Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Butyl Acetate also serve as an effective solvent for fats, oils, resins, and polymers, but it also finds extensive applications in diverse industries. From medicines and personal-care products to paints and coatings, food flavoring, plasticizers, and electronics, the usage of Butyl Acetate spans across multiple sectors. Its mild volatility makes it particularly suitable for manufacturing paints with excellent leveling and gloss. The coatings and paints industry, along with the flavoring sector, constitutes the largest market for Butyl Acetate.

However, this versatile chemical also acts as a solvent in resins, varnishes, fragrances, nail polish removers, and photographic film. As the demand for water-based coatings and automotive paints continues to rise globally, the Butyl Acetate industry is experiencing significant growth.

The adhesives and cosmetics industries are also driving the demand for Butyl Acetate, fueling market expansion. Looking ahead, ongoing research and development endeavors to create innovative products like tert-butyl acetate as a substitute for volatile organic compounds (VOCs) present promising opportunities for the future expansion of the Butyl Acetate market. The continuous exploration of cutting-edge solutions will contribute to the sustained growth and diversification of this versatile compound.

Key Market Drivers

Growing Demand of Butyl Acetate in Food & Beverage Industry

Butyl acetate, a commonly used flavoring agent in the food and beverage industry, is renowned for its ability to enhance the taste and aroma of various products. Its fruity and sweet scent adds an alluring touch to artificial flavors, making it a popular choice among confectioneries, soft drinks, ice creams, and baked goods. With its pleasant and desirable fragrance profile, butyl acetate brings an extra dimension of sensory delight to these delectable treats.In addition to its flavor-enhancing properties, butyl acetate serves as a versatile solvent in the food industry. It plays a crucial role in dissolving and distributing food additives like coloring agents, preservatives, and emulsifiers. Due to its solubility characteristics, butyl acetate ensures the uniform dispersion of these additives throughout food and beverage products, guaranteeing consistent quality and visual appeal.

Butyl acetate's exceptional cleaning properties also make it a valuable asset in the food processing industry. It effectively removes oils, greases, and residues from equipment and surfaces, leaving them spotless and free from any harmful traces. This cleaning prowess contributes to maintaining high cleanliness and hygiene standards in food production facilities, ensuring product safety and quality.

As the food and beverage industry face stringent regulatory standards, the use of butyl acetate as a food-grade solvent becomes even more significant. Manufacturers must adhere to these quality requirements to maintain product safety and consistency. Fortunately, butyl acetate meets these regulatory guidelines, making it a safe and reliable choice for food and beverage manufacturers. Its compliance enhances its appeal and further drives its demand in the industry.

The growing demand for butyl acetate in the food and beverage sector has significant implications for the Europe butyl acetate market. Key players in the market can expect increased demand from food and beverage manufacturers, presenting opportunities for them to expand their production capacities and strengthen their supply chains to meet the rising requirements. Furthermore, the versatility of butyl acetate opens avenues for research and development, fostering the exploration of new applications within the food and beverage industry. Manufacturers can invest in developing innovative formulations and customized solutions to cater to specific customer demands, further enhancing their competitive edge in the market.

Growing Demand of Butyl Acetate in Construction Industry

The construction industry heavily relies on paints and coatings for protection, aesthetics, and durability of structures. Butyl acetate, a versatile solvent, plays a crucial role in the formulation of these coatings. Its unique properties, such as smooth application, quick evaporation, and good leveling, contribute to high-quality finishes, ensuring that structures not only look appealing but also stand the test of time. Butyl acetate goes beyond coatings and finds its significance in the manufacturing of adhesives and sealants used in construction.As a solvent, it facilitates the effective blending of various adhesive ingredients, resulting in strong bonds and durable applications. Its solvency properties enhance the flexibility, adhesion, and ease of application of these adhesives and sealants, meeting the demanding requirements of construction projects. In the pursuit of performance and longevity, the construction industry often incorporates concrete additives. Butyl acetate, as a solvent in the production of these additives, improves the workability, water resistance, and strength of concrete structures.

It aids in the dispersion of other ingredients within the concrete mixture, ensuring uniformity and optimal performance. As sustainability and environmental regulations gain prominence, the construction industry embraces materials that align with these requirements. Butyl acetate stands out as a low-toxicity solvent with minimal impact on the environment, making it a preferred choice for construction projects aiming for eco-friendly practices. Looking ahead, manufacturers of butyl acetate in Europe have an opportunity to capitalize on this industry trend. By expanding production capacities and optimizing supply chains, they can meet the rising demand for environmentally friendly solvents.

Research and development efforts can focus on enhancing the properties of butyl acetate to address specific construction needs and further improve its performance in various applications. In summary, the versatility and beneficial properties of butyl acetate make it an indispensable component in the construction industry. From coatings to adhesives, sealants to concrete additives, its multifaceted role ensures the longevity, performance, and sustainability of structures. As the industry progresses, the continuous exploration and innovation surrounding butyl acetate will pave the way for even more advancements in construction practices.

Growing Demand of Butyl Acetate in Automotive Industry

Butyl acetate serves as a crucial and versatile component in the manufacturing of adhesives and sealants used in the automotive sector. Its exceptional solvency properties enable the effective blending of various adhesive ingredients, resulting in the formation of strong bonds and reliable sealing applications. Furthermore, butyl acetate significantly contributes to the flexibility, adhesion, and ease of application of these automotive adhesives and sealants, ensuring their optimal performance in demanding conditions.In addition to its role as a key ingredient in adhesives and sealants, butyl acetate also acts as a highly effective plasticizer in certain automotive applications. By adding butyl acetate as a plasticizer to automotive plastics, the flexibility, durability, and resistance to heat and chemicals of these materials are greatly enhanced. As a result, the performance and longevity of plastic components in automobiles are significantly improved, meeting the stringent requirements of the automotive industry.

Butyl acetate finds application in the formulation of automotive polishes, contributing to the achievement of a high gloss and impeccable shine on vehicle surfaces. As automotive manufacturers continuously strive for advancements in coating technologies to enhance the appearance and durability of their vehicles, butyl acetate plays a crucial and multi-faceted role in meeting these objectives. Its excellent flow properties, superior leveling characteristics, and fast drying capabilities enable the development of high-quality automotive coatings.

As automotive coatings continue to evolve, the demand for butyl acetate is expected to grow, driven by its valuable contribution to the overall performance and aesthetics of coated surfaces. The automotive industry’s increasing focus on lightweight materials to enhance fuel efficiency and reduce emissions has further elevated the significance of butyl acetate. As a plasticizer, butyl acetate actively contributes to the development of lightweight automotive plastics that not only meet stringent safety and performance requirements but also contribute to the overall weight reduction of vehicles. With the prominence of lightweight materials on the rise, the demand for butyl acetate as a plasticizer is expected to witness significant growth.

In Europe, manufacturers of butyl acetate are likely to benefit from this industry trend by expanding their production capacities and optimizing their supply chains to meet the growing requirements of the automotive sector. Furthermore, research and development efforts may focus on further enhancing the properties of butyl acetate to address specific needs of the automotive industry and improve its performance in various automotive applications. By continuously pushing the boundaries of innovation, butyl acetate manufacturers strive to meet the evolving demands of the automotive sector and contribute to the advancement of automotive technology.

Key Market Challenges

Volatility in Prices of Raw Materials

One of the key raw materials used in the production of butyl acetate is n-butanol. N-butanol, a primary alcohol, plays a crucial role in the synthesis of butyl acetate, which is widely utilized in various industries such as paints, coatings, adhesives, and solvents. The prices of n-butanol, along with other essential raw materials, have experienced significant fluctuations in recent years. These price fluctuations can be attributed to a multitude of factors, including the delicate balance of supply and demand dynamics in the market. Global economic conditions, trade policies, and geopolitical events also exert their influence on raw material prices. This volatility in raw material prices directly impacts the entire supply chain of butyl acetate, encompassing manufacturers, distributors, and consumers alike.For manufacturers, fluctuating raw material prices pose challenges in maintaining competitiveness in the market. As production costs rise due to increased prices of key raw materials, manufacturers may face the dilemma of either absorbing the extra costs or passing them onto consumers through higher prices for butyl acetate products. Balancing these considerations becomes crucial to ensure sustainable business operations and meet customer demands effectively.

