Global Formwork Systems Market - Key Trends & Drivers Summarized

Why Are Formwork Systems at the Core of Modern Construction Methodologies?

Formwork systems have become a fundamental element of global construction practices, supporting the shaping and stabilization of concrete structures during casting and curing. These temporary or permanent molds are critical in ensuring structural integrity, dimensional accuracy, and efficient project execution. With the global construction industry experiencing significant growth - driven by urbanization, infrastructure modernization, and rising residential and commercial developments - the demand for advanced, reusable, and cost-effective formwork solutions has surged. Unlike traditional timber-based systems, modern formwork utilizes materials like steel, aluminum, plastic, and engineered wood to increase durability, reduce waste, and improve safety. The shift toward high-rise buildings, complex architectural forms, and mega infrastructure projects has further underscored the importance of adaptable and modular formwork systems that can accommodate challenging geometries and timelines. Their role is not only technical but also economic, as efficient formwork can significantly reduce labor costs, construction time, and material consumption. As sustainability and speed become priorities across construction ecosystems, formwork systems are proving indispensable in delivering quality, safety, and efficiency across a broad spectrum of structural projects worldwide.How Are Technology and Design Innovations Reshaping Formwork Solutions?

Advancements in materials science, automation, and construction design are revolutionizing the capabilities and applications of formwork systems. Lightweight aluminum formwork systems have become increasingly popular due to their portability, strength-to-weight ratio, and corrosion resistance - offering significant advantages in both vertical and horizontal structural elements. Modular systems, which can be reused multiple times across different projects, are helping contractors reduce waste and achieve cost savings while maintaining high accuracy. Innovations like self-climbing formwork, jump form systems, and tunnel formwork are enhancing the construction of high-rise buildings, bridges, and tunnels by enabling faster and safer construction cycles with reduced crane dependency. 3D modeling, Building Information Modeling (BIM), and digital formwork planning tools are also being integrated to optimize formwork layout, streamline scheduling, and improve on-site coordination. Robotic formwork placement and automated removal systems are emerging in advanced markets, increasing efficiency and minimizing labor risks. Moreover, formwork panels with embedded sensors are being tested to monitor pressure, temperature, and curing conditions in real time, allowing for proactive adjustments and quality assurance. These technological shifts are transforming formwork from a passive support structure into a dynamic, intelligent construction tool aligned with the demands of next-generation building practices.Which Construction Sectors and Global Markets Are Driving Formwork System Demand?

Formwork systems are widely used across residential, commercial, industrial, and infrastructure construction projects, with each segment demanding specialized solutions tailored to project scale and complexity. In residential and high-rise construction, formwork is essential for casting walls, slabs, staircases, and columns, especially in repetitive floor plans where modular systems offer high productivity. In the infrastructure sector, bridges, highways, tunnels, and metro rail projects heavily rely on custom-engineered formwork to support complex geometries and large-scale pours. In industrial construction - such as factories, energy plants, and storage facilities - formwork is used to build durable concrete foundations and structural frameworks. Geographically, the Asia-Pacific region leads the market, driven by rapid urbanization, government infrastructure programs, and booming real estate development in China, India, and Southeast Asia. Europe and North America follow closely, with high demand for advanced formwork systems that meet sustainability targets and strict safety regulations. The Middle East, fueled by megaprojects in Saudi Arabia, the UAE, and Qatar, is also a significant growth market. In Latin America and Africa, expanding urban populations and investments in affordable housing and transport infrastructure are gradually boosting demand for cost-effective, reusable formwork systems, highlighting a global trend toward modularity, efficiency, and industrialized construction.What Are the Key Forces Accelerating Growth and Shaping Market Trajectories?

The growth in the formwork systems market is driven by several critical factors rooted in construction dynamics, cost-efficiency imperatives, labor considerations, and technological transformation. First, the global surge in infrastructure development - including roads, bridges, airports, and urban transit - has created a vast demand for flexible and scalable formwork solutions capable of handling diverse architectural and engineering requirements. Second, labor shortages and rising labor costs in key construction markets are pushing contractors toward formwork systems that reduce manual handling, enable faster assembly, and support automation. Third, sustainability regulations and green building standards are encouraging the use of reusable, recyclable, and low-waste formwork materials, which align with LEED and other environmental certification goals. Fourth, rising investment in affordable housing and mass housing schemes in developing regions is creating demand for standardized formwork systems that support repetitive, high-speed construction. Additionally, digital construction trends such as BIM integration and data-driven project management are encouraging the adoption of intelligent formwork solutions that enhance site visibility, resource planning, and structural accuracy. Finally, strategic collaborations between construction firms and formwork manufacturers are driving innovation in system design, logistics, and rental services - broadening the appeal of formwork as a high-value, service-integrated solution. Together, these drivers are positioning formwork systems as a central enabler of modern construction efficiency, safety, and sustainability across global markets.Report Scope

The report analyzes the Formwork Systems market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Offering (Solution, Services); Type (Timber Formwork, Steel Formwork, Aluminum Formwork, Other Types); Applications (Buildings, Transportation, Industrial Facilities, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solution Component segment, which is expected to reach US$5.5 Billion by 2030 with a CAGR of a 5%. The Services Component segment is also set to grow at 2.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.9 Billion in 2024, and China, forecasted to grow at an impressive 7.7% CAGR to reach $1.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Formwork Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Formwork Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Formwork Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agilent Technologies Inc., Alpha Laboratories Ltd., Arrowhead Forensics, Becton, Dickinson and Company, BÜHLMANN Laboratories AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Formwork Systems market report include:

- Acrow Corporation

- Alsina Formwork

- BrandSafway

- Doka GmbH

- EFCO Corp

- Faresin Formwork S.p.A.

- FORSA S.A.

- Harsco Infrastructure

- Hünnebeck GmbH

- MEVA Schalungs-Systeme GmbH

- MFE Formwork Technology

- NOE-Schaltechnik

- PASCHAL-Werk G. Maier GmbH

- PERI GmbH

- Pilosio S.p.A.

- RMD Kwikform

- Suzhou TECON Construction

- ULMA Construction

- Urtim Formwork and Scaffolding

- Waco International

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acrow Corporation

- Alsina Formwork

- BrandSafway

- Doka GmbH

- EFCO Corp

- Faresin Formwork S.p.A.

- FORSA S.A.

- Harsco Infrastructure

- Hünnebeck GmbH

- MEVA Schalungs-Systeme GmbH

- MFE Formwork Technology

- NOE-Schaltechnik

- PASCHAL-Werk G. Maier GmbH

- PERI GmbH

- Pilosio S.p.A.

- RMD Kwikform

- Suzhou TECON Construction

- ULMA Construction

- Urtim Formwork and Scaffolding

- Waco International

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 370 |

| Published | February 2026 |

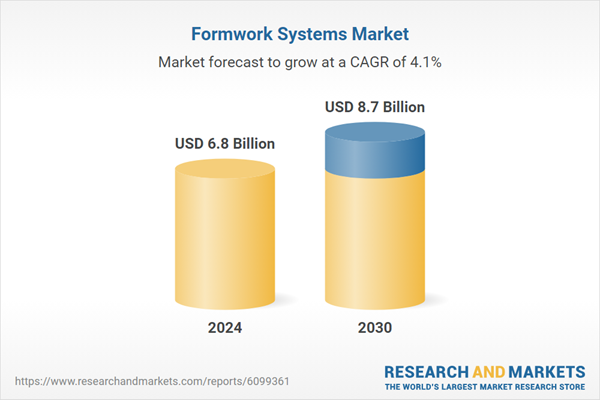

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.8 Billion |

| Forecasted Market Value ( USD | $ 8.7 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |