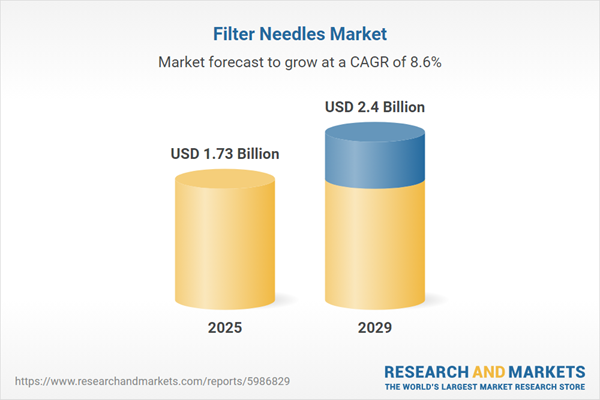

The filter needles market size has grown strongly in recent years. It will grow from $1.59 billion in 2024 to $1.73 billion in 2025 at a compound annual growth rate (CAGR) of 9%. The growth in the historic period can be attributed to growing emphasis on patient safety and infection control, increasing prevalence of chronic diseases, regulatory requirements regarding medication preparation and administration, growth in healthcare infrastructure, and increased healthcare spending globally.

The filter needles market size is expected to see strong growth in the next few years. It will grow to $2.4 billion in 2029 at a compound annual growth rate (CAGR) of 8.6%. The growth in the forecast period can be attributed to growing preference for single-use medical devices to minimize contamination risks, modernization of healthcare facilities, rising aging population, heightened focus on infection control measures, and increasing trend towards home-based healthcare services. Major trends in the forecast period include integration of smart features, emphasis on sustainability in medical device manufacturing, innovation in safety features such as needlestick prevention mechanisms and ergonomic designs, integration of remote monitoring capabilities into filter needle devices, and integration of advanced technologies such as automation and connectivity.

An increase in surgical procedures is anticipated to drive the expansion of the filter needle market in the foreseeable future. Surgical processes involve medical interventions conducted by surgeons or healthcare professionals to address illnesses, injuries, or deformities through operative measures. The surge in surgical procedures is attributed to advancements in medical technology, broader accessibility to healthcare services, and the escalating incidence of chronic diseases necessitating surgical intervention for treatment. Filter needles play a critical role in surgical procedures by ensuring the purity and sterility of medication solutions, thereby safeguarding patient safety and mitigating the risk of contamination or infection during surgeries. For instance, in March 2023, data from the British Association of Aesthetic Plastic Surgeons revealed a significant increase in cosmetic surgical procedures performed in the UK, totaling 31,057 in 2022, marking a notable 102% rise from the previous year. Consequently, the uptick in surgical procedures is propelling the growth of the filter needle market.

Leading companies in the filter needle market are directing their efforts towards the development of innovative solutions, such as integrated filter needles, to enhance their competitive position. Integrated filter needles, characterized by their all-in-one design, eliminate the need for healthcare professionals to change needles after filtering medication, thereby simplifying the medication preparation process. For instance, in May 2024, CarrTech Corp., a US-based medical device firm, introduced the FROG (Filter Removal of Glass) device, a patented medical instrument engineered to streamline the extraction of medications from glass ampoules. The FROG represents an integrated filter needle solution, enabling technicians and providers to withdraw medication from ampoules without needle changes, consequently lowering the risks associated with needle sticks, contamination, and potential harm to patients.

In January 2022, ICU Medical Inc., a US-based company specializing in innovative medical products for infusion therapy, acquired Smiths Medical from Smiths Group plc for an undisclosed sum. The acquisition was intended to integrate syringe and ambulatory infusion devices, vascular access solutions, and vital care products into ICU Medical's existing portfolio. Smiths Medical, also based in the US, is known for its production of filter needles.