The uncertainty created by volatile raw material prices further complicates long-term planning and investment decisions for manufacturers. To navigate this uncertainty, manufacturers must constantly monitor and analyze the price trends of raw materials. This helps them make informed decisions regarding production volumes, pricing strategies, and supply chain management. Accurate forecasting of future costs becomes challenging due to the unpredictability of raw material prices, potentially impacting profitability and overall financial stability. In summary, the volatility in raw material prices for butyl acetate presents a range of challenges for manufacturers.

Key Market Trends

Growing Demand of Sustainable Formulations and Green Chemistry

Sustainable formulations are at the forefront of efforts to minimize the environmental impact of chemical products throughout their entire lifecycle. From the sourcing of raw materials to production, use, and disposal, the focus is on reducing harm to the environment. In parallel, green chemistry aims to design and develop chemical processes that are inherently safer, more efficient, and environmentally friendly.As global awareness and emphasis on sustainability continue to grow, more and more manufacturers and consumers are seeking sustainable alternatives across various industries, including chemicals and coatings. Even widely used solvents like butyl acetate are not exempt from this trend. Within the butyl acetate market, the demand for sustainable formulations is driven by the need to reduce the carbon footprint and overall environmental impact of chemical products. Manufacturers are increasingly adopting green chemistry principles to minimize or eliminate hazardous substances, reduce waste generation, and improve energy efficiency. Such an approach aligns with the goals of sustainable development and supports the transition towards a more environmentally conscious economy.

Regulatory frameworks and policies in Europe are pushing for stricter environmental standards and promoting the use of sustainable chemicals. These regulations encourage companies to adopt sustainable practices, including the development and use of environmentally friendly formulations. Consequently, manufacturers in the European butyl acetate market are investing in research and development to innovate and produce more sustainable alternatives.

Consumers also play a significant role in driving the demand for sustainable formulations. With increasing environmental awareness, consumers are actively seeking products that align with their values and contribute to a greener future. This demand for eco-friendly solutions extends to industries such as automotive, construction, and packaging, all of which rely on butyl acetate as a crucial component. As a result, manufacturers face pressure to provide sustainable options that meet consumer expectations and remain competitive. Efforts to promote sustainable formulations and green chemistry in the butyl acetate market are further supported by research projects and initiatives in Europe.

For instance, projects like ECOBIOFOR focus on developing bio-based solvents using greener chemical processes and renewable raw materials. These endeavors contribute to the expansion of sustainable options in the industry and drive the adoption of green chemistry practices. By continuously striving for sustainability, the butyl acetate market can contribute to a more environmentally friendly and socially responsible future. The combined efforts of manufacturers, consumers, regulatory bodies, and research projects pave the way for innovative solutions that reduce environmental impact and foster a more sustainable chemical industry.

Segmental Insights

Grade Insights

Based on the category of grade, Industry Grade/Technical Grade segment emerged as the dominant segment in the Europe market for butyl acetate in 2023. The dominance of Industry Grade/Technical Grade in the Europe butyl acetate market can be attributed to several reasons. Firstly, Industry Grade/Technical Grade butyl acetate is primarily used in industrial applications such as paints and coatings, adhesives, plastics, and textiles. These sectors have a high demand for butyl acetate as a solvent due to its excellent solvency power, low volatility, and compatibility with various materials.For instance, in the paints and coatings industry, butyl acetate is widely utilized as a solvent for its ability to dissolve and disperse other components effectively, resulting in improved application properties and film formation. Moreover, its low odor and high boiling point make it suitable for high-temperature applications in the adhesives and plastics industries. Secondly, Industry Grade/Technical Grade butyl acetate often offers cost advantages compared to other grades. It is produced through a more straightforward and less costly manufacturing process, making it a preferred choice for industries that require large volumes of the solvent. The lower cost of Industry Grade/Technical Grade butyl acetate makes it more attractive to manufacturers and end-users, driving its dominance in the market.

The availability of abundant raw materials for its production further contributes to its cost-effectiveness. Thirdly, regulatory requirements and standards in certain industries favor the use of Industry Grade/Technical Grade butyl acetate. For example, in the paints and coatings industry, Industry Grade/Technical Grade butyl acetate meets the necessary performance and quality specifications for various applications. This grade provides the desired properties and functionality required by industrial users, ensuring compliance with regulatory guidelines. Furthermore, its stability and compatibility with a wide range of resins and additives make it a versatile choice for formulators in the paints and coatings industry.

Regional Insights

Germany emerged as the dominant region in the Europe Butyl Acetate Market in 2023, holding the largest market share in terms of value. Germany's domination of the Europe butyl acetate market can be attributed to several factors. Firstly, the strong presence of the chemical industry in Germany plays a significant role in driving the demand for butyl acetate. With a well-established manufacturing infrastructure and a robust supply chain, Germany stands as a key producer and consumer of butyl acetate in Europe.Germany's automotive and pharmaceutical sectors further contribute to its dominance. The automotive industry in Germany, being one of the largest in the world, extensively relies on butyl acetate for its automotive paints and coatings. This not only highlights the importance of butyl acetate in the industry but also showcases Germany's expertise in automotive manufacturing.

Germany's thriving pharmaceutical industry also adds to its prominence in the butyl acetate market. Butyl acetate serves as a vital solvent in drug formulation and manufacturing processes, making it an indispensable component for pharmaceutical companies. The high demand for butyl acetate from these industries reinforces Germany's position as a dominant player in the market. With its strong chemical industry, automotive prowess, and thriving pharmaceutical sector, Germany continues to maintain its stronghold in the Europe butyl acetate market.

Key Market Players

- BASF SE

- Celanese Corporation.

- Eastman Chemical Company

- Solvay S.A

- Sasol Chemicals Europe Ltd

- Solventis Ltd

- Dow Europe Gmbh

- KH Chemicals B.V

- Thermo Fisher (Kandel) GmbH

- OQ Chemicals GmbH

Report Scope:

In this report, the Europe Butyl Acetate Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Europe Butyl Acetate Market, By Grade:

- Industry Grade/Technical Grade

- Pharmaceutical Grade

Europe Butyl Acetate Market, By Application:

- Adhesives & Sealants

- Cosmetic & Personal Care

- Food & Beverages

- Automotive

- Others

Europe Butyl Acetate Market, By Country:

- Germany

- United Kingdom

- France

- Russia

- Spain

- Italy

- Rest of Europe

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Europe Butyl Acetate Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF SE

- Celanese Corporation.

- Eastman Chemical Company

- Solvay S.A

- Sasol Chemicals Europe Ltd

- Solventis Ltd

- Dow Europe Gmbh

- KH Chemicals B.V

- Thermo Fisher (Kandel) GmbH

- OQ Chemicals GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | December 2024 |

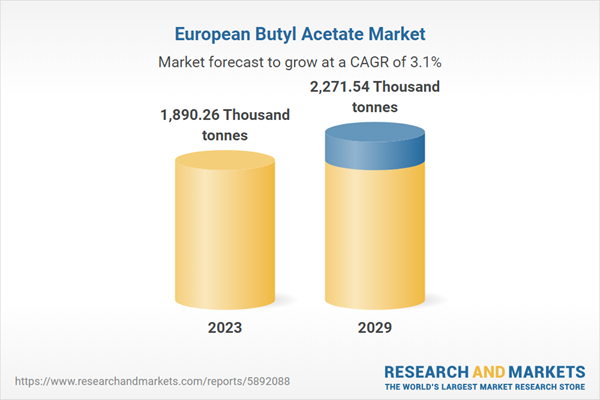

| Forecast Period | 2023 - 2029 |

| Estimated Market Value in 2023 | 1890.26 Thousand tonnes |

| Forecasted Market Value by 2029 | 2271.54 Thousand tonnes |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 10 |