Global Geranium Oil Market - Key Trends and Drivers Summarized

What Exactly Is Geranium Oil and Where Does It Come From?

Geranium oil is a potent and aromatic essential oil that has gained significant attention in recent years. Extracted primarily from the leaves and stems of the Pelargonium graveolens plant, geranium oil is known for its rich, rose-like scent and its remarkable versatility. Originally native to South Africa, the cultivation of the Pelargonium plant has since expanded to regions across the world, particularly in Egypt, China, and India, where it is grown for both domestic use and export. The extraction process typically involves steam distillation, which preserves the plant's aromatic compounds and yields a fragrant, golden-hued oil that is highly sought after in numerous industries. Geranium oil contains a complex chemical composition, including citronellol, geraniol, and linalool - compounds that give it its unique fragrance and therapeutic properties. Traditionally, this oil was valued for its medicinal applications, being used in folk remedies for wound healing and infections, as well as for its calming effects on the mind. Today, its applications have broadened substantially, finding a place in modern beauty, personal care, and even the food and beverage industries, as awareness of natural and plant-based ingredients continues to grow globally.How Is Geranium Oil Changing the Skincare and Wellness Industry?

Geranium oil has become a key ingredient in the booming skincare and wellness industries, thanks to its wide array of beneficial properties. Its natural astringent and anti-inflammatory qualities make it an ideal addition to skincare products aimed at balancing oil levels, reducing breakouts, and improving the overall texture of the skin. This has made it especially popular in treatments for acne-prone or sensitive skin. Furthermore, the antioxidant-rich nature of geranium oil allows it to fight free radicals, which are known to contribute to premature aging. This makes the oil a favored ingredient in anti-aging serums, creams, and masks designed to reduce wrinkles and promote skin elasticity. Beyond skincare, the wellness industry has also embraced geranium oil, particularly in the growing field of aromatherapy. The oil's mood-enhancing and stress-relieving properties have made it a staple in essential oil diffusers, massage oils, and wellness products aimed at promoting mental clarity and emotional balance. With the global shift toward natural and holistic health practices, consumers are increasingly seeking products that offer both physical and emotional benefits. Geranium oil's versatility in addressing both skincare concerns and mental well-being has positioned it as a standout ingredient in an era where consumers are highly conscious of what goes into the products they use.What's Fueling the Popularity of Geranium Oil in Food and Fragrance Sectors?

In addition to its dominance in the wellness and beauty spaces, geranium oil is also making significant strides in the food, beverage, and fragrance industries. Its sweet, floral, and slightly spicy aroma has made it a highly desirable component in natural fragrances, particularly as a middle note in perfumes. Perfume manufacturers prize geranium oil for its ability to blend harmoniously with other scents, enhancing both floral and citrus notes. This ability to complement a wide range of fragrances has led to its incorporation in many high-end perfumes, colognes, and personal care items like lotions and deodorants. As the trend towards clean beauty continues, geranium oil's status as a natural and sustainable ingredient boosts its popularity among consumers who are increasingly choosing products free from synthetic chemicals. Moreover, the demand for natural flavoring agents in food and beverages has also created a niche for geranium oil. It is now being used as a natural flavoring in gourmet foods, herbal teas, and artisanal beverages. The complex taste profile of geranium oil - floral with a hint of spice - makes it particularly popular in niche markets like organic and artisanal products. As consumer demand grows for natural, ethically sourced, and transparent product labeling, geranium oil's botanical origin positions it perfectly to meet the needs of discerning buyers in these sectors.What's Driving the Growth in the Geranium Oil Market?

The growth in the geranium oil market is driven by several factors, reflecting shifts in consumer behavior, industry practices, and technological advancements. First and foremost, the rising consumer preference for natural and organic products across various industries is a major driver of market expansion. As consumers become increasingly aware of the negative impacts of synthetic chemicals, they are seeking out products that are derived from natural sources, particularly in the personal care and cosmetics sectors. This has encouraged manufacturers to incorporate more plant-based ingredients like geranium oil in their formulations. Another crucial factor is the expanding wellness trend, which has brought holistic health solutions to the forefront of consumer preferences. Geranium oil's mood-enhancing, stress-relieving, and skincare benefits make it a key ingredient in products targeting the wellness-conscious consumer. Moreover, the rapid growth of the aromatherapy market has further propelled demand, as more consumers turn to essential oils for mental well-being and alternative health solutions. In the fragrance and flavor industries, geranium oil's clean-label appeal is also a major growth driver. With consumers demanding greater transparency and sustainability in product formulations, natural oils like geranium have become preferred ingredients. Additionally, technological advancements in cultivation and extraction techniques, particularly in major producing countries like Egypt and China, have enhanced the quality, yield, and consistency of geranium oil, allowing for more widespread use across diverse industries. These factors, combined with an overall push towards more ethical and environmentally conscious consumerism, continue to fuel the growing demand for geranium oil in both established and emerging markets.Report Scope

The report analyzes the Geranium Oil market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Conventional Geranium Oil, Organic Geranium Oil); Distribution Channel (Offline Distribution Channel, Online Distribution Channel); Application (Aromatherapy Application, Cosmetics & Personal Care Application, Flavor & Fragrances Application, Other Applications).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Conventional Geranium Oil segment, which is expected to reach US$97.7 Million by 2030 with a CAGR of a 4.4%. The Organic Geranium Oil segment is also set to grow at 2.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $24.1 Million in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $24.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Geranium Oil Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Geranium Oil Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Geranium Oil Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A. G. Industries, AOS Products Pvt. Ltd., Aromaaz International, Aromatics International, Berje and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Geranium Oil market report include:

- A. G. Industries

- AOS Products Pvt. Ltd.

- Aromaaz International

- Aromatics International

- Berje

- De Monchy Aromatics Limited

- doTERRA International LLC

- Garden Mother Herbs

- Jurlique Holistic Skin Care, Inc.

- LorAnn Oils, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A. G. Industries

- AOS Products Pvt. Ltd.

- Aromaaz International

- Aromatics International

- Berje

- De Monchy Aromatics Limited

- doTERRA International LLC

- Garden Mother Herbs

- Jurlique Holistic Skin Care, Inc.

- LorAnn Oils, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 374 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

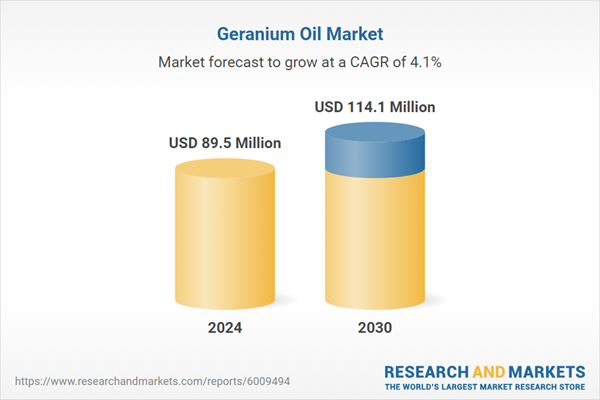

| Estimated Market Value ( USD | $ 89.5 Million |

| Forecasted Market Value ( USD | $ 114.1 Million |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |