Implementation of Hybrid Working Styles Drives Europe DNS Security Software Market

The growing shift toward hybrid work and the increasing mobility of the workforce have created a strong demand for DNS security software. During the COVID-19 crisis, a large proportion of employed people faced changing work patterns, including working from home. In 2019, ~1 in 20 (5.5%) employees aged 20-64 in Europe mostly worked from home. The impact of the pandemic was evident as this share expanded in 2020 to 12.3% (+6.8%). There was a further increase in the percentage of employees working from home in 2021, reaching 13.5% (+1.2%). Further, according to the data of Eurostat, the Netherlands is the European country with the highest proportion of employees working remotely. The report showed that across Europe, on average, 30% of workers regularly worked from home in 2022 (either fully remote or in a hybrid model. With the increasing hybrid working styles, IT executives are devising strategies around securing their organization's resources and operations within and outside their protected walls. Having control over traffic between the organization's applications and each remote worker is critical to ensure smooth business operations and reduce DNS security issues. According to the Neustar International Security Council survey conducted in September 2021, 55% of companies think of DNS security as critical for protecting a remote workforce, and 51% are considering setting up a Private Enterprise DoH to protect the data privacy of their remote workers. DNS filtering is essential to protect remote users, as 78% of threats involve the DNS layer. In 2022, 88% of organizations experienced a cyber-attack; 51% of organizations were victims of phishing, and 43% of organizations were victims of ransomware. Therefore, the growing implementation of a hybrid work culture is establishing substantial opportunities for the future growth of the DNS security software market.Europe DNS Security Software Market Overview

The Europe DNS security software market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. In Europe, various telecommunication providers are partnering with DNS security service providers to offer a convenient protection layer for mobile devices of the telecommunication operator's customers. For instance, in August 2023, FâSecure, a global leader in simplifying cyber security, announced a major partnership with one of Europe's leading communications service providers (CSPs). The strategic alliance will allow FâSecure's DNS Security to be integrated into the operator's mobile network, protecting its consumer customers. The partnership leverages FâSecure's expertise in DNS Security to offer a convenient protection layer for mobile devices across the operator's customer base. By integrating DNS security at the network level, users will experience seamless protection without the need for installation or regular updates.Various security software technologies are also launching their security services for the data center industry in Europe. In June 2022, Cisco Umbrella launched a new Secure Access Service Edge (SASE) data center in Northern Europe for security customers. Cisco Umbrella's new SASE secure services are available for customers in Denmark and Sweden. Cisco Umbrella helps combine firewall, Secure Web Gateway (SWG), Cloud Access Security Broker (CASB), DNS-layer security, and threat intelligence into a single cloud service. In Germany, various DNS security software market players are expanding their presence through joint ventures. The joint ventures in Germany are helping to boost the adoption of DNS Security Software services in SMEs (Small and Medium Enterprises) and large enterprises for data security protection. For instance, in December 2020, Germany-based cyan Security Group and US-based DNS software provider Secure64 Software Corporation entered into a strategic partnership for joint product developments and worldwide distribution. This joint approach allows both companies, in different areas of the DNS business, to generate the best possible product offering for large organizations. The joint venture also aims to offer a professional DNS solution paired with security products for large organizations. Further, in June 2021, German cooperative banks were hit by a DDoS attack on an IT provider. The DDoS attack intensified over the night, shutting down or slowing the websites of cooperative banks throughout the country, including banks such as Berliner Volksbank. Therefore, the rising DNS attacks and cybersecurity threats influence the growth of the DNS security software market in the country.

Europe DNS Security Software Market Segmentation

The Europe DNS security software market is segmented into deployment, organization size, and country.Based on deployment, the Europe DNS security software market is bifurcated into on-premise and cloud. The cloud segment held a larger share of the Europe DNS security software market in 2022.

In terms of organization size, the Europe DNS security software market is bifurcated small & medium enterprises and large enterprises. The large enterprises segment held a larger share of the Europe DNS security software market in 2022.

Based on country, the Europe DNS security software market is segmented into the UK, Germany, France, Italy, Russia, and the Rest of Europe. Germany dominated the Europe DNS security software market in 2022.

Akamai Technologies; Comodo Security Solutions, Inc; DNSFilter Inc.; TitanHQ; Efficient IP; Open Text Corporation; ScoutDNS, LLC; Avast Software s.r.o.; and Cisco Systems Inc are some of the leading companies operating in the Europe DNS security software market.

Table of Contents

Companies Mentioned

- Akamai Technologies

- Comodo Security Solutions, Inc

- DNSFilter Inc.

- Efficient IP

- Open Text Corporation

- ScoutDNS, LLC - Global

- TitanHQ

- Avast Software s.r.o.

- Cisco Systems Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 84 |

| Published | May 2024 |

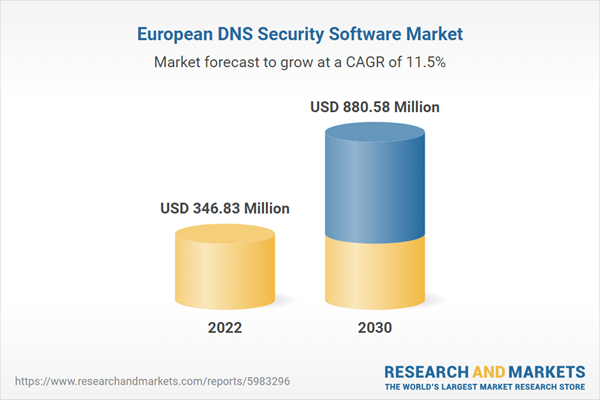

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 346.83 Million |

| Forecasted Market Value ( USD | $ 880.58 Million |

| Compound Annual Growth Rate | 11.5% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 9 |