Global Fabrication Gold Market - Key Trends and Drivers Summarized

How Is Gold Fabrication Revolutionizing the Jewelry and Electronics Industries?

Gold fabrication is a vital process that shapes how gold is used in various industries, particularly in jewelry and electronics. The process involves refining and manipulating raw gold into finished products such as fine jewelry, coins, or electronic components. In jewelry, gold fabrication includes techniques such as casting, soldering, engraving, and electroplating to create intricate designs and high-quality pieces. In the electronics industry, gold's excellent conductivity, resistance to corrosion, and malleability make it ideal for fabricating connectors, circuit boards, and microprocessors.Gold fabrication is revolutionizing both luxury and technology sectors by merging artistry with advanced manufacturing techniques. In jewelry, innovations such as laser engraving and 3D printing are enabling designers to create more complex and customizable pieces, while also reducing material waste. In electronics, gold's superior conductivity is critical in the production of high-performance devices such as smartphones, computers, and medical equipment. As industries continue to push the boundaries of design and technology, gold fabrication is playing an essential role in driving both aesthetic appeal and technological advancements.

Why Is Gold Fabrication Essential for Jewelry Craftsmanship and Technological Advancement?

Gold fabrication is essential for jewelry craftsmanship because it allows for the creation of intricate, durable, and aesthetically appealing pieces. Gold, in its pure form, is highly malleable and can be shaped into fine, detailed designs, making it the metal of choice for high-end jewelry. Fabrication techniques such as casting, forging, and laser cutting enable jewelers to produce everything from traditional designs to modern, avant-garde pieces. Additionally, gold's resistance to tarnish and corrosion ensures that jewelry remains in pristine condition for years, enhancing its value and longevity. Electroplating and gold alloy fabrication further allow jewelers to modify gold's color and hardness, giving them creative flexibility in producing unique and lasting designs.In the electronics industry, gold fabrication is crucial for advancing technology due to gold's superior electrical conductivity and resistance to oxidation. Gold is widely used in fabricating connectors, microchips, and circuit boards, which are essential components in high-performance electronics. In smartphones, for instance, gold is used to fabricate connectors that transfer data and power with minimal resistance. Its corrosion resistance ensures that these components have a longer lifespan, which is critical in devices that undergo frequent use. As electronic devices become smaller and more powerful, gold fabrication is integral in producing compact components that require high precision and reliability. Whether it's in the form of wires, thin films, or nanoparticle coatings, gold remains an indispensable material for innovation in electronics.

What Are the Expanding Applications and Innovations in Gold Fabrication Across Industries?

Gold fabrication is expanding into various industries beyond traditional jewelry and electronics, driven by innovations in material science and manufacturing technologies. In the medical field, for example, gold is increasingly used in biomedical devices and diagnostics due to its biocompatibility and non-reactive nature. Gold nanoparticles are used in drug delivery systems and cancer treatments, where they help target specific cells while minimizing damage to surrounding healthy tissues. In dentistry, gold alloys are used to fabricate crowns, bridges, and fillings due to their durability and biocompatibility. Innovations in gold fabrication are enabling the development of more advanced medical devices, such as biosensors and implants, where gold's stability and conductivity are essential for performance and longevity.In the luxury and fashion industries, gold fabrication is being transformed by technological advancements such as 3D printing and laser cutting. These technologies allow for more intricate designs, faster production, and reduced waste in gold jewelry manufacturing. 3D printing, in particular, is revolutionizing how gold pieces are conceptualized and produced, enabling designers to create complex, customized designs that were previously impossible with traditional fabrication methods. This has led to the rise of personalized, made-to-order jewelry, where consumers can work with designers to create one-of-a-kind pieces. Furthermore, gold electroplating is being used in the fashion industry to coat accessories and garments with a thin layer of gold, adding value and luxury appeal to everyday items.

Gold's role in the electronics industry is also expanding with the advent of nanotechnology and advanced manufacturing techniques. Gold nanoparticles are now used in a variety of high-tech applications, including flexible electronics, sensors, and solar cells. In these applications, gold's conductive properties and ability to be formed into extremely thin layers make it an ideal material for fabricating cutting-edge technologies. Gold is also being explored for use in quantum computing and energy storage systems, where its unique properties could help develop more efficient, high-capacity devices. As industries push the limits of miniaturization and performance, innovations in gold fabrication are playing a pivotal role in unlocking new possibilities for both luxury and technology.

What Factors Are Driving the Growth of the Gold Fabrication Market?

Several key factors are driving the growth of the gold fabrication market, including the increasing demand for high-quality jewelry, advancements in technology, and the growing use of gold in electronics and medical devices. One of the primary drivers is the ongoing demand for gold jewelry, particularly in regions such as Asia and the Middle East, where gold is valued both as a symbol of wealth and as an investment. The ability to fabricate intricate, high-end designs through advanced techniques such as laser cutting and 3D printing has led to a resurgence in the popularity of custom, artisanal gold jewelry. Additionally, gold's status as a hedge against inflation and economic uncertainty continues to boost demand, with consumers seeking out gold products not only for their aesthetic value but also as long-term investments.In the technology sector, the rapid advancement of electronics, particularly in the fields of telecommunications and computing, is driving demand for gold fabrication. The ongoing miniaturization of electronic devices, from smartphones to wearable technology, requires highly conductive materials that can function reliably in increasingly smaller spaces. Gold's excellent conductivity, resistance to corrosion, and ability to be formed into thin, precise layers make it essential for fabricating components such as connectors, circuit boards, and microprocessors. Moreover, the rise of 5G technology, the Internet of Things (IoT), and artificial intelligence (AI) is further fueling demand for high-performance electronic components, where gold fabrication plays a key role in ensuring reliability and efficiency.

Another significant factor contributing to the growth of the gold fabrication market is the increasing use of gold in medical devices and biotechnologies. Gold's biocompatibility, conductivity, and chemical stability make it ideal for use in a range of medical applications, from implants and dental restorations to cutting-edge nanomedicine and drug delivery systems. As the healthcare industry continues to innovate, the demand for gold-based medical devices and treatments is expected to rise. Additionally, the ongoing development of gold nanoparticles for targeted drug therapies and cancer treatments represents a major growth area within the medical sector. Governments and healthcare institutions are investing in research and development focused on utilizing gold for more advanced and effective treatments, further driving market expansion.

Finally, sustainability and responsible sourcing are becoming important considerations in the gold fabrication market. As consumers and industries become more environmentally conscious, there is growing demand for gold that is ethically sourced and produced with minimal environmental impact. This has led to the rise of recycled gold and fair-trade gold initiatives, where companies are working to ensure that their gold products meet ethical and environmental standards. This trend is particularly strong in the luxury goods and jewelry industries, where consumers are increasingly seeking transparency about the origins of the materials used in the products they purchase. These factors, combined with ongoing technological advancements, are driving the continued growth and evolution of the gold fabrication market.

In conclusion, the gold fabrication market is experiencing significant growth, driven by strong demand in the jewelry, electronics, and medical industries. As industries continue to innovate, gold fabrication remains essential for producing high-quality, high-performance products that meet the evolving needs of consumers and businesses. With advancements in fabrication techniques, the development of new applications for gold, and an increasing focus on sustainability, gold fabrication is poised to play an even more central role in shaping the future of both luxury and technology markets.

Report Scope

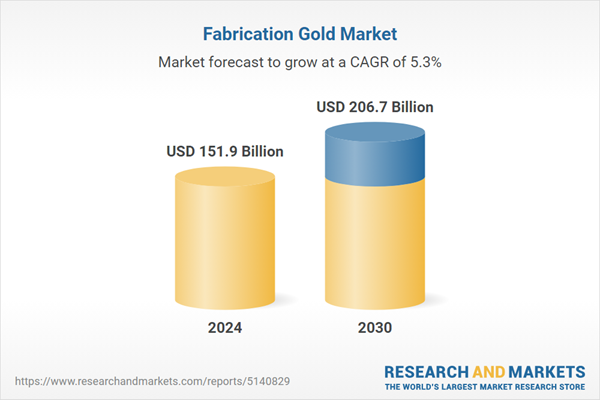

The report analyzes the Fabrication Gold market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material Source (Mine Production, Scrap Supply); Application (Jewelry, Official Coins, Electronics, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Jewelry Application segment, which is expected to reach US$105.3 Billion by 2030 with a CAGR of 5.9%. The Official Coins Application segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $40.3 Billion in 2024, and China, forecasted to grow at an impressive 8.4% CAGR to reach $45.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fabrication Gold Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fabrication Gold Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fabrication Gold Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AngloGold Ashanti Limited, Ascendant Resources, Eagle Mountain Mining, Franklin Mining, Gold Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Fabrication Gold market report include:

- AngloGold Ashanti Limited

- Ascendant Resources

- Eagle Mountain Mining

- Franklin Mining

- Gold Group

- Golden Eagle Coins

- GRIFFIN MINING LIMITED

- Hartadinata Abadi

- Mennica Polska

- Metalor Technologies International SA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AngloGold Ashanti Limited

- Ascendant Resources

- Eagle Mountain Mining

- Franklin Mining

- Gold Group

- Golden Eagle Coins

- GRIFFIN MINING LIMITED

- Hartadinata Abadi

- Mennica Polska

- Metalor Technologies International SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 151.9 Billion |

| Forecasted Market Value ( USD | $ 206.7 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |