Global Film Adhesives Market - Key Trends and Drivers Summarized

How Are Film Adhesives Revolutionizing Aerospace, Automotive, and Electronics Industries?

Film adhesives are transforming the aerospace, automotive, and electronics industries by providing a highly efficient and reliable bonding solution for critical applications requiring precision, durability, and high-performance materials. These adhesives are pre-formed, thin layers of bonding agents that can be applied between two surfaces to create strong, consistent, and long-lasting bonds. Unlike liquid adhesives, film adhesives offer controlled thickness and even distribution, making them ideal for applications where precision and structural integrity are paramount.Film adhesives are widely used in industries that demand lightweight, high-strength, and reliable bonding, such as aircraft assembly, automotive component manufacturing, and electronics. In aerospace, film adhesives are essential for bonding metal and composite materials in aircraft structures, ensuring that the components remain secure under extreme conditions such as high temperatures, pressure, and vibration. In the automotive industry, film adhesives are used to assemble lightweight, fuel-efficient vehicles by bonding metals, composites, and plastics. Electronics manufacturers use film adhesives to bond components in devices where reliability, thermal management, and durability are critical. With growing demand for lightweight materials, improved performance, and enhanced durability, film adhesives are becoming a vital component in modern manufacturing processes.

Why Are Film Adhesives Critical for Enhancing Performance and Durability in Aerospace, Automotive, and Electronics?

Film adhesives are critical for enhancing performance and durability in industries like aerospace, automotive, and electronics due to their ability to provide strong, uniform bonds that can withstand harsh conditions. In aerospace, for example, where safety and performance are non-negotiable, film adhesives are used to bond structural components, such as wings, fuselage sections, and interior panels. These adhesives are engineered to resist extreme temperatures, high pressure, and environmental factors like humidity and corrosion. This ensures that aircraft components maintain their integrity over long service lives, reducing the need for mechanical fasteners that can add weight and create potential points of failure. The lightweight nature of film adhesives contributes to overall weight reduction, improving fuel efficiency and reducing operational costs for airlines.In the automotive industry, film adhesives are crucial for bonding dissimilar materials such as aluminum, carbon fiber, and plastics. As automakers strive to build lighter, more fuel-efficient vehicles, they increasingly rely on film adhesives to replace traditional mechanical joining methods like welding, rivets, or bolts. Film adhesives not only help reduce vehicle weight but also distribute stress more evenly across bonded surfaces, leading to improved crash performance and structural integrity. Moreover, film adhesives provide better sealing and vibration damping, contributing to a quieter and more comfortable ride.

In the electronics sector, film adhesives are essential for assembling and bonding components in devices such as smartphones, laptops, and wearable technology. These adhesives offer excellent electrical insulation, thermal management, and resistance to environmental factors like moisture and dust. By providing a consistent bond line thickness and minimizing the risk of air bubbles or inconsistencies, film adhesives improve the overall reliability and durability of electronic devices. With miniaturization becoming increasingly important in electronics, film adhesives provide the precision and reliability needed for bonding delicate components without adding excess bulk or weight.

What Are the Expanding Applications and Innovations in Film Adhesives Across Various Industries?

The applications of film adhesives are rapidly expanding across various industries, driven by innovations in materials science, bonding technology, and the growing need for lightweight, high-performance solutions. In the aerospace sector, film adhesives are increasingly used in the construction of modern aircraft, where composite materials are replacing traditional metals to achieve significant weight reductions and improved fuel efficiency. These adhesives are used in bonding components such as wing assemblies, fuselage panels, and aircraft interiors, ensuring that the joints are not only lightweight but also resistant to environmental stresses such as temperature extremes, UV exposure, and pressure fluctuations. Innovations in aerospace adhesives, such as those with improved thermal resistance and fire retardancy, are making them even more critical in ensuring the safety and performance of next-generation aircraft.In the automotive industry, film adhesives are playing a key role in the shift toward electric vehicles (EVs), where lightweighting and energy efficiency are top priorities. As electric vehicle manufacturers seek to reduce the overall weight of cars to extend battery range, film adhesives are being used to bond components like battery packs, body panels, and structural reinforcements. Additionally, the need for improved thermal management in EVs has led to the development of heat-resistant film adhesives that can dissipate heat generated by batteries and electronic systems, improving both safety and performance. Film adhesives are also being used in automotive interiors, where they bond components like dashboard panels, headliners, and trim pieces, ensuring a clean and aesthetically pleasing finish without the need for mechanical fasteners.

