Key Highlights

- The performance of the European office real estate market is strongly connected to the growth of the region’s economy. Though the European economy is recovering from the consequences of the COVID-19 pandemic, the office real estate industry may take some time to reach normalcy.

- Occupier demand has slowed, and uncertainty has increased, resulting in a 40% drop in office take-up in 2020 compared to 2019. Offices were not expected to be fully occupied until at least the end of 2021. However, as uncertainty related to the pandemic lessened, take-up was projected to increase by 7% in 2021 over 2020. Barcelona (59% p.a. in 2020-2021), Paris Central Business District (CBD) (52%), Cologne (42%), and Central London (29%) are estimated to see a faster recovery in office leasing activity.

Europe Office Real Estate Market Trends

Offices Remain a Core Sector

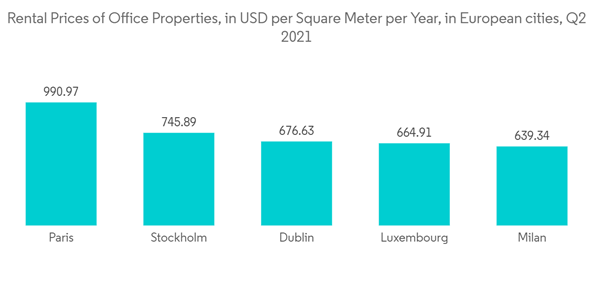

Although the COVID-19 pandemic has changed the way people work, there is still a high demand for office space. According to INREV, a European organization that shares knowledge of the non-listed real estate business, offices are still a favored asset category for European investors, particularly those headquartered in France and Germany.Prime rents increased by 0.5% on average in Q3 2021, following increases of 0.3% in Q2 2021, and 0.1% in Q1 2021. For the first time since the pandemic in Q2 2020, annual growth has been positive, with rents being 0.3% higher Y-o-Y. No markets saw a decrease in rentals throughout Q3 2021. Yields continue to fall, albeit slowly, with the European prime yield falling by 3 basis points to a new low of 4.16% in the third quarter.

Rise in Rental Prices of Office Properties in European Cities

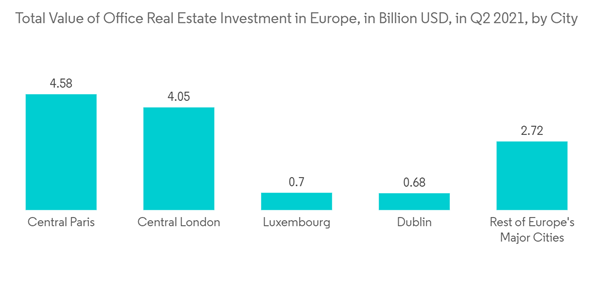

The office market has historically been the most popular asset type among real estate investors, accounting for 40-50% of the total investment volume. The major share of European investment activity is concentrated in Paris and London, as well as Germany's big four (Berlin, Frankfurt, Munich, and Hamburg).Central Paris garnered EUR 3.8 billion (USD 3.9 Billion) in investments in Q2 2021, which was EUR 500 million (USD 513.7 million) higher than Central London. The London Stock Exchange is one of the world's largest foreign exchange markets, and many major global companies, such as HSBC, BP, Unilever, and Barclays, are headquartered in this region. London’s office real estate sector has historically been one of the most competitive, with prime yields as low as 3.5% as of Q3 2020. Yields in Germany's big four were significantly lower, at less than 3%.

Europe Office Real Estate Market Competitor Analysis

The office real estate market in Europe is relatively fragmented. The market is anticipated to regain normalcy by the end of 2023. Companies are gearing up to meet future needs, and many companies are entering the market for further opportunities. Hochtief Aktiengesellschaft, AF Group ASA, JLL, Cushman & Wakefield, Engel & Völkers Germany, etc., are major market participants in the Europe Office Real Estate Market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- JLL

- Cushman & Wakefield

- CBRE

- Savills

- Engel & Volkers Germany