Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

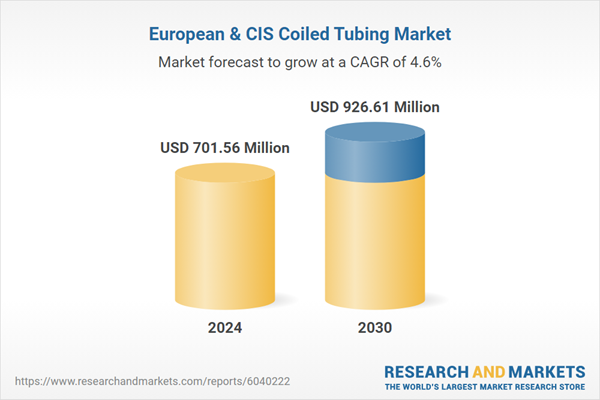

The Europe & CIS Coiled Tubing Market involves the use of coiled tubing, a continuous length of small-diameter pipe, primarily for oil and gas operations, including drilling, completion, and well intervention. This technique offers several advantages over traditional methods, such as reduced rig time, enhanced safety, and the ability to perform operations in challenging environments, making it increasingly popular among energy companies. The market is poised for growth due to several factors, including the rising demand for efficient resource extraction amid fluctuating oil prices and the need for enhanced recovery techniques to maximize the output from aging oil fields.

Additionally, the shift towards more sustainable and environmentally friendly practices in the energy sector is driving innovation and investment in coiled tubing technologies. Technological advancements, such as the integration of advanced monitoring and control systems, are further boosting the efficiency and effectiveness of coiled tubing operations. Moreover, the growing trend of offshore drilling and the exploration of unconventional resources, such as shale gas and tight oil, are creating new opportunities for coiled tubing applications. As countries in Europe & CIS aim to secure their energy supply and reduce dependency on imports, investments in domestic oil and gas exploration are expected to rise, contributing to market expansion.

Regulatory support and incentives for energy production will also play a significant role in fostering a conducive environment for coiled tubing services. The increasing focus on well integrity and maintenance, coupled with the necessity for cost-effective solutions in the highly competitive energy landscape, will further drive the adoption of coiled tubing methods. Overall, the Europe & CIS Coiled Tubing Market is set to rise as operators seek to optimize production, improve operational efficiency, and adopt innovative technologies to meet the evolving demands of the energy sector.

Key Market Drivers

Increasing Demand for Efficient Resource Extraction

The growing need for efficient resource extraction is a primary driver of the Europe & CIS Coiled Tubing Market. As the global demand for oil and natural gas continues to rise, companies are under pressure to optimize their production capabilities. Coiled tubing technology offers distinct advantages over conventional drilling methods, including reduced rig time and the ability to perform various operations without the need for significant downtime. This efficiency translates into cost savings and improved productivity, making it an attractive option for energy operators.Moreover, the depletion of easily accessible resources has led to the exploration of unconventional reserves, such as shale gas and tight oil. These challenging environments require advanced techniques to extract resources effectively. Coiled tubing allows for enhanced well intervention, facilitating operations such as cleanouts, perforations, and hydraulic fracturing. As operators seek to maximize output from existing wells and explore new ones, the demand for coiled tubing services is expected to grow significantly.

In addition to efficiency, environmental concerns have prompted operators to adopt more sustainable extraction methods. Coiled tubing operations often produce less waste and require fewer resources compared to traditional techniques. As regulatory pressures increase and public scrutiny grows regarding environmental impacts, companies are likely to adopt coiled tubing to align with sustainable practices, further propelling market growth. Automation and AI are becoming integral to the oil and gas sector, with AI-driven predictive maintenance expected to save the industry up to USD 40 billion annually.

Technological Advancements in Coiled Tubing Equipment

Technological advancements play a pivotal role in driving the Europe & CIS Coiled Tubing Market. Innovations in equipment and techniques have enhanced the capabilities of coiled tubing operations, making them more versatile and effective. For instance, the development of advanced monitoring systems allows for real-time data analysis during operations, leading to improved decision-making and operational efficiency. Enhanced drilling technologies, such as directional drilling and the use of advanced materials, have also contributed to the expanded applications of coiled tubing.The integration of automation and digital technologies has revolutionized coiled tubing operations. Remote monitoring and control systems enable operators to manage operations from afar, reducing the need for on-site personnel and minimizing safety risks. This shift towards automation not only improves efficiency but also allows for better resource management, reducing costs and enhancing productivity.

