Since the beginning of the global COVID-19 pandemic, the European food flavor market's year-over-year growth rate has declined. Government restrictions and significant manufacturing and supply chain disruptions followed this. However, the market also saw a slow but steady rise in demand during the period when the lockdowns were lifted as more people throughout the world began to buy more food products, including food and beverages.

Over the years, globalization and modernization have accelerated the need for flavors and food processing industries. Additionally, the rise in the consumption rate of low-fat, low-salt, and low-carbohydrate food is the key driver for the increasing food flavors’ consumption/demand. As flavors are region and country-specific, manufacturers are focusing on acquiring a larger market share by producing customized flavors.

The food flavoring industry is highly dependent on the easy availability of raw materials. The market players have set up production bases in the local market to get easy access to the same, which has intensified the competition in the local market. This changing consumer behavior and market dynamics for food flavorings are pushing food manufacturers to quit the application of artificial additives in food products. Major food companies like Kellogg's, General Mills, Nestle, Campbell, and Kraft have further committed to restricting the use of artificial additives and flavors in their product formulations, pointing to a promising future for naturally occurring flavors derived from plants during the forecast period.

Europe Food Flavor Market Trends

Growing Inclination toward Ready to Eat Meals

One of the key drivers propelling the growth of the food flavor market is the rising demand for ready-to-eat meals (including ready-to-eat foods, ready-to-drink drinks, snacks, frozen meals, and other such food products). The demand for processed and packaged foods is rising in both developed and developing regions of the world as a result of rising urbanization, an expanding middle-class population, an increase in the number of working women, and an increase in disposable incomes. As a result, there is a significantly larger need for food packaging and processing solutions. Food flavors are, therefore, widely utilized in processed and convenience food items in order to maintain the freshness, safety, taste, appearance, and texture of processed meals. The demand for high-end food products with fresh tastes has also grown as customers' awareness of their own health has expanded. In order to increase their consumer base, manufacturers are encouraged to provide a wide selection of food products with all kinds of premium alternatives. For instance, Mane, a France-based manufacturer of premium, high-performing natural flavors, offers new premium natural flavors, such as Amarena, Burnt Sugar, Crema Fiorentina, and Mascarpone.Germany Accounts for the Largest Market Share

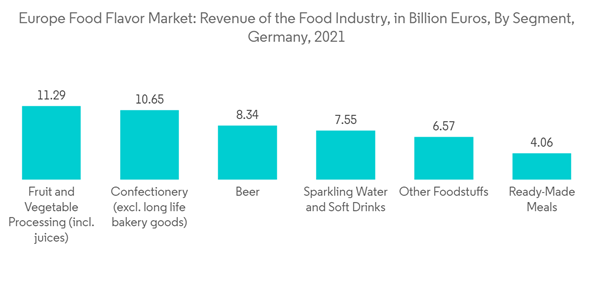

Germany is the biggest market for food and beverages in the European Union. The food processing industry represents the third-largest industry in Germany, according to the US Department of Agriculture (USDA). The country's food and beverage industry offers excellent potential for tastemakers since flavor is a vital component of foods and beverages, which contributes to palatability, product positioning, and customer targeting. As the aging population in Germany consumes more nutritive products due to rising health concerns, there is a continuous rise in demand for specialty ingredients, along with natural food flavors in the functional and fortified beverages segment. Food flavor producers and companies regularly monitor market trends and always seek alternative techniques to capitalize on evolving consumer preferences.Europe Food Flavor Market Competitor Analysis

The food flavor market in Europe is highly competitive. Kerry Group plc, Firmenich SA, Givaudan, European Flavours and Fragrances, and BASF SE are a few key players present in the market. These players are adopting strategic approaches such as expansion, partnerships, and mergers and acquisitions to gain market share. Companies operating in the market studied are focusing on producing products with fewer artificial ingredients and with clean labels. For instance, in July 2021, Synergy Flavours launched Inspiring Fruits, a collection of fruit essences and natural flavors. In addition, companies are introducing clean labels and organic flavor ranges and are acquiring and partnering with local players to increase their market presence in untapped and potential markets.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Givaudan

- Kerry Group Plc

- European Flavours and Fragrances

- BASF

- Firmenich

- FMC Corporation

- International Flavors & Fragrances Inc.

- DuPont de Nemours Inc.

- Symrise

- Sensient Technologies Corporation