Major companies operating in the filter needles market are Cardinal Health, Thermo Fisher Scientific Inc., Novo Nordisk A/S, Asahi Kasei Corporation, Becton, Dickinson And Company, Baxter International Inc., Terumo Corporation, VWR International LLC, Nipro Medical Corporation, Smiths Group, B. Braun Medical Inc., Gerresheimer AG, Hamilton Company, Avanos Medical Inc., Vygon SA, Argon Medical Devices, Filtertek Inc., Apellis Pharmaceuticals Inc., Micronclean Ltd, SOL-MILLENNIUM MEDICAL INC., GBUK Group Ltd, DiaMedical USA, Changzhou SUNTON Medical Technology Co.Ltd, Shanghai Mekon Medical Devices Co. Ltd., Bionic Medizintechnik GmbH.

North America was the largest region in the filter needles market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the filter needles market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the filter needles market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A filter needle is a specialized medical instrument crafted with an integrated filter aimed at eliminating particulates, contaminants, or impurities from medications or solutions being drawn into or expelled from a syringe. Frequently employed in medical environments, these needles play a critical role in guaranteeing the safety and purity of injectable medications, especially during the process of withdrawing medication from ampoules or reconstituting powdered drugs.

The primary varieties of filter needles encompass membrane filter needles, depth filter needles, and others. Membrane filter needles are specialized medical tools engineered with a porous membrane serving as a filtration barrier to eliminate particulate matter and impurities from liquid medications or solutions. They are crafted from materials such as stainless steel, glass, and others, with applications spanning drug preparation, laboratory procedures, and more. These needles find utility across a spectrum of end-users, including hospitals, clinics, ambulatory surgery centers, and others.

The filter needles market research report is one of a series of new reports that provides filter needles market statistics, including the filter needles industry global market size, regional shares, competitors with filter needles market share, detailed filter needles market segments, market trends, and opportunities, and any further data you may need to thrive in the filter needles industry. These filter needles market research reports deliver a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The filter needles market consists of sales of vented filter needles, needle-free filter devices, standard filter needles, syringe filter needles, blunt filter needles, inline filter needles, and prefilter needles. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Filter Needles Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on filter needles market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for filter needles ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The filter needles market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Membrane Filter Needles; Depth Filter Needles; Other Types2) By Raw Material: Stainless Steel; Glass; Other Raw Materials

3) By Application: Drug Preparation; Laboratory Procedures; Other Applications

4) By End Use: Hospitals; Clinics; Ambulatory Surgery Centers; Other End Uses

Subsegments:

1) Membrane Filter Needles: Polypropylene Membrane Filter Needles; Nylon Membrane Filter Needles; PVDF Membrane Filter Needles2) Depth Filter Needles: Fiberglass Depth Filter Needles; Cellulose Depth Filter Needles; Polypropylene Depth Filter Needles

3) Other Types: Activated Carbon Filter Needles; Glass Fiber Filter Needles; Stainless Steel Filter Needles

Key Companies Mentioned: Cardinal Health; Thermo Fisher Scientific Inc.; Novo Nordisk a/S; Asahi Kasei Corporation; Becton, Dickinson and Company

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Filter Needles market report include:- Cardinal Health

- Thermo Fisher Scientific Inc.

- Novo Nordisk A/S

- Asahi Kasei Corporation

- Becton, Dickinson And Company

- Baxter International Inc.

- Terumo Corporation

- VWR International LLC

- Nipro Medical Corporation

- Smiths Group

- B. Braun Medical Inc.

- Gerresheimer AG

- Hamilton Company

- Avanos Medical Inc.

- Vygon SA

- Argon Medical Devices

- Filtertek Inc.

- Apellis Pharmaceuticals Inc.

- Micronclean Ltd

- SOL-MILLENNIUM MEDICAL INC.

- GBUK Group Ltd

- DiaMedical USA

- Changzhou SUNTON Medical Technology Co.Ltd

- Shanghai Mekon Medical Devices Co. Ltd.

- Bionic Medizintechnik GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.73 Billion |

| Forecasted Market Value ( USD | $ 2.4 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |