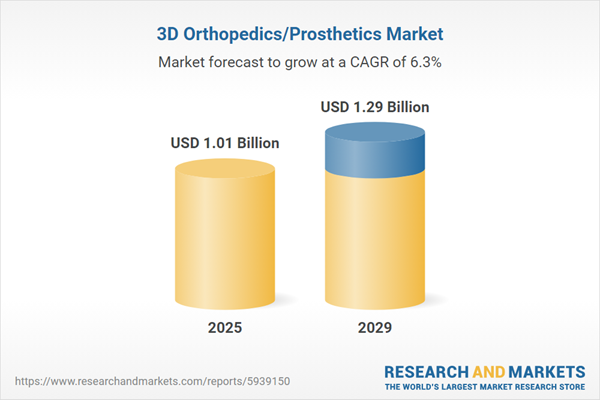

The 3D orthopedics/prosthetics market size is expected to see strong growth in the next few years. It will grow to $1.29 billion in 2029 at a compound annual growth rate (CAGR) of 6.3%. The growth in the forecast period can be attributed to the rising geriatric population, rising number of diabetes-related amputations, rising incidences of road accidents and sports injuries, and an increase in demand for joint reconstruction disorders. Major trends in the forecast period include adopting smart wearables to precisely control the prosthesis, focusing on eco-friendly alternatives, using artificial intelligence to compare a patient's unique anatomy, using Internet-of-things (IoT) enabled solutions to help monitor and collect data for surgery, customizing implants according to a patient’s problem using novel biomaterials, developing technologies to for improved outcomes and efficiency, partnering with companies to expand their market and leverage each other’s resources and investing in the companies to develop advanced products.

The rising incidence of trauma cases and accidental injuries is fueling the growth of the 3D orthopedics and prosthetics market. Orthopedic prosthetics refer to the use of artificial limbs (prostheses) to enhance the functionality and quality of life for individuals who have lost limbs. To effectively meet an individual's functional requirements, a prosthesis must be a tailored combination of proper alignment, construction, materials, and design. For example, in December 2023, the Wisconsin Department of Health Services, a public health agency in the U.S., reported a 4% increase in the number of traumatic injuries treated at Trauma System Hospitals in Wisconsin, along with a 3% rise in pediatric trauma cases. Additionally, there were 44,970 entries into the trauma system and 38,198 unique injury events recorded in 2023. Consequently, the growing number of trauma cases and accidental injuries is driving demand in the 3D orthopedics and prosthetics market.

The growth of the 3D orthopedics/prosthetics market is further fueled by the rising number of amputations associated with diabetes. Diabetes-related amputations, involving the surgical removal of a toe, foot, or part of a leg, are a significant complication of the condition. High blood sugar levels contribute to these amputations, creating a demand for 3D orthopedics/prosthetics to replace lost body parts and support essential functions. According to estimates by the Centers for Disease Control and Prevention (CDC), 1 in 5 Americans is expected to have diabetes by 2025. This high prevalence of diabetes indicates an anticipated increase in amputations, driving the demand for 3D orthopedics/prosthetics in the coming years.

Smart wearables are gaining momentum in the 3D orthopedics/prosthetics market, leveraging robotics and artificial intelligence to provide precise control over prostheses. These smart wearables utilize algorithms that interpret electric nerve signals from the patient's muscles, allowing for advanced functionalities. An example of this technological advancement is seen in the prosthetic arm developed by Esper Bionics, a New York-based engineering startup. The Esper Hand incorporates intuitive self-learning technology, surpassing comparable prosthetics in predicting intended movement. It operates through a brain-computer interface (BCI) based on electromyography, capturing brain signals to activate specific muscles and control the prosthetic in response to the wearer's intentions.

There is a growing emphasis on eco-friendly solutions in the 3D orthopedics/prosthetics market. Major players are prioritizing sustainability by introducing environmentally friendly alternatives to drive innovation and maintain a competitive edge. For instance, Sculpteo, a France-based company specializing in cloud-based 3D printing, collaborated with Daniel Robert Orthopedie to develop an innovative eco-friendly orthosis. This collaboration aims to bring forth next-generation prostheses and orthotics with a focus on sustainability. The wearable, designed by additive manufacturing using Sculpteo's bio-based PA11, is made from castor beans, creating a material that is both sustainable and customizable to meet patients' unique needs. This initiative reflects a commitment to eco-friendly practices within the realm of 3D orthopedics/prosthetics.

In August 2024, OrthoPediatrics Corp., a U.S.-based medical device company, acquired Boston Orthotics & Prosthetics for an undisclosed amount. This acquisition aims to enhance OrthoPediatrics' custom orthopedic solutions for children and improve patient care. Boston Orthotics & Prosthetics is a U.S.-based healthcare company specializing in 3D orthopedics and prosthetics.

Major companies operating in the 3D orthopedics/prosthetics market include Johnson & Johnson Inc., Zimmer Biomet, Ottobock Inc., DJO Global Inc., Instalimb Inc., Open Bionics, Tangible Solutions Inc., Tornier Inc., Corin Group Plc., PolyNovo Limited, Exactech Inc., United Orthopedic Corporation, Aesculap Implant Systems Victrex, Evonik, Stryker Corporation, Allegra Orthopedics, Lepu Medical Technology Company (Beijing) Co. Ltd, Yuwell - Jiangsu Yuyue Medical Equipment & Supply Co. Ltd, Shanghai Runda Medical Technology Co. Ltd., GE Healthcare China Co. Ltd., Beznoska Company Ltd, Sanatmetal Ltd, Medin a.s., Globus Medical Inc., Collagen Matrix Inc., NEOORTHO, Manoel Amaral Baumer, Biomecânica, ORTOBIO, Smith & Nephew, Ortosintese, IMPOL Próteses Ortopédicas, Wright Medical, B. Braun, Meril Life, Elixir Medical Equipment LLC, Matrix Medical, Gulf Medical Co, Almarfa Medical, Lithotech Medical, 3D Systems, Global Medical, Medtronic Africa, EgiFix Medical.

North America was the largest region in the 3D orthopedics/prosthetics market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the 3d orthopedics/prosthetics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the 3d orthopedics/prosthetics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

3D orthopedic devices and prosthetics are artificial limbs or components designed to replace missing body parts lost due to accidents, trauma, or congenital conditions, ultimately enhancing a person's functionality and quality of life. These prosthetics can be tailored to fit individual requirements and may incorporate advanced features such as biomechanical joints and smart technology to optimize performance.

Primary products encompass upper extremity prosthetics, lower extremity prosthetics, lower extremity orthopedics & prosthetics, and others. Upper extremity prosthetics refer to limb replacements for areas from the shoulder joint to fingers, utilizing technologies such as conventional, electric-powered, and hybrid. These prosthetics find application in various sectors such as hospitals, orthopedic and prosthetic centers, rehabilitation facilities, among others.

The 3D orthopedics/prosthetics market research report is one of a series of new reports that provides 3D orthopedics/prosthetics market statistics, including 3D orthopedics/prosthetics industry global market size, regional shares, competitors with a 3D orthopedics/prosthetics market share, detailed 3D orthopedics/prosthetics market segments, market trends and opportunities, and any further data you may need to thrive in the 3D orthopedics/prosthetics industry. This 3D orthopedics/prosthetics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The 3D orthopedics/prosthetics market consists of sales of implants, medical devices, surgical planning models, orthotics, and prosthetics. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

3D Orthopedics/Prosthetics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on 3d orthopedics/prosthetics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for 3d orthopedics/prosthetics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The 3d orthopedics/prosthetics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Upper Extremity Orthopedic & Prosthetics, Lower Extremity Orthopedic & Prosthetics, Other Product Type2) By Technology: Conventional, Electric-powered, Hybrid

3) By End User: Hospitals, Orthopedic and Prosthetic Centers, Rehabilitation Center, Other End-Users

Subsegments:

1) By Upper Extremity Orthopedic and Prosthetics: Prosthetic Arms; Prosthetic Hands; Orthotic Braces for Arms; Shoulder and Elbow Supports2) By Lower Extremity Orthopedic and Prosthetics: Prosthetic Legs; Prosthetic Feet; Orthotic Braces for Legs; Knee and Ankle Supports

3) By Other Product Type: Custom-Made Orthopedic Devices; 3D Printed Implants; Surgical Guides and Templates; Rehabilitation Devices

Key Companies Mentioned: Johnson & Johnson Inc.; Zimmer Biomet; Ottobock Inc.; DJO Global Inc.; Instalimb Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Johnson & Johnson Inc.

- Zimmer Biomet

- Ottobock Inc.

- DJO Global Inc.

- Instalimb Inc.

- Open Bionics

- Tangible Solutions Inc.

- Tornier Inc.

- Corin Group Plc.

- PolyNovo Limited

- Exactech Inc.

- United Orthopedic Corporation

- Aesculap Implant Systems Victrex

- Evonik

- Stryker Corporation

- Allegra Orthopedics

- Lepu Medical Technology Company (Beijing) Co. Ltd

- Yuwell - Jiangsu Yuyue Medical Equipment & Supply Co. Ltd

- Shanghai Runda Medical Technology Co. Ltd.

- GE Healthcare China Co. Ltd.

- Beznoska Company Ltd

- Sanatmetal Ltd

- Medin a.s.

- Globus Medical Inc.

- Collagen Matrix Inc.

- NEOORTHO

- Manoel Amaral Baumer

- Biomecânica

- ORTOBIO

- Smith & Nephew

- Ortosintese

- IMPOL Próteses Ortopédicas

- Wright Medical

- B. Braun

- Meril Life

- Elixir Medical Equipment LLC

- Matrix Medical

- Gulf Medical Co

- Almarfa Medical

- Lithotech Medical

- 3D Systems

- Global Medical

- Medtronic Africa

- EgiFix Medical

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.01 Billion |

| Forecasted Market Value ( USD | $ 1.29 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 44 |