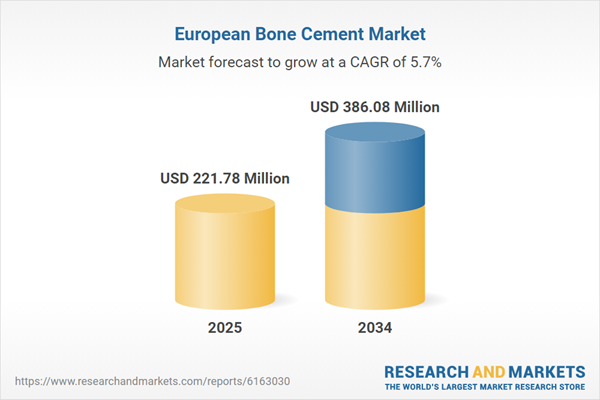

Europe Bone Cement Market Overview

Bone cement is defined as a component used as a filler or fixer of bone when a patient suffers from a fracture or some kind of bone injury. Bone cement can be adhered inside a body in its powdered or liquid form and can last up to 15 to 20 years.The high demand for orthopedic procedures and the presence of advanced healthcare infrastructure significantly elevate the Europe bone cement market value in the forecast period. The market is expected to witness substantial growth in the coming years supported by the increasing elderly population and advancements in bone cement formulations. In addition, calcium phosphate cement (CPC) is experiencing high market demand due to its biocompatibility and osteoconductive and is poised to aid the expansion of the global bone cement market . Other factors that influence the market dynamics in Europe include the increasing use of bone cement in outpatient settings for various surgical procedures and the rising demand for minimally invasive surgeries.

Europe Bone Cement Market Growth Drivers

Rising Introduction of Innovative Bone Cement Solutions to Affect the Market Landscape Significantly

The rising introduction of bone cement products in Europe with improved properties such as higher viscosity, faster setting times, and enhanced biocompatibility are projected to stimulate market growth in the coming years. For instance, Kyphon VuE™ cement developed by leading medical device company Medtronic plc is a high-viscosity radiopaque polymethyl methacrylate (PMMA) cement with augmented barium particles. This bone cement product is quick to harden and facilitates fluoroscopic visualization of cement flow during vertebral augmentation procedures. Such advancements in bone cement solutions are not only ensuring optimal handling performance but also helping in achieving better surgical outcomes and patient safety. Thus, the continuous innovation in bone cement products, stimulated by significant R&D investments by the market players, is propelling the growth of the market in Europe.Europe Bone Cement Market Trends

The market is witnessing several trends and developments to improve the current scenario in North America. Some of the notable trends are as follows:Focus on Infection Control

The growing demand for antibiotic-loaded bone cement that contains antibiotics to prevent post-surgical infections is a major trend fuelling the market growth. For instance, Stryker's Antibiotic Simplex Bone Cement contains Erythromycin/Colistin, which helps in reducing the risk of infection in patients undergoing joint replacement surgeries.Rising Regulatory Approvals

The increase in regulatory approvals by health agencies such as the European Medicines Agency (EMA) is leading to a faster market entry for new bone cement products, which influences the Europe bone cement market share. The market also benefits from streamlined regulatory processes and successful clinical trials to ensure the rapid introduction of innovative bone cement in healthcare facilities.Growing Incidence of Sports Injuries

In Europe, the increased participation in sports and physical activities results in a higher incidence of sports-related injuries, which amplifies the demand for bone cement products in surgical repairs. Knee and shoulder arthroscopy procedures are commonly used to treat sports injuries and often utilize bone cement to repair damaged tissues and secure prosthetic components.Increased Strategic Collaborations

One of the major trends in the Europe bone cement market is the increased strategic collaborations between research institutes and medical device companies in Europe, which is driving innovation in bone cement technology including the development of bioactive cement that promotes bone healing. Such collaborative initiatives are likely to improve clinical outcomes and propel the market expansion in the forecast period.Europe Bone Cement Market Segmentation

Europe Bone Cement Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product

- Calcium Phosphate Cement (CPC)

- Glass Polyalkenoate Cement

- Polymethyl Methacrylate (PMMA) Cement

Market Breakup by Application

- Kyphoplasty

- Arthroplasty

- Vertebroplasty

Market Breakup by End User

- Hospital

- Ambulatory Surgical Centres

- Clinics

Market Breakup by Region

- United Kingdom

- Germany

- France

- Italy

- Others

Europe Bone Cement Market Share

Market Segmentation Based on Product is Anticipated to Witness Substantial Growth

Based on products, the market is divided into calcium phosphate cement (CPC), glass polyalkenoate cement and polymethyl methacrylate (PMMA) cement. The calcium phosphate cement (CPC) segment, holds a significant share in the Europe bone cement market. Calcium phosphate bone cement can penetrate through the bone by being injected during the process of surgery, which makes this process minimally invasive. In this regard, the increasing awareness and inclination towards minimally invasive surgical procedures among patients are driving the segment's growth.In the Europe bone cement market, calcium phosphate cement is a widely used compound to treat bone fracture due to its self-setting properties, osteoconductivity, easy mouldability, and excellent biocompatibility. Meanwhile, the heightened application of polymethyl methacrylate (PMMA) cement in vertebroplasty and arthroplasty is further fuelling the growth of the Europe market for bone cement.

Kyphoplasty Segment Covers a Significant Market Share

Application areas of bone cement include kyphoplasty, arthroplasty and vertebroplasty. The kyphoplasty segment accounts for a healthy share of the market. This procedure aims at improving spine health and provides comfort to patients suffering from spinal injuries. The increasing prevalence of traumatic spinal cord injuries induced by transport-related accidents across countries like Spain and Germany is propelling the Europe bone cement demand to facilitate kyphoplasty.In addition, the increasing geriatric population in the region is further fuelling the cases of bone injuries, which elevates the market value. Moreover, the increasing complaints of joint pain and fractures, owing to the increasing inclination towards adventure and sports, is expected to boost the demand for bone cement in arthroplasty and vertebroplasty.

Europe Bone Cement Market Analysis by Region

Based on the region, the market is segmented into the United Kingdom, Germany, France, Italy, and others. The United Kingdom holds a substantial market share, owing to the increasing elderly population that has a higher incidence of joint-related issues. Increased R&D related to orthopedic solutions in the region further supports the market growth. Moreover, the rising strategic collaborations among key market players and favorable government policies also aid the market expansion in the United Kingdom market.Germany is also one of the major bone cement markets in Europe, benefitting from significant healthcare expenditure and robust healthcare policies supporting the adoption of advanced medical technologies, including bone cement products.

Leading Players in the Europe Bone Cement Market

The key features of the market report comprise the patent analysis, funding and investment analysis, and strategic initiatives by the leading players. The major companies in the market are as follows:Johnson & Johnson MedTech (Depuy Synthes)

Johnson & Johnson MedTech (Depuy Synthes) is a leading market player and offers an extensive portfolio of orthopedic solutions, including bone cement for various surgical applications. The company is actively engaged in research and development initiatives to improve its bone cement formulations.

Medtronic plc

Medtronic plc is one of the key players in the bone cement market in Europe. It is known for its advanced bone cement solutions for orthopedic and spinal surgeries. The company leverages strategic partnerships to expand its presence and product offerings.Arthrex, Inc.

Arthrex, Inc., a manufacturer of minimally invasive orthopedic products, significantly contributes to the Europe bone cement market growth. Its advanced bone cement formulations, known for its reliability and strong fixation properties, are widely used for joint reconstruction and repair.Cardinal Health, Inc.

Cardinal Health, Inc., a global manufacturer, and distributor of medical products, has a strong presence in the market. It provides a range of medical supplies, including high-quality bone cement solutions. The company is focused on improving its supply chain to ensure the availability of bone cement products across Europe.Other key players in the market include Stryker Corporation, Zimmer Biomet Holdings, Inc., Smith & Nephew plc, DJO, LLC, Globus Medical, Inc., and Heraeus Medical LLC.

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Johnson & Johnson MedTech (Depuy Synthes)

- Stryker Corporation

- Zimmer Biomet Holdings, Inc

- Smith & Nephew plc

- Medtronic plc

- DJO, LLC

- Globus Medical, Inc

- Arthrex, Inc.

- Cardinal Health, Inc.

- Heraeus Medical LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 221.78 Million |

| Forecasted Market Value ( USD | $ 386.08 Million |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 10 |