At present, the market is growing due to rising demand for processed and packaged food products. People are seeking convenient and ready-to-eat (RTE) items, which is increasing the use of additives that improve taste, texture, and shelf life. Food manufacturers are employing preservatives, stabilizers, and colorants to maintain product quality. The trend of healthier eating is also driving the demand for natural additives like plant-based sweeteners and colors. Besides this, as urban lifestyles are becoming busier, people continue to rely more on packaged food, supporting the market growth. Increasing worldwide population and disposable incomes are further boosting utilization. Moreover, technological advancements in food processing are encouraging innovations in additive use.

The United States has emerged as a major region in the food additives market owing to many factors. Increasing demand for processed and convenience food items is impelling the food additives market growth. Rising population is catalyzing food demand, creating the need for additives to enhance shelf life. According to the Worldometer, as of Sunday, June 1, 2025, the population of the United States stood at 347,119,300. People prefer RTE meals, snacks, and beverages, promoting the use of preservatives, flavor enhancers, and emulsifiers. The growing health consciousness among Americans is also driving the demand for natural additives, such as plant-based colors, natural sweeteners, and clean-label ingredients. Food manufacturers are investing in innovations to improve taste, texture, and shelf life while meeting regulatory standards. In addition, the popularity of low-fat, low-sugar, and gluten-free products is encouraging the utilization of specialized additives. Apart from this, advancements in food processing technologies and packaging are facilitating wider employment of additives.

Food Additives Market Trends:

Rising demand for convenience food items

The escalating demand for convenience food items is propelling the market growth. According to the publisher, the global convenience food market reached USD 511.1 Billion in 2024 and is set to broaden at a CAGR of 5.25% from 2025-2033. Convenience food products, which include RTE meals, packaged snacks, and microwaveable items, offer consumers an easy and quick way to satiate hunger without the hassle of cooking from scratch. These products often require the incorporation of various additives to maintain their taste, texture, and shelf life. In line with this, preservatives are used to extend the longevity of these items, flavor enhancers heighten the taste, and emulsifiers ensure a consistent texture. Moreover, urban, suburban, and rural areas are witnessing significant growth in on-the-go lifestyles, which in turn is driving the demand for food products that not only save time but also meet quality expectations, thus encouraging manufacturers to utilize a range of food additives.Rapid globalization of food supply chains

The rapid globalization of food supply chains is positively influencing the market. Food products are sourced and distributed across great distances, often crossing multiple international borders. This global network introduces challenges in maintaining the safety, quality, and longevity of food products. In line with this, food additives, such as preservatives and stabilizers, are becoming crucial. Consequently, the global food preservatives market is growing at a CAGR of 3.57% from 2025-2033 and is anticipated to attain USD 4.51 Billion by 2033, as per the publisher. They act as safeguarding agents that help maintain the food's quality, safety, and appeal during its journey from the farm to the consumer's table. Furthermore, the exponential growth in globally sourced food products owing to the implementation of various international trade agreements is further elevating the need for effective food additives to ensure that they reach people in optimal condition.Escalating health awareness among consumers

Escalating health awareness among consumers is offering a favorable food additives market outlook. Individuals are reading nutrition labels, researching ingredients, and seeking food items that offer health benefits beyond basic nutrition, which, in turn, is driving the demand for functional food additives, such as vitamins, minerals, and probiotics. Overall, the functional foods market reached USD 233.8 Billion in 2024 and is set to grow at a CAGR of 5.45% during 2025-2033, according to industry reports. These additives not only enhance the food's sensory attributes but also offer additional health benefits. Furthermore, the heightened awareness about diet-oriented health issues, such as cardiovascular diseases (CVDs), diabetes, and obesity, is encouraging consumers to opt for foods with reduced sugar, salt, and fat content. For instance, in 2023, cardiovascular diseases (CVDs) ranked as the top cause of mortality globally, accounting for around 17.9 Million fatalities annually, as reported by the World Health Organization (WHO). This has paved the way for the incorporation of alternative ingredients that serve the function of additives like stevia and plant sterols.Food Additives Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global food additives market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, source, and application.Analysis by Product Type:

- Colorants

- Synthetic Food Colorants

- Natural Food Colorants

- Emulsifiers

- Mono, Di-glycerides & Derivatives

- Lecithin

- Sorbate Esters

- Enzymes

- Carbohydrase

- Protease

- Lipase

- Fat Replacers

- Protein

- Starch

- Others

- Flavors and Enhancers

- Natural Flavors

- Artificial Flavors and Enhancers

- Shelf-life Stabilizers

- Sweeteners

- HIS

- HFCS

- Others

- Others

Analysis by Source:

