Global Full Truckload Transportation Market - Key Trends and Drivers Summarized

How Is Full Truckload Transportation Transforming the Logistics and Supply Chain Industry?

Full truckload (FTL) transportation is transforming the logistics and supply chain industry by offering a highly efficient and reliable method for moving large volumes of goods over long distances. Unlike less-than-truckload (LTL) shipments, where multiple shippers share space in a single truck, FTL involves dedicating an entire truck to one shipment, which maximizes capacity and minimizes handling. This approach reduces the risk of damage, speeds up delivery times, and is particularly advantageous for businesses that need to move bulk goods or time-sensitive materials. FTL transportation is integral to industries like manufacturing, retail, and e-commerce, where timely and secure delivery of large shipments is critical to maintaining smooth operations. By providing a streamlined, point-to-point service, FTL transportation enhances the efficiency of supply chains, reduces costs associated with multiple handling and transfers, and meets the growing demand for faster, more reliable delivery services in today's fast-paced market.What Innovations Are Enhancing the Efficiency of Full Truckload Transportation?

Innovations in full truckload transportation are enhancing efficiency through advancements in route optimization, telematics, and automated freight matching. Route optimization software uses real-time data, such as traffic conditions, weather forecasts, and road closures, to plan the most efficient routes for trucks, reducing fuel consumption and delivery times. Telematics systems provide fleet managers with detailed information on vehicle performance, driver behavior, and fuel usage, enabling proactive maintenance and improved safety, which are critical for maximizing the reliability and efficiency of FTL operations. Another significant innovation is the use of automated freight matching platforms, which use algorithms to connect shippers with available trucks in real-time, reducing the time and effort required to arrange shipments and ensuring that trucks operate at full capacity. These platforms often integrate with digital freight marketplaces, allowing for seamless booking and tracking of shipments. Additionally, advancements in electric and autonomous trucks are on the horizon, promising to further enhance the sustainability and cost-effectiveness of full truckload transportation in the near future.How Does Full Truckload Transportation Impact Supply Chain Reliability and Cost Efficiency?

Full truckload transportation significantly impacts supply chain reliability and cost efficiency by providing a direct, uninterrupted shipping service that minimizes delays and reduces the potential for cargo damage. Since FTL shipments travel directly from the origin to the destination without stopping at multiple terminals, there is less handling of goods, which lowers the risk of loss or damage and ensures that deliveries are more predictable and on schedule. This reliability is crucial for industries that rely on just-in-time (JIT) inventory systems, where any delay can disrupt production lines and lead to costly downtime. Additionally, FTL transportation can be more cost-efficient for large shipments, as the cost per unit decreases when an entire truck is utilized, and there are no intermediate handling fees associated with LTL shipments. The ability to optimize load capacity and reduce the number of trips also leads to lower fuel consumption and reduced overall transportation costs. By enhancing both reliability and cost efficiency, full truckload transportation plays a vital role in supporting robust, responsive supply chains that can meet the demands of modern commerce.What Trends Are Driving Growth in the Full Truckload Transportation Market?

Several key trends are driving growth in the full truckload transportation market, including the expansion of e-commerce, increasing demand for fast and reliable delivery services, and advancements in logistics technology. The explosive growth of e-commerce has created a surge in demand for FTL services, as online retailers require efficient transportation solutions to move large volumes of goods from distribution centers to customers across vast geographic areas. The increasing consumer expectation for rapid delivery, particularly in the age of same-day and next-day shipping, is also pushing businesses to rely more heavily on FTL transportation, which can offer faster transit times compared to LTL options. Additionally, advancements in logistics technology, such as digital freight platforms and real-time tracking systems, are making it easier for shippers and carriers to manage FTL shipments, optimize routes, and increase load efficiency. Sustainability concerns are also influencing the market, with a growing emphasis on reducing carbon emissions, which is leading to investments in fuel-efficient and electric trucks within FTL fleets. These trends highlight the essential role of full truckload transportation in the evolving logistics landscape, where efficiency, speed, and reliability are paramount.Report Scope

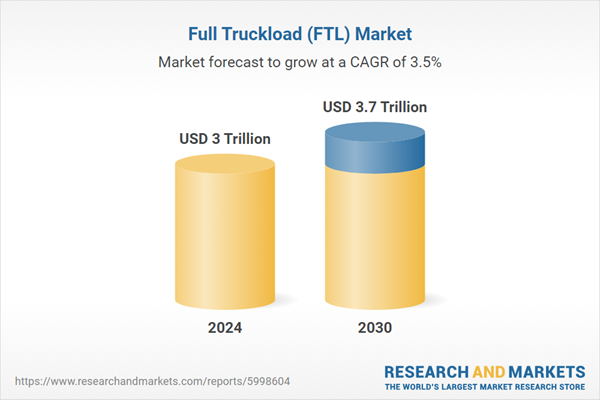

The report analyzes the Full Truckload (FTL) market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Mobility (Domestic Mobility, International Mobility); End-Use (Agriculture, Fishing, & Forestry End-Use; Manufacturing End-Use; Wholesale & Retail Trade End-Use; Other End-Uses).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Domestic Mobility segment, which is expected to reach US$2.4 Trillion by 2030 with a CAGR of a 4.4%. The International Mobility segment is also set to grow at 2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $810.9 Billion in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $779.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Full Truckload (FTL) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Full Truckload (FTL) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Full Truckload (FTL) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as C.H. Robinson Worldwide, Inc., Cowtown Express, DB SCHENKER, DSV A/S, Ease Logistics and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Full Truckload (FTL) market report include:

- C.H. Robinson Worldwide, Inc.

- Cowtown Express

- DB SCHENKER

- DSV A/S

- Ease Logistics

- Estes Express Lines

- FedEx Corporation

- J.B. Hunt Transport Services, Inc.

- Landstar System, Inc.

- NFI Industries Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- C.H. Robinson Worldwide, Inc.

- Cowtown Express

- DB SCHENKER

- DSV A/S

- Ease Logistics

- Estes Express Lines

- FedEx Corporation

- J.B. Hunt Transport Services, Inc.

- Landstar System, Inc.

- NFI Industries Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3 Trillion |

| Forecasted Market Value ( USD | $ 3.7 Trillion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |