Increasing Preference for Gluten-Free Products Drives Europe Tortilla Market

The prevalence of Celiac disease is rising in different countries across the globe. According to the data published by Epidemiology, Presentation, and Diagnosis of Celiac Disease in 2021, cases of celiac disease are found across the globe, contrary to earlier beliefs that it affects people in Western and Northern Europe. Celiac disease can cause thyroid/Type 1 diabetes or damage the intestine lining in some patients. The gluten-free diet can help reduce celiac disease's effect by promoting intestinal healing. Therefore, consumers are tremendously preferring gluten-free diets. As per the Leisure Food & Beverages EXPO in 2021, people aged 20-39 are the primary consumers of a gluten-free diet in the UK. Also, 41% of athletes in the country have said they followed a gluten-free diet. This has propelled the demand for gluten-free products in the UK in recent years. Increasing consumption of healthy food products to prevent health issues such as chronic pulmonary disease, diabetes, heart disease, obesity, and metabolic syndrome is expected to boost the demand for gluten-free food items such as tortillas. Gluten-free tortillas are manufactured from rice flour, corn flour, or tapioca flour. Many people try new diets such as keto or paleo diets. In addition, individuals adopt a gluten-free diet due to their existing medical conditions. Further, manufacturers are focusing on developing and launching gluten-free products in response to their increasing demand among consumers. For instance, in 2021, Mission Foods unveiled its better-for-you tortilla offerings with two new varieties - almond flour tortillas and cauliflower tortillas. Both are certified gluten-free and vegan-friendly. Thus, the increasing preference for gluten-free products is expected to create a huge opportunity for the tortilla market during the forecast period.Europe Tortilla Market Overview

Constant changes in consumer preferences and a rise in diverse culinary experiences led to the popularity of Mexican cuisine, which boosted the demand for tortilla products in Europe. Tortillas are often considered a healthier alternative to bread owing to the presence of lower fat and fiber content. Hence, the population of health-conscious consumers opt for tortilla-based meals as part of a balanced diet. Consumers are also seeking convenient and versatile options that can be used in various dishes, such as tacos, wraps, quesadillas, and burritos, which contributes to the growing sales of tortillas.A rise in the working population and dual-income families are major factors promoting the consumption of processed foods such as packaged flour tortillas in Europe. For instance, Eurostat reported that approximately 73.1% of the population in the region, amounting to 250 million people, were working professionals in 2021. In the same year, the Department of Public Health of Belgium estimated that the consumption of ultra-processed food and drinks increased to 44% in the UK and 14% in countries such as Italy and Romania. Further, the National Research Council of Italy revealed that approximately 50% of the average daily energy intake in European countries emerged from the consumption of processed foods in 2021.

The presence of a robust retail sector and the growing preference for online shopping are boosting the demand for tortillas in Europe. Retailers provide a wide range of tortilla products from different brands and adopt various other promotional strategies to boost sales. For example, they offer huge discounts and deals to attract a large number of customers who prefer tortillas.

Europe Tortilla Market Segmentation

The Europe tortilla market is categorized into source, product type, category, distribution channel, and country.Based on source, the Europe tortilla market is segmented into wheat, corn, and others. The corn segment held the largest market share in 2023.

By product type, the Europe tortilla market is segmented into tortilla chips/tostada chips taco shells, tortilla wraps, others. The tortilla chips/tostada chips segment held the largest market share in 2023. The tortilla chips/tostada chips segment is further sub segmented into corn chips and other chips.

Based on category, the Europe tortilla market is bifurcated into organic and conventional. The conventional segment held a larger market share in 2023.

Based on distribution channel, the Europe tortilla market is segmented into supermarkets and hypermarkets, convenience stores, online retail, others. The supermarkets and hypermarkets segment held the largest market share in 2023.

By country, the Europe tortilla market is segmented into Germany, France, Italy, the UK, Spain, and the Rest of Europe. The Rest of Europe dominated the Europe tortilla market share in 2023.

GRUMA SAB de CV; PepsiCo Inc; La Tortilla Factory Inc; Aranda’s Tortilla Co Inc; Paulig Ltd; General Mills Inc; Goya Foods Inc; Moctezuma Foods SRO; Komali Tortillas GmbH; Greendot Health Foods Pvt. Ltd.; Paul’s Organics; Delibreads Europe S.L.; Leighton Foods AS; and The Hain Celestial Group Inc are some of the leading companies operating in the Europe tortilla market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Europe tortilla market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Europe tortilla market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Europe market trends and outlook coupled with the factors driving the Europe tortilla market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the Europe Tortilla Market include:- GRUMA SAB de CV

- PepsiCo Inc

- La Tortilla Factory Inc

- Aranda’s Tortilla Co Inc

- Paulig Ltd

- General Mills Inc

- Goya Foods Inc

- Moctezuma Foods SRO

- Komali Tortillas GmbH

- Greendot Health Foods Pvt. Ltd.

- Paul’s Organics

- Delibreads Europe S.L.

- Leighton Foods AS

- The Hain Celestial Group Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 166 |

| Published | April 2025 |

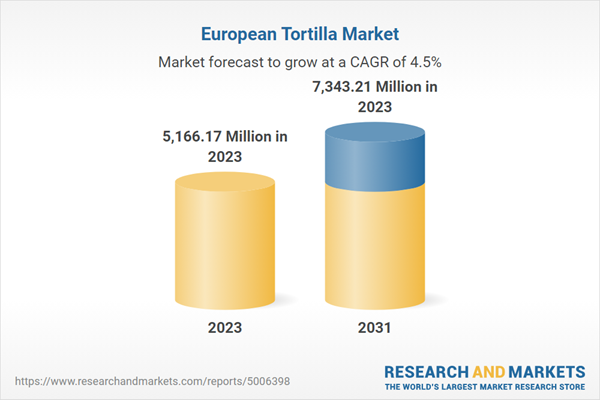

| Forecast Period | 2023 - 2031 |

| Estimated Market Value in 2023 | 5166.17 Million in 2023 |

| Forecasted Market Value by 2031 | 7343.21 Million by 2031 |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 15 |