Gas compressors are mechanical devices designed to increase the pressure of a gas by reducing its volume. They play a crucial role in various industries, including energy, manufacturing, and transportation. Gas compressors are typically composed of components such as a motor, compressor unit, and control system. The process involves drawing in gas and subsequently compressing it using either positive displacement or dynamic methods. Positive displacement compressors use mechanisms like reciprocating pistons or rotary screws to trap and reduce gas volume, while dynamic compressors utilize techniques like centrifugal force to accelerate and compress gas. Advantages of gas compressors encompass enhanced transport efficiency, increased storage capacity, and the facilitation of various industrial processes. Their application spans from powering pneumatic tools to aiding in natural gas transportation over long distances. Broadly, gas compressors fall into two main categories: positive displacement and dynamic compressors.

The global gas compressors market is influenced by the rising demand for natural gas as a cleaner energy source and the expanding industrial activities across sectors, such as oil and gas, manufacturing, and petrochemicals. Moreover, advancements in technology, particularly in reciprocating and centrifugal compressor designs, is augmenting market growth. In line with this, stringent environmental regulations encourage the adoption of compressors that minimize emissions and ensure compliance, further supporting market growth. Apart from this, the growing exploration and production activities in untapped regions, increasing investments in infrastructure development, and the shift towards renewable energy sources are propelling market growth.

Gas Compressors Market Trends/Drivers:

Rising demand for natural gas

The global gas compressors market is significantly propelled by the escalating demand for natural gas as an environmentally friendly energy alternative. As nations strive to reduce their carbon footprint, natural gas has emerged as a key transition fuel due to its lower carbon emissions compared to conventional fossil fuels. This demand surge is driven by the desire to meet energy needs while adhering to climate goals. Gas compressors play a pivotal role in the extraction, transportation, and distribution of natural gas. They ensure efficient compression, enabling seamless movement through pipelines and storage facilities. This driver is expected to remain steadfast as countries continue to transition towards cleaner energy sources.Expanding industrial activities

The expansion of industrial activities across sectors such as oil and gas, manufacturing, and petrochemicals acts as a substantial driver for the global gas compressors market. These industries heavily rely on compressed gases for various processes, such as pneumatic tools, air conditioning, refrigeration, and more. As industrialization continues to flourish, the demand for compressed gases escalates, necessitating reliable and efficient compression solutions. Gas compressors ensure the optimal functioning of essential processes, supporting increased production capacities. This driver underscores the essential role that gas compressors play in maintaining the smooth operation of industrial activities worldwide.Advancements in compressor technology

Advancements in compressor technology, particularly in reciprocating and centrifugal compressor designs, are instrumental in shaping the trajectory of the global gas compressors market. Engineers and manufacturers are continuously innovating to enhance compressor efficiency, performance, and reliability. Cutting-edge designs incorporate features like variable speed drives, improved materials, and enhanced sealing mechanisms, resulting in higher efficiency and reduced maintenance requirements. These technological advancements not only boost the overall efficiency of compression processes but also enable customization to meet specific industry needs. As industries increasingly demand compressors that deliver superior performance while minimizing energy consumption, the evolution of compressor technology remains a pivotal driver in the market's growth and development.Gas Compressors Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global gas compressors market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on compressor type and end use industry.Breakup by Compressor Type:

- Positive Displacement Compressor

- Dynamic Compressor

Positive displacement compressor dominates the market

The report has provided a detailed breakup and analysis of the market based on the compressor type. This includes positive displacement compressor and dynamic compressor. According to the report, positive displacement compressor represented the largest segment.The positive displacement compressor segment is influenced by several key factors, which includes its inherent ability to deliver a consistent flow of compressed gas regardless of discharge pressure variations. Moreover, the versatility of positive displacement compressors in handling a wide range of gases, including viscous and high-pressure gases, expands their applicability across diverse sectors such as petrochemicals, manufacturing, and pharmaceuticals. In line with this, the simplicity of design and ease of maintenance of positive displacement compressors attract industries looking for efficient yet straightforward solutions. Furthermore, their capability to deliver high compression ratios makes them suitable for applications requiring specific pressure levels. Additionally, the segment benefits from ongoing technological advancements, which enhance their efficiency and performance while addressing environmental concerns.

