The rise in the prevalence of coronary artery diseases, increase in atherosclerosis in coronary artery patients, and surge in angina episodes are projected to drive the external counterpulsation devices market’s growth. With a significant proportion of coronary artery disease cases preceding angina and the rising adoption of ECP devices for managing angina, the market is expected to grow. The incidence of atherosclerosis, most common in patients above 40, further contributes to the demand for ECP therapy, as nearly 50% of individuals in this age group are likely to develop serious atherosclerosis conditions.

Significant growth has been seen in the market for external counterpulsation (ECP) devices, driven by technological breakthroughs and innovations in the industry. By adding advanced monitoring capabilities, customization choices, and electronic medical record system integration, manufacturers continuously enhance ECP devices, improving patient care, safety, and treatment outcomes. Positive reimbursement policies and regulatory frameworks promote the growing use of ECP devices in clinic and hospital settings, which adds to the market's upward trend. Additionally, significant competitors in the market and FDA clearance for treating several cardiac diseases are anticipated to fuel the expansion of the worldwide ECP devices market.

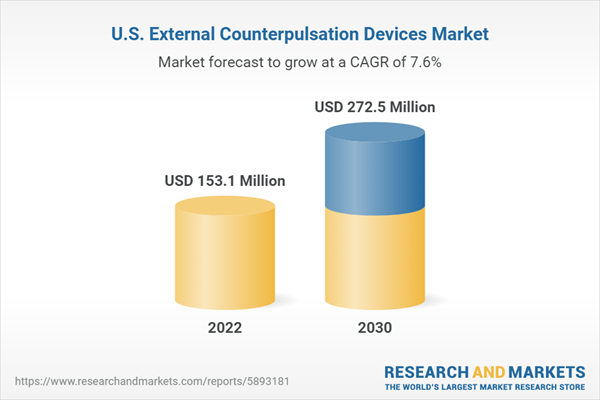

U.S. External Counterpulsation Devices Market Report Highlights

- In 2022, the pneumatic ECP devices segment held a dominant market share of 35.68%. These devices use air pressure to improve blood flow to the heart, effectively reducing symptoms in angina and refractory angina pectoris patients. Their non-invasive nature, cost-effectiveness, and ongoing technological advancements make them appealing to patients and healthcare providers. The rising prevalence of cardiovascular diseases further fuels the growth of this segment, making it a promising therapeutic option for cardiac patients

- In 2022, hospitals dominated the ECP device market with a share of 35.68%. Their larger patient volumes, specialized care for cardiovascular diseases, access to advanced resources and technologies, and comprehensive treatment options make hospitals the preferred choice for ECP therapy. As cardiovascular diseases continue to rise, the demand for hospital ECP devices is expected to reinforce their market dominance

- Some key market players are Vaso Corporation, ACS Diagnostics, Scottcare Corporation, and Cardiomedics Inc.

Table of Contents

Companies Mentioned

- Vaso Corporation

- ACS Diagnostics

- Scottcare Corporation

- Cardiomedics Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | September 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 153.1 Million |

| Forecasted Market Value ( USD | $ 272.5 Million |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 4 |