Speak directly to the analyst to clarify any post sales queries you may have.

Essential overview of fire resistant lubricant fundamentals emphasizing safety integration, chemical trade-offs, and the evolving role of lubrication in asset risk management

Fire resistant lubricants occupy a critical niche where safety, performance, and regulatory compliance intersect. These specialized formulations are engineered to reduce the risk of catastrophic ignition in high-temperature and high-pressure environments while maintaining the tribological properties required by industrial equipment. The technical landscape spans water-based and synthetic chemistries, varying degrees of thermal stability, and distinct trade-offs between fire resistance and lubricity. As operations modernize, maintenance teams and reliability engineers increasingly treat lubricant selection as an active component of asset risk management rather than a purely cost-driven commodity choice.

In addition to their core function of reducing friction and wear, fire resistant lubricants play a preventive role in sectors where ignition sources and combustible materials coexist. The interplay between chemical formulation and equipment compatibility requires close collaboration among formulators, OEMs, and end users to reconcile material compatibility with seals, metals, and insulation systems. Furthermore, evolving workplace safety regulations and industry standards are compelling organizations to re-evaluate legacy fluids and adopt safer alternatives. Consequently, procurement cycles now incorporate technical validation, safety case documentation, and cross-functional sign-off, which elevates lubricant strategy to a board-level operational resilience consideration.

How regulation, digital maintenance practices, and sustainability priorities are converging to redefine formulation choices and supplier responsibilities across the lubricant value chain

The fire resistant lubricant landscape is undergoing several transformative shifts driven by regulation, technology, and sustainability priorities. Regulatory pressure has tightened requirements around workplace safety and environmental impact, compelling manufacturers to accelerate the reformulation of legacy products and validate new chemistries against stricter flammability and biodegradability criteria. At the same time, digitalization in maintenance practices-such as condition-based monitoring and predictive analytics-has shifted the value proposition of lubricants toward long-term reliability and measurable operational outcomes rather than short-term cost savings.

Technological innovation is reshaping formulation strategies. Advances in synthetic ester chemistry, refined phosphate ester stabilization, and new water-miscible systems have expanded the options available to engineers faced with tough fire-safety requirements. These innovations are accompanied by improvements in additive technologies that mitigate corrosion, enhance anti-wear performance, and extend service intervals. Sustainability considerations are also prompting end users to demand lower-toxicity formulations, reduced lifecycle environmental footprint, and packaging solutions that align with circular economy initiatives. Together, these trends are causing manufacturers, distributors, and end users to reconfigure supply chains, place greater emphasis on validation testing, and prioritize transparency in specification documentation.

Evaluation of the cascading operational consequences of United States 2025 tariff measures on procurement strategies, supplier qualification, and supply chain resilience

United States tariff actions in 2025 produced a series of cumulative effects that extend beyond simple cost adjustments, influencing supply chain strategies, supplier selection, and inventory management practices. Tariffs altered the calculus for global procurement by increasing the relative cost of certain imported raw materials and finished formulations, which in turn prompted buyers to re-examine domestic sourcing options, qualify alternative suppliers, and, in some cases, reformulate to rely on domestically available chemistries. These procurement decisions have had cascading implications for inventory holding patterns and lead-time buffers, as buyers sought to mitigate exposure to further trade policy volatility.

Operationally, the tariff environment accelerated conversations around near-shoring and dual-sourcing strategies. Organizations that had previously depended on single-source imports began to invest in supplier redundancy and local partnerships to preserve continuity of supply. This strategic pivot required investments in qualification testing and documentation to ensure that alternate suppliers met cross-sector performance and compatibility expectations. Moreover, the tariff-driven cost increases incentivized collaboration between formulators and end users to identify cost-neutral reformulation pathways or packaging efficiencies that could offset price impacts without compromising safety or performance. In sum, tariffs in 2025 reshaped supply priorities by heightening the emphasis on supply chain resilience, qualification agility, and closer commercial-technical collaboration between manufacturers and customers.

Integrated segmentation analysis connecting product chemistries, packaging formats, application demands, end-use industrial drivers, and evolving distribution channels to strategic supplier decisions

Insightful segmentation provides a structured lens for interpreting product performance, logistics challenges, and end-user requirements. When considering product type across HFA (High Water Content Fluids), HFB (Water Glycol Fluids), HFC (Polyol Esters or Synthetic Ester Fluids), HFDR (Phosphate Esters), and HFDU (Anhydrous Synthetic Fluids), it becomes apparent that each chemistry presents distinct trade-offs in fire resistance, thermal stability, and material compatibility; consequently, selection hinges on the application’s thermal profile, seal and metallurgy interfaces, and environmental considerations. Packaging choices among Bulk, Drum, and Intermediate Bulk Container formats drive different supply chain decisions: bulk deliveries favor high-volume continuous operations and streamlined logistics, while drums and IBCs provide flexibility for intermittent demand and facilitate tighter lot-level traceability.

Application segmentation across chain oils, compressor fluid, gear oils, greases, hydraulic fluid, transformer fluids, and turbine oils clarifies how operational requirements shape formulation priorities. For instance, compressor and turbine fluids demand exceptional oxidative stability and foaming resistance, whereas greases and chain oils prioritize adhesion and particulate entrainment control. End use industry differentiation spanning Aerospace & Defense, Automotive, Chemical, Energy & Power, Mining, Oil & Gas, and Steel & Metal Processing determines regulatory exposure, duty-cycle severity, and maintenance cadence, which in turn influences inventory practices and specification strictness. Finally, distribution channel dynamics between offline and online procurement pathways are altering how technical data, certification evidence, and traceability documentation are accessed and validated, with online channels expanding availability while offline channels continue to dominate for specialized technical sales and onsite support.

Comparative regional analysis of supply chain, compliance, and adoption patterns across the Americas, Europe Middle East & Africa, and Asia-Pacific that shape procurement and specification choices

Regional dynamics significantly influence supply chain design, regulatory compliance needs, and technology adoption rates. In the Americas, the combination of mature industrial infrastructure and evolving safety regulations creates strong demand for validated high-performance formulations and value-added services such as technical audits and onsite training. North American procurement teams emphasize reliability, supplier transparency, and robust documentation to support asset reliability programs, while Latin American markets may prioritize cost-effective solutions that balance availability with adequate safety performance.

In Europe, Middle East & Africa, regulatory frameworks and environmental standards drive conservative adoption paths for novel chemistries, with end users often requiring extended compatibility testing and lifecycle assessments. Furthermore, energy and power sectors in the EMEA region exert steady demand for proven transformer and turbine fluid technologies. In contrast, the Asia-Pacific region exhibits a broad spectrum of adoption: highly industrialized economies demand advanced synthetic esters and rigorous qualification, while developing markets focus on scalable solutions and accessible supply chains. The Asia-Pacific manufacturing base also plays a major role in global raw material supply, which influences formulation choices worldwide. Across all regions, compliance, logistics infrastructure, and local manufacturing capacity are key determinants of product selection and procurement strategy.

Capability and competitive analysis of leading formulators and service-focused suppliers emphasizing R&D differentiation, OEM partnerships, and supply chain excellence

Competitive dynamics are driven by a blend of formulation expertise, application-specific validation capabilities, and supply chain reliability. Leading companies differentiate through investments in research and development that expand the operational envelope of fire resistant lubricants, including improvements in thermal stability, additive compatibility, and reduced environmental toxicity. Strategic partnerships with original equipment manufacturers and end users for co-development projects are common, enabling faster qualification cycles and tailored product portfolios that align with specific asset requirements.

Service differentiation is also critical; companies offering comprehensive technical support-ranging from in-situ fluid testing and failure analysis to training programs and specification audits-tend to secure longer-term contracts and higher customer loyalty. Supply chain excellence, including regional warehousing, certified logistics, and transparent sourcing of raw materials, further elevates supplier attractiveness. Additionally, firms that proactively publish safety data, compatibility matrices, and third-party validation reports gain credibility with technical procurement teams. Finally, a focus on sustainability and lifecycle impact reduction positions certain suppliers to meet the shifting priorities of risk-averse and environmentally conscious customers.

Practical and prioritized recommendations for suppliers and end users to improve supplier resilience, technical validation, packaging efficiency, and sustainability performance in lubricant portfolios

Industry leaders should prioritize a set of pragmatic actions to enhance resilience, optimize performance, and align lubricant strategy with broader operational objectives. First, strengthen supplier qualification protocols by incorporating multi-attribute testing that examines fire resistance, material compatibility, and environmental impact under representative operating conditions. Adopting rigorous qualification criteria reduces downstream risk and shortens the time needed to validate alternate suppliers when supply disruptions occur.

Second, implement dual-sourcing or near-shoring where feasible to mitigate exposure to trade policy shifts and raw material bottlenecks. This approach should be accompanied by investments in joint validation programs to ensure alternate suppliers meet technical expectations. Third, integrate lubricant specification and monitoring into the broader predictive maintenance strategy by leveraging condition-monitoring tools and scheduled fluid analysis to inform proactive change-out and replenishment decisions. Fourth, collaborate with suppliers on packaging optimization and returnable or consolidated container programs to drive logistics efficiencies and reduce lifecycle waste. Finally, embed sustainability metrics into procurement scorecards to reflect regulatory trends and stakeholder expectations, ensuring that safety and environmental performance are both tracked and rewarded within supplier relationships.

Transparent explanation of primary interviews, technical literature review, multi-criteria analyses, and validation techniques used to produce reliable and actionable lubricant insights

The research methodology blends primary stakeholder engagement, technical literature review, and structured validation to ensure robust, actionable insights. Primary inputs included interviews with maintenance engineers, procurement leaders, formulators, and OEM technical representatives to capture firsthand perspectives on performance priorities, qualification hurdles, and supply chain constraints. The investigative approach also incorporated a systematic review of publicly available technical papers, regulatory standards, material safety data sheets, and OEM compatibility guidance to ground the analysis in authoritative technical detail.

Analytical frameworks employed include multi-criteria trade-off analysis to evaluate formulation attributes against application requirements and risk matrices to map supplier resilience under different disruption scenarios. Findings were validated through cross-referencing interview responses with technical documentation and third-party compatibility data where available. Throughout the process, emphasis was placed on transparency of assumptions and traceability of source material to ensure that conclusions are defensible, replicable, and relevant to both procurement and engineering audiences. Any proprietary datasets used to enrich the analysis were integrated with clear provenance and contextual explanation.

Concise synthesis of strategic imperatives, collaborative validation needs, and supply chain priorities to maximize safety, reliability, and sustainable adoption of fire resistant lubricants

In conclusion, the intersection of safety imperatives, evolving chemistry options, regulatory tightening, and supply chain volatility is redefining how organizations approach fire resistant lubricant selection and lifecycle management. Technical choice is no longer only a matter of compatibility; it is integral to operational resilience, regulatory compliance, and environmental stewardship. Companies that proactively align procurement policy with rigorous technical validation, diversify their supplier base, and adopt condition-based maintenance practices will be better positioned to manage risk and achieve sustained equipment reliability.

Moving forward, successful adoption will require collaborative engagement between formulators, OEMs, and end users to co-develop specifications that balance fire resistance with long-term performance. Further, supply chain strategies that prioritize redundancy, regional capacity, and transparent sourcing will reduce exposure to policy-driven disruptions. Ultimately, the organizations that view lubricant strategy as a cross-functional priority-integrated into asset management, procurement, and sustainability frameworks-will derive the most value from advanced fire resistant lubricant solutions.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Fire Resistant Lubricant Market

Companies Mentioned

The key companies profiled in this Fire Resistant Lubricant market report include:- BASF SE

- BioBlend Renewable Resources, LLC

- Castrol Limited

- Chevron Corporation

- Condat S.A.

- Eastman Chemical Company

- ExxonMobil Corporation

- Fuchs Petrolub SE

- Klüber Lubrication

- KMN Lubricants

- KOST USA

- Lanxess AG

- MORESCO Corporation

- Phillips 66 Company

- Quaker Chemical Corporation

- Shell PLC

- The Dow Chemical Company

- The Hill and Griffith Company

- TotalEnergies SE

- Twin Specialties Corp.

- U.S. Lubricants

- USHA LUBES Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | January 2026 |

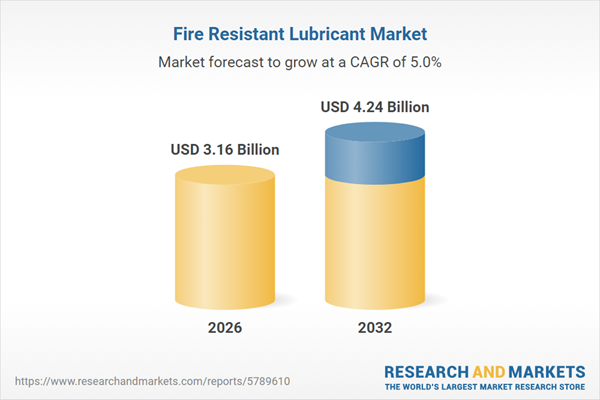

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 3.16 Billion |

| Forecasted Market Value ( USD | $ 4.24 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |