Fluorinated Ethylene Propylene (FEP) is a fluoropolymer tubing material known for its exceptional thermal stability, chemical resistance, and low friction properties. These qualities make it ideal for a wide range of applications in industries such as chemical processing, automotive, electronics, and medical devices. FEP tubing is valued for its clarity, allowing easy monitoring of fluid flow, and its ability to withstand high temperatures (up to 200°C) without significant degradation. Thus, the Fluorinated Ethylene Propylene (FEP) in Germany market registered a volume of 439.81 Tonnes in 2023.

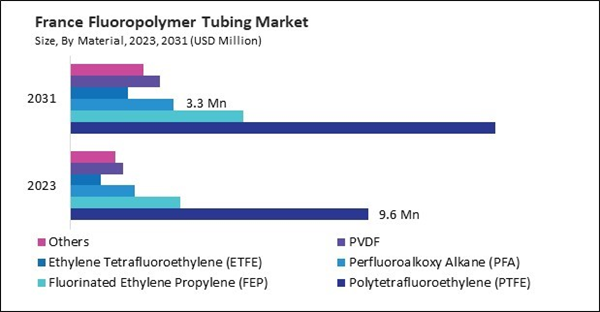

The Germany market dominated the Europe Fluoropolymer Tubing Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $49.63 millions by 2031. The UK market is exhibiting a CAGR of 3.8% during 2024-2031. Additionally, the France market would experience a CAGR of 5.6% during 2024-2031.

These tubing is employed in various automotive and aerospace industries, including fuel lines, brake systems, hydraulic systems, and pneumatic controls. Its lightweight, corrosion-resistant, and temperature-resistant properties make it well-suited for harsh operating conditions and demanding environments.

In automotive and aerospace braking systems, where reliability and safety are paramount, this is often employed for hydraulic brake lines. Its ability to withstand high pressures, temperature extremes, and harsh brake fluids makes it ideal for transmitting hydraulic pressure from brake pedals to wheel cylinders or calipers. They resistance to corrosion and degradation ensures brake system performance and longevity, contributing to overall vehicle or aircraft safety.

The growing automotive sector in Italy is expected to drive significant demand for these across various applications, including fuel systems, hydraulic systems, pneumatic controls, instrumentation, and lightweight construction. As per the data from the International Trade Administration, the latest available data (December 2022) show that in 2022, the automotive sector’s turnover was €92.7 billion, which was 9.3% of Italy’s manufacturing turnover and 5.2% of Italy’s GDP. The UK has several major aerospace manufacturers and suppliers involved in aircraft manufacturing, assembly, and maintenance. As the aerospace sector continues to expand in the UK, driven by increasing air travel demand, fleet modernization, and defense spending, there is a growing need for advanced materials and components, including this tubing. As per the International Trade Administration, the aerospace sector in the United Kingdom is export-driven and ranks second largest globally, after the United States. Hence, the expansion of the European automotive and aerospace sectors is expected to drive the regional market.

List of Key Companies Profiled

- Saint-Gobain S.A.

- Parker Hannifin Corporation

- TE Connectivity Ltd.

- Ametek, Inc.

- Teleflex Incorporated

- 3M Company

- NewAge Industries, Inc.

- The Chemours Company

- AGC Chemicals Pvt. Ltd

- Arkema S.A.

Market Report Segmentation

By Material (Volume, Tonnes, USD Million, 2020-2031)

- Polytetrafluoroethylene (PTFE)

- Fluorinated Ethylene Propylene (FEP)

- Perfluoroalkoxy Alkane (PFA)

- Ethylene Tetrafluoroethylene (ETFE)

- PVDF

- Others

By Application (Volume, Tonnes, USD Million, 2020-2031)

- Medical

- Energy

- Semiconductor

- Oil & Gas

- Aerospace

- Automotive

- General Industrial

- Fluid Management

- Others

By Country (Volume, Tonnes, USD Million, 2020-2031)

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

- Saint-Gobain S.A.

- Parker Hannifin Corporation

- TE Connectivity Ltd.

- Ametek, Inc.

- Teleflex Incorporated

- 3M Company

- NewAge Industries, Inc.

- The Chemours Company

- AGC Chemicals Pvt. Ltd

- Arkema S.A.