In electronics, the miniaturization of devices has created new opportunities for film adhesives. As smartphones, tablets, and wearables become smaller and more powerful, the need for precise, reliable bonding solutions has grown. Film adhesives are being used to bond displays, touchscreens, and internal components, providing the strength and durability needed to withstand daily wear and tear while ensuring that the devices remain slim and lightweight. Innovations in flexible and conductive adhesives are opening up new possibilities for flexible electronics, where components need to bend and flex without losing structural integrity. These advancements are driving the adoption of film adhesives in emerging technologies like foldable smartphones, wearable medical devices, and flexible sensors.

The renewable energy sector is also seeing increased use of film adhesives in the manufacturing of wind turbines and solar panels. In wind energy, film adhesives are used to bond composite materials in turbine blades, ensuring that they can withstand the high-stress environments of wind farms while remaining lightweight. In solar energy, film adhesives are used to bond photovoltaic cells to substrates, providing long-lasting durability and resistance to environmental factors like UV radiation and moisture. As the demand for clean energy grows, the need for reliable bonding solutions in renewable energy infrastructure is driving innovation in film adhesive technologies that can meet the unique challenges of these industries.

Another significant innovation in film adhesives is the development of environmentally friendly, low-VOC (volatile organic compound) formulations. These adhesives are designed to reduce the environmental impact of manufacturing processes by minimizing the release of harmful chemicals into the atmosphere. This is particularly important in industries like automotive and aerospace, where sustainability is becoming a top priority. Additionally, advancements in adhesive formulations are improving the bonding strength and flexibility of film adhesives, making them more versatile and capable of handling a wider range of materials, including advanced composites and lightweight metals.

What Factors Are Driving the Growth of the Film Adhesives Market?

Several key factors are driving the growth of the film adhesives market, including the increasing demand for lightweight materials in industries such as aerospace and automotive, the shift toward electric vehicles, and the rise of advanced electronics and renewable energy technologies. One of the primary drivers is the need for lightweighting in manufacturing, particularly in aerospace and automotive, where reducing weight is crucial for improving fuel efficiency and performance. Film adhesives offer a lightweight bonding solution that can replace heavier mechanical fasteners, helping manufacturers achieve significant weight reductions without compromising strength or durability.The automotive industry's transition to electric vehicles (EVs) is another significant factor contributing to the growth of the film adhesives market. As EV manufacturers seek to extend battery range and improve overall vehicle performance, the need for lightweight materials and advanced thermal management solutions has become critical. Film adhesives provide an ideal solution for bonding lightweight materials such as aluminum and composites, while also offering the heat resistance needed for bonding battery packs and electronic systems. With the global push toward sustainability and the rapid growth of the EV market, the demand for film adhesives in automotive applications is expected to increase significantly in the coming years.

The rise of advanced electronics and miniaturization is also fueling the demand for film adhesives. As electronic devices become smaller, thinner, and more powerful, manufacturers require bonding solutions that can offer precision, reliability, and durability without adding bulk. Film adhesives provide the consistent bond line thickness needed for assembling small components, while also offering excellent electrical insulation and thermal management properties. With the continued growth of consumer electronics, wearables, and smart devices, the electronics industry is expected to be a major driver of the film adhesives market.