Furthermore, advancements in coiled tubing design, such as the development of lightweight and high-strength materials, have improved the durability and performance of coiled tubing units. These innovations enable operators to tackle more challenging wells and extend the life of existing infrastructure. As technology continues to evolve, the Europe & CIS Coiled Tubing Market will benefit from improved operational capabilities and expanded service offerings. The global mining industry was valued at USD 1.6 trillion in 2023 and is expected to grow at a CAGR of 6-7%, reaching around USD 2.6 trillion by 2030.

Growing Investment in Oil and Gas Exploration

The growing investment in oil and gas exploration is a significant driver of the Europe & CIS Coiled Tubing Market. With energy security becoming increasingly critical for many Europe & CIS nations, governments and private companies are ramping up their exploration efforts. This trend is particularly evident in regions with untapped resources or aging fields that require enhanced recovery techniques.Investments in exploration activities often lead to the discovery of new reserves, which necessitate the use of advanced technologies for extraction. Coiled tubing services are essential for efficiently developing these resources, especially in offshore and remote locations where traditional drilling methods may be less effective. The ability to conduct multiple operations simultaneously with coiled tubing makes it an attractive option for operators looking to maximize their investments.

Additionally, the recent volatility in oil prices has spurred renewed interest in optimizing existing assets. Companies are focusing on enhancing recovery rates from mature fields to maintain profitability. Coiled tubing plays a crucial role in well intervention strategies, allowing operators to revitalize aging wells and extend their productive life. As investment in exploration continues to rise, the demand for coiled tubing services will correspondingly increase. Well intervention accounts for approximately 40-45% of the coiled tubing market.

Key Market Challenges

High Operational Costs and Investment Requirements

One of the significant challenges facing the Europe & CIS Coiled Tubing Market is the high operational costs and substantial investment requirements associated with coiled tubing operations. While coiled tubing offers various advantages, such as increased efficiency and reduced downtime, the initial costs of equipment and technology can be considerable. The specialized machinery required for coiled tubing operations, including high-pressure pumps, coiled tubing units, and associated monitoring systems, demands significant capital investment. For many companies, especially smaller operators or those with limited financial resources, this poses a barrier to entry and can hinder competitive capabilities.Furthermore, the operational costs associated with coiled tubing are also influenced by factors such as maintenance, skilled labor, and the logistics of transporting equipment to remote or offshore locations. The need for highly trained personnel to manage and operate coiled tubing systems further compounds these costs. As the complexity of operations increases, companies must invest in training and development to ensure that their workforce is equipped with the necessary skills and knowledge. The ongoing operational expenses may deter some organizations from fully adopting coiled tubing technology, particularly in a fluctuating market where profit margins can be tight.

Additionally, the competitive landscape of the oil and gas industry can further exacerbate these challenges. As companies strive to maintain profitability amidst fluctuating energy prices, they may prioritize cost-cutting measures over investment in advanced technologies such as coiled tubing. This could lead to a slower rate of adoption and innovation within the market, hindering overall growth. To mitigate these challenges, stakeholders must explore strategic partnerships and financing options to share the financial burden and facilitate access to coiled tubing technologies.

Regulatory and Environmental Concerns

The regulatory landscape and environmental concerns represent another significant challenge for the Europe & CIS Coiled Tubing Market. As Europe & CIS countries increasingly prioritize environmental sustainability and climate change mitigation, regulatory bodies are implementing stringent guidelines governing the oil and gas industry. These regulations often include rigorous standards for emissions, waste management, and the impact of extraction activities on local ecosystems. While these regulations aim to promote safer and more sustainable practices, they can also pose challenges for coiled tubing operations.Complying with evolving regulations requires significant investment in monitoring and reporting systems, as well as modifications to existing operational practices. Companies may need to upgrade their technology and processes to meet new standards, resulting in increased operational complexity and costs. Moreover, the regulatory environment can vary significantly across different countries within Europe & CIS, creating additional challenges for operators who must navigate a patchwork of requirements. This inconsistency can complicate project planning and execution, particularly for organizations that operate in multiple jurisdictions.

Furthermore, the growing public scrutiny surrounding environmental issues adds another layer of complexity. Stakeholders, including local communities, environmental advocacy groups, and investors, are increasingly demanding transparency and accountability from energy companies. Any perceived failure to adhere to environmental regulations or a lack of commitment to sustainable practices can lead to reputational damage, legal challenges, and potential financial penalties. This pressure can deter companies from pursuing coiled tubing projects, especially in sensitive areas. To overcome these challenges, organizations must prioritize compliance and sustainability, investing in technology and practices that align with regulatory requirements while also addressing public concerns.

Key Market Trends

Increasing Adoption of Automation and Digital Technologies

The integration of automation and digital technologies is a prominent trend reshaping the Europe & CIS Coiled Tubing Market. As the industry grapples with the need for greater efficiency and reduced operational costs, many companies are turning to advanced digital solutions to optimize their coiled tubing operations. Automated systems for real-time monitoring, data analytics, and remote control are becoming increasingly prevalent. These technologies enhance operational efficiency by minimizing human error, improving safety, and enabling better decision-making through data-driven insights.Moreover, the use of digital twins - virtual representations of physical assets - allows operators to simulate and analyze various operational scenarios, optimizing performance and predictive maintenance. This capability not only improves the efficiency of coiled tubing operations but also extends the lifespan of equipment, thereby reducing costs. Additionally, the rise of the Internet of Things (IoT) enables seamless communication between equipment, providing operators with valuable insights into performance metrics and potential issues before they escalate.

As the market continues to evolve, companies that embrace automation and digitalization will be better positioned to compete, adapt to changing market conditions, and meet the growing demand for efficient resource extraction. This trend is expected to drive innovation and enhance the overall effectiveness of coiled tubing operations in Europe & CIS. The global market for digital well intervention technologies, which includes coiled tubing, is projected to reach USD 1.2 billion by 2027, growing at a CAGR of 15%. Technologies such as real-time data analytics, IoT sensors, and predictive maintenance are becoming critical in optimizing coiled tubing operations.

Focus on Sustainable Practices and Environmental Compliance

Sustainability has emerged as a central focus within the Europe & CIS Coiled Tubing Market, driven by increasing regulatory pressures and heightened public awareness of environmental issues. Energy companies are recognizing the need to adopt environmentally friendly practices in response to stringent regulations and the growing demand for transparency regarding their environmental impact. Coiled tubing operations, which typically produce less waste and have a smaller environmental footprint compared to traditional drilling methods, are increasingly viewed as a viable option for achieving sustainability goals.As part of this trend, many companies are investing in research and development to enhance the environmental performance of their operations. This includes the implementation of cleaner technologies, improved waste management practices, and initiatives aimed at reducing greenhouse gas emissions. Additionally, operators are adopting measures to ensure compliance with evolving regulations, which often necessitate significant investments in monitoring and reporting systems.

The emphasis on sustainability is not only about regulatory compliance; it is also a strategic differentiator in a competitive market. Companies that prioritize sustainable practices can enhance their reputation and attract environmentally conscious investors and customers. As the focus on sustainability intensifies, the coiled tubing market is likely to see increased adoption of practices that align with both regulatory expectations and societal values.

Growth in Offshore and Unconventional Resource Development

The development of offshore and unconventional resources is a significant trend influencing the Europe & CIS Coiled Tubing Market. With traditional oil and gas reserves declining, energy companies are increasingly turning their attention to offshore drilling and unconventional resources such as shale gas and tight oil. Coiled tubing technology is particularly well-suited for these applications due to its flexibility, efficiency, and ability to operate in challenging environments.Offshore drilling operations often face unique challenges, including harsh environmental conditions and the need for specialized equipment. Coiled tubing can be deployed for a variety of operations, including well intervention, hydraulic fracturing, and pipeline installation, making it an essential tool for maximizing productivity in offshore fields. Similarly, the extraction of unconventional resources often requires advanced techniques to ensure effective resource recovery. Coiled tubing allows for efficient well completion and intervention, enabling operators to optimize their extraction processes.

As countries in Europe & CIS seek to bolster their energy independence and reduce reliance on imported fossil fuels, investments in offshore and unconventional resource development are expected to rise. This trend will likely drive demand for coiled tubing services, positioning the technology as a critical component in the future landscape of the energy sector. As operators continue to explore new frontiers, the Europe & CIS Coiled Tubing Market is poised for growth, supported by the ongoing expansion of offshore and unconventional resource development initiatives.