- Natural

- Synthetic

Analysis by Application:

- Bakery and Confectionery

- Beverages

- Convenience Foods

- Dairy and Frozen Desserts

- Spices, Condiments, Sauces and Dressings

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Food Additives Market Analysis

The United States holds 87.50% of the market share in North America. The market is primarily driven by shifting consumer preferences, regulatory influences, and industry requirements. Increasing awareness about food quality, safety, and nutrition has heightened the demand for natural and clean-label additives, such as plant-based preservatives and colorants. Simultaneously, rising preferences for processed and convenience food products are creating the need for additives that enhance shelf life, flavor, and texture. According to this report, the convenience foods market in the United States is growing at a CAGR of 3.33% during 2025-2033. Furthermore, innovations in food technology have led to the development of multifunctional additives, improving efficiency and reducing production costs for manufacturers. The rise of health-conscious consumerism has also increased the use of fortifying agents like vitamins and minerals in functional food products and beverages. Additionally, the food service and packaged food sectors continue to expand, particularly with the proliferation of online food delivery platforms, further catalyzing the demand. According to the US Department of Agriculture (USDA), in 2023, the food retail and food service sectors provided USD 2.6 Trillion in food, with food service establishments contributing USD 1.5 Trillion. Besides this, regulatory oversight from agencies, such as the FDA, is ensuring safety and compliance, encouraging transparency, fostering consumer trust, and supporting the market growth.Europe Food Additives Market Analysis

The Europe market is experiencing robust growth, fueled by regulatory, consumer, and industry trends. A key factor is the increasing demand for processed and convenience food items, which require preservatives, flavor enhancers, emulsifiers, and colorants to maintain taste, appearance, and shelf life. Changing lifestyles and the growing preference for RTE meals and snacks among busy urban populations are driving this demand. The market is also being propelled by the rising trend of sustainable and plant-based food production as manufacturers continue to seek additives that align with environmental and ethical concerns. The increasing adoption of vegan and vegetarian diets across Europe has created the need for plant-derived additives like natural colorants, thickeners, and flavor enhancers. According to a 2021 industry report, 38% of citizens in Europe were discovered to be adhering to a vegan, vegetarian, flexitarian, or pescatarian diet. Among these, Austria had the highest percentage of vegans at 5% of its total population, while the UK had the greatest number of vegetarians, making up 7% of its total population. Additionally, the popularity of ethnic cuisines and gourmet products is encouraging the employment of specialty additives that enhance taste and authenticity.Asia-Pacific Food Additives Market Analysis

In the Asia-Pacific region, the market is expanding due to rapid urbanization and shifting dietary patterns. This is creating the need for convenience and processed food items, which often require additives for preservation and enhancement. For instance, in India, the food processing sector is projected to more than double from USD 307 Billion in 2023 to USD 700 Billion by 2030, as per the India Brand Equity Foundation (IBEF). The burgeoning food processing sector is expected to subsequently catalyze the demand for adequate food additives. Moreover, economic growth in countries, such as China, India, and Southeast Asia, has led to higher disposable incomes, allowing people to spend more on premium food products that incorporate additives for improved quality and taste. The expanding middle-class population is also driving the demand for premium food products, which often incorporate specialty additives to meet quality and taste expectations.Latin America Food Additives Market Analysis

The Latin America market is significantly influenced by the region’s thriving F&B manufacturing sector, supported by foreign investments and government initiatives to modernize food production infrastructure. Growth in export-oriented food industries, particularly in Brazil, Argentina, and Chile, is driving the demand for additives that ensure product stability during transportation and long shelf life. For instance, Argentina ranked as the third largest food exporter globally, with an average food export value of USD 34.83 billion from 2019 to 2021, according to the World Bank Group. During the same timeframe, Brazil exported an average of USD 84.53 billion in food products. Increased consumer interest in fortified food items aimed at addressing nutrient deficiencies, particularly in rural and underserved populations, is further boosting the use of vitamin and mineral additives, making the market both economically and socially relevant across Latin America.Middle East and Africa Food Additives Market Analysis

In the Middle East and Africa region, the market is being increasingly propelled by the growing influence of Western dietary patterns and globalization of food supply chains, which are introducing a variety of international food products requiring specific additives. The rise in health-conscious consumerism is catalyzing the demand for natural and clean-label additives, encouraging innovations in plant-based and organic ingredient solutions for individuals following organic and plant-based diets. For instance, the plant-based food market in Saudi Arabia reached USD 0.11 Billion in 2024 and is set to grow at a CAGR of 11.28% during 2025-2033, according to the publisher. Other than this, broadening halal food production, which requires compliant additive utilization, is further strengthening the market. Increasing investments from multinational food companies are also fueling regional market expansion.Competitive Landscape:

Top companies are developing new types of food additives that are more efficient, cost-effective, and aligned with consumer needs. Furthermore, they are proactively working to comply with international food safety regulations to not only ensure the safety and quality of their products but also better position themselves in the global distribution chain. Besides this, leading market players are forming alliances and partnerships with other companies, research institutions, and government agencies to pool resources and expertise for more effective and rapid development of new products and technologies. In addition, companies are expanding their market presence through mergers, acquisitions, and entering new geographical territories. Moreover, several key players are focusing on sustainability by sourcing raw materials responsibly, reducing waste, and decreasing the environmental impact of their operations and products. For instance, in June 2024, the Food Safety and Standards Authority of India (FSSAI) declared changes to the Food Safety and Standards (Food Products Standards and Food Additives) Regulations, 2011. Key changes involved removing the minimum requirement for total soluble solids and replacing ‘nutritive sweeteners’ with ‘sweeteners’ in synthetic syrups for carbonated beverages. Additionally, acidity restrictions were no longer applicable for retort or aseptically processed sauces and culinary pastes.The report provides a comprehensive analysis of the competitive landscape in the food additives market with detailed profiles of all major companies, including:

- Ajinomoto Co. Inc.

- Archer Daniels Midland

- BASF SE

- Cargill Incorporated

- Chr. Hansen A/S

- Corbion N.V.

- Dow Chemical Company

- Eastman Chemical Company

- Givaudan

- Ingredion Incorporated

- Kerry Group

- Koninklijke DSM N.V.

- Novozymes A/S

- Tate & Lyle

Key Questions Answered in This Report

1. How big is the food additives market?2. What is the future outlook of food additives market?

3. What are the key factors driving the food additives market?

4. Which region accounts for the largest food additives market share?

5. Which are the leading companies in the global food additives market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Food Additives Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Product Type

6.1 Colorants

6.1.1 Market Trends

6.1.2 Major Types

6.1.2.1 Synthetic Food Colorants

6.1.2.2 Natural Food Colorants

6.1.3 Market Forecast

6.2 Emulsifiers

6.2.1 Market Trends

6.2.2 Major Types

6.2.2.1 Mono, Di-glycerides & Derivatives

6.2.2.2 Lecithin

6.2.2.3 Sorbate Esters

6.2.3 Market Forecast

6.3 Enzymes

6.3.1 Market Trends

6.3.2 Major Types

6.3.2.1 Carbohydrase

6.3.2.2 Protease

6.3.2.3 Lipase

6.3.3 Market Forecast

6.4 Fat Replacers

6.4.1 Market Trends

6.4.2 Major Types

6.4.2.1 Protein

6.4.2.2 Starch

6.4.2.3 Others

6.4.3 Market Forecast

6.5 Flavors and Enhancers

6.5.1 Market Trends

6.5.2 Major Types

6.5.2.1 Natural Flavors

6.5.2.2 Artificial Flavors & Enhancers

6.5.3 Market Forecast

6.6 Shelf-life Stabilizers

6.6.1 Market Trends

6.6.2 Market Forecast

6.7 Sweeteners

6.7.1 Market Trends

6.7.2 Major Types

6.7.2.1 HIS

6.7.2.2 HFCS

6.7.2.3 Others

6.7.3 Market Forecast

6.8 Others

6.8.1 Market Trends

6.8.2 Market Forecast

7 Market Breakup by Source

7.1 Natural

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Synthetic

7.2.1 Market Trends

7.2.2 Market Forecast

8 Market Breakup by Application

8.1 Bakery & Confectionery

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Beverages

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Convenience Foods

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Dairy & Frozen Desserts

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Spices, Condiments, Sauces & Dressings

8.5.1 Market Trends

8.5.2 Market Forecast

8.6 Others

8.6.1 Market Trends

8.6.2 Market Forecast

9 Market Breakup by Region

9.1 North America

9.1.1 United States

9.1.1.1 Market Trends

9.1.1.2 Market Forecast

9.1.2 Canada

9.1.2.1 Market Trends

9.1.2.2 Market Forecast

9.2 Asia Pacific

9.2.1 China

9.2.1.1 Market Trends

9.2.1.2 Market Forecast

9.2.2 Japan

9.2.2.1 Market Trends

9.2.2.2 Market Forecast

9.2.3 India

9.2.3.1 Market Trends

9.2.3.2 Market Forecast

9.2.4 South Korea

9.2.4.1 Market Trends

9.2.4.2 Market Forecast

9.2.5 Australia

9.2.5.1 Market Trends

9.2.5.2 Market Forecast

9.2.6 Indonesia

9.2.6.1 Market Trends

9.2.6.2 Market Forecast

9.2.7 Others

9.2.7.1 Market Trends

9.2.7.2 Market Forecast

9.3 Europe

9.3.1 Germany

9.3.1.1 Market Trends

9.3.1.2 Market Forecast

9.3.2 France

9.3.2.1 Market Trends

9.3.2.2 Market Forecast

9.3.3 United Kingdom

9.3.3.1 Market Trends

9.3.3.2 Market Forecast

9.3.4 Italy

9.3.4.1 Market Trends

9.3.4.2 Market Forecast

9.3.5 Spain

9.3.5.1 Market Trends

9.3.5.2 Market Forecast

9.3.6 Russia

9.3.6.1 Market Trends

9.3.6.2 Market Forecast

9.3.7 Others

9.3.7.1 Market Trends

9.3.7.2 Market Forecast

9.4 Latin America

9.4.1 Brazil

9.4.1.1 Market Trends

9.4.1.2 Market Forecast

9.4.2 Mexico

9.4.2.1 Market Trends

9.4.2.2 Market Forecast

9.4.3 Others

9.4.3.1 Market Trends

9.4.3.2 Market Forecast

9.5 Middle East and Africa

9.5.1 Market Trends

9.5.2 Market Breakup by Country

9.5.3 Market Forecast

10 SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Price Indicators

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 Ajinomoto Co. Inc.

14.3.1.1 Company Overview

14.3.1.2 Product Portfolio

14.3.1.3 Financials

14.3.1.4 SWOT Analysis

14.3.2 Archer Daniels Midland

14.3.2.1 Company Overview

14.3.2.2 Product Portfolio

14.3.2.3 Financials

14.3.2.4 SWOT Analysis

14.3.3 BASF SE

14.3.3.1 Company Overview

14.3.3.2 Product Portfolio

14.3.3.3 Financials

14.3.3.4 SWOT Analysis

14.3.4 Cargill Incorporated

14.3.4.1 Company Overview

14.3.4.2 Product Portfolio

14.3.4.3 SWOT Analysis

14.3.5 Chr. Hansen A/S

14.3.5.1 Company Overview

14.3.5.2 Product Portfolio

14.3.5.3 Financials

14.3.6 Corbion N.V.

14.3.6.1 Company Overview

14.3.6.2 Product Portfolio

14.3.6.3 Financials

14.3.7 Dow Chemical Company

14.3.7.1 Company Overview

14.3.7.2 Product Portfolio

14.3.7.3 Financials

14.3.8 Eastman Chemical Company

14.3.8.1 Company Overview

14.3.8.2 Product Portfolio

14.3.8.3 Financials

14.3.8.4 SWOT Analysis

14.3.9 Givaudan

14.3.9.1 Company Overview

14.3.9.2 Product Portfolio

14.3.10 Ingredion Incorporated

14.3.10.1 Company Overview

14.3.10.2 Product Portfolio

14.3.10.3 Financials

14.3.10.4 SWOT Analysis

14.3.11 Kerry Group

14.3.11.1 Company Overview

14.3.11.2 Product Portfolio

14.3.11.3 Financials

14.3.12 Koninklijke DSM N.V.

14.3.12.1 Company Overview

14.3.12.2 Product Portfolio

14.3.12.3 Financials

14.3.12.4 SWOT Analysis

14.3.13 Novozymes A/S

14.3.13.1 Company Overview

14.3.13.2 Product Portfolio

14.3.13.3 Financials

14.3.13.4 SWOT Analysis

14.3.14 Tate & Lyle

14.3.14.1 Company Overview

14.3.14.2 Product Portfolio

14.3.14.3 Financials

14.3.14.4 SWOT Analysis

List of Figures

Figure 1: Global: Food Additives Market: Major Drivers and Challenges

Figure 2: Global: Food Additives Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Food Additives Market: Breakup by Product Type (in %), 2024

Figure 4: Global: Food Additives Market: Breakup by Source (in %), 2024

Figure 5: Global: Food Additives Market: Breakup by Application (in %), 2024

Figure 6: Global: Food Additives Market: Breakup by Region (in %), 2024

Figure 7: Global: Food Additives Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 8: Global: Food Additives (Colorants) Market: Sales Value (in Million USD), 2019 & 2024

Figure 9: Global: Food Additives (Colorants) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 10: Global: Food Additives (Emulsifiers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Food Additives (Emulsifiers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Food Additives (Enzymes) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Food Additives (Enzymes) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Food Additives (Fat Replacers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Food Additives (Fat Replacers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Food Additives (Flavors and Enhancers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Food Additives (Flavors and Enhancers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Food Additives (Shelf-life Stabilizers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Food Additives (Shelf-life Stabilizers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Food Additives (Sweeteners) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Food Additives (Sweeteners) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Food Additives (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Food Additives (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Food Additives (Natural) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Food Additives (Natural) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Food Additives (Synthetic) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Food Additives (Synthetic) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Food Additives (Bakery & Confectionery) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Food Additives (Bakery & Confectionery) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Food Additives (Beverages) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Food Additives (Beverages) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Food Additives (Convenience Foods) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Food Additives (Convenience Foods) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Food Additives (Dairy & Frozen Desserts) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Food Additives (Dairy & Frozen Desserts) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Global: Food Additives (Spices, Condiments, Sauces & Dressings) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Global: Food Additives (Spices, Condiments, Sauces & Dressings) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Global: Food Additives (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Global: Food Additives (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: North America: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: North America: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: United States: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: United States: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: Canada: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: Canada: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: Asia Pacific: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: Asia Pacific: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: China: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: China: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: Japan: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: Japan: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: India: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: India: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: South Korea: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: South Korea: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: Australia: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: Australia: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: Indonesia: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: Indonesia: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: Others: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: Others: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: Europe: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: Europe: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: Germany: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: Germany: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: France: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: France: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: United Kingdom: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: United Kingdom: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: Italy: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: Italy: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: Spain: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: Spain: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Russia: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Russia: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Others: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Others: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Latin America: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: Latin America: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: Brazil: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: Brazil: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: Mexico: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 83: Mexico: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 84: Others: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 85: Others: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 86: Middle East and Africa: Food Additives Market: Sales Value (in Million USD), 2019 & 2024

Figure 87: Middle East and Africa: Food Additives Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 88: Global: Food Additives Industry: SWOT Analysis

Figure 89: Global: Food Additives Industry: Value Chain Analysis

Figure 90: Global: Food Additives Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: Food Additives Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Food Additives Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

Table 3: Global: Food Additives Market Forecast: Breakup by Source (in Million USD), 2025-2033

Table 4: Global: Food Additives Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 5: Global: Food Additives Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 6: Global: Food Additives Market: Competitive Structure

Table 7: Global: Food Additives Market: Key Players

Companies Mentioned

- Ajinomoto Co. Inc.

- Archer Daniels Midland

- BASF SE

- Cargill Incorporated

- Chr. Hansen A/S

- Corbion N.V.

- Dow Chemical Company

- Eastman Chemical Company

- Givaudan

- Ingredion Incorporated

- Kerry Group

- Koninklijke DSM N.V.

- Novozymes A/S

- Tate & Lyle

Table Information

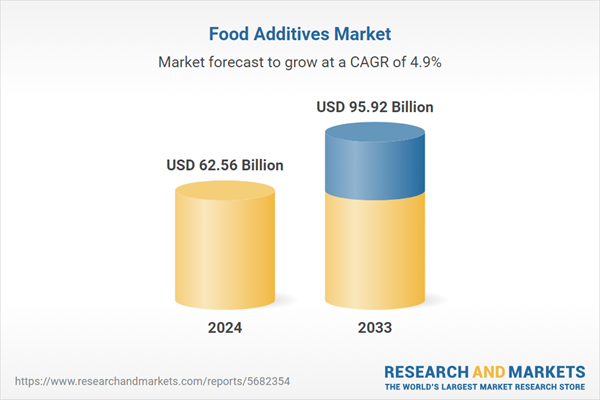

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 62.56 Billion |

| Forecasted Market Value ( USD | $ 95.92 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |