Rigid packaging represents a significant application area for coatings in the Packaging Coatings Market, offering durable and protective solutions for a wide range of products. Coatings play a crucial role in enhancing the performance and aesthetics of rigid packaging materials such as metal, glass, and plastic containers. For metal packaging, coatings provide corrosion resistance, scratch resistance, and decorative finishes, ensuring the longevity and visual appeal of metal cans, bottles, and closures. Consequently, the Germany market utilized 27.21 kilo tonnes of these coatings in rigid packaging in 2023.

The Germany market dominated the Europe Packaging Coatings Market by Country in 2023, and is forecast to continue being a dominant market till 2031; thereby, achieving a market value of $303.8 million by 2031. The UK market is exhibiting a CAGR of 3.4% during (2024 - 2031). Additionally, The France market is projected to experience a CAGR of 5.1% during (2024 - 2031).

Packaging coatings may also be engineered to provide specific functional properties tailored to the needs of different food products and packaging formats. For example, coatings with moisture barrier properties help prevent moisture migration and absorption, preserving the crispness of snacks and baked goods, while coatings with grease resistance properties are essential for packaging fatty or oily foods to prevent oil seepage and staining.

Additionally, these coatings are extensively used in the cosmetics and personal care industry, serving as protective barriers, decorative embellishments, and branding elements for beauty and personal care products. Coatings with high-gloss finishes, tactile textures, and vibrant colors enhance the visual appeal and shelf presence of cosmetics packaging, attracting consumers and reinforcing brand identity.

The EU cosmetics industry is characterized by a strong emphasis on product safety, quality, and regulatory compliance, driving demand for these coatings that meet stringent regulatory standards and ensure the integrity of packaged products. According to the Cosmetic, Toiletry, and Perfume Association Limited (CTPA), the European countries with the highest demand for personal care products and cosmetics are France, Italy, the UK, and Spain. In 2022, the personal care products and cosmetics industry in France had a market value of €12.882 billion, followed by Italy at €11.505 billion, the United Kingdom at €10.487 billion, and Spain at €9.250 billion. In addition, the food and beverage industry in the United Kingdom has witnessed substantial expansion in recent times. As per the data from the Government of the United Kingdom, with a value of £6.5 billion in 2021, beverages constituted the largest manufacturing category in terms of gross value added. Its share of the food and beverage manufacturing GVA was 21.4%. Hence, the growing food & beverage and cosmetics sectors in Europe will increase demand for these coatings in the region.

List of Key Companies Profiled

- Axalta Coating Systems Ltd.

- Akzo Nobel N.V.

- BASF SE

- Arkema S.A.

- Berger Paints India Limited

- Chugoku Marine Paints, Ltd.

- DuPont de Nemours, Inc.

- Evonik Industries AG (RAG-Stiftung)

- Henkel AG & Company, KGaA

- Kansai Paint Co., Ltd.

Market Report Segmentation

By Packaging Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)- Flexible Packaging

- Rigid Packaging

- Others

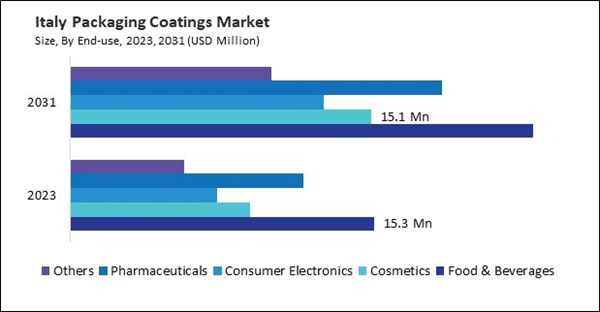

- Food & Beverages

- Cosmetics

- Consumer Electronics

- Pharmaceuticals

- Others

- Epoxies

- Polyurethane

- Acrylics

- Polyolefins

- Polyester

- Others

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

- Axalta Coating Systems Ltd.

- Akzo Nobel N.V.

- BASF SE

- Arkema S.A.

- Berger Paints India Limited

- Chugoku Marine Paints, Ltd.

- DuPont de Nemours, Inc.

- Evonik Industries AG (RAG-Stiftung)

- Henkel AG & Company, KGaA

- Kansai Paint Co., Ltd.