Polyvinyl Butyral (PVB) finds extensive use in the Paint & Coating industry across various applications due to its versatile properties. Primarily utilized as a resin or binder, PVB enhances the adhesion, durability, and flexibility of coatings, making it indispensable in architectural coatings, automotive coatings, and industrial coatings. In architectural coatings, PVB contributes to the formulation of durable and weather-resistant paints for exterior surfaces, such as building facades and bridges, providing excellent adhesion to substrates and resistance to harsh environmental conditions. Thus, the Germany market consumed 6,706.75 tonnes of this chemical for paint and coatings applications in 2023.

The Germany market dominated the Europe Polyvinyl Butyral (PVB) Market by Country in 2023, and is forecast to continue being a dominant market till 2031; thereby, achieving a market value of $351.4 million by 2031. The UK market is exhibiting a CAGR of 4.9% during (2024 - 2031). Additionally, The France market is projected to experience a CAGR of 6.7% during (2024 - 2031).

PVB provides strong adhesion to glass and other surfaces, ensuring that the layers within the solar panel remain securely bonded. Over time, this stability is critical for preserving the structural integrity of the panels. PVB's robustness contributes to the long lifespan of solar panels. It protects the PV cells from environmental factors such as moisture, mechanical stress, and temperature variations, which can degrade the cells and reduce their efficiency.

The optical clarity PVB provides is crucial for electronic displays to ensure sharp and vibrant images. This property is crucial for smartphones, tablets, computers, and television applications where high display quality is a key selling point. PVB helps minimize visual distortions and improve the viewing experience, which is particularly important in high-resolution and high-definition displays.

According to the UK Government, with its highly linked supply chains and substantial demand for UK-built cars throughout the region, the European region has benefited the UK automotive sector with its varied products, encompassing volume, premium, and niche vehicles. Similarly, the most recent data available (December 2022) from the International Trade Administration (ITA) indicates that the automotive sector generated €92.7 billion in revenue in 2022, representing 9.3% of Italy's manufacturing turnover and 5.2% of the country's GDP. Italy produced 782,629 vehicles in 2022 (including 486,111 cars, 234,798 light commercial vehicles, and 61,720 trucks and buses). In 2022, 1,335,487 new cars were registered. Thus, all these factors will uplift the regional market’s expansion in the coming years.

List of Key Companies Profiled

- Kuraray Co., Ltd.

- Eastman Chemical Company

- Sekisui Chemical Co. Ltd.

- Chang Chun Group

- Huakai Plastic (Chongqing) Co.,Ltd.

- Everlam BV

- Tridev Resins (India) Pvt. Ltd.

- WMC Glass

- Perry Chemical Corp.

- Shark Solutions ApS

Market Report Segmentation

By Application (Volume, Tonnes, USD Billion, 2020-2031)- Films & Sheets

- Paint & Coatings

- Adhesives

- Others

- Automotive

- Construction

- Electronics & Electricals

- Others

- Germany

- UK

- France

- Russia

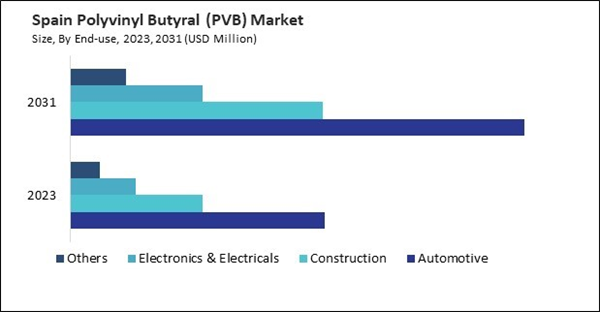

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

- Kuraray Co., Ltd.

- Eastman Chemical Company

- Sekisui Chemical Co. Ltd.

- Chang Chun Group

- Huakai Plastic (Chongqing) Co.,Ltd.

- Everlam BV

- Tridev Resins (India) Pvt. Ltd.

- WMC Glass

- Perry Chemical Corp.

- Shark Solutions ApS