Breakup by End Use Industry:

- General Manufacturing

- Construction

- Oil and Gas

- Mining

- Chemicals and Petrochemicals

- Power Generation

- Others

Oil and gas dominates the market

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes general manufacturing, construction, oil and gas, mining, chemicals and petrochemicals, power generation, and others. According to the report, oil and gas represented the largest segment.The oil and gas segment is accelerated by a confluence of key factors, including the burgeoning global energy, especially in sectors such as transportation, manufacturing, and power generation. As economies grow and modernize, the need for these fuels remains essential. Moreover, exploration and production activities in untapped regions, including deep-sea reserves and unconventional sources like shale, drive investments in the oil and gas sector. Apart from this, geopolitical factors, such as supply disruptions and political tensions, influence market volatility and pricing. Furthermore, advancements in drilling technologies enhance efficiency, enabling the extraction of oil and gas from increasingly challenging environments. In line with this, the ongoing demand for petrochemical products fuels the need for feedstock, further anchoring the oil and gas segment.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest gas compressors market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.The Asia Pacific gas compressors market is being propelled by a confluence of factors, including rapid industrialization in countries like China, India, and Southeast Asian nations, which is driving demand for efficient compression solutions across manufacturing, petrochemicals, and energy sectors. This trend is reinforced by the shift towards clean energy, with gas compressors playing a vital role in distributing natural gas as a substitute for coal. The region's expanding energy sector, encompassing exploration, production, and refining, further augments compressor demand, ensuring a steady gas supply to power plants and industries. The burgeoning liquefied natural gas (LNG) industry in the region relies heavily on compressors for production, storage, and transportation. Technological advancements in compressor designs and digital solutions, such as IoT integration and data analytics, are fostering innovation and optimizing operational efficiency in the market. Manufacturers are actively tailoring compression solutions to regional needs, driving sustainable growth in the Asia Pacific gas compressors market.

Competitive Landscape:

The competitive landscape of the global gas compressors market is characterized by intense rivalry among key industry players striving to secure a significant market share. Companies compete not only based on product quality and performance but also on factors such as technological innovation, pricing strategies, and comprehensive after-sales services. The industry's growth is further fueled by a constant drive for research and development, leading to the introduction of advanced and energy-efficient compressor technologies. Market participants focus on enhancing their global footprint through strategic partnerships, collaborations, and acquisitions to expand their market presence and customer base. As the demand for cleaner energy solutions continues to rise, competition is driven by the need to offer environmentally sustainable compressor solutions that align with evolving regulatory standards. Amidst these factors, differentiation through product diversification and a strong emphasis on customer relationships remain central to gaining a competitive edge in this dynamic and evolving market landscape.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Ariel Corporation

- Atlas Copco AB

- Bauer Compressors Inc.

- Burckhardt Compression

- Chart Industries

- HAUG Sauer Kompressoren AG

- IDEX Corporation

- Ingersoll Rand

- Kobelco Compressors America Inc.

- Siemens Energy

Key Questions Answered in This Report

1. What was the size of the global gas compressors market in 2024?2. What is the expected growth rate of the global gas compressors market during 2025-2033?

3. What are the key factors driving the global gas compressors market?

4. What has been the impact of COVID-19 on the global gas compressors market?

5. What is the breakup of the global gas compressors market based on the compressor type?

6. What is the breakup of the global gas compressors market based on the end use industry?

7. What are the key regions in the global gas compressors market?

8. Who are the key players/companies in the global gas compressors market?

Table of Contents

Companies Mentioned

- Ariel Corporation

- Atlas Copco AB

- Bauer Compressors Inc.

- Burckhardt Compression

- Chart Industries

- HAUG Sauer Kompressoren AG

- IDEX Corporation

- Ingersoll Rand

- Kobelco Compressors America Inc.

- Siemens Energy

Table Information

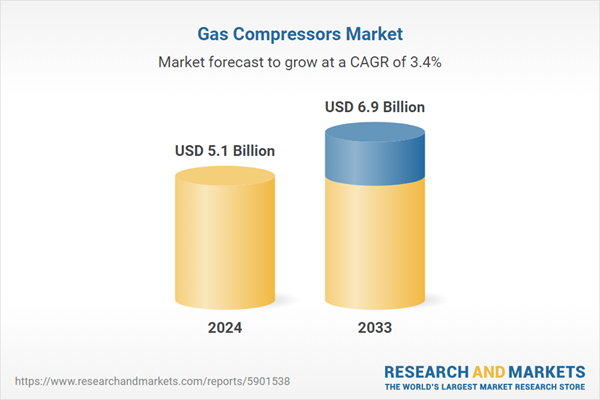

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 5.1 Billion |

| Forecasted Market Value ( USD | $ 6.9 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |