1h Free Analyst Time

Speak directly to the analyst to clarify any post sales queries you may have.

The fresh food market is undergoing complex transformation as buyers, suppliers, and channel partners adapt to shifting consumer expectations, regulatory requirements, and supply chain realities. Leaders seeking long-term value must prioritize agile responses to sector volatility, technological change, and evolving distribution formats.

Market Snapshot

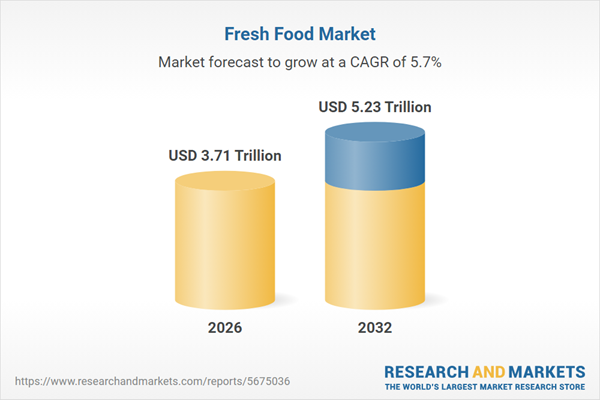

The Fresh Food Market expanded from USD 3.53 trillion in 2025 to USD 3.71 trillion in 2026 and is forecast to reach USD 5.23 trillion by 2032, reflecting a CAGR of 5.74%. This growth reflects the combined impact of rising demand, rapid channel innovation, regulatory shifts, and investment in sustainability.

Scope & Segmentation

- Product Types: Bakery & Snacks, Dairy & Eggs, Fruits, Meat & Poultry, Seafood, Vegetables

- Distribution Channels: Supermarkets & Hypermarkets, Specialty Stores, Convenience Stores, Online Retail (including Direct to Consumer and E-Retailers), Foodservice (including Restaurants, Cafes & Bakeries, Hotels & Catering)

- End Users: Commercial (Hospitality, Institutional) and Residential segments

- Regional Coverage: Americas, Europe Middle East & Africa, Asia-Pacific

- Procurement Focus: Supplier diversification, traceability, sourcing strategies, and risk management

- Technology Drivers: Cold chain logistics, inventory management systems, packaging innovations, and provenance tracking

Key Takeaways

- Technological adoption—especially enhanced cold chain tracking and real-time inventory visibility—supports longer shelf life, targeted waste reduction, and improved assortment testing for fresh food market participants.

- Increasing consumer demand for transparency and sustainability is prompting greater investment in provenance assurance and traceability systems, affecting supplier partnerships and brand positioning.

- Channel convergence, including digital and convenience formats, challenges legacy distribution models and accelerates omnichannel strategy redesign, integrating education and freshness guarantees into service models.

- Competitive differentiation arises from a blend of operational excellence, capability in digital fulfillment, and the ability to form resilient partnerships between producers, distributors, and retailers.

- Firms must continually reassess capital allocation, supply relationships, and innovation investment to meet both regulatory requirements and consumer quality standards.

Tariff Impact

Recent changes in the 2025 tariff landscape have added complexity to cross-border sourcing and procurement processes. Adjustments in policy have triggered adaptations such as diversifying supplier locations, shortening lead times, and re-negotiating terms to address cost and supply continuity risks. Companies are increasingly turning to regional sourcing and reformulation to offset margin pressures, while integrating scenario analysis and flexible logistics into risk management playbooks.

Methodology & Data Sources

Research for this report combined interviews with stakeholders—producers, processors, distributors, retailers, and foodservice operators—with direct field observations of distribution and cold chain operations. Secondary data analysis included trade data, regulatory updates, and operational metrics, providing cross-validated patterns for robust, actionable insights.

Why This Report Matters

- Supports procurement, operations, and commercial leaders in aligning strategies with fresh food market realities and technological advances.

- Equips executives to address channel transformation, regulatory changes, and ongoing volatility with clear, evidence-based guidance.

- Enables data-driven decisions that strengthen supplier diversification, waste reduction, and resilience in complex market conditions.

Conclusion

Sector success depends on integrating supply, channel, and regulatory strategies with disciplined execution. Those who adapt quickly will enhance margin protection, customer loyalty, and sustained advantage in the evolving fresh food market.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

1. Preface

1.1. Objectives of the Study

1.2. Market Definition

1.3. Market Segmentation & Coverage

1.4. Years Considered for the Study

1.5. Currency Considered for the Study

1.6. Language Considered for the Study

1.7. Key Stakeholders

1.2. Market Definition

1.3. Market Segmentation & Coverage

1.4. Years Considered for the Study

1.5. Currency Considered for the Study

1.6. Language Considered for the Study

1.7. Key Stakeholders

2. Research Methodology

2.1. Introduction

2.2. Research Design

2.2.1. Primary Research

2.2.2. Secondary Research

2.3. Research Framework

2.3.1. Qualitative Analysis

2.3.2. Quantitative Analysis

2.4. Market Size Estimation

2.4.1. Top-Down Approach

2.4.2. Bottom-Up Approach

2.5. Data Triangulation

2.6. Research Outcomes

2.7. Research Assumptions

2.8. Research Limitations

2.2. Research Design

2.2.1. Primary Research

2.2.2. Secondary Research

2.3. Research Framework

2.3.1. Qualitative Analysis

2.3.2. Quantitative Analysis

2.4. Market Size Estimation

2.4.1. Top-Down Approach

2.4.2. Bottom-Up Approach

2.5. Data Triangulation

2.6. Research Outcomes

2.7. Research Assumptions

2.8. Research Limitations

3. Executive Summary

3.1. Introduction

3.2. CXO Perspective

3.3. Market Size & Growth Trends

3.4. Market Share Analysis, 2025

3.5. FPNV Positioning Matrix, 2025

3.6. New Revenue Opportunities

3.7. Next-Generation Business Models

3.8. Industry Roadmap

3.2. CXO Perspective

3.3. Market Size & Growth Trends

3.4. Market Share Analysis, 2025

3.5. FPNV Positioning Matrix, 2025

3.6. New Revenue Opportunities

3.7. Next-Generation Business Models

3.8. Industry Roadmap

4. Market Overview

4.1. Introduction

4.2. Industry Ecosystem & Value Chain Analysis

4.2.1. Supply-Side Analysis

4.2.2. Demand-Side Analysis

4.2.3. Stakeholder Analysis

4.3. Porter’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Market Outlook

4.5.1. Near-Term Market Outlook (0-2 Years)

4.5.2. Medium-Term Market Outlook (3-5 Years)

4.5.3. Long-Term Market Outlook (5-10 Years)

4.6. Go-to-Market Strategy

4.2. Industry Ecosystem & Value Chain Analysis

4.2.1. Supply-Side Analysis

4.2.2. Demand-Side Analysis

4.2.3. Stakeholder Analysis

4.3. Porter’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Market Outlook

4.5.1. Near-Term Market Outlook (0-2 Years)

4.5.2. Medium-Term Market Outlook (3-5 Years)

4.5.3. Long-Term Market Outlook (5-10 Years)

4.6. Go-to-Market Strategy

5. Market Insights

5.1. Consumer Insights & End-User Perspective

5.2. Consumer Experience Benchmarking

5.3. Opportunity Mapping

5.4. Distribution Channel Analysis

5.5. Pricing Trend Analysis

5.6. Regulatory Compliance & Standards Framework

5.7. ESG & Sustainability Analysis

5.8. Disruption & Risk Scenarios

5.9. Return on Investment & Cost-Benefit Analysis

5.2. Consumer Experience Benchmarking

5.3. Opportunity Mapping

5.4. Distribution Channel Analysis

5.5. Pricing Trend Analysis

5.6. Regulatory Compliance & Standards Framework

5.7. ESG & Sustainability Analysis

5.8. Disruption & Risk Scenarios

5.9. Return on Investment & Cost-Benefit Analysis

7. Cumulative Impact of Artificial Intelligence 2025

8. Fresh Food Market, by Source

8.1. Conventional

8.2. Organic

8.2. Organic

9. Fresh Food Market, by Product Type

9.1. Fruits

9.1.1. Citrus Fruits

9.1.1.1. Oranges

9.1.1.2. Lemons

9.1.1.3. Limes

9.1.1.4. Grapefruits

9.1.2. Berries

9.1.2.1. Strawberries

9.1.2.2. Blueberries

9.1.2.3. Raspberries

9.1.3. Pome Fruits

9.1.3.1. Apples

9.1.3.2. Pears

9.1.4. Stone Fruits

9.1.4.1. Peaches & Nectarines

9.1.4.2. Plums

9.1.4.3. Cherries

9.1.5. Tropical & Exotic Fruits

9.1.5.1. Bananas

9.1.5.2. Mangoes

9.1.5.3. Pineapples

9.1.5.4. Avocado

9.1.6. Melons

9.1.6.1. Watermelons

9.1.6.2. Cantaloupes & Honeydews

9.2. Vegetables

9.2.1. Leafy Greens

9.2.1.1. Lettuce

9.2.1.2. Spinach

9.2.1.3. Kale & Chard

9.2.2. Cruciferous Vegetables

9.2.2.1. Broccoli

9.2.2.2. Cauliflower

9.2.2.3. Cabbage & Brussels Sprouts

9.2.3. Root & Tuber Vegetables

9.2.3.1. Potatoes

9.2.3.2. Carrots

9.2.3.3. Beets & Radishes

9.2.4. Allium Vegetables

9.2.4.1. Onions

9.2.4.2. Garlic

9.2.4.3. Leeks & Spring Onions

9.2.5. Nightshade Vegetables

9.2.5.1. Tomatoes

9.2.5.2. Peppers & Chilies

9.2.5.3. Eggplants

9.2.6. Gourds & Squash

9.2.6.1. Pumpkins

9.2.6.2. Zucchini & Summer Squash

9.2.7. Legume Vegetables

9.2.7.1. Green Peas

9.2.7.2. Green Beans

9.3. Meat & Poultry

9.3.1. Red Meat

9.3.1.1. Beef

9.3.1.2. Pork

9.3.1.3. Lamb & Mutton

9.3.2. Poultry

9.3.2.1. Chicken

9.3.2.2. Turkey

9.3.2.3. Duck & Goose

9.3.3. Game Meat

9.3.3.1. Venison

9.3.3.2. Rabbit & Other Game Meat

9.4. Seafood

9.4.1. Fish

9.4.1.1. White Fish

9.4.1.2. Oily Fish

9.4.2. Shellfish

9.4.2.1. Crustaceans

9.4.2.2. Mollusks

9.5. Dairy

9.5.1. Milk

9.5.2. Fresh Cheese

9.5.3. Yogurt & Cultured Products

9.5.4. Cream

9.5.5. Butter

9.6. Eggs

9.6.1. Chicken Eggs

9.7. Bakery

9.7.1. Bread & Rolls

9.7.2. Pastries & Croissants

9.7.3. Cakes & Muffins

9.7.4. Fresh Desserts & Puddings

9.8. Ready-To-Eat Meals

9.8.1. Chilled Prepared Meals

9.8.2. Fresh Pizza & Savory Bakery

9.8.3. Fresh Pasta & Noodle Meals

9.8.4. Fresh Sushi & Asian-Style Meals

9.8.5. Fresh Sandwiches & Wraps

9.8.6. Salad Meals & Bowls

9.9. Fresh Prepared Components

9.9.1. Cut Fruit Packs

9.9.2. Cut Vegetable Packs

9.9.3. Salad Kits & Mixes

9.9.4. Fresh Dips & Spreads

9.9.5. Fresh Sauces & Marinades

9.10. Herbs & Spices

9.10.1. Fresh Herbs

9.10.2. Fresh Chili Peppers

9.10.3. Fresh Spice Roots

9.1.1. Citrus Fruits

9.1.1.1. Oranges

9.1.1.2. Lemons

9.1.1.3. Limes

9.1.1.4. Grapefruits

9.1.2. Berries

9.1.2.1. Strawberries

9.1.2.2. Blueberries

9.1.2.3. Raspberries

9.1.3. Pome Fruits

9.1.3.1. Apples

9.1.3.2. Pears

9.1.4. Stone Fruits

9.1.4.1. Peaches & Nectarines

9.1.4.2. Plums

9.1.4.3. Cherries

9.1.5. Tropical & Exotic Fruits

9.1.5.1. Bananas

9.1.5.2. Mangoes

9.1.5.3. Pineapples

9.1.5.4. Avocado

9.1.6. Melons

9.1.6.1. Watermelons

9.1.6.2. Cantaloupes & Honeydews

9.2. Vegetables

9.2.1. Leafy Greens

9.2.1.1. Lettuce

9.2.1.2. Spinach

9.2.1.3. Kale & Chard

9.2.2. Cruciferous Vegetables

9.2.2.1. Broccoli

9.2.2.2. Cauliflower

9.2.2.3. Cabbage & Brussels Sprouts

9.2.3. Root & Tuber Vegetables

9.2.3.1. Potatoes

9.2.3.2. Carrots

9.2.3.3. Beets & Radishes

9.2.4. Allium Vegetables

9.2.4.1. Onions

9.2.4.2. Garlic

9.2.4.3. Leeks & Spring Onions

9.2.5. Nightshade Vegetables

9.2.5.1. Tomatoes

9.2.5.2. Peppers & Chilies

9.2.5.3. Eggplants

9.2.6. Gourds & Squash

9.2.6.1. Pumpkins

9.2.6.2. Zucchini & Summer Squash

9.2.7. Legume Vegetables

9.2.7.1. Green Peas

9.2.7.2. Green Beans

9.3. Meat & Poultry

9.3.1. Red Meat

9.3.1.1. Beef

9.3.1.2. Pork

9.3.1.3. Lamb & Mutton

9.3.2. Poultry

9.3.2.1. Chicken

9.3.2.2. Turkey

9.3.2.3. Duck & Goose

9.3.3. Game Meat

9.3.3.1. Venison

9.3.3.2. Rabbit & Other Game Meat

9.4. Seafood

9.4.1. Fish

9.4.1.1. White Fish

9.4.1.2. Oily Fish

9.4.2. Shellfish

9.4.2.1. Crustaceans

9.4.2.2. Mollusks

9.5. Dairy

9.5.1. Milk

9.5.2. Fresh Cheese

9.5.3. Yogurt & Cultured Products

9.5.4. Cream

9.5.5. Butter

9.6. Eggs

9.6.1. Chicken Eggs

9.7. Bakery

9.7.1. Bread & Rolls

9.7.2. Pastries & Croissants

9.7.3. Cakes & Muffins

9.7.4. Fresh Desserts & Puddings

9.8. Ready-To-Eat Meals

9.8.1. Chilled Prepared Meals

9.8.2. Fresh Pizza & Savory Bakery

9.8.3. Fresh Pasta & Noodle Meals

9.8.4. Fresh Sushi & Asian-Style Meals

9.8.5. Fresh Sandwiches & Wraps

9.8.6. Salad Meals & Bowls

9.9. Fresh Prepared Components

9.9.1. Cut Fruit Packs

9.9.2. Cut Vegetable Packs

9.9.3. Salad Kits & Mixes

9.9.4. Fresh Dips & Spreads

9.9.5. Fresh Sauces & Marinades

9.10. Herbs & Spices

9.10.1. Fresh Herbs

9.10.2. Fresh Chili Peppers

9.10.3. Fresh Spice Roots

10. Fresh Food Market, by End User

10.1. Commercial

10.1.1. Hospitality

10.1.2. Institutional

10.2. Residential

10.1.1. Hospitality

10.1.2. Institutional

10.2. Residential

11. Fresh Food Market, by Distribution Channel

11.1. Convenience Stores

11.2. Foodservice

11.2.1. Cafes Bakeries

11.2.2. Hotels Catering

11.2.3. Restaurants

11.3. Online Retail

11.4. Specialty Stores

11.5. Supermarkets Hypermarkets

11.2. Foodservice

11.2.1. Cafes Bakeries

11.2.2. Hotels Catering

11.2.3. Restaurants

11.3. Online Retail

11.4. Specialty Stores

11.5. Supermarkets Hypermarkets

12. Fresh Food Market, by Region

12.1. Americas

12.1.1. North America

12.1.2. Latin America

12.2. Europe, Middle East & Africa

12.2.1. Europe

12.2.2. Middle East

12.2.3. Africa

12.3. Asia-Pacific

12.1.1. North America

12.1.2. Latin America

12.2. Europe, Middle East & Africa

12.2.1. Europe

12.2.2. Middle East

12.2.3. Africa

12.3. Asia-Pacific

13. Fresh Food Market, by Group

13.1. ASEAN

13.2. GCC

13.3. European Union

13.4. BRICS

13.5. G7

13.6. NATO

13.2. GCC

13.3. European Union

13.4. BRICS

13.5. G7

13.6. NATO

14. Fresh Food Market, by Country

14.1. United States

14.2. Canada

14.3. Mexico

14.4. Brazil

14.5. United Kingdom

14.6. Germany

14.7. France

14.8. Russia

14.9. Italy

14.10. Spain

14.11. China

14.12. India

14.13. Japan

14.14. Australia

14.15. South Korea

14.2. Canada

14.3. Mexico

14.4. Brazil

14.5. United Kingdom

14.6. Germany

14.7. France

14.8. Russia

14.9. Italy

14.10. Spain

14.11. China

14.12. India

14.13. Japan

14.14. Australia

14.15. South Korea

16. China Fresh Food Market

17. Competitive Landscape

17.1. Market Concentration Analysis, 2025

17.1.1. Concentration Ratio (CR)

17.1.2. Herfindahl Hirschman Index (HHI)

17.2. Recent Developments & Impact Analysis, 2025

17.3. Product Portfolio Analysis, 2025

17.4. Benchmarking Analysis, 2025

17.5. AeroFarms, LLC

17.6. AppHarvest, Inc.

17.7. Bonduelle Group

17.8. Bowery Farming, Inc.

17.9. BrightFarms, Inc.

17.10. Chiquita Brands International S.A.

17.11. Dole Food Company, Inc.

17.12. Driscoll's, Inc.

17.13. Earthbound Farm, LLC

17.14. Fresh Del Monte Produce Inc.

17.15. Gotham Greens

17.16. Grimmway Farms, Inc.

17.17. Houweling's Tomatoes

17.18. Mann Packing Company, Inc.

17.19. Mastronardi Produce Ltd.

17.20. Mucci Farms

17.21. Naturipe Berry Growers

17.22. Naturipe Farms, LLC

17.23. Ocean Mist Farms

17.24. Plenty Unlimited Inc.

17.25. Tanimura & Antle, Inc.

17.26. Taylor Farms

17.27. Well-Pict Berries

17.28. Wish Farms, Inc.

17.1.1. Concentration Ratio (CR)

17.1.2. Herfindahl Hirschman Index (HHI)

17.2. Recent Developments & Impact Analysis, 2025

17.3. Product Portfolio Analysis, 2025

17.4. Benchmarking Analysis, 2025

17.5. AeroFarms, LLC

17.6. AppHarvest, Inc.

17.7. Bonduelle Group

17.8. Bowery Farming, Inc.

17.9. BrightFarms, Inc.

17.10. Chiquita Brands International S.A.

17.11. Dole Food Company, Inc.

17.12. Driscoll's, Inc.

17.13. Earthbound Farm, LLC

17.14. Fresh Del Monte Produce Inc.

17.15. Gotham Greens

17.16. Grimmway Farms, Inc.

17.17. Houweling's Tomatoes

17.18. Mann Packing Company, Inc.

17.19. Mastronardi Produce Ltd.

17.20. Mucci Farms

17.21. Naturipe Berry Growers

17.22. Naturipe Farms, LLC

17.23. Ocean Mist Farms

17.24. Plenty Unlimited Inc.

17.25. Tanimura & Antle, Inc.

17.26. Taylor Farms

17.27. Well-Pict Berries

17.28. Wish Farms, Inc.

List of Figures

FIGURE 1. GLOBAL FRESH FOOD MARKET SIZE, 2018-2032 (USD MILLION)

FIGURE 2. GLOBAL FRESH FOOD MARKET SHARE, BY KEY PLAYER, 2025

FIGURE 3. GLOBAL FRESH FOOD MARKET, FPNV POSITIONING MATRIX, 2025

FIGURE 4. GLOBAL FRESH FOOD MARKET SIZE, BY SOURCE, 2025 VS 2026 VS 2032 (USD MILLION)

FIGURE 5. GLOBAL FRESH FOOD MARKET SIZE, BY PRODUCT TYPE, 2025 VS 2026 VS 2032 (USD MILLION)

FIGURE 6. GLOBAL FRESH FOOD MARKET SIZE, BY END USER, 2025 VS 2026 VS 2032 (USD MILLION)

FIGURE 7. GLOBAL FRESH FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025 VS 2026 VS 2032 (USD MILLION)

FIGURE 8. GLOBAL FRESH FOOD MARKET SIZE, BY REGION, 2025 VS 2026 VS 2032 (USD MILLION)

FIGURE 9. GLOBAL FRESH FOOD MARKET SIZE, BY GROUP, 2025 VS 2026 VS 2032 (USD MILLION)

FIGURE 10. GLOBAL FRESH FOOD MARKET SIZE, BY COUNTRY, 2025 VS 2026 VS 2032 (USD MILLION)

FIGURE 11. UNITED STATES FRESH FOOD MARKET SIZE, 2018-2032 (USD MILLION)

FIGURE 12. CHINA FRESH FOOD MARKET SIZE, 2018-2032 (USD MILLION)

FIGURE 2. GLOBAL FRESH FOOD MARKET SHARE, BY KEY PLAYER, 2025

FIGURE 3. GLOBAL FRESH FOOD MARKET, FPNV POSITIONING MATRIX, 2025

FIGURE 4. GLOBAL FRESH FOOD MARKET SIZE, BY SOURCE, 2025 VS 2026 VS 2032 (USD MILLION)

FIGURE 5. GLOBAL FRESH FOOD MARKET SIZE, BY PRODUCT TYPE, 2025 VS 2026 VS 2032 (USD MILLION)

FIGURE 6. GLOBAL FRESH FOOD MARKET SIZE, BY END USER, 2025 VS 2026 VS 2032 (USD MILLION)

FIGURE 7. GLOBAL FRESH FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025 VS 2026 VS 2032 (USD MILLION)

FIGURE 8. GLOBAL FRESH FOOD MARKET SIZE, BY REGION, 2025 VS 2026 VS 2032 (USD MILLION)

FIGURE 9. GLOBAL FRESH FOOD MARKET SIZE, BY GROUP, 2025 VS 2026 VS 2032 (USD MILLION)

FIGURE 10. GLOBAL FRESH FOOD MARKET SIZE, BY COUNTRY, 2025 VS 2026 VS 2032 (USD MILLION)

FIGURE 11. UNITED STATES FRESH FOOD MARKET SIZE, 2018-2032 (USD MILLION)

FIGURE 12. CHINA FRESH FOOD MARKET SIZE, 2018-2032 (USD MILLION)

List of Tables

TABLE 1. GLOBAL FRESH FOOD MARKET SIZE, 2018-2032 (USD MILLION)

TABLE 2. GLOBAL FRESH FOOD MARKET SIZE, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 3. GLOBAL FRESH FOOD MARKET SIZE, BY CONVENTIONAL, BY REGION, 2018-2032 (USD MILLION)

TABLE 4. GLOBAL FRESH FOOD MARKET SIZE, BY CONVENTIONAL, BY GROUP, 2018-2032 (USD MILLION)

TABLE 5. GLOBAL FRESH FOOD MARKET SIZE, BY CONVENTIONAL, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 6. GLOBAL FRESH FOOD MARKET SIZE, BY ORGANIC, BY REGION, 2018-2032 (USD MILLION)

TABLE 7. GLOBAL FRESH FOOD MARKET SIZE, BY ORGANIC, BY GROUP, 2018-2032 (USD MILLION)

TABLE 8. GLOBAL FRESH FOOD MARKET SIZE, BY ORGANIC, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 9. GLOBAL FRESH FOOD MARKET SIZE, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 10. GLOBAL FRESH FOOD MARKET SIZE, BY FRUITS, BY REGION, 2018-2032 (USD MILLION)

TABLE 11. GLOBAL FRESH FOOD MARKET SIZE, BY FRUITS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 12. GLOBAL FRESH FOOD MARKET SIZE, BY FRUITS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 13. GLOBAL FRESH FOOD MARKET SIZE, BY FRUITS, 2018-2032 (USD MILLION)

TABLE 14. GLOBAL FRESH FOOD MARKET SIZE, BY CITRUS FRUITS, BY REGION, 2018-2032 (USD MILLION)

TABLE 15. GLOBAL FRESH FOOD MARKET SIZE, BY CITRUS FRUITS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 16. GLOBAL FRESH FOOD MARKET SIZE, BY CITRUS FRUITS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 17. GLOBAL FRESH FOOD MARKET SIZE, BY CITRUS FRUITS, 2018-2032 (USD MILLION)

TABLE 18. GLOBAL FRESH FOOD MARKET SIZE, BY ORANGES, BY REGION, 2018-2032 (USD MILLION)

TABLE 19. GLOBAL FRESH FOOD MARKET SIZE, BY ORANGES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 20. GLOBAL FRESH FOOD MARKET SIZE, BY ORANGES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 21. GLOBAL FRESH FOOD MARKET SIZE, BY LEMONS, BY REGION, 2018-2032 (USD MILLION)

TABLE 22. GLOBAL FRESH FOOD MARKET SIZE, BY LEMONS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 23. GLOBAL FRESH FOOD MARKET SIZE, BY LEMONS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 24. GLOBAL FRESH FOOD MARKET SIZE, BY LIMES, BY REGION, 2018-2032 (USD MILLION)

TABLE 25. GLOBAL FRESH FOOD MARKET SIZE, BY LIMES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 26. GLOBAL FRESH FOOD MARKET SIZE, BY LIMES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 27. GLOBAL FRESH FOOD MARKET SIZE, BY GRAPEFRUITS, BY REGION, 2018-2032 (USD MILLION)

TABLE 28. GLOBAL FRESH FOOD MARKET SIZE, BY GRAPEFRUITS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 29. GLOBAL FRESH FOOD MARKET SIZE, BY GRAPEFRUITS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 30. GLOBAL FRESH FOOD MARKET SIZE, BY BERRIES, BY REGION, 2018-2032 (USD MILLION)

TABLE 31. GLOBAL FRESH FOOD MARKET SIZE, BY BERRIES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 32. GLOBAL FRESH FOOD MARKET SIZE, BY BERRIES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 33. GLOBAL FRESH FOOD MARKET SIZE, BY BERRIES, 2018-2032 (USD MILLION)

TABLE 34. GLOBAL FRESH FOOD MARKET SIZE, BY STRAWBERRIES, BY REGION, 2018-2032 (USD MILLION)

TABLE 35. GLOBAL FRESH FOOD MARKET SIZE, BY STRAWBERRIES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 36. GLOBAL FRESH FOOD MARKET SIZE, BY STRAWBERRIES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 37. GLOBAL FRESH FOOD MARKET SIZE, BY BLUEBERRIES, BY REGION, 2018-2032 (USD MILLION)

TABLE 38. GLOBAL FRESH FOOD MARKET SIZE, BY BLUEBERRIES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 39. GLOBAL FRESH FOOD MARKET SIZE, BY BLUEBERRIES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 40. GLOBAL FRESH FOOD MARKET SIZE, BY RASPBERRIES, BY REGION, 2018-2032 (USD MILLION)

TABLE 41. GLOBAL FRESH FOOD MARKET SIZE, BY RASPBERRIES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 42. GLOBAL FRESH FOOD MARKET SIZE, BY RASPBERRIES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 43. GLOBAL FRESH FOOD MARKET SIZE, BY POME FRUITS, BY REGION, 2018-2032 (USD MILLION)

TABLE 44. GLOBAL FRESH FOOD MARKET SIZE, BY POME FRUITS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 45. GLOBAL FRESH FOOD MARKET SIZE, BY POME FRUITS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 46. GLOBAL FRESH FOOD MARKET SIZE, BY POME FRUITS, 2018-2032 (USD MILLION)

TABLE 47. GLOBAL FRESH FOOD MARKET SIZE, BY APPLES, BY REGION, 2018-2032 (USD MILLION)

TABLE 48. GLOBAL FRESH FOOD MARKET SIZE, BY APPLES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 49. GLOBAL FRESH FOOD MARKET SIZE, BY APPLES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 50. GLOBAL FRESH FOOD MARKET SIZE, BY PEARS, BY REGION, 2018-2032 (USD MILLION)

TABLE 51. GLOBAL FRESH FOOD MARKET SIZE, BY PEARS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 52. GLOBAL FRESH FOOD MARKET SIZE, BY PEARS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 53. GLOBAL FRESH FOOD MARKET SIZE, BY STONE FRUITS, BY REGION, 2018-2032 (USD MILLION)

TABLE 54. GLOBAL FRESH FOOD MARKET SIZE, BY STONE FRUITS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 55. GLOBAL FRESH FOOD MARKET SIZE, BY STONE FRUITS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 56. GLOBAL FRESH FOOD MARKET SIZE, BY STONE FRUITS, 2018-2032 (USD MILLION)

TABLE 57. GLOBAL FRESH FOOD MARKET SIZE, BY PEACHES & NECTARINES, BY REGION, 2018-2032 (USD MILLION)

TABLE 58. GLOBAL FRESH FOOD MARKET SIZE, BY PEACHES & NECTARINES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 59. GLOBAL FRESH FOOD MARKET SIZE, BY PEACHES & NECTARINES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 60. GLOBAL FRESH FOOD MARKET SIZE, BY PLUMS, BY REGION, 2018-2032 (USD MILLION)

TABLE 61. GLOBAL FRESH FOOD MARKET SIZE, BY PLUMS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 62. GLOBAL FRESH FOOD MARKET SIZE, BY PLUMS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 63. GLOBAL FRESH FOOD MARKET SIZE, BY CHERRIES, BY REGION, 2018-2032 (USD MILLION)

TABLE 64. GLOBAL FRESH FOOD MARKET SIZE, BY CHERRIES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 65. GLOBAL FRESH FOOD MARKET SIZE, BY CHERRIES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 66. GLOBAL FRESH FOOD MARKET SIZE, BY TROPICAL & EXOTIC FRUITS, BY REGION, 2018-2032 (USD MILLION)

TABLE 67. GLOBAL FRESH FOOD MARKET SIZE, BY TROPICAL & EXOTIC FRUITS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 68. GLOBAL FRESH FOOD MARKET SIZE, BY TROPICAL & EXOTIC FRUITS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 69. GLOBAL FRESH FOOD MARKET SIZE, BY TROPICAL & EXOTIC FRUITS, 2018-2032 (USD MILLION)

TABLE 70. GLOBAL FRESH FOOD MARKET SIZE, BY BANANAS, BY REGION, 2018-2032 (USD MILLION)

TABLE 71. GLOBAL FRESH FOOD MARKET SIZE, BY BANANAS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 72. GLOBAL FRESH FOOD MARKET SIZE, BY BANANAS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 73. GLOBAL FRESH FOOD MARKET SIZE, BY MANGOES, BY REGION, 2018-2032 (USD MILLION)

TABLE 74. GLOBAL FRESH FOOD MARKET SIZE, BY MANGOES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 75. GLOBAL FRESH FOOD MARKET SIZE, BY MANGOES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 76. GLOBAL FRESH FOOD MARKET SIZE, BY PINEAPPLES, BY REGION, 2018-2032 (USD MILLION)

TABLE 77. GLOBAL FRESH FOOD MARKET SIZE, BY PINEAPPLES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 78. GLOBAL FRESH FOOD MARKET SIZE, BY PINEAPPLES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 79. GLOBAL FRESH FOOD MARKET SIZE, BY AVOCADO, BY REGION, 2018-2032 (USD MILLION)

TABLE 80. GLOBAL FRESH FOOD MARKET SIZE, BY AVOCADO, BY GROUP, 2018-2032 (USD MILLION)

TABLE 81. GLOBAL FRESH FOOD MARKET SIZE, BY AVOCADO, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 82. GLOBAL FRESH FOOD MARKET SIZE, BY MELONS, BY REGION, 2018-2032 (USD MILLION)

TABLE 83. GLOBAL FRESH FOOD MARKET SIZE, BY MELONS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 84. GLOBAL FRESH FOOD MARKET SIZE, BY MELONS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 85. GLOBAL FRESH FOOD MARKET SIZE, BY MELONS, 2018-2032 (USD MILLION)

TABLE 86. GLOBAL FRESH FOOD MARKET SIZE, BY WATERMELONS, BY REGION, 2018-2032 (USD MILLION)

TABLE 87. GLOBAL FRESH FOOD MARKET SIZE, BY WATERMELONS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 88. GLOBAL FRESH FOOD MARKET SIZE, BY WATERMELONS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 89. GLOBAL FRESH FOOD MARKET SIZE, BY CANTALOUPES & HONEYDEWS, BY REGION, 2018-2032 (USD MILLION)

TABLE 90. GLOBAL FRESH FOOD MARKET SIZE, BY CANTALOUPES & HONEYDEWS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 91. GLOBAL FRESH FOOD MARKET SIZE, BY CANTALOUPES & HONEYDEWS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 92. GLOBAL FRESH FOOD MARKET SIZE, BY VEGETABLES, BY REGION, 2018-2032 (USD MILLION)

TABLE 93. GLOBAL FRESH FOOD MARKET SIZE, BY VEGETABLES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 94. GLOBAL FRESH FOOD MARKET SIZE, BY VEGETABLES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 95. GLOBAL FRESH FOOD MARKET SIZE, BY VEGETABLES, 2018-2032 (USD MILLION)

TABLE 96. GLOBAL FRESH FOOD MARKET SIZE, BY LEAFY GREENS, BY REGION, 2018-2032 (USD MILLION)

TABLE 97. GLOBAL FRESH FOOD MARKET SIZE, BY LEAFY GREENS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 98. GLOBAL FRESH FOOD MARKET SIZE, BY LEAFY GREENS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 99. GLOBAL FRESH FOOD MARKET SIZE, BY LEAFY GREENS, 2018-2032 (USD MILLION)

TABLE 100. GLOBAL FRESH FOOD MARKET SIZE, BY LETTUCE, BY REGION, 2018-2032 (USD MILLION)

TABLE 101. GLOBAL FRESH FOOD MARKET SIZE, BY LETTUCE, BY GROUP, 2018-2032 (USD MILLION)

TABLE 102. GLOBAL FRESH FOOD MARKET SIZE, BY LETTUCE, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 103. GLOBAL FRESH FOOD MARKET SIZE, BY SPINACH, BY REGION, 2018-2032 (USD MILLION)

TABLE 104. GLOBAL FRESH FOOD MARKET SIZE, BY SPINACH, BY GROUP, 2018-2032 (USD MILLION)

TABLE 105. GLOBAL FRESH FOOD MARKET SIZE, BY SPINACH, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 106. GLOBAL FRESH FOOD MARKET SIZE, BY KALE & CHARD, BY REGION, 2018-2032 (USD MILLION)

TABLE 107. GLOBAL FRESH FOOD MARKET SIZE, BY KALE & CHARD, BY GROUP, 2018-2032 (USD MILLION)

TABLE 108. GLOBAL FRESH FOOD MARKET SIZE, BY KALE & CHARD, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 109. GLOBAL FRESH FOOD MARKET SIZE, BY CRUCIFEROUS VEGETABLES, BY REGION, 2018-2032 (USD MILLION)

TABLE 110. GLOBAL FRESH FOOD MARKET SIZE, BY CRUCIFEROUS VEGETABLES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 111. GLOBAL FRESH FOOD MARKET SIZE, BY CRUCIFEROUS VEGETABLES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 112. GLOBAL FRESH FOOD MARKET SIZE, BY CRUCIFEROUS VEGETABLES, 2018-2032 (USD MILLION)

TABLE 113. GLOBAL FRESH FOOD MARKET SIZE, BY BROCCOLI, BY REGION, 2018-2032 (USD MILLION)

TABLE 114. GLOBAL FRESH FOOD MARKET SIZE, BY BROCCOLI, BY GROUP, 2018-2032 (USD MILLION)

TABLE 115. GLOBAL FRESH FOOD MARKET SIZE, BY BROCCOLI, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 116. GLOBAL FRESH FOOD MARKET SIZE, BY CAULIFLOWER, BY REGION, 2018-2032 (USD MILLION)

TABLE 117. GLOBAL FRESH FOOD MARKET SIZE, BY CAULIFLOWER, BY GROUP, 2018-2032 (USD MILLION)

TABLE 118. GLOBAL FRESH FOOD MARKET SIZE, BY CAULIFLOWER, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 119. GLOBAL FRESH FOOD MARKET SIZE, BY CABBAGE & BRUSSELS SPROUTS, BY REGION, 2018-2032 (USD MILLION)

TABLE 120. GLOBAL FRESH FOOD MARKET SIZE, BY CABBAGE & BRUSSELS SPROUTS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 121. GLOBAL FRESH FOOD MARKET SIZE, BY CABBAGE & BRUSSELS SPROUTS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 122. GLOBAL FRESH FOOD MARKET SIZE, BY ROOT & TUBER VEGETABLES, BY REGION, 2018-2032 (USD MILLION)

TABLE 123. GLOBAL FRESH FOOD MARKET SIZE, BY ROOT & TUBER VEGETABLES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 124. GLOBAL FRESH FOOD MARKET SIZE, BY ROOT & TUBER VEGETABLES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 125. GLOBAL FRESH FOOD MARKET SIZE, BY ROOT & TUBER VEGETABLES, 2018-2032 (USD MILLION)

TABLE 126. GLOBAL FRESH FOOD MARKET SIZE, BY POTATOES, BY REGION, 2018-2032 (USD MILLION)

TABLE 127. GLOBAL FRESH FOOD MARKET SIZE, BY POTATOES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 128. GLOBAL FRESH FOOD MARKET SIZE, BY POTATOES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 129. GLOBAL FRESH FOOD MARKET SIZE, BY CARROTS, BY REGION, 2018-2032 (USD MILLION)

TABLE 130. GLOBAL FRESH FOOD MARKET SIZE, BY CARROTS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 131. GLOBAL FRESH FOOD MARKET SIZE, BY CARROTS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 132. GLOBAL FRESH FOOD MARKET SIZE, BY BEETS & RADISHES, BY REGION, 2018-2032 (USD MILLION)

TABLE 133. GLOBAL FRESH FOOD MARKET SIZE, BY BEETS & RADISHES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 134. GLOBAL FRESH FOOD MARKET SIZE, BY BEETS & RADISHES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 135. GLOBAL FRESH FOOD MARKET SIZE, BY ALLIUM VEGETABLES, BY REGION, 2018-2032 (USD MILLION)

TABLE 136. GLOBAL FRESH FOOD MARKET SIZE, BY ALLIUM VEGETABLES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 137. GLOBAL FRESH FOOD MARKET SIZE, BY ALLIUM VEGETABLES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 138. GLOBAL FRESH FOOD MARKET SIZE, BY ALLIUM VEGETABLES, 2018-2032 (USD MILLION)

TABLE 139. GLOBAL FRESH FOOD MARKET SIZE, BY ONIONS, BY REGION, 2018-2032 (USD MILLION)

TABLE 140. GLOBAL FRESH FOOD MARKET SIZE, BY ONIONS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 141. GLOBAL FRESH FOOD MARKET SIZE, BY ONIONS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 142. GLOBAL FRESH FOOD MARKET SIZE, BY GARLIC, BY REGION, 2018-2032 (USD MILLION)

TABLE 143. GLOBAL FRESH FOOD MARKET SIZE, BY GARLIC, BY GROUP, 2018-2032 (USD MILLION)

TABLE 144. GLOBAL FRESH FOOD MARKET SIZE, BY GARLIC, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 145. GLOBAL FRESH FOOD MARKET SIZE, BY LEEKS & SPRING ONIONS, BY REGION, 2018-2032 (USD MILLION)

TABLE 146. GLOBAL FRESH FOOD MARKET SIZE, BY LEEKS & SPRING ONIONS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 147. GLOBAL FRESH FOOD MARKET SIZE, BY LEEKS & SPRING ONIONS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 148. GLOBAL FRESH FOOD MARKET SIZE, BY NIGHTSHADE VEGETABLES, BY REGION, 2018-2032 (USD MILLION)

TABLE 149. GLOBAL FRESH FOOD MARKET SIZE, BY NIGHTSHADE VEGETABLES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 150. GLOBAL FRESH FOOD MARKET SIZE, BY NIGHTSHADE VEGETABLES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 151. GLOBAL FRESH FOOD MARKET SIZE, BY NIGHTSHADE VEGETABLES, 2018-2032 (USD MILLION)

TABLE 152. GLOBAL FRESH FOOD MARKET SIZE, BY TOMATOES, BY REGION, 2018-2032 (USD MILLION)

TABLE 153. GLOBAL FRESH FOOD MARKET SIZE, BY TOMATOES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 154. GLOBAL FRESH FOOD MARKET SIZE, BY TOMATOES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 155. GLOBAL FRESH FOOD MARKET SIZE, BY PEPPERS & CHILIES, BY REGION, 2018-2032 (USD MILLION)

TABLE 156. GLOBAL FRESH FOOD MARKET SIZE, BY PEPPERS & CHILIES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 157. GLOBAL FRESH FOOD MARKET SIZE, BY PEPPERS & CHILIES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 158. GLOBAL FRESH FOOD MARKET SIZE, BY EGGPLANTS, BY REGION, 2018-2032 (USD MILLION)

TABLE 159. GLOBAL FRESH FOOD MARKET SIZE, BY EGGPLANTS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 160. GLOBAL FRESH FOOD MARKET SIZE, BY EGGPLANTS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 161. GLOBAL FRESH FOOD MARKET SIZE, BY GOURDS & SQUASH, BY REGION, 2018-2032 (USD MILLION)

TABLE 162. GLOBAL FRESH FOOD MARKET SIZE, BY GOURDS & SQUASH, BY GROUP, 2018-2032 (USD MILLION)

TABLE 163. GLOBAL FRESH FOOD MARKET SIZE, BY GOURDS & SQUASH, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 164. GLOBAL FRESH FOOD MARKET SIZE, BY GOURDS & SQUASH, 2018-2032 (USD MILLION)

TABLE 165. GLOBAL FRESH FOOD MARKET SIZE, BY PUMPKINS, BY REGION, 2018-2032 (USD MILLION)

TABLE 166. GLOBAL FRESH FOOD MARKET SIZE, BY PUMPKINS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 167. GLOBAL FRESH FOOD MARKET SIZE, BY PUMPKINS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 168. GLOBAL FRESH FOOD MARKET SIZE, BY ZUCCHINI & SUMMER SQUASH, BY REGION, 2018-2032 (USD MILLION)

TABLE 169. GLOBAL FRESH FOOD MARKET SIZE, BY ZUCCHINI & SUMMER SQUASH, BY GROUP, 2018-2032 (USD MILLION)

TABLE 170. GLOBAL FRESH FOOD MARKET SIZE, BY ZUCCHINI & SUMMER SQUASH, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 171. GLOBAL FRESH FOOD MARKET SIZE, BY LEGUME VEGETABLES, BY REGION, 2018-2032 (USD MILLION)

TABLE 172. GLOBAL FRESH FOOD MARKET SIZE, BY LEGUME VEGETABLES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 173. GLOBAL FRESH FOOD MARKET SIZE, BY LEGUME VEGETABLES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 174. GLOBAL FRESH FOOD MARKET SIZE, BY LEGUME VEGETABLES, 2018-2032 (USD MILLION)

TABLE 175. GLOBAL FRESH FOOD MARKET SIZE, BY GREEN PEAS, BY REGION, 2018-2032 (USD MILLION)

TABLE 176. GLOBAL FRESH FOOD MARKET SIZE, BY GREEN PEAS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 177. GLOBAL FRESH FOOD MARKET SIZE, BY GREEN PEAS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 178. GLOBAL FRESH FOOD MARKET SIZE, BY GREEN BEANS, BY REGION, 2018-2032 (USD MILLION)

TABLE 179. GLOBAL FRESH FOOD MARKET SIZE, BY GREEN BEANS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 180. GLOBAL FRESH FOOD MARKET SIZE, BY GREEN BEANS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 181. GLOBAL FRESH FOOD MARKET SIZE, BY MEAT & POULTRY, BY REGION, 2018-2032 (USD MILLION)

TABLE 182. GLOBAL FRESH FOOD MARKET SIZE, BY MEAT & POULTRY, BY GROUP, 2018-2032 (USD MILLION)

TABLE 183. GLOBAL FRESH FOOD MARKET SIZE, BY MEAT & POULTRY, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 184. GLOBAL FRESH FOOD MARKET SIZE, BY MEAT & POULTRY, 2018-2032 (USD MILLION)

TABLE 185. GLOBAL FRESH FOOD MARKET SIZE, BY RED MEAT, BY REGION, 2018-2032 (USD MILLION)

TABLE 186. GLOBAL FRESH FOOD MARKET SIZE, BY RED MEAT, BY GROUP, 2018-2032 (USD MILLION)

TABLE 187. GLOBAL FRESH FOOD MARKET SIZE, BY RED MEAT, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 188. GLOBAL FRESH FOOD MARKET SIZE, BY RED MEAT, 2018-2032 (USD MILLION)

TABLE 189. GLOBAL FRESH FOOD MARKET SIZE, BY BEEF, BY REGION, 2018-2032 (USD MILLION)

TABLE 190. GLOBAL FRESH FOOD MARKET SIZE, BY BEEF, BY GROUP, 2018-2032 (USD MILLION)

TABLE 191. GLOBAL FRESH FOOD MARKET SIZE, BY BEEF, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 192. GLOBAL FRESH FOOD MARKET SIZE, BY PORK, BY REGION, 2018-2032 (USD MILLION)

TABLE 193. GLOBAL FRESH FOOD MARKET SIZE, BY PORK, BY GROUP, 2018-2032 (USD MILLION)

TABLE 194. GLOBAL FRESH FOOD MARKET SIZE, BY PORK, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 195. GLOBAL FRESH FOOD MARKET SIZE, BY LAMB & MUTTON, BY REGION, 2018-2032 (USD MILLION)

TABLE 196. GLOBAL FRESH FOOD MARKET SIZE, BY LAMB & MUTTON, BY GROUP, 2018-2032 (USD MILLION)

TABLE 197. GLOBAL FRESH FOOD MARKET SIZE, BY LAMB & MUTTON, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 198. GLOBAL FRESH FOOD MARKET SIZE, BY POULTRY, BY REGION, 2018-2032 (USD MILLION)

TABLE 199. GLOBAL FRESH FOOD MARKET SIZE, BY POULTRY, BY GROUP, 2018-2032 (USD MILLION)

TABLE 200. GLOBAL FRESH FOOD MARKET SIZE, BY POULTRY, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 201. GLOBAL FRESH FOOD MARKET SIZE, BY POULTRY, 2018-2032 (USD MILLION)

TABLE 202. GLOBAL FRESH FOOD MARKET SIZE, BY CHICKEN, BY REGION, 2018-2032 (USD MILLION)

TABLE 203. GLOBAL FRESH FOOD MARKET SIZE, BY CHICKEN, BY GROUP, 2018-2032 (USD MILLION)

TABLE 204. GLOBAL FRESH FOOD MARKET SIZE, BY CHICKEN, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 205. GLOBAL FRESH FOOD MARKET SIZE, BY TURKEY, BY REGION, 2018-2032 (USD MILLION)

TABLE 206. GLOBAL FRESH FOOD MARKET SIZE, BY TURKEY, BY GROUP, 2018-2032 (USD MILLION)

TABLE 207. GLOBAL FRESH FOOD MARKET SIZE, BY TURKEY, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 208. GLOBAL FRESH FOOD MARKET SIZE, BY DUCK & GOOSE, BY REGION, 2018-2032 (USD MILLION)

TABLE 209. GLOBAL FRESH FOOD MARKET SIZE, BY DUCK & GOOSE, BY GROUP, 2018-2032 (USD MILLION)

TABLE 210. GLOBAL FRESH FOOD MARKET SIZE, BY DUCK & GOOSE, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 211. GLOBAL FRESH FOOD MARKET SIZE, BY GAME MEAT, BY REGION, 2018-2032 (USD MILLION)

TABLE 212. GLOBAL FRESH FOOD MARKET SIZE, BY GAME MEAT, BY GROUP, 2018-2032 (USD MILLION)

TABLE 213. GLOBAL FRESH FOOD MARKET SIZE, BY GAME MEAT, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 214. GLOBAL FRESH FOOD MARKET SIZE, BY GAME MEAT, 2018-2032 (USD MILLION)

TABLE 215. GLOBAL FRESH FOOD MARKET SIZE, BY VENISON, BY REGION, 2018-2032 (USD MILLION)

TABLE 216. GLOBAL FRESH FOOD MARKET SIZE, BY VENISON, BY GROUP, 2018-2032 (USD MILLION)

TABLE 217. GLOBAL FRESH FOOD MARKET SIZE, BY VENISON, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 218. GLOBAL FRESH FOOD MARKET SIZE, BY RABBIT & OTHER GAME MEAT, BY REGION, 2018-2032 (USD MILLION)

TABLE 219. GLOBAL FRESH FOOD MARKET SIZE, BY RABBIT & OTHER GAME MEAT, BY GROUP, 2018-2032 (USD MILLION)

TABLE 220. GLOBAL FRESH FOOD MARKET SIZE, BY RABBIT & OTHER GAME MEAT, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 221. GLOBAL FRESH FOOD MARKET SIZE, BY SEAFOOD, BY REGION, 2018-2032 (USD MILLION)

TABLE 222. GLOBAL FRESH FOOD MARKET SIZE, BY SEAFOOD, BY GROUP, 2018-2032 (USD MILLION)

TABLE 223. GLOBAL FRESH FOOD MARKET SIZE, BY SEAFOOD, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 224. GLOBAL FRESH FOOD MARKET SIZE, BY SEAFOOD, 2018-2032 (USD MILLION)

TABLE 225. GLOBAL FRESH FOOD MARKET SIZE, BY FISH, BY REGION, 2018-2032 (USD MILLION)

TABLE 226. GLOBAL FRESH FOOD MARKET SIZE, BY FISH, BY GROUP, 2018-2032 (USD MILLION)

TABLE 227. GLOBAL FRESH FOOD MARKET SIZE, BY FISH, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 228. GLOBAL FRESH FOOD MARKET SIZE, BY FISH, 2018-2032 (USD MILLION)

TABLE 229. GLOBAL FRESH FOOD MARKET SIZE, BY WHITE FISH, BY REGION, 2018-2032 (USD MILLION)

TABLE 230. GLOBAL FRESH FOOD MARKET SIZE, BY WHITE FISH, BY GROUP, 2018-2032 (USD MILLION)

TABLE 231. GLOBAL FRESH FOOD MARKET SIZE, BY WHITE FISH, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 232. GLOBAL FRESH FOOD MARKET SIZE, BY OILY FISH, BY REGION, 2018-2032 (USD MILLION)

TABLE 233. GLOBAL FRESH FOOD MARKET SIZE, BY OILY FISH, BY GROUP, 2018-2032 (USD MILLION)

TABLE 234. GLOBAL FRESH FOOD MARKET SIZE, BY OILY FISH, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 235. GLOBAL FRESH FOOD MARKET SIZE, BY SHELLFISH, BY REGION, 2018-2032 (USD MILLION)

TABLE 236. GLOBAL FRESH FOOD MARKET SIZE, BY SHELLFISH, BY GROUP, 2018-2032 (USD MILLION)

TABLE 237. GLOBAL FRESH FOOD MARKET SIZE, BY SHELLFISH, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 238. GLOBAL FRESH FOOD MARKET SIZE, BY SHELLFISH, 2018-2032 (USD MILLION)

TABLE 239. GLOBAL FRESH FOOD MARKET SIZE, BY CRUSTACEANS, BY REGION, 2018-2032 (USD MILLION)

TABLE 240. GLOBAL FRESH FOOD MARKET SIZE, BY CRUSTACEANS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 241. GLOBAL FRESH FOOD MARKET SIZE, BY CRUSTACEANS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 242. GLOBAL FRESH FOOD MARKET SIZE, BY MOLLUSKS, BY REGION, 2018-2032 (USD MILLION)

TABLE 243. GLOBAL FRESH FOOD MARKET SIZE, BY MOLLUSKS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 244. GLOBAL FRESH FOOD MARKET SIZE, BY MOLLUSKS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 245. GLOBAL FRESH FOOD MARKET SIZE, BY DAIRY, BY REGION, 2018-2032 (USD MILLION)

TABLE 246. GLOBAL FRESH FOOD MARKET SIZE, BY DAIRY, BY GROUP, 2018-2032 (USD MILLION)

TABLE 247. GLOBAL FRESH FOOD MARKET SIZE, BY DAIRY, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 248. GLOBAL FRESH FOOD MARKET SIZE, BY DAIRY, 2018-2032 (USD MILLION)

TABLE 249. GLOBAL FRESH FOOD MARKET SIZE, BY MILK, BY REGION, 2018-2032 (USD MILLION)

TABLE 250. GLOBAL FRESH FOOD MARKET SIZE, BY MILK, BY GROUP, 2018-2032 (USD MILLION)

TABLE 251. GLOBAL FRESH FOOD MARKET SIZE, BY MILK, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 252. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH CHEESE, BY REGION, 2018-2032 (USD MILLION)

TABLE 253. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH CHEESE, BY GROUP, 2018-2032 (USD MILLION)

TABLE 254. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH CHEESE, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 255. GLOBAL FRESH FOOD MARKET SIZE, BY YOGURT & CULTURED PRODUCTS, BY REGION, 2018-2032 (USD MILLION)

TABLE 256. GLOBAL FRESH FOOD MARKET SIZE, BY YOGURT & CULTURED PRODUCTS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 257. GLOBAL FRESH FOOD MARKET SIZE, BY YOGURT & CULTURED PRODUCTS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 258. GLOBAL FRESH FOOD MARKET SIZE, BY CREAM, BY REGION, 2018-2032 (USD MILLION)

TABLE 259. GLOBAL FRESH FOOD MARKET SIZE, BY CREAM, BY GROUP, 2018-2032 (USD MILLION)

TABLE 260. GLOBAL FRESH FOOD MARKET SIZE, BY CREAM, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 261. GLOBAL FRESH FOOD MARKET SIZE, BY BUTTER, BY REGION, 2018-2032 (USD MILLION)

TABLE 262. GLOBAL FRESH FOOD MARKET SIZE, BY BUTTER, BY GROUP, 2018-2032 (USD MILLION)

TABLE 263. GLOBAL FRESH FOOD MARKET SIZE, BY BUTTER, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 264. GLOBAL FRESH FOOD MARKET SIZE, BY EGGS, BY REGION, 2018-2032 (USD MILLION)

TABLE 265. GLOBAL FRESH FOOD MARKET SIZE, BY EGGS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 266. GLOBAL FRESH FOOD MARKET SIZE, BY EGGS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 267. GLOBAL FRESH FOOD MARKET SIZE, BY EGGS, 2018-2032 (USD MILLION)

TABLE 268. GLOBAL FRESH FOOD MARKET SIZE, BY CHICKEN EGGS, BY REGION, 2018-2032 (USD MILLION)

TABLE 269. GLOBAL FRESH FOOD MARKET SIZE, BY CHICKEN EGGS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 270. GLOBAL FRESH FOOD MARKET SIZE, BY CHICKEN EGGS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 271. GLOBAL FRESH FOOD MARKET SIZE, BY BAKERY, BY REGION, 2018-2032 (USD MILLION)

TABLE 272. GLOBAL FRESH FOOD MARKET SIZE, BY BAKERY, BY GROUP, 2018-2032 (USD MILLION)

TABLE 273. GLOBAL FRESH FOOD MARKET SIZE, BY BAKERY, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 274. GLOBAL FRESH FOOD MARKET SIZE, BY BAKERY, 2018-2032 (USD MILLION)

TABLE 275. GLOBAL FRESH FOOD MARKET SIZE, BY BREAD & ROLLS, BY REGION, 2018-2032 (USD MILLION)

TABLE 276. GLOBAL FRESH FOOD MARKET SIZE, BY BREAD & ROLLS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 277. GLOBAL FRESH FOOD MARKET SIZE, BY BREAD & ROLLS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 278. GLOBAL FRESH FOOD MARKET SIZE, BY PASTRIES & CROISSANTS, BY REGION, 2018-2032 (USD MILLION)

TABLE 279. GLOBAL FRESH FOOD MARKET SIZE, BY PASTRIES & CROISSANTS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 280. GLOBAL FRESH FOOD MARKET SIZE, BY PASTRIES & CROISSANTS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 281. GLOBAL FRESH FOOD MARKET SIZE, BY CAKES & MUFFINS, BY REGION, 2018-2032 (USD MILLION)

TABLE 282. GLOBAL FRESH FOOD MARKET SIZE, BY CAKES & MUFFINS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 283. GLOBAL FRESH FOOD MARKET SIZE, BY CAKES & MUFFINS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 284. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH DESSERTS & PUDDINGS, BY REGION, 2018-2032 (USD MILLION)

TABLE 285. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH DESSERTS & PUDDINGS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 286. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH DESSERTS & PUDDINGS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 287. GLOBAL FRESH FOOD MARKET SIZE, BY READY-TO-EAT MEALS, BY REGION, 2018-2032 (USD MILLION)

TABLE 288. GLOBAL FRESH FOOD MARKET SIZE, BY READY-TO-EAT MEALS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 289. GLOBAL FRESH FOOD MARKET SIZE, BY READY-TO-EAT MEALS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 290. GLOBAL FRESH FOOD MARKET SIZE, BY READY-TO-EAT MEALS, 2018-2032 (USD MILLION)

TABLE 291. GLOBAL FRESH FOOD MARKET SIZE, BY CHILLED PREPARED MEALS, BY REGION, 2018-2032 (USD MILLION)

TABLE 292. GLOBAL FRESH FOOD MARKET SIZE, BY CHILLED PREPARED MEALS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 293. GLOBAL FRESH FOOD MARKET SIZE, BY CHILLED PREPARED MEALS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 294. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH PIZZA & SAVORY BAKERY, BY REGION, 2018-2032 (USD MILLION)

TABLE 295. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH PIZZA & SAVORY BAKERY, BY GROUP, 2018-2032 (USD MILLION)

TABLE 296. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH PIZZA & SAVORY BAKERY, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 297. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH PASTA & NOODLE MEALS, BY REGION, 2018-2032 (USD MILLION)

TABLE 298. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH PASTA & NOODLE MEALS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 299. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH PASTA & NOODLE MEALS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 300. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH SUSHI & ASIAN-STYLE MEALS, BY REGION, 2018-2032 (USD MILLION)

TABLE 301. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH SUSHI & ASIAN-STYLE MEALS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 302. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH SUSHI & ASIAN-STYLE MEALS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 303. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH SANDWICHES & WRAPS, BY REGION, 2018-2032 (USD MILLION)

TABLE 304. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH SANDWICHES & WRAPS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 305. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH SANDWICHES & WRAPS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 306. GLOBAL FRESH FOOD MARKET SIZE, BY SALAD MEALS & BOWLS, BY REGION, 2018-2032 (USD MILLION)

TABLE 307. GLOBAL FRESH FOOD MARKET SIZE, BY SALAD MEALS & BOWLS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 308. GLOBAL FRESH FOOD MARKET SIZE, BY SALAD MEALS & BOWLS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 309. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH PREPARED COMPONENTS, BY REGION, 2018-2032 (USD MILLION)

TABLE 310. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH PREPARED COMPONENTS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 311. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH PREPARED COMPONENTS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 312. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH PREPARED COMPONENTS, 2018-2032 (USD MILLION)

TABLE 313. GLOBAL FRESH FOOD MARKET SIZE, BY CUT FRUIT PACKS, BY REGION, 2018-2032 (USD MILLION)

TABLE 314. GLOBAL FRESH FOOD MARKET SIZE, BY CUT FRUIT PACKS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 315. GLOBAL FRESH FOOD MARKET SIZE, BY CUT FRUIT PACKS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 316. GLOBAL FRESH FOOD MARKET SIZE, BY CUT VEGETABLE PACKS, BY REGION, 2018-2032 (USD MILLION)

TABLE 317. GLOBAL FRESH FOOD MARKET SIZE, BY CUT VEGETABLE PACKS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 318. GLOBAL FRESH FOOD MARKET SIZE, BY CUT VEGETABLE PACKS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 319. GLOBAL FRESH FOOD MARKET SIZE, BY SALAD KITS & MIXES, BY REGION, 2018-2032 (USD MILLION)

TABLE 320. GLOBAL FRESH FOOD MARKET SIZE, BY SALAD KITS & MIXES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 321. GLOBAL FRESH FOOD MARKET SIZE, BY SALAD KITS & MIXES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 322. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH DIPS & SPREADS, BY REGION, 2018-2032 (USD MILLION)

TABLE 323. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH DIPS & SPREADS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 324. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH DIPS & SPREADS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 325. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH SAUCES & MARINADES, BY REGION, 2018-2032 (USD MILLION)

TABLE 326. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH SAUCES & MARINADES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 327. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH SAUCES & MARINADES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 328. GLOBAL FRESH FOOD MARKET SIZE, BY HERBS & SPICES, BY REGION, 2018-2032 (USD MILLION)

TABLE 329. GLOBAL FRESH FOOD MARKET SIZE, BY HERBS & SPICES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 330. GLOBAL FRESH FOOD MARKET SIZE, BY HERBS & SPICES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 331. GLOBAL FRESH FOOD MARKET SIZE, BY HERBS & SPICES, 2018-2032 (USD MILLION)

TABLE 332. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH HERBS, BY REGION, 2018-2032 (USD MILLION)

TABLE 333. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH HERBS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 334. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH HERBS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 335. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH CHILI PEPPERS, BY REGION, 2018-2032 (USD MILLION)

TABLE 336. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH CHILI PEPPERS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 337. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH CHILI PEPPERS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 338. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH SPICE ROOTS, BY REGION, 2018-2032 (USD MILLION)

TABLE 339. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH SPICE ROOTS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 340. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH SPICE ROOTS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 341. GLOBAL FRESH FOOD MARKET SIZE, BY END USER, 2018-2032 (USD MILLION)

TABLE 342. GLOBAL FRESH FOOD MARKET SIZE, BY COMMERCIAL, BY REGION, 2018-2032 (USD MILLION)

TABLE 343. GLOBAL FRESH FOOD MARKET SIZE, BY COMMERCIAL, BY GROUP, 2018-2032 (USD MILLION)

TABLE 344. GLOBAL FRESH FOOD MARKET SIZE, BY COMMERCIAL, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 345. GLOBAL FRESH FOOD MARKET SIZE, BY COMMERCIAL, 2018-2032 (USD MILLION)

TABLE 346. GLOBAL FRESH FOOD MARKET SIZE, BY HOSPITALITY, BY REGION, 2018-2032 (USD MILLION)

TABLE 347. GLOBAL FRESH FOOD MARKET SIZE, BY HOSPITALITY, BY GROUP, 2018-2032 (USD MILLION)

TABLE 348. GLOBAL FRESH FOOD MARKET SIZE, BY HOSPITALITY, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 349. GLOBAL FRESH FOOD MARKET SIZE, BY INSTITUTIONAL, BY REGION, 2018-2032 (USD MILLION)

TABLE 350. GLOBAL FRESH FOOD MARKET SIZE, BY INSTITUTIONAL, BY GROUP, 2018-2032 (USD MILLION)

TABLE 351. GLOBAL FRESH FOOD MARKET SIZE, BY INSTITUTIONAL, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 352. GLOBAL FRESH FOOD MARKET SIZE, BY RESIDENTIAL, BY

TABLE 2. GLOBAL FRESH FOOD MARKET SIZE, BY SOURCE, 2018-2032 (USD MILLION)

TABLE 3. GLOBAL FRESH FOOD MARKET SIZE, BY CONVENTIONAL, BY REGION, 2018-2032 (USD MILLION)

TABLE 4. GLOBAL FRESH FOOD MARKET SIZE, BY CONVENTIONAL, BY GROUP, 2018-2032 (USD MILLION)

TABLE 5. GLOBAL FRESH FOOD MARKET SIZE, BY CONVENTIONAL, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 6. GLOBAL FRESH FOOD MARKET SIZE, BY ORGANIC, BY REGION, 2018-2032 (USD MILLION)

TABLE 7. GLOBAL FRESH FOOD MARKET SIZE, BY ORGANIC, BY GROUP, 2018-2032 (USD MILLION)

TABLE 8. GLOBAL FRESH FOOD MARKET SIZE, BY ORGANIC, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 9. GLOBAL FRESH FOOD MARKET SIZE, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 10. GLOBAL FRESH FOOD MARKET SIZE, BY FRUITS, BY REGION, 2018-2032 (USD MILLION)

TABLE 11. GLOBAL FRESH FOOD MARKET SIZE, BY FRUITS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 12. GLOBAL FRESH FOOD MARKET SIZE, BY FRUITS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 13. GLOBAL FRESH FOOD MARKET SIZE, BY FRUITS, 2018-2032 (USD MILLION)

TABLE 14. GLOBAL FRESH FOOD MARKET SIZE, BY CITRUS FRUITS, BY REGION, 2018-2032 (USD MILLION)

TABLE 15. GLOBAL FRESH FOOD MARKET SIZE, BY CITRUS FRUITS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 16. GLOBAL FRESH FOOD MARKET SIZE, BY CITRUS FRUITS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 17. GLOBAL FRESH FOOD MARKET SIZE, BY CITRUS FRUITS, 2018-2032 (USD MILLION)

TABLE 18. GLOBAL FRESH FOOD MARKET SIZE, BY ORANGES, BY REGION, 2018-2032 (USD MILLION)

TABLE 19. GLOBAL FRESH FOOD MARKET SIZE, BY ORANGES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 20. GLOBAL FRESH FOOD MARKET SIZE, BY ORANGES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 21. GLOBAL FRESH FOOD MARKET SIZE, BY LEMONS, BY REGION, 2018-2032 (USD MILLION)

TABLE 22. GLOBAL FRESH FOOD MARKET SIZE, BY LEMONS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 23. GLOBAL FRESH FOOD MARKET SIZE, BY LEMONS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 24. GLOBAL FRESH FOOD MARKET SIZE, BY LIMES, BY REGION, 2018-2032 (USD MILLION)

TABLE 25. GLOBAL FRESH FOOD MARKET SIZE, BY LIMES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 26. GLOBAL FRESH FOOD MARKET SIZE, BY LIMES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 27. GLOBAL FRESH FOOD MARKET SIZE, BY GRAPEFRUITS, BY REGION, 2018-2032 (USD MILLION)

TABLE 28. GLOBAL FRESH FOOD MARKET SIZE, BY GRAPEFRUITS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 29. GLOBAL FRESH FOOD MARKET SIZE, BY GRAPEFRUITS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 30. GLOBAL FRESH FOOD MARKET SIZE, BY BERRIES, BY REGION, 2018-2032 (USD MILLION)

TABLE 31. GLOBAL FRESH FOOD MARKET SIZE, BY BERRIES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 32. GLOBAL FRESH FOOD MARKET SIZE, BY BERRIES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 33. GLOBAL FRESH FOOD MARKET SIZE, BY BERRIES, 2018-2032 (USD MILLION)

TABLE 34. GLOBAL FRESH FOOD MARKET SIZE, BY STRAWBERRIES, BY REGION, 2018-2032 (USD MILLION)

TABLE 35. GLOBAL FRESH FOOD MARKET SIZE, BY STRAWBERRIES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 36. GLOBAL FRESH FOOD MARKET SIZE, BY STRAWBERRIES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 37. GLOBAL FRESH FOOD MARKET SIZE, BY BLUEBERRIES, BY REGION, 2018-2032 (USD MILLION)

TABLE 38. GLOBAL FRESH FOOD MARKET SIZE, BY BLUEBERRIES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 39. GLOBAL FRESH FOOD MARKET SIZE, BY BLUEBERRIES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 40. GLOBAL FRESH FOOD MARKET SIZE, BY RASPBERRIES, BY REGION, 2018-2032 (USD MILLION)

TABLE 41. GLOBAL FRESH FOOD MARKET SIZE, BY RASPBERRIES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 42. GLOBAL FRESH FOOD MARKET SIZE, BY RASPBERRIES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 43. GLOBAL FRESH FOOD MARKET SIZE, BY POME FRUITS, BY REGION, 2018-2032 (USD MILLION)

TABLE 44. GLOBAL FRESH FOOD MARKET SIZE, BY POME FRUITS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 45. GLOBAL FRESH FOOD MARKET SIZE, BY POME FRUITS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 46. GLOBAL FRESH FOOD MARKET SIZE, BY POME FRUITS, 2018-2032 (USD MILLION)

TABLE 47. GLOBAL FRESH FOOD MARKET SIZE, BY APPLES, BY REGION, 2018-2032 (USD MILLION)

TABLE 48. GLOBAL FRESH FOOD MARKET SIZE, BY APPLES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 49. GLOBAL FRESH FOOD MARKET SIZE, BY APPLES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 50. GLOBAL FRESH FOOD MARKET SIZE, BY PEARS, BY REGION, 2018-2032 (USD MILLION)

TABLE 51. GLOBAL FRESH FOOD MARKET SIZE, BY PEARS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 52. GLOBAL FRESH FOOD MARKET SIZE, BY PEARS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 53. GLOBAL FRESH FOOD MARKET SIZE, BY STONE FRUITS, BY REGION, 2018-2032 (USD MILLION)

TABLE 54. GLOBAL FRESH FOOD MARKET SIZE, BY STONE FRUITS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 55. GLOBAL FRESH FOOD MARKET SIZE, BY STONE FRUITS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 56. GLOBAL FRESH FOOD MARKET SIZE, BY STONE FRUITS, 2018-2032 (USD MILLION)

TABLE 57. GLOBAL FRESH FOOD MARKET SIZE, BY PEACHES & NECTARINES, BY REGION, 2018-2032 (USD MILLION)

TABLE 58. GLOBAL FRESH FOOD MARKET SIZE, BY PEACHES & NECTARINES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 59. GLOBAL FRESH FOOD MARKET SIZE, BY PEACHES & NECTARINES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 60. GLOBAL FRESH FOOD MARKET SIZE, BY PLUMS, BY REGION, 2018-2032 (USD MILLION)

TABLE 61. GLOBAL FRESH FOOD MARKET SIZE, BY PLUMS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 62. GLOBAL FRESH FOOD MARKET SIZE, BY PLUMS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 63. GLOBAL FRESH FOOD MARKET SIZE, BY CHERRIES, BY REGION, 2018-2032 (USD MILLION)

TABLE 64. GLOBAL FRESH FOOD MARKET SIZE, BY CHERRIES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 65. GLOBAL FRESH FOOD MARKET SIZE, BY CHERRIES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 66. GLOBAL FRESH FOOD MARKET SIZE, BY TROPICAL & EXOTIC FRUITS, BY REGION, 2018-2032 (USD MILLION)

TABLE 67. GLOBAL FRESH FOOD MARKET SIZE, BY TROPICAL & EXOTIC FRUITS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 68. GLOBAL FRESH FOOD MARKET SIZE, BY TROPICAL & EXOTIC FRUITS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 69. GLOBAL FRESH FOOD MARKET SIZE, BY TROPICAL & EXOTIC FRUITS, 2018-2032 (USD MILLION)

TABLE 70. GLOBAL FRESH FOOD MARKET SIZE, BY BANANAS, BY REGION, 2018-2032 (USD MILLION)

TABLE 71. GLOBAL FRESH FOOD MARKET SIZE, BY BANANAS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 72. GLOBAL FRESH FOOD MARKET SIZE, BY BANANAS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 73. GLOBAL FRESH FOOD MARKET SIZE, BY MANGOES, BY REGION, 2018-2032 (USD MILLION)

TABLE 74. GLOBAL FRESH FOOD MARKET SIZE, BY MANGOES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 75. GLOBAL FRESH FOOD MARKET SIZE, BY MANGOES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 76. GLOBAL FRESH FOOD MARKET SIZE, BY PINEAPPLES, BY REGION, 2018-2032 (USD MILLION)

TABLE 77. GLOBAL FRESH FOOD MARKET SIZE, BY PINEAPPLES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 78. GLOBAL FRESH FOOD MARKET SIZE, BY PINEAPPLES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 79. GLOBAL FRESH FOOD MARKET SIZE, BY AVOCADO, BY REGION, 2018-2032 (USD MILLION)

TABLE 80. GLOBAL FRESH FOOD MARKET SIZE, BY AVOCADO, BY GROUP, 2018-2032 (USD MILLION)

TABLE 81. GLOBAL FRESH FOOD MARKET SIZE, BY AVOCADO, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 82. GLOBAL FRESH FOOD MARKET SIZE, BY MELONS, BY REGION, 2018-2032 (USD MILLION)

TABLE 83. GLOBAL FRESH FOOD MARKET SIZE, BY MELONS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 84. GLOBAL FRESH FOOD MARKET SIZE, BY MELONS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 85. GLOBAL FRESH FOOD MARKET SIZE, BY MELONS, 2018-2032 (USD MILLION)

TABLE 86. GLOBAL FRESH FOOD MARKET SIZE, BY WATERMELONS, BY REGION, 2018-2032 (USD MILLION)

TABLE 87. GLOBAL FRESH FOOD MARKET SIZE, BY WATERMELONS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 88. GLOBAL FRESH FOOD MARKET SIZE, BY WATERMELONS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 89. GLOBAL FRESH FOOD MARKET SIZE, BY CANTALOUPES & HONEYDEWS, BY REGION, 2018-2032 (USD MILLION)

TABLE 90. GLOBAL FRESH FOOD MARKET SIZE, BY CANTALOUPES & HONEYDEWS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 91. GLOBAL FRESH FOOD MARKET SIZE, BY CANTALOUPES & HONEYDEWS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 92. GLOBAL FRESH FOOD MARKET SIZE, BY VEGETABLES, BY REGION, 2018-2032 (USD MILLION)

TABLE 93. GLOBAL FRESH FOOD MARKET SIZE, BY VEGETABLES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 94. GLOBAL FRESH FOOD MARKET SIZE, BY VEGETABLES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 95. GLOBAL FRESH FOOD MARKET SIZE, BY VEGETABLES, 2018-2032 (USD MILLION)

TABLE 96. GLOBAL FRESH FOOD MARKET SIZE, BY LEAFY GREENS, BY REGION, 2018-2032 (USD MILLION)

TABLE 97. GLOBAL FRESH FOOD MARKET SIZE, BY LEAFY GREENS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 98. GLOBAL FRESH FOOD MARKET SIZE, BY LEAFY GREENS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 99. GLOBAL FRESH FOOD MARKET SIZE, BY LEAFY GREENS, 2018-2032 (USD MILLION)

TABLE 100. GLOBAL FRESH FOOD MARKET SIZE, BY LETTUCE, BY REGION, 2018-2032 (USD MILLION)

TABLE 101. GLOBAL FRESH FOOD MARKET SIZE, BY LETTUCE, BY GROUP, 2018-2032 (USD MILLION)

TABLE 102. GLOBAL FRESH FOOD MARKET SIZE, BY LETTUCE, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 103. GLOBAL FRESH FOOD MARKET SIZE, BY SPINACH, BY REGION, 2018-2032 (USD MILLION)

TABLE 104. GLOBAL FRESH FOOD MARKET SIZE, BY SPINACH, BY GROUP, 2018-2032 (USD MILLION)

TABLE 105. GLOBAL FRESH FOOD MARKET SIZE, BY SPINACH, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 106. GLOBAL FRESH FOOD MARKET SIZE, BY KALE & CHARD, BY REGION, 2018-2032 (USD MILLION)

TABLE 107. GLOBAL FRESH FOOD MARKET SIZE, BY KALE & CHARD, BY GROUP, 2018-2032 (USD MILLION)

TABLE 108. GLOBAL FRESH FOOD MARKET SIZE, BY KALE & CHARD, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 109. GLOBAL FRESH FOOD MARKET SIZE, BY CRUCIFEROUS VEGETABLES, BY REGION, 2018-2032 (USD MILLION)

TABLE 110. GLOBAL FRESH FOOD MARKET SIZE, BY CRUCIFEROUS VEGETABLES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 111. GLOBAL FRESH FOOD MARKET SIZE, BY CRUCIFEROUS VEGETABLES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 112. GLOBAL FRESH FOOD MARKET SIZE, BY CRUCIFEROUS VEGETABLES, 2018-2032 (USD MILLION)

TABLE 113. GLOBAL FRESH FOOD MARKET SIZE, BY BROCCOLI, BY REGION, 2018-2032 (USD MILLION)

TABLE 114. GLOBAL FRESH FOOD MARKET SIZE, BY BROCCOLI, BY GROUP, 2018-2032 (USD MILLION)

TABLE 115. GLOBAL FRESH FOOD MARKET SIZE, BY BROCCOLI, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 116. GLOBAL FRESH FOOD MARKET SIZE, BY CAULIFLOWER, BY REGION, 2018-2032 (USD MILLION)

TABLE 117. GLOBAL FRESH FOOD MARKET SIZE, BY CAULIFLOWER, BY GROUP, 2018-2032 (USD MILLION)

TABLE 118. GLOBAL FRESH FOOD MARKET SIZE, BY CAULIFLOWER, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 119. GLOBAL FRESH FOOD MARKET SIZE, BY CABBAGE & BRUSSELS SPROUTS, BY REGION, 2018-2032 (USD MILLION)

TABLE 120. GLOBAL FRESH FOOD MARKET SIZE, BY CABBAGE & BRUSSELS SPROUTS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 121. GLOBAL FRESH FOOD MARKET SIZE, BY CABBAGE & BRUSSELS SPROUTS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 122. GLOBAL FRESH FOOD MARKET SIZE, BY ROOT & TUBER VEGETABLES, BY REGION, 2018-2032 (USD MILLION)

TABLE 123. GLOBAL FRESH FOOD MARKET SIZE, BY ROOT & TUBER VEGETABLES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 124. GLOBAL FRESH FOOD MARKET SIZE, BY ROOT & TUBER VEGETABLES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 125. GLOBAL FRESH FOOD MARKET SIZE, BY ROOT & TUBER VEGETABLES, 2018-2032 (USD MILLION)

TABLE 126. GLOBAL FRESH FOOD MARKET SIZE, BY POTATOES, BY REGION, 2018-2032 (USD MILLION)

TABLE 127. GLOBAL FRESH FOOD MARKET SIZE, BY POTATOES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 128. GLOBAL FRESH FOOD MARKET SIZE, BY POTATOES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 129. GLOBAL FRESH FOOD MARKET SIZE, BY CARROTS, BY REGION, 2018-2032 (USD MILLION)

TABLE 130. GLOBAL FRESH FOOD MARKET SIZE, BY CARROTS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 131. GLOBAL FRESH FOOD MARKET SIZE, BY CARROTS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 132. GLOBAL FRESH FOOD MARKET SIZE, BY BEETS & RADISHES, BY REGION, 2018-2032 (USD MILLION)

TABLE 133. GLOBAL FRESH FOOD MARKET SIZE, BY BEETS & RADISHES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 134. GLOBAL FRESH FOOD MARKET SIZE, BY BEETS & RADISHES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 135. GLOBAL FRESH FOOD MARKET SIZE, BY ALLIUM VEGETABLES, BY REGION, 2018-2032 (USD MILLION)

TABLE 136. GLOBAL FRESH FOOD MARKET SIZE, BY ALLIUM VEGETABLES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 137. GLOBAL FRESH FOOD MARKET SIZE, BY ALLIUM VEGETABLES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 138. GLOBAL FRESH FOOD MARKET SIZE, BY ALLIUM VEGETABLES, 2018-2032 (USD MILLION)

TABLE 139. GLOBAL FRESH FOOD MARKET SIZE, BY ONIONS, BY REGION, 2018-2032 (USD MILLION)

TABLE 140. GLOBAL FRESH FOOD MARKET SIZE, BY ONIONS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 141. GLOBAL FRESH FOOD MARKET SIZE, BY ONIONS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 142. GLOBAL FRESH FOOD MARKET SIZE, BY GARLIC, BY REGION, 2018-2032 (USD MILLION)

TABLE 143. GLOBAL FRESH FOOD MARKET SIZE, BY GARLIC, BY GROUP, 2018-2032 (USD MILLION)

TABLE 144. GLOBAL FRESH FOOD MARKET SIZE, BY GARLIC, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 145. GLOBAL FRESH FOOD MARKET SIZE, BY LEEKS & SPRING ONIONS, BY REGION, 2018-2032 (USD MILLION)

TABLE 146. GLOBAL FRESH FOOD MARKET SIZE, BY LEEKS & SPRING ONIONS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 147. GLOBAL FRESH FOOD MARKET SIZE, BY LEEKS & SPRING ONIONS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 148. GLOBAL FRESH FOOD MARKET SIZE, BY NIGHTSHADE VEGETABLES, BY REGION, 2018-2032 (USD MILLION)

TABLE 149. GLOBAL FRESH FOOD MARKET SIZE, BY NIGHTSHADE VEGETABLES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 150. GLOBAL FRESH FOOD MARKET SIZE, BY NIGHTSHADE VEGETABLES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 151. GLOBAL FRESH FOOD MARKET SIZE, BY NIGHTSHADE VEGETABLES, 2018-2032 (USD MILLION)

TABLE 152. GLOBAL FRESH FOOD MARKET SIZE, BY TOMATOES, BY REGION, 2018-2032 (USD MILLION)

TABLE 153. GLOBAL FRESH FOOD MARKET SIZE, BY TOMATOES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 154. GLOBAL FRESH FOOD MARKET SIZE, BY TOMATOES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 155. GLOBAL FRESH FOOD MARKET SIZE, BY PEPPERS & CHILIES, BY REGION, 2018-2032 (USD MILLION)

TABLE 156. GLOBAL FRESH FOOD MARKET SIZE, BY PEPPERS & CHILIES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 157. GLOBAL FRESH FOOD MARKET SIZE, BY PEPPERS & CHILIES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 158. GLOBAL FRESH FOOD MARKET SIZE, BY EGGPLANTS, BY REGION, 2018-2032 (USD MILLION)

TABLE 159. GLOBAL FRESH FOOD MARKET SIZE, BY EGGPLANTS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 160. GLOBAL FRESH FOOD MARKET SIZE, BY EGGPLANTS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 161. GLOBAL FRESH FOOD MARKET SIZE, BY GOURDS & SQUASH, BY REGION, 2018-2032 (USD MILLION)

TABLE 162. GLOBAL FRESH FOOD MARKET SIZE, BY GOURDS & SQUASH, BY GROUP, 2018-2032 (USD MILLION)

TABLE 163. GLOBAL FRESH FOOD MARKET SIZE, BY GOURDS & SQUASH, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 164. GLOBAL FRESH FOOD MARKET SIZE, BY GOURDS & SQUASH, 2018-2032 (USD MILLION)

TABLE 165. GLOBAL FRESH FOOD MARKET SIZE, BY PUMPKINS, BY REGION, 2018-2032 (USD MILLION)

TABLE 166. GLOBAL FRESH FOOD MARKET SIZE, BY PUMPKINS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 167. GLOBAL FRESH FOOD MARKET SIZE, BY PUMPKINS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 168. GLOBAL FRESH FOOD MARKET SIZE, BY ZUCCHINI & SUMMER SQUASH, BY REGION, 2018-2032 (USD MILLION)

TABLE 169. GLOBAL FRESH FOOD MARKET SIZE, BY ZUCCHINI & SUMMER SQUASH, BY GROUP, 2018-2032 (USD MILLION)

TABLE 170. GLOBAL FRESH FOOD MARKET SIZE, BY ZUCCHINI & SUMMER SQUASH, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 171. GLOBAL FRESH FOOD MARKET SIZE, BY LEGUME VEGETABLES, BY REGION, 2018-2032 (USD MILLION)

TABLE 172. GLOBAL FRESH FOOD MARKET SIZE, BY LEGUME VEGETABLES, BY GROUP, 2018-2032 (USD MILLION)

TABLE 173. GLOBAL FRESH FOOD MARKET SIZE, BY LEGUME VEGETABLES, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 174. GLOBAL FRESH FOOD MARKET SIZE, BY LEGUME VEGETABLES, 2018-2032 (USD MILLION)

TABLE 175. GLOBAL FRESH FOOD MARKET SIZE, BY GREEN PEAS, BY REGION, 2018-2032 (USD MILLION)

TABLE 176. GLOBAL FRESH FOOD MARKET SIZE, BY GREEN PEAS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 177. GLOBAL FRESH FOOD MARKET SIZE, BY GREEN PEAS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 178. GLOBAL FRESH FOOD MARKET SIZE, BY GREEN BEANS, BY REGION, 2018-2032 (USD MILLION)

TABLE 179. GLOBAL FRESH FOOD MARKET SIZE, BY GREEN BEANS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 180. GLOBAL FRESH FOOD MARKET SIZE, BY GREEN BEANS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 181. GLOBAL FRESH FOOD MARKET SIZE, BY MEAT & POULTRY, BY REGION, 2018-2032 (USD MILLION)

TABLE 182. GLOBAL FRESH FOOD MARKET SIZE, BY MEAT & POULTRY, BY GROUP, 2018-2032 (USD MILLION)

TABLE 183. GLOBAL FRESH FOOD MARKET SIZE, BY MEAT & POULTRY, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 184. GLOBAL FRESH FOOD MARKET SIZE, BY MEAT & POULTRY, 2018-2032 (USD MILLION)

TABLE 185. GLOBAL FRESH FOOD MARKET SIZE, BY RED MEAT, BY REGION, 2018-2032 (USD MILLION)

TABLE 186. GLOBAL FRESH FOOD MARKET SIZE, BY RED MEAT, BY GROUP, 2018-2032 (USD MILLION)

TABLE 187. GLOBAL FRESH FOOD MARKET SIZE, BY RED MEAT, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 188. GLOBAL FRESH FOOD MARKET SIZE, BY RED MEAT, 2018-2032 (USD MILLION)

TABLE 189. GLOBAL FRESH FOOD MARKET SIZE, BY BEEF, BY REGION, 2018-2032 (USD MILLION)

TABLE 190. GLOBAL FRESH FOOD MARKET SIZE, BY BEEF, BY GROUP, 2018-2032 (USD MILLION)

TABLE 191. GLOBAL FRESH FOOD MARKET SIZE, BY BEEF, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 192. GLOBAL FRESH FOOD MARKET SIZE, BY PORK, BY REGION, 2018-2032 (USD MILLION)

TABLE 193. GLOBAL FRESH FOOD MARKET SIZE, BY PORK, BY GROUP, 2018-2032 (USD MILLION)

TABLE 194. GLOBAL FRESH FOOD MARKET SIZE, BY PORK, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 195. GLOBAL FRESH FOOD MARKET SIZE, BY LAMB & MUTTON, BY REGION, 2018-2032 (USD MILLION)

TABLE 196. GLOBAL FRESH FOOD MARKET SIZE, BY LAMB & MUTTON, BY GROUP, 2018-2032 (USD MILLION)

TABLE 197. GLOBAL FRESH FOOD MARKET SIZE, BY LAMB & MUTTON, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 198. GLOBAL FRESH FOOD MARKET SIZE, BY POULTRY, BY REGION, 2018-2032 (USD MILLION)

TABLE 199. GLOBAL FRESH FOOD MARKET SIZE, BY POULTRY, BY GROUP, 2018-2032 (USD MILLION)

TABLE 200. GLOBAL FRESH FOOD MARKET SIZE, BY POULTRY, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 201. GLOBAL FRESH FOOD MARKET SIZE, BY POULTRY, 2018-2032 (USD MILLION)

TABLE 202. GLOBAL FRESH FOOD MARKET SIZE, BY CHICKEN, BY REGION, 2018-2032 (USD MILLION)

TABLE 203. GLOBAL FRESH FOOD MARKET SIZE, BY CHICKEN, BY GROUP, 2018-2032 (USD MILLION)

TABLE 204. GLOBAL FRESH FOOD MARKET SIZE, BY CHICKEN, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 205. GLOBAL FRESH FOOD MARKET SIZE, BY TURKEY, BY REGION, 2018-2032 (USD MILLION)

TABLE 206. GLOBAL FRESH FOOD MARKET SIZE, BY TURKEY, BY GROUP, 2018-2032 (USD MILLION)

TABLE 207. GLOBAL FRESH FOOD MARKET SIZE, BY TURKEY, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 208. GLOBAL FRESH FOOD MARKET SIZE, BY DUCK & GOOSE, BY REGION, 2018-2032 (USD MILLION)

TABLE 209. GLOBAL FRESH FOOD MARKET SIZE, BY DUCK & GOOSE, BY GROUP, 2018-2032 (USD MILLION)

TABLE 210. GLOBAL FRESH FOOD MARKET SIZE, BY DUCK & GOOSE, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 211. GLOBAL FRESH FOOD MARKET SIZE, BY GAME MEAT, BY REGION, 2018-2032 (USD MILLION)

TABLE 212. GLOBAL FRESH FOOD MARKET SIZE, BY GAME MEAT, BY GROUP, 2018-2032 (USD MILLION)

TABLE 213. GLOBAL FRESH FOOD MARKET SIZE, BY GAME MEAT, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 214. GLOBAL FRESH FOOD MARKET SIZE, BY GAME MEAT, 2018-2032 (USD MILLION)

TABLE 215. GLOBAL FRESH FOOD MARKET SIZE, BY VENISON, BY REGION, 2018-2032 (USD MILLION)

TABLE 216. GLOBAL FRESH FOOD MARKET SIZE, BY VENISON, BY GROUP, 2018-2032 (USD MILLION)

TABLE 217. GLOBAL FRESH FOOD MARKET SIZE, BY VENISON, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 218. GLOBAL FRESH FOOD MARKET SIZE, BY RABBIT & OTHER GAME MEAT, BY REGION, 2018-2032 (USD MILLION)

TABLE 219. GLOBAL FRESH FOOD MARKET SIZE, BY RABBIT & OTHER GAME MEAT, BY GROUP, 2018-2032 (USD MILLION)

TABLE 220. GLOBAL FRESH FOOD MARKET SIZE, BY RABBIT & OTHER GAME MEAT, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 221. GLOBAL FRESH FOOD MARKET SIZE, BY SEAFOOD, BY REGION, 2018-2032 (USD MILLION)

TABLE 222. GLOBAL FRESH FOOD MARKET SIZE, BY SEAFOOD, BY GROUP, 2018-2032 (USD MILLION)

TABLE 223. GLOBAL FRESH FOOD MARKET SIZE, BY SEAFOOD, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 224. GLOBAL FRESH FOOD MARKET SIZE, BY SEAFOOD, 2018-2032 (USD MILLION)

TABLE 225. GLOBAL FRESH FOOD MARKET SIZE, BY FISH, BY REGION, 2018-2032 (USD MILLION)

TABLE 226. GLOBAL FRESH FOOD MARKET SIZE, BY FISH, BY GROUP, 2018-2032 (USD MILLION)

TABLE 227. GLOBAL FRESH FOOD MARKET SIZE, BY FISH, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 228. GLOBAL FRESH FOOD MARKET SIZE, BY FISH, 2018-2032 (USD MILLION)

TABLE 229. GLOBAL FRESH FOOD MARKET SIZE, BY WHITE FISH, BY REGION, 2018-2032 (USD MILLION)

TABLE 230. GLOBAL FRESH FOOD MARKET SIZE, BY WHITE FISH, BY GROUP, 2018-2032 (USD MILLION)

TABLE 231. GLOBAL FRESH FOOD MARKET SIZE, BY WHITE FISH, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 232. GLOBAL FRESH FOOD MARKET SIZE, BY OILY FISH, BY REGION, 2018-2032 (USD MILLION)

TABLE 233. GLOBAL FRESH FOOD MARKET SIZE, BY OILY FISH, BY GROUP, 2018-2032 (USD MILLION)

TABLE 234. GLOBAL FRESH FOOD MARKET SIZE, BY OILY FISH, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 235. GLOBAL FRESH FOOD MARKET SIZE, BY SHELLFISH, BY REGION, 2018-2032 (USD MILLION)

TABLE 236. GLOBAL FRESH FOOD MARKET SIZE, BY SHELLFISH, BY GROUP, 2018-2032 (USD MILLION)

TABLE 237. GLOBAL FRESH FOOD MARKET SIZE, BY SHELLFISH, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 238. GLOBAL FRESH FOOD MARKET SIZE, BY SHELLFISH, 2018-2032 (USD MILLION)

TABLE 239. GLOBAL FRESH FOOD MARKET SIZE, BY CRUSTACEANS, BY REGION, 2018-2032 (USD MILLION)

TABLE 240. GLOBAL FRESH FOOD MARKET SIZE, BY CRUSTACEANS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 241. GLOBAL FRESH FOOD MARKET SIZE, BY CRUSTACEANS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 242. GLOBAL FRESH FOOD MARKET SIZE, BY MOLLUSKS, BY REGION, 2018-2032 (USD MILLION)

TABLE 243. GLOBAL FRESH FOOD MARKET SIZE, BY MOLLUSKS, BY GROUP, 2018-2032 (USD MILLION)

TABLE 244. GLOBAL FRESH FOOD MARKET SIZE, BY MOLLUSKS, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 245. GLOBAL FRESH FOOD MARKET SIZE, BY DAIRY, BY REGION, 2018-2032 (USD MILLION)

TABLE 246. GLOBAL FRESH FOOD MARKET SIZE, BY DAIRY, BY GROUP, 2018-2032 (USD MILLION)

TABLE 247. GLOBAL FRESH FOOD MARKET SIZE, BY DAIRY, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 248. GLOBAL FRESH FOOD MARKET SIZE, BY DAIRY, 2018-2032 (USD MILLION)

TABLE 249. GLOBAL FRESH FOOD MARKET SIZE, BY MILK, BY REGION, 2018-2032 (USD MILLION)

TABLE 250. GLOBAL FRESH FOOD MARKET SIZE, BY MILK, BY GROUP, 2018-2032 (USD MILLION)

TABLE 251. GLOBAL FRESH FOOD MARKET SIZE, BY MILK, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 252. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH CHEESE, BY REGION, 2018-2032 (USD MILLION)

TABLE 253. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH CHEESE, BY GROUP, 2018-2032 (USD MILLION)

TABLE 254. GLOBAL FRESH FOOD MARKET SIZE, BY FRESH CHEESE, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 255. GLOBAL FRESH FOOD MARKET SIZE, BY YOGURT & CULTURED PRODUCTS, BY REGION, 2018-2032 (USD MILLION)

TABLE 256. GLOBAL FRESH FOOD MARKET SIZE, BY YOGURT & CULTURED PRODUCTS, BY GROUP, 2018-2032 (USD MILLION)