Artificial Intelligence in Life Sciences Market Analysis:

- Major Market Drivers: Artificial intelligence in life sciences is mainly driven by the increase in the volume of biomedical data from genomic sequences and electronic health records which necessitates the incorporation of powerful AI tools for effective management and analysis. In line with this, artificial intelligence is instrumental in accelerating drug discovery and development processes thereby significantly reducing time and costs. Moreover, regulatory support for AI integration in clinical settings and advancements in machine learning and computational algorithms further propel artificial intelligence in life sciences market growth.

- Key Market Trends: Key market trends in artificial intelligence in the life sciences sector include the integration of artificial intelligence along with cloud computing and Internet of Things (IoT) devices further enhancing data accessibility and real-time analysis. There is also a significant trend toward the development of AI-driven predictive models that forecast disease progression and patient outcomes improving clinical decision-making. In line with this, collaborative efforts between AI tech firms and pharmaceutical companies are on the rise mainly aimed at leveraging AI for drug development and patient monitoring. The growing focus on ethical AI and transparent algorithms to ensure patient data security and privacy compliance is another notable trend. Furthermore, the use of AI in robotic process automation (RPA) is a streamlining administrative task in healthcare further driving artificial intelligence in life sciences market growth.

- Geographical Trends: Geographically, North America leads the artificial intelligence and life sciences market mainly driven by its advanced technological infrastructure, substantial investment in artificial intelligence and healthcare, and strong support from regulatory bodies. Europe follows closely, with significant growth because of the increase in the adoption of AI in healthcare systems and support from government policies regarding AI research and data protection. Asia Pacific is experiencing significant growth mainly fueled by increasing healthcare demands, technological advancements, and government initiatives to promote AI in countries like China, Japan, and India.

- Competitive Landscape: Some of the major market players in the artificial intelligence in life sciences industry include AiCure LLC, Apixio Inc. (Centene Corporation), Atomwise Inc, Enlitic Inc., International Business Machines Corporation, Insilico Medicine Inc., Nuance Communications Inc., NuMedii Inc., Sensely Inc. Sophia Genetics SA., among many others.

- Challenges and Opportunities: The artificial intelligence and life sciences market faces various challenges, which include high implementation costs, a need for more skilled artificial intelligence professionals, and growing concerns over data privacy and security. The complexity of biological data requires more sophisticated AI models, which can be difficult to develop. On the opportunity side, artificial intelligence shows potential in improving drug development efficiency, reducing costs, and in personalized patient care. Furthermore, there is also significant potential for growth in emerging markets where AI can address the gaps in healthcare services.

Artificial Intelligence in Life Sciences Market Trends/Drivers:

Drug Discovery and Development Acceleration

The traditional drug development process is a lengthy, costly, and often inefficient endeavour, taking over a decade to bring a new drug into the market. AI transforms this landscape by expediting various stages of drug development. For instance, in 2023, Cognizant launched an Advanced Artificial Intelligence (AI) Lab in San Francisco to mainly focus on core AI research, innovation, and development of cutting-edge AI systems. The lab, staffed by a team of dedicated AI researchers and developers, has already produced 75 issued and pending patents and will collaborate with research institutions, customers, and startups.Machine learning algorithms analyse vast datasets, including biological and chemical information, clinical trial data, and existing drug databases, to identify potential drug candidates with unprecedented speed and accuracy. This enables researchers to pinpoint promising compounds, predict their efficacy, and optimize their properties, significantly reducing the time and cost required for drug discovery, thereby propelling the artificial intelligence in life sciences market growth.

Personalized Medicine and Healthcare

Traditional medical treatments often follow a one-size-fits-all approach, with medications and therapies prescribed based on broad population averages. AI harnesses the power of big data and machine learning to analyze an individual's genetic makeup, clinical history, lifestyle factors, and real-time health data to develop highly tailored treatment plans. In 2023, OM1 introduced PhenOM, an AI-powered platform for personalized medicine, leveraging enriched healthcare datasets and AI technology. Calibrated using longitudinal health history data, PhenOM identifies unique digital phenotypes associated with conditions, enabling personalized healthcare insights at scale.With a focus on chronic conditions, OM1 pioneers innovative RWE research, delivering personalized impact on patient outcomes and advancing healthcare through cutting-edge AI solutions.This level of personalization ensures that patients receive treatments that are not only more effective but also less likely to cause adverse side effects. Also, AI-driven predictive models can help identify patients at higher risk of certain diseases, allowing for early intervention and preventive measures. Additionally, in oncology, AI assists in pinpointing the specific genetic mutations driving a patient's cancer, enabling oncologists to recommend targeted therapies that are more likely to be successful.

