The Germany market dominated the Europe Dietary Supplement Contract Manufacturing Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $1,483.5 million by 2031. The UK market is exhibiting a CAGR of 6.4% during (2024 - 2031). Additionally, The France market would experience a CAGR of 8.1% during (2024 - 2031).

The contract manufacturing of dietary supplements encompasses many products, including vitamins, minerals, herbal extracts, sports nutrition supplements, and specialty formulations. Contract manufacturers offer various services, including formulation development, ingredient sourcing, quality control testing, packaging, and labeling, tailored to the specific needs of their clients.

Additionally, the proliferation of e-commerce platforms has transformed how consumers discover, purchase, and consume dietary supplements. Online marketplaces offer unparalleled convenience, accessibility, and variety, allowing consumers to explore various supplement options from the comfort of their homes. This shift towards online shopping has significantly expanded the reach of dietary supplements to a larger number of audiences, creating new opportunities for brands to connect with consumers.

Awareness of the significance of nutrition, exercise, and overall wellness is increasing among the populace of the United Kingdom. According to the data provided by the Government of the United Kingdom, a nationwide survey of more than 5,000 adults in England revealed that 80% of those aged 18 and older intended to alter their lifestyle in 2021. Nearly 50% of people (43%) are more inspired to change their lives in January than in 2020. In the range of 6 million adults (aged 40 to 60), 40% plan to eat more healthfully. Moreover, Belgium's growing pharmaceutical sector is expected to significantly boost the demand for dietary supplementcontract manufacturing services. According to the International Trade Administration data, Belgium’s pharmaceutical industry spends $1.64 billion (€1.5 billion) on R&D annually, equivalent to 40 percent of all private investment in Belgium. As a result, Belgium is home to 29 of the world’s top 30 pharmaceutical companies, including important subsidiaries of major U.S. companies such as Johnson and Johnson and Pfizer. Thus, the rising pharmaceutical sector and increasing health and fitness trends in Europe will drive the expansion of the regional dietary supplement contract manufacturing market.

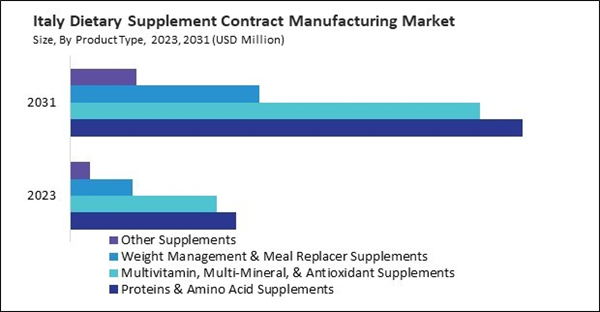

Based on Product Type, the market is segmented into Proteins & Amino Acid Supplements, Multivitamin, Multi-Mineral, & Antioxidant Supplements, Weight Management & Meal Replacer Supplements and Other Supplements. Based on Dosage Form, the market is segmented into Tablets, Capsules, Liquid Oral, Powder In Sachet/Jar, Gummies and Others. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

List of Key Companies Profiled

- Ashland Inc.

- Lonza Group Ltd.

- Captek Softgel International, Inc.

- DCC Plc

- Glanbia PLC

- Catalent, Inc.

- Biotrex Nutraceuticals

- Martinez Nieto, S.A.

- Menadiona SL

- Nutrivo LLC

Market Report Segmentation

By Product Type- Proteins & Amino Acid Supplements

- Multivitamin, Multi-Mineral, & Antioxidant Supplements

- Weight Management & Meal Replacer Supplements

- Other Supplements

- Tablets

- Capsules

- Liquid Oral

- Powder In Sachet/Jar

- Gummies

- Others

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

- Ashland Inc.

- Lonza Group Ltd.

- Captek Softgel International, Inc.

- DCC Plc

- Glanbia PLC

- Catalent, Inc.

- Biotrex Nutraceuticals

- Martinez Nieto, S.A.

- Menadiona SL

- Nutrivo LLC