Segmental Insights

Application Insights

In 2024, the well intervention segment dominated the Europe & CIS Coiled Tubing Market and is expected to maintain its dominance throughout the forecast period. This can be attributed to the increasing need for efficient maintenance and enhancement of existing wells, particularly as many oil and gas fields in Europe & CIS mature and face declining production rates. Well intervention techniques using coiled tubing provide significant advantages, including reduced operational downtime, enhanced safety, and the ability to conduct multiple tasks without the need for extensive rig setups. As operators seek to maximize the productivity of aging wells, the demand for well intervention services is anticipated to rise.Additionally, advancements in coiled tubing technology, such as improved materials and enhanced operational capabilities, have further bolstered the effectiveness of well intervention processes, making them a preferred choice for energy companies. The ongoing trend toward optimizing production and extending the life of existing assets aligns with the strategic focus of many operators in the region, leading to sustained investment in well intervention services. Furthermore, the regulatory landscape, which emphasizes environmental sustainability and the efficient use of resources, supports the growth of this segment, as coiled tubing operations typically generate less waste and have a smaller environmental footprint compared to traditional methods. As a result, the well intervention segment is expected to remain at the forefront of the Europe & CIS Coiled Tubing Market, driven by the dual imperatives of maximizing resource recovery and adhering to environmental standards while addressing the operational challenges posed by aging infrastructure.

Country Insights

In 2024, Germany dominated the Europe & CIS Coiled Tubing Market and is expected to maintain this leading position throughout the forecast period. This dominance is attributed to Germany's robust oil and gas infrastructure, characterized by advanced technological capabilities and a strong emphasis on efficient extraction techniques. The country's strategic focus on maximizing domestic energy production, coupled with investments in both conventional and unconventional resources, has driven significant demand for coiled tubing services.Furthermore, Germany's commitment to sustainability and compliance with stringent environmental regulations aligns well with the benefits of coiled tubing operations, which typically generate less waste and have a smaller environmental footprint compared to traditional methods. The presence of key industry players and a supportive regulatory framework further bolster the market's growth prospects in this region.

Additionally, as Germany continues to invest in research and development to enhance operational efficiencies and adopt innovative technologies, it is well-positioned to capitalize on emerging opportunities within the coiled tubing sector. Other regions, such as the United Kingdom and Russia, also contribute to the market but are expected to trail behind Germany in terms of market share and investment levels. As energy companies across Europe and the Commonwealth of Independent States prioritize efficient resource recovery and the optimization of existing assets, Germany's leadership in the coiled tubing market is likely to be sustained, reinforcing its role as a key player in the evolving energy landscape.

Key Market Players

- Schlumberger Limited.

- Halliburton Energy Services, Inc.

- Baker Hughes Company

- Weatherford International plc

- NOV INC

- Superior Energy Services, Inc

- Nabors Industries Ltd.

- Patterson-UTI Energy, Inc

- Oil States International, Inc

- Calfrac Well Services Ltd

Report Scope:

In this report, the Europe & CIS Coiled Tubing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Europe & CIS Coiled Tubing Market, By Application:

- Well Intervention

- Drilling

- Completion

- Others

Europe & CIS Coiled Tubing Market, By Material:

- Steel

- Alloy

- Composite

Europe & CIS Coiled Tubing Market, By Service Type:

- Hydraulic Workover

- Cleanout

- Stimulation

- Others

Europe & CIS Coiled Tubing Market, By End-User Industry:

- Oil and Gas

- Geothermal

- Mining

- Others

Europe & CIS Coiled Tubing Market, By Country:

- Germany

- Spain

- France

- Italy

- United Kingdom

- Belgium

- Netherlands

- Russia

- Rest of Europe & CIS

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Europe & CIS Coiled Tubing Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Schlumberger Limited.

- Halliburton Energy Services, Inc.

- Baker Hughes Company

- Weatherford International plc

- NOV INC

- Superior Energy Services, Inc

- Nabors Industries Ltd.

- Patterson-UTI Energy, Inc

- Oil States International, Inc

- Calfrac Well Services Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 133 |

| Published | January 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 701.56 Million |

| Forecasted Market Value ( USD | $ 926.61 Million |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Europe, Russia |

| No. of Companies Mentioned | 10 |