Disease Diagnosis and Biomarker Discovery

AI algorithms can analyze diverse medical data sources, including medical images, such as X-rays, MRIs, and CT scans, patient electronic health records, and genomic profiles, with exceptional accuracy and efficiency. In radiology, AI-powered image analysis can assist radiologists in detecting subtle abnormalities and flagging potential health issues, aiding in early diagnosis and treatment. In 2024, Rad AI has partnered with Google to enhance radiology reporting by leveraging AI technology, aiming to save radiologists time, reduce burnout, and improve patient care quality. This collaboration will streamline workflows, automate repetitive tasks, and advance the efficiency and accuracy of radiology reporting.Moreover, AI is instrumental in the discovery of disease biomarkers, which are crucial in identifying diseases at their earliest stages and monitoring their progression. Machine learning models can detect subtle patterns in molecular data, helping to identify specific biomarkers associated with various diseases, including cancer, Alzheimer's, and cardiovascular conditions. These biomarkers serve as early warning signs and can guide clinicians in making timely and informed decisions about patient care.

Artificial Intelligence in Life Sciences Industry Segmentation:

The research provides an analysis of the key trends in each segment of the global artificial intelligence in life sciences market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on offering, deployment, and application.Breakup by Offering:

- Software

- Hardware

- Service.

Software dominates the market

The report has provided a detailed breakup and analysis of the market based on the offering. This includes software, hardware, and services. According to the report, software represented the largest segment.Software in the context of AI encompasses a wide array of tools, platforms, and applications specifically designed to process, analyze, and interpret the immense volume of data generated in life sciences research. These software solutions utilize machine learning algorithms, natural language processing, deep learning, and other AI techniques to sift through complex biological datasets, making sense of genomics, proteomics, and clinical data. The versatility of AI software allows researchers to explore various aspects of drug discovery, disease diagnosis, and patient care with unprecedented precision and efficiency.

Additionally, the scalability and adaptability of AI software make it a preferred choice for organizations operating in the life sciences domain. Researchers can customize and fine-tune AI algorithms to meet their specific research needs, whether it involves drug target identification, biomarker discovery, or patient stratification for clinical trials. This flexibility empowers scientists to adapt to evolving research objectives and swiftly respond to emerging challenges in healthcare and life sciences. Furthermore, AI software offerings are at the forefront of addressing some of the most pressing issues in the industry.

Breakup by Deployment:

- On-premises

- Cloud-base.

Cloud-based dominate the market

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes on-premises and cloud-based. According to the report, cloud-based represented the largest segment.Cloud-based deployment offers unparalleled scalability and flexibility, which are crucial for the resource-intensive nature of AI applications in life sciences. Researchers and organizations can tap into cloud resources as needed, scaling up or down depending on the complexity and volume of data being processed. This dynamic scalability ensures that computational resources are optimally allocated, avoiding underutilization or resource bottlenecks, which can occur with on-premises solutions. Additionally, cloud-based deployment eliminates the need for significant upfront hardware and infrastructure investments.

This cost-effectiveness is particularly attractive for research institutions, pharmaceutical companies, and healthcare providers looking to leverage AI without the burden of substantial capital expenditures. Cloud services provide pay-as-you-go pricing models, allowing organizations to pay only for the computing resources they consume, thus optimizing cost management. Moreover, cloud-based deployments offer the advantage of accessibility and collaboration. Researchers and scientists can access AI tools and applications from anywhere with an internet connection, facilitating collaboration across geographic boundaries and enabling real-time data sharing and analysis.

Breakup by Application:

- Drug Discovery

- Medical Diagnosis

- Biotechnology

- Clinical Trials

- Precision and Personalized Medicine

- Patient Monitorin.

Drug discovery dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes drug discovery, medical diagnosis, biotechnology, clinical trials, precision and personalized medicine, and patient monitoring. According to the report, drug discovery represented the largest segment.AI-driven drug discovery is not limited to target identification alone. AI models can predict the pharmacokinetics and toxicity profiles of potential drugs, allowing researchers to assess their safety and efficacy earlier in the development pipeline. This risk mitigation not only saves time but also reduces the likelihood of costly late-stage failures, a common challenge in the pharmaceutical industry. Additionally, AI plays a pivotal role in drug repurposing, where existing drugs are explored for new therapeutic applications. By analyzing biological data, AI algorithms can identify overlooked connections between drugs and diseases, potentially unveiling novel treatment options.

This approach not only accelerates the availability of treatments for various medical conditions but also leverages existing knowledge and resources more efficiently. Furthermore, the personalized medicine revolution is closely linked to AI-driven drug discovery. As AI models analyze patients' genetic profiles, clinical histories, and real-time health data, they can identify specific genetic markers and mutations that influence drug response.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

North America exhibits a clear dominance, accounting for the largest artificial intelligence in life sciences market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America boasts significant investments in AI research and development. Government initiatives, private sector funding, and venture capital investments have poured into AI projects and startups, fueling innovation and technological advancements. This financial backing has accelerated the growth of AI-driven solutions, from drug discovery and genomics to healthcare analytics and personalized medicine. Moreover, North America's robust regulatory framework and intellectual property protection create a conducive environment for AI development and commercialization. Several regulatory agencies have been proactive in engaging with AI developers to establish clear guidelines and approval processes for AI-based medical devices and treatments.

This regulatory clarity gives businesses confidence to invest in AI projects. Furthermore, North America's healthcare infrastructure is among the most advanced globally, making it a prime testing ground for AI applications. The region's large patient population, extensive electronic health record systems, and well-established pharmaceutical and biotech industries provide ample opportunities for AI-driven healthcare solutions to demonstrate their efficacy and impact.

Competitive Landscape:

Numerous companies in this market are focused on using AI to accelerate drug discovery processes. They develop AI algorithms and platforms that analyze biological data, identify potential drug candidates, predict drug interactions, and optimize drug design, all with the goal of bringing new therapies to market faster and more efficiently. Also, AI companies in the life sciences sector work on solutions for genomic analysis. They develop tools that can decipher and interpret genetic information, identify disease markers, predict disease risk, and enable personalized medicine by tailoring treatments based on an individual's genetic profile.Moreover, companies are developing AI-driven solutions that assist radiologists and pathologists in interpreting medical images such as X-rays, MRIs, and CT scans. These tools can help detect diseases and anomalies earlier and with greater accuracy. Companies are also actively engaged in predictive analytics, utilizing AI to identify disease biomarkers, predict patient outcomes, and stratify patients for clinical trials. These AI-driven insights can inform treatment decisions and improve patient care.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AiCure LLC

- Apixio Inc. (Centene Corporation)

- Atomwise Inc

- Enlitic Inc.

- International Business Machines Corporation

- Insilico Medicine Inc.

- Nuance Communications Inc.

- NuMedii Inc.

- Sensely Inc.

- Sophia Genetics S.

Key Questions Answered in This Report

- How big is the artificial intelligence in life sciences market?

- What is the expected growth rate of the global artificial intelligence in life sciences market during 2025-2033?

- What are the key factors driving the global artificial intelligence in life sciences market?

- What has been the impact of COVID-19 on the global artificial intelligence in life sciences market?

- What is the breakup of the global artificial intelligence in life sciences market based on the offering?

- What is the breakup of the global artificial intelligence in life sciences market based on the deployment?

- What is the breakup of the global artificial intelligence in life sciences market based on the application?

- What are the key regions in the global artificial intelligence in life sciences market?

- Who are the key players/companies in the global artificial intelligence in life sciences market?

Table of Contents

Companies Mentioned

- AiCure LLC

- Apixio Inc. (Centene Corporation)

- Atomwise Inc

- Enlitic Inc.

- International Business Machines Corporation

- Insilico Medicine Inc.

- Nuance Communications Inc.

- NuMedii Inc.

- Sensely Inc. Sophia Genetics SA

Table Information

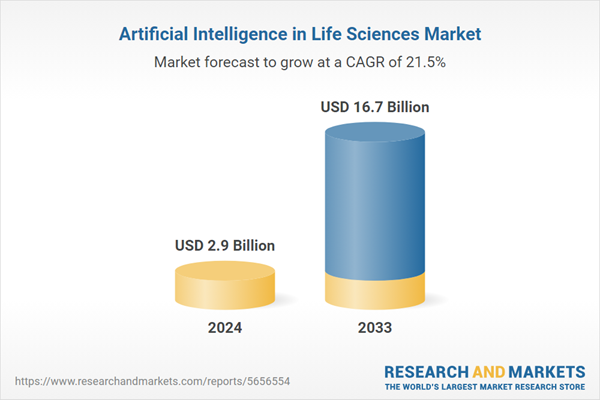

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 2.9 Billion |

| Forecasted Market Value ( USD | $ 16.7 Billion |

| Compound Annual Growth Rate | 21.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |