The expanded polystyrene (EPS) market in Europe is experiencing steady growth, driven by growing e-commerce, food packaging, and protective packaging sectors. The rapid rise of online shopping, fueled by platforms such as Amazon, Zalando, and Bol.com, has significantly increased the demand for protective EPS packaging to ensure the safe transport of fragile goods, electronics, and appliances.

As major logistics and trade hubs, Belgium and the Netherlands, particularly through the Port of Rotterdam, Port of Antwerp, and Brussels Airport Cargo, contribute significantly to EPS consumption, given its lightweight nature, impact resistance, and cost-effectiveness. Additionally, the growing trend of quick-commerce grocery platforms (e.g., Gorillas, Flink, and Getir) in Germany fuels the demand for EPS-insulated packaging for temperature-sensitive food and beverage products.

Europe is experiencing a rise in residential, commercial, industrial, and infrastructural construction. According to the European Commission, the construction industry contributes ~9% to the gross domestic product (GDP). The industry supports economic growth by assisting the supply chain, which creates several business opportunities and services, thereby increasing employment rates. Moreover, the focus on renovating and remodeling old buildings in the region, along with significant investment to improve public infrastructure, is growing significantly. Rising populations have led to a rapid expansion of cities, requiring more and better infrastructure of roads, housing, and office spaces.

Germany is the largest construction market in Europe, where the construction sector in the country is growing significantly. The requirement for residential buildings in the country is increasing due to rising population and a favorable economic environment. There is also an increasing interest in micro-apartments and prefabricated buildings. The Netherlands is another major construction market in Europe where commercial construction activities are rising notably.

Government and private sector investments in EPS collection and recycling programs in Europe are expected to act as future trends for the recycled EPS market. With increasing regulatory pressures on plastic waste, these countries focus on circular economy initiatives that promote the recovery, reuse, and recycling of EPS materials. Programs such as chemical recycling and closed-loop EPS processing are gaining traction, allowing manufacturers to produce high-quality recycled EPS (rEPS) for construction, packaging, and insulation applications.

Companies that offer eco-friendly, low-carbon EPS solutions can capitalize on growing sustainability trends across industries. Many businesses actively seek environmentally responsible alternatives that maintain EPS's lightweight, insulating, and protective properties while reducing its environmental footprint. Innovations in bio-based EPS, carbon-neutral manufacturing processes, and enhanced recyclability present a strong market potential, especially in construction, logistics, and temperature-sensitive packaging.

A few key players operating in the Europe expanded polystyrene (EPS) market are Knauf Digital GmbH, Bewi ASA, BASF SE, Saudi Basic Industries Corp, TotalEnergies SE, ISOSTAR BV, Krautz TEMAX, HSV Group, UNIPOL, and SUNPOR Kunststoff GmbH. Players operating in the market are highly focused on developing high-quality and innovative product offerings to fulfill customers' requirements.

The overall Europe expanded polystyrene (EPS) market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the Europe expanded polystyrene (EPS) market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. The participants of this process include industry experts, such as VPs, business development managers, market intelligence managers, and national sales managers - along with external consultants, such as valuation experts, research analysts, and key opinion leaders - specializing in the Europe expanded polystyrene (EPS) market.

Reasons to buy:

- Progressive industry trends in the Europe expanded polystyrene (EPS) market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the Europe expanded polystyrene (EPS) market from 2021 to 2031

- Estimation of the demand for expanded polystyrene (EPS) across various countries

- Porter’s five forces analysis provide a 360-degree view of the Europe expanded polystyrene (EPS) market

- Recent developments to understand the competitive market scenario and the demand for expanded polystyrene (EPS) in the Europe scenario

- Market trends and outlook coupled with factors driving and restraining the growth of the Europe expanded polystyrene (EPS) market.

- Decision-making process by understanding strategies that underpin commercial interest concerning the Europe expanded polystyrene (EPS) market growth

- The Europe expanded polystyrene (EPS) market size at various nodes of market

- Detailed overview and segmentation of the Europe expanded polystyrene (EPS) market as well as its dynamics in the industry

- The Europe expanded polystyrene (EPS) market size in different countries with promising growth opportunities

Table of Contents

Companies Mentioned

Some of the leading companies in the Europe Expanded Polystyrene (EPS) Market include:- Knauf Digital GmbH

- Bewi ASA

- BASF SE

- Saudi Basic Industries Corp

- TotalEnergies SE

- ISOSTAR BV

- Krautz TEMAX

- HSV Group

- UNIPOL

- SUNPOR Kunststoff GmbH

Table Information

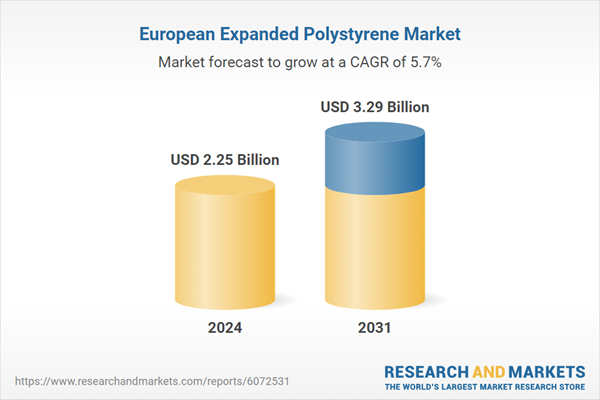

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | March 2025 |

| Forecast Period | 2024 - 2031 |

| Estimated Market Value ( USD | $ 2.25 Billion |

| Forecasted Market Value ( USD | $ 3.29 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 11 |