Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Technological advancements in battery technology have significantly enhanced the performance and affordability of electric commercial vehicles. The development of high-energy-density batteries and improved charging infrastructure has made eLCVs more practical for commercial use. Longer battery ranges, faster charging times, and lower maintenance costs are contributing to their rising appeal. Furthermore, According to Fraunhofer Institute, battery pack costs for commercial EVs in Europe have declined from €210/kWh in 2020 to €135/kWh in 2024. This drop has made electric vans and medium-duty trucks more financially viable for fleet operators.

The shift towards integrated smart technologies, such as telematics and fleet management software, further enhances the efficiency and convenience of eLCVs. As the technology matures and economies of scale reduce production costs, these vehicles are becoming more accessible to a wider range of businesses, especially small and medium-sized enterprises (SMEs).

Despite the market's positive momentum, several challenges remain that could impact its growth. One of the key barriers is the high upfront cost of electric vehicles compared to traditional internal combustion engine (ICE) vehicles. Although operating costs are lower in the long term, the initial investment remains a significant hurdle for many businesses.

Charging infrastructure is another challenge, as the availability of reliable, fast charging stations is still limited in certain regions, making it difficult for fleet operators to fully transition to electric vehicles. Overcoming these challenges requires continued investment in infrastructure development and further cost reductions in electric vehicle production. These factors, however, are expected to evolve as the market matures, opening up new opportunities for growth and expansion in the coming years.

Market Drivers

Government Regulations and Incentives

Government policies play a significant role in shaping the growth of the electric commercial vehicle market. Many countries have set ambitious emissions reduction targets and are providing financial incentives for businesses to adopt electric vehicles. The European Commission aims to reduce CO₂ emissions from new trucks by 90% by 2040 under its Green Deal goals. In alignment with this, countries like Germany, France, and the Netherlands are offering generous subsidies to boost ECV adoption, especially for last-mile logistics and urban freight operations.These include tax credits, grants, and exemptions from road taxes, which reduce the financial burden on fleet operators. Stringent environmental regulations, such as the European Union’s “Green Deal” and “Fit for 55” initiative, are pushing businesses to transition to cleaner alternatives. This regulatory pressure is encouraging the growth of eLCVs as they offer a way to comply with emission reduction goals while reducing environmental impact.

Key Market Challenges

High Upfront Cost

One of the major challenges hindering the widespread adoption of electric commercial vehicles is the high initial cost compared to conventional diesel or gasoline-powered vehicles. Even though eLCVs have lower operating costs, the higher upfront cost of electric vehicles, primarily due to expensive batteries, makes them less accessible for many businesses, particularly small and medium-sized enterprises (SMEs). Despite long-term savings in fuel and maintenance, the initial investment can be a significant barrier, especially in the context of limited budgets and cash flow constraints in many sectors.Key Market Trends

Integration of Smart Technologies

The adoption of smart technologies, such as telematics, fleet management systems, and autonomous driving features, is a significant trend in the electric commercial vehicle market. These technologies enable fleet operators to optimize vehicle routes, monitor battery levels, track maintenance schedules, and improve overall fleet efficiency. Real-time data collection and analysis help businesses reduce operational costs and improve service delivery. As smart technologies continue to evolve, they will further enhance the performance of electric vehicles, making them more attractive for fleet operators.Key Market Players

- ADDAX MOTORS NV.

- Arrival UK Ltd.

- Daimler AG (Mercedes-Benz AG)

- Stellantis Europe S.p.A.

- Ford Motor Company

- Groupe Renault

- Nissan Motor Co. Ltd.

- IVECO S.p.A

- Toyota Motor Corporation

- Volkswagen AG

Report Scope:

In this report, the Europe Electric Commercial Vehicle Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Europe Electric Commercial Vehicle Market, By Propulsion Type:

- BEV

- HEV

- PHEV

- FCEV

Europe Electric Commercial Vehicle Market, By Vehicle Type:

- Bus

- Truck

- LCV

Europe Electric Commercial Vehicle Market, By Range:

- 0-150 Miles

- 151-250 Miles

- 251-500 Miles

- 501 Miles & Above

Europe Electric Commercial Vehicle Market, By Country:

- France

- Germany

- United Kingdom

- Netherlands

- Italy

- Spain

- Rest of Europe

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Europe Electric Commercial Vehicle Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- ADDAX MOTORS NV.

- Arrival UK Ltd.

- Daimler AG (Mercedes-Benz AG)

- Stellantis Europe S.p.A.

- Ford Motor Company

- Groupe Renault

- Nissan Motor Co. Ltd.

- IVECO S.p.A

- Toyota Motor Corporation

- Volkswagen AG

Table Information

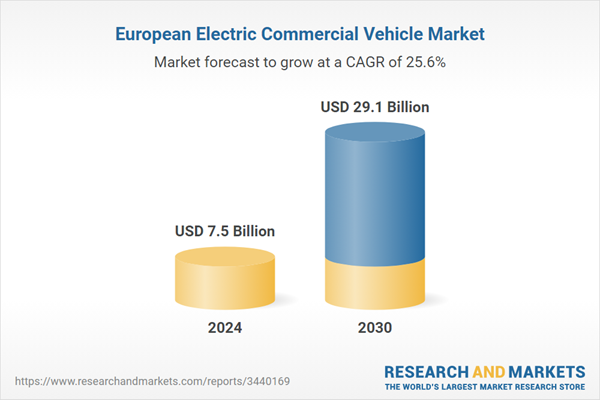

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.5 Billion |

| Forecasted Market Value ( USD | $ 29.1 Billion |

| Compound Annual Growth Rate | 25.6% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 10 |