In the aerospace sector, the increasing use of composite materials in aircraft construction is driving the demand for film adhesives. As airlines seek to reduce fuel consumption and emissions, manufacturers are turning to advanced composites to build lighter, more fuel-efficient aircraft. Film adhesives are essential for bonding these composite materials, providing the strength and flexibility needed to withstand the extreme conditions of flight. Additionally, the aerospace industry's focus on improving safety and reducing maintenance costs is leading to the adoption of high-performance film adhesives that offer enhanced resistance to temperature, pressure, and environmental factors.

Technological advancements in adhesive formulations are also contributing to market growth. Innovations in film adhesives, such as improved thermal conductivity, flexibility, and resistance to harsh environments, are expanding their applications across industries. These advancements are allowing film adhesives to be used in more demanding applications, such as in high-temperature environments or in bonding dissimilar materials. As industries continue to push the boundaries of materials science and product design, the demand for advanced film adhesives is expected to grow.

In conclusion, the film adhesives market is poised for significant growth as industries across the globe seek lightweight, durable, and high-performance bonding solutions. With their ability to provide strong, uniform bonds in critical applications, film adhesives are becoming an essential component in industries such as aerospace, automotive, electronics, and renewable energy. As technological advancements continue to improve the performance and versatility of film adhesives, their role in shaping the future of manufacturing and product innovation will only expand.

Report Scope

The report analyzes the Film Adhesives market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Resin (Epoxy, Acrylic, Cyanate Ester, Other Resins); End-Use (Electrical & Electronics, Automotive & Transportation, Consumer, Aerospace, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Electrical & Electronics End-Use segment, which is expected to reach US$769.7 Million by 2030 with a CAGR of 5%. The Automotive & Transportation End-Use segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $410.1 Million in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $439.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Film Adhesives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Film Adhesives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Film Adhesives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AI Technology, Inc., Arkema Group, Axiom Materials, Inc., Bondline Electronic Adhesives, Inc., Cytec Solvay Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Film Adhesives market report include:

- AI Technology, Inc.

- Arkema Group

- Axiom Materials, Inc.

- Bondline Electronic Adhesives, Inc.

- Cytec Solvay Group

- Dai Nippon Printing Co., Ltd.

- Everad Adhesives

- Fastel Adhesives and Substrate Products

- GLUETEX GmbH

- Gurit Holding AG

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hexcel Corporation

- Hmt Mfg. Inc.

- Lord Corporation

- M Company

- Master Bond, Inc.

- NuSil Technology LLC

- Permabond LLC

- Protavic International

- Rogers Corporation

- Royal Ten Cate NV

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AI Technology, Inc.

- Arkema Group

- Axiom Materials, Inc.

- Bondline Electronic Adhesives, Inc.

- Cytec Solvay Group

- Dai Nippon Printing Co., Ltd.

- Everad Adhesives

- Fastel Adhesives and Substrate Products

- GLUETEX GmbH

- Gurit Holding AG

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hexcel Corporation

- Hmt Mfg. Inc.

- Lord Corporation

- M Company

- Master Bond, Inc.

- NuSil Technology LLC

- Permabond LLC

- Protavic International

- Rogers Corporation

- Royal Ten Cate NV

Table Information

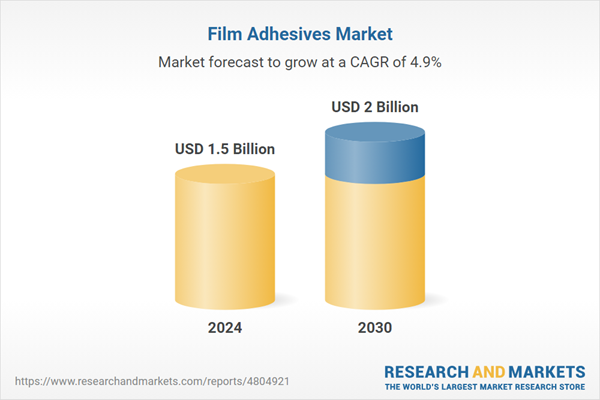

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.5 Billion |

| Forecasted Market Value ( USD | $ 2 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |