Sodium persulfate is a white, crystalline compound with the chemical formula Na2S2O8. It is a strong oxidizing agent widely used in various industrial and scientific applications. One of its primary uses is as an initiator for polymerization reactions, particularly in the production of acrylics, adhesives, and coatings. Sodium persulfate is also utilized in the electronics industry for etching printed circuit boards (PCBs), where it effectively removes copper layers during the manufacturing process. Thus, the Germany market consumed 48.89 hundred tonnes of sodium persulfate in 2023.

The Germany market dominated the Europe Persulfates Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $58.8 million by 2031. The UK market is exhibiting a CAGR of 2.8% during (2024 - 2031). Additionally, The France market would experience a CAGR of 3.5% during (2024 - 2031).

In environmental remediation projects, these chemicals are applied to oxidize and degrade organic contaminants in contaminated soil and groundwater. The textile industry utilizes these chemicals to bleach fabrics, including cotton and synthetic fibres. Persulfate-based bleaching agents effectively remove impurities, stains, and natural colorants from textiles, resulting in fabrics with enhanced brightness, whiteness, and colour consistency. The expansion of the textile industry translates into higher demand for the these chemicals.

Furthermore, these chemicals find application in the oil and gas industry for enhanced oil recovery (EOR) processes. By breaking down complex hydrocarbons and reducing the viscosity of crude oil, these chemicals improve the flow properties of reservoir fluids, thereby enhancing oil production efficiency and recovery rates. High oil production propels the demand for the these chemicals.

The EU has stringent environmental regulations to protect human health and the environment from the adverse effects of hazardous substances and pollutants. As a result, electronics manufacturers in the EU are subject to strict regulatory requirements regarding the use and disposal of chemicals, including those used in PCB fabrication processes. As relatively environmentally friendly etchants compared to alternatives like ferric chloride, these chemicals align with EU regulations and sustainability goals, making them preferred choices for electronics manufacturing applications. Therefore, the high production of electronics in the region is driving the market’s growth.

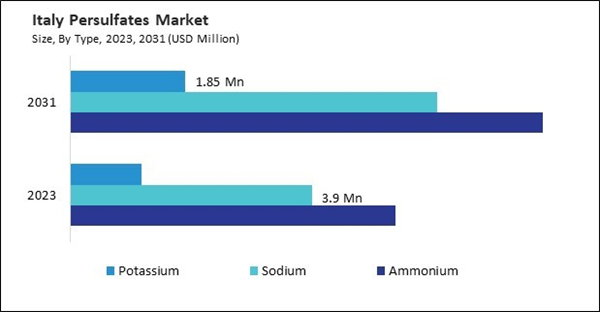

Based on Type, the market is segmented into Ammonium, Sodium and Potassium. Based on End-use, the market is segmented into Polymers, Electronics, Oil & Gas, Pulp, Paper, & Textile, Water Treatment, and Others. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

List of Key Companies Profiled

- Evonik Industries AG (RAG-Stiftung)

- Calibre Chemicals Pvt. Ltd. (Everstone Capital Asia Pte. Ltd.)

- United Initiators GmbH (EQUISTONE PARTNERS EUROPE)

- Mitsubishi Gas Chemical Company, Inc.

- Fujian ZhanHua Chemical Co., Ltd

- Ak-kim Kimya Sanayi ve Ticaret A.Ş (Akkök Holding A.Ş)

- Yatai Electrochemistry Co., Ltd.

- ABC Chemicals(Shanghai)Co., Ltd.

- San Yuan Chemical Co., Ltd.

- Adeka Corporation

Market Report Segmentation

By Type (Volume, Hundred Tonnes, USD Billion, 2020-31)- Ammonium

- Sodium

- Potassium

- Polymers

- Electronics

- Oil & Gas

- Pulp, Paper, & Textile

- Water Treatment

- Others

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

- Evonik Industries AG (RAG-Stiftung)

- Calibre Chemicals Pvt. Ltd. (Everstone Capital Asia Pte. Ltd.)

- United Initiators GmbH (EQUISTONE PARTNERS EUROPE)

- Mitsubishi Gas Chemical Company, Inc.

- Fujian ZhanHua Chemical Co., Ltd

- Ak-kim Kimya Sanayi ve Ticaret A.Ş (Akkök Holding A.Ş)

- Yatai Electrochemistry Co., Ltd.

- ABC Chemicals(Shanghai)Co., Ltd.

- San Yuan Chemical Co., Ltd.

- Adeka Corporation