Rising Demand for SOCaaS in Finance Sector Drives Europe SOC as a Service Market

Financial and banking institutes handle a vast amount of sensitive data, which makes them a prime target for cyberattacks. Also, digitalization and securing business continuity are highly prioritized in the finance industry. This increases the demand for SOCaaS solutions. SOCaaS providers help banks monitor networks and systems 24/7, ensuring quick detection and mitigation of potential security threats and reducing the data breach risk. In addition, SOCaaS providers also help banks to comply with various regulatory requirements. For instance, the Payment Card Industry Data Security Standard (PCI DSS) requires banks to have a robust security program. They can help banks meet such regulatory requirements by providing the needed monitoring, analysis, and reporting capabilities.Moreover, in recent years, financial institutions witnessed a large number of data breach cases. As of December 2022, finance and insurance organizations experienced ~566 breaches worldwide, which led to over 254 million leaked records. In addition, according to the State of Ransomware in Financial Services 2023 report released by Sophos, the ransomware attacks on financial services increased from 55% in 2022 to 64% in 2023, which is approximately double the 34% reported in 2021. Hence, due to the rise in data breach cases, various banks across the globe are integrating SOCaaS solutions. Thus, the growing recognition of the essential need for comprehensive and exhaustive SIEM and threat intelligence solutions by banks is raising the demand for SOCaaS, thereby driving the market.

Europe SOC as a Service Market Overview

Germany, France, the UK, and Italy are among the major countries contributing to the growth of the Europe SOC as a Service market. The growing number of cyberattacks, incidents, and new ransomware detections drives the demand for the SOC as a Service. The severity of cyber breaches is becoming highly intense in (Western) European countries, including the Netherlands, the UK, Bulgaria, Belarus, Ukraine, France, Lithuania, and Romania, among others. According to AAG, 39% of businesses in the UK reported suffering from cyberattacks, which incurred an average cost of US$ 5.10 billion to businesses in 2022. Business owners are losing huge profits due to a rise in cyberattacks, which increases the demand for SOC as a Service among customers to protect data from cyberattacks. Furthermore, the Russia-Ukraine war increased the number of cyberattacks in Europe, which is expected to increase the demand for SOC as a Service among businesses in Europe. According to data published by Thales Group, in March 2022, the rise of cyberattacks in the European Union (EU) countries increased from 9.8% to 46.5% in 2021. The data shows that a direct increase in these attacks is associated with the Ukrainian conflict, while 61% of the global cyberattacks originate from Russia. The rising cyberattack cases in Europe are increasing the demand and adoption of SOC as a Service among industries to protect their confidential data and information. The market in Europe is projected to expand during the forecast period due to the presence of major players such as Atos SE and Thales Group. These players continuously expand their presence across the region to help their customers protect sensitive data from cyberattacks or breaches. For instance, in March 2022, Atos SE opened a next-generation Security Operations Center (SOC) in Bulgaria. The new center was opened in Sofia, supporting the company to strengthen its sovereign security offering in Europe. The center is designed to provide 24/7 threat monitoring, detection, and targeted customer response. The center supports large organizations in rapidly identifying and limiting the impact of cyberattack incidents. Atos SE leverages artificial intelligence (AI) and machine learning (ML) technologies to strengthen its SOC network and help organizations protect their confidential information and customer's data from cyberattacks.Europe SOC as a Service Market Segmentation

The Europe SOC as a service market is segmented into service type, enterprise size, application, industry, and country.Based on service type, the Europe SOC as a service market is segmented into prevention service, detection service, and incident response service. The prevention service segment held the largest share of the Europe SOC as a service market in 2022.

Based on enterprise size, the Europe SOC as a service market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger share of the Europe SOC as a service market in 2022.

Based on application, the Europe SOC as a service market is segmented into network security, endpoint security, application security, and cloud security. The endpoint security segment held the largest share of the Europe SOC as a service market in 2022.

Based on industry, the Europe SOC as a service market is segmented into BFSI, IT and telecom, manufacturing, retail, government and public sector, healthcare, and others. The BFSI segment held the largest share of the Europe SOC as a service market in 2022.

Based on country, the Europe SOC as a service market is segmented into France, Germany, the UK, Italy, Russia, and the Rest of Europe. Germany dominated the Europe SOC as a service market in 2022.

AT&T Inc, Atos SE, Cloudflare Inc, ConnectWise LLC, Fortinet Inc, NTT Data Corp, Thales SA, and Verizon Communications Inc are some of the leading companies operating in the Europe SOC as a service market.

Table of Contents

Companies Mentioned

- AT&T Inc

- Atos SE

- Cloudflare Inc

- ConnectWise LLC

- Fortinet Inc

- NTT Data Corp

- Thales SA

- Verizon Communications Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 103 |

| Published | May 2024 |

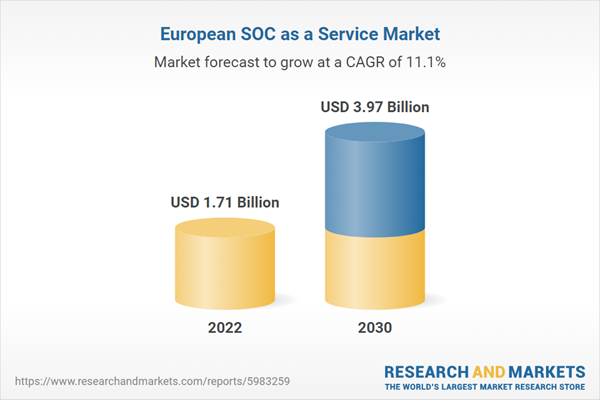

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 1.71 Billion |

| Forecasted Market Value ( USD | $ 3.97 Billion |

| Compound Annual Growth Rate | 11.1% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 8 |