Rising Exploration Activities of Rare Earth Metals Drive Europe Mining Chemicals Market

Rare earth metals are known for their unique properties and have various applications across different industries, including electronics, renewable energy, automotive, defense & aerospace, and medical equipment. The growing demand for rare earth metals from these sectors has propelled the need to explore their new deposits. In January 2023, the state-owned mining firm in Sweden, LKAB, declared that it had found over one million tons of rare earth oxides in the country's northern region. It is the largest known deposit in Europe.Successful exploration results and identifying economically viable rare earth metal deposits can lead to expansion operations. Before commencing mining operations, extensive site preparation and infrastructure development are required. This includes clearing vegetation, leveling terrain, constructing access roads, and establishing mining facilities. Mining chemicals are employed in these activities to clear land, shape terrain, and build access routes, facilitating the development of mining sites for rare earth metals.

Further, rare earth metals are often embedded within hard rock formations, making their extraction challenging. The exploration activities for rare earth metals involve extensive drilling and blasting to extract mineral samples and access the viability of deposits. Mining chemicals are crucial in breaking down rocks and facilitating access to mineral-rich areas. As companies move from exploration to production, the demand for mining chemicals escalates to support larger-scale mining activities. Thus, the growing exploration activities of rare earth metals would offer lucrative opportunities for the mining chemicals market during the forecast period.

Europe Mining Chemicals Market Overview

According to the European Commission, major mining areas in Europe are located in the Fennoscandian belt in northern Finland and Sweden, Bergslagen (Sweden), the Variscan Belt of Iberia, and the Central European Kupferschiefer mineral belt. As per the World Mineral Production report by the British Geological Survey published in 2023, the production of refined lead in the UK grew from 342.8 thousand metric tons in 2019 to 362.6 thousand metric tons in 2021. The report also revealed the rising chromium production in Finland and Russia. The production of fluorspar increased from 160.0 thousand metric tons in 2019 to 236.5 thousand metric tons in 2021.There are more than 2,000 active mines and quarries in the UK, producing a wide range of minerals, coal, and aggregates. In June 2023, the Norwegian government announced its plans to approve commercial seabed mining operations to decrease dependency on the oil & gas industry. Further, in September 2023, Russia commenced the Udokan project, a copper concentrate production at an underdeveloped copper deposit in Russia. Mining of many minerals such as copper, tin, bauxite, iron, gold, and nickel, involves the utilization of mining chemicals. The lucrative mining industry in Europe is expected to create potential business opportunities for the mining chemicals market in Europe during the forecast period.

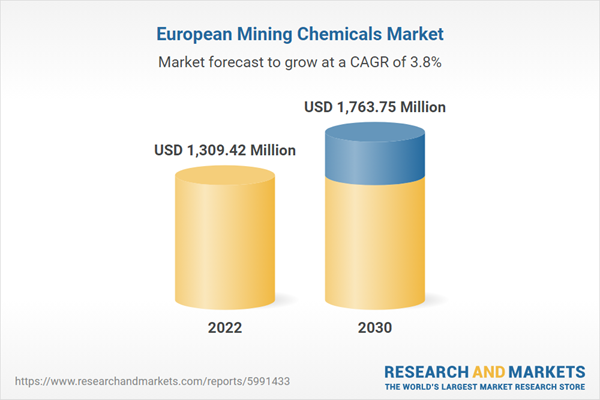

Europe Mining Chemicals Market Revenue and Forecast to 2030 (US$ Million)

Europe Mining Chemicals Market Segmentation

The Europe mining chemicals market is segmented based on type, mineral type, application, and country.In terms of type, the Europe mining chemicals market is segmented into flotation chemicals, solvent extractants, grinding aids, and others. The flotation chemicals segment is sub segmented into frothers, flocculants, depressants, collectors, and others. The flotation chemicals segment held the largest share in 2022.

By mineral type, the Europe mining chemicals market is categorized into base metals, non-metallic minerals, precious metals, and others. The non-metallic minerals segment held the largest share in 2022.

In terms of application, the Europe mining chemicals market is segmented into mineral processing, wastewater treatment, and others. The mineral processing segment held the largest share in 2022.

Based on country, the Europe mining chemicals market is categorized into Germany, France, the UK, Italy, Russia, and the Rest of Europe. Russia dominated the Europe mining chemicals market in 2022.

Orica Ltd, Kemira Oyj, BASF SE, Clariant AG, Dow Inc, AECI Ltd, Nouryon Chemicals Holding BV, Solvay SA, and Arkema SA are some of the leading companies operating in the Europe mining chemicals market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Europe mining chemicals market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in Europe mining chemicals market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Europe market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

- Orica Ltd

- Kemira Oyj

- BASF SE

- Clariant AG

- Dow Inc

- AECI Ltd

- Nouryon Chemicals Holding BV

- Solvay SA

- Arkema SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 132 |

| Published | June 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 1309.42 Million |

| Forecasted Market Value ( USD | $ 1763.75 Million |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 9 |