe Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 13. LIN: Europe Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 14. FLEXRAY: Europe Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 15. Others: Europe Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 16. Europe Automotive Transceivers Market Revenue Share, By Application (2021 & 2028)

Figure 17. Safety: Europe Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 18. Body Control Module: Europe Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 19. Chassis: Europe Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 20. Powertrain: Europe Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 21. Steering Wheel: Europe Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 22. Engine: Europe Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 23. Door/Seat: Europe Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 24. Europe Automotive Transceivers Market Revenue Share, By Vehicle Type (2021 & 2028)

Figure 25. Passenger Vehicles: Europe Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 26. Commercial Vehicles: Europe Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 27. Europe Automotive Transceivers Market Revenue Share, by Key Country (2021 & 2028)

Figure 28. France: Automotive Transceivers Market - Revenue, and Forecast to 2028 (US$ Million)

Figure 29. Germany: Automotive Transceivers Market - Revenue, and Forecast to 2028 (US$ Million)

Figure 30. UK: Automotive Transceivers Market - Revenue, and Forecast to 2028 (US$ Million)

Figure 31. Italy: Automotive Transceivers Market - Revenue, and Forecast to 2028 (US$ Million)

Figure 32. Russia: Automotive Transceivers Market - Revenue, and Forecast to 2028 (US$ Million)

Figure 33. Rest of Europe Automotive Transceivers Market - Revenue, and Forecast to 2028 (US$ Million)

Companies Mentioned

- Broadcom Inc

- Maxim Integrated Products Inc

- Microchip Technology Inc

- NXP Semiconductors NV

- Renesas Electronics Corp

- Robert Bosch

- STMicroelectronics NV

- Texas Instruments Inc

- Toshiba Corp

Table Information

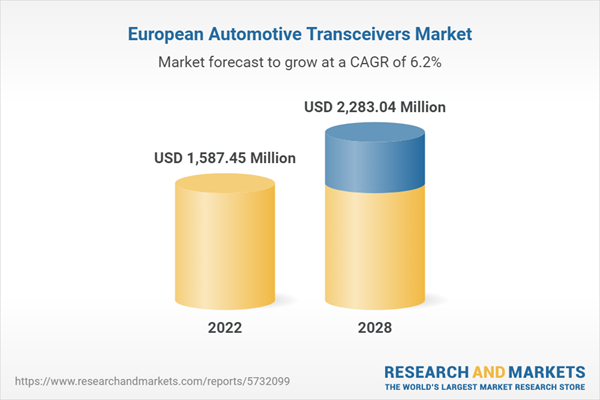

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | January 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1587.45 Million |

| Forecasted Market Value ( USD | $ 2283.04 Million